If you are thinking about a career in risk management, one question quietly sits in the background. What will I earn, and how will it grow over time? That is where the idea of an FRM salary becomes real. It is not just a number on a job offer. It is a reflection of how valuable your skill is in the financial system.

Every financial decision carries risk. A bank giving a loan carries risk. A company raising money carries risk. Even a payment made through an app carries risk. Someone has to measure it, control it, and report it. That is the role of a risk professional. When the stakes are high, the people managing that risk are valued highly as well.

Think of a hospital. The surgeon operates, but the anaesthetist ensures the patient stays safe through it. In finance, investment teams take positions in markets, while risk teams ensure those positions do not damage the firm. This balance is what keeps the system stable. This is also why the FRM salary grows steadily with experience and responsibility.

This article takes a clear and practical look at what you can expect with an FRM Certification. It breaks down earnings at each stage. It shows how roles and locations change your income. It explains how combining skills or adding other qualifications can change your trajectory. It also answers the most common questions that come up when someone evaluates this path.

If you are at the stage of deciding your direction, the goal is to make an informed choice. The numbers, examples, and insights that follow are meant to help you see the full picture in a simple and honest way.

Understanding the FRM Certification

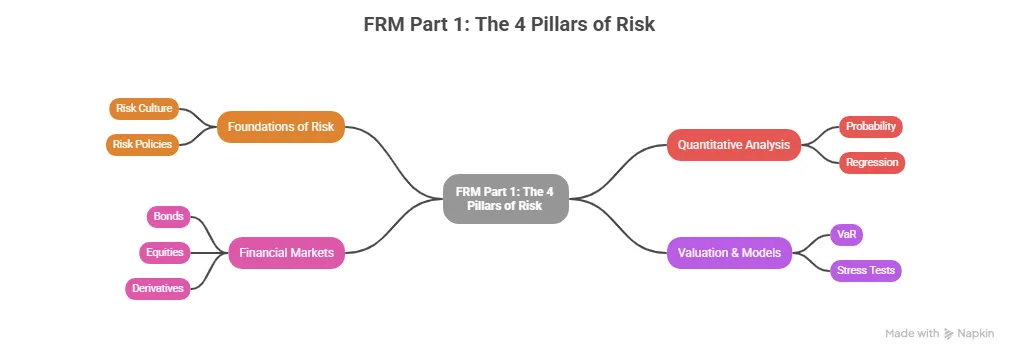

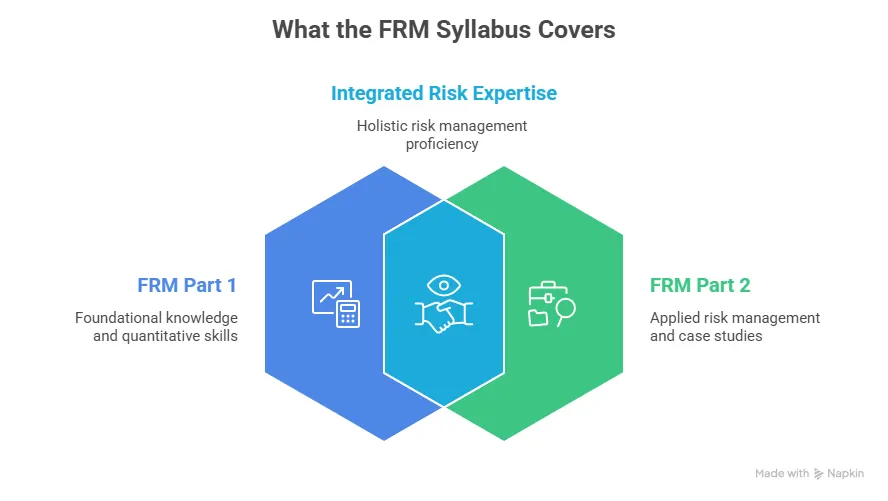

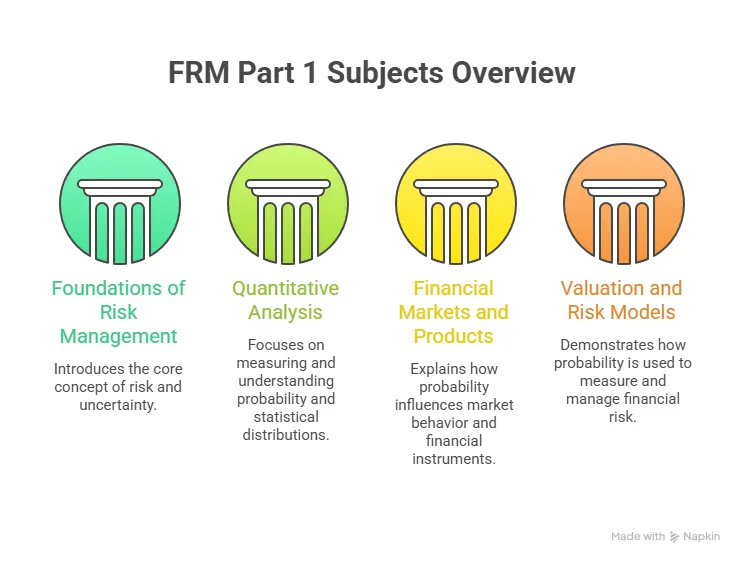

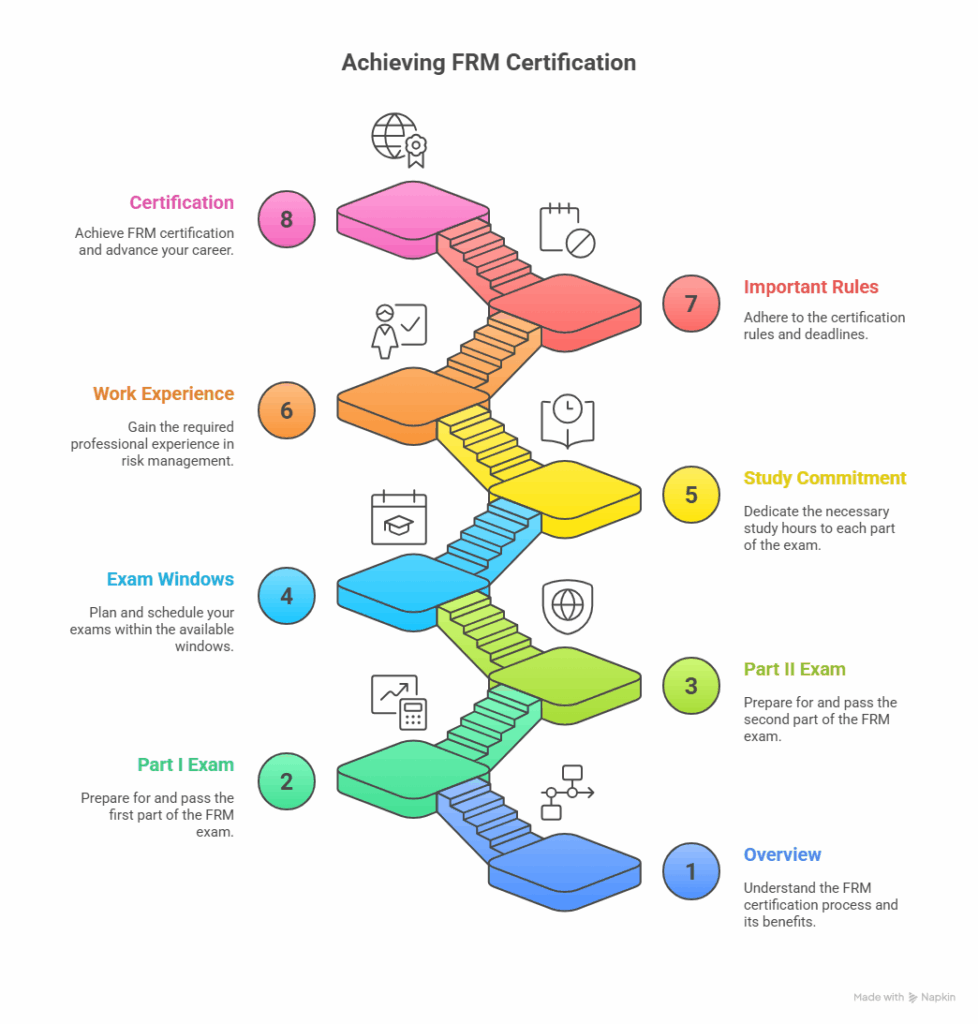

When you see salary numbers across risk roles, they are tied to a specific set of skills. Those skills come from the Financial Risk Manager qualification. It is designed to prepare professionals to measure and manage risk in banks, fintech firms, consulting companies, and large financial institutions. An in-depth understanding of: what is FRM? Gives you a clear explanation of the curriculum and exam framework.

What The FRM Designation Represents

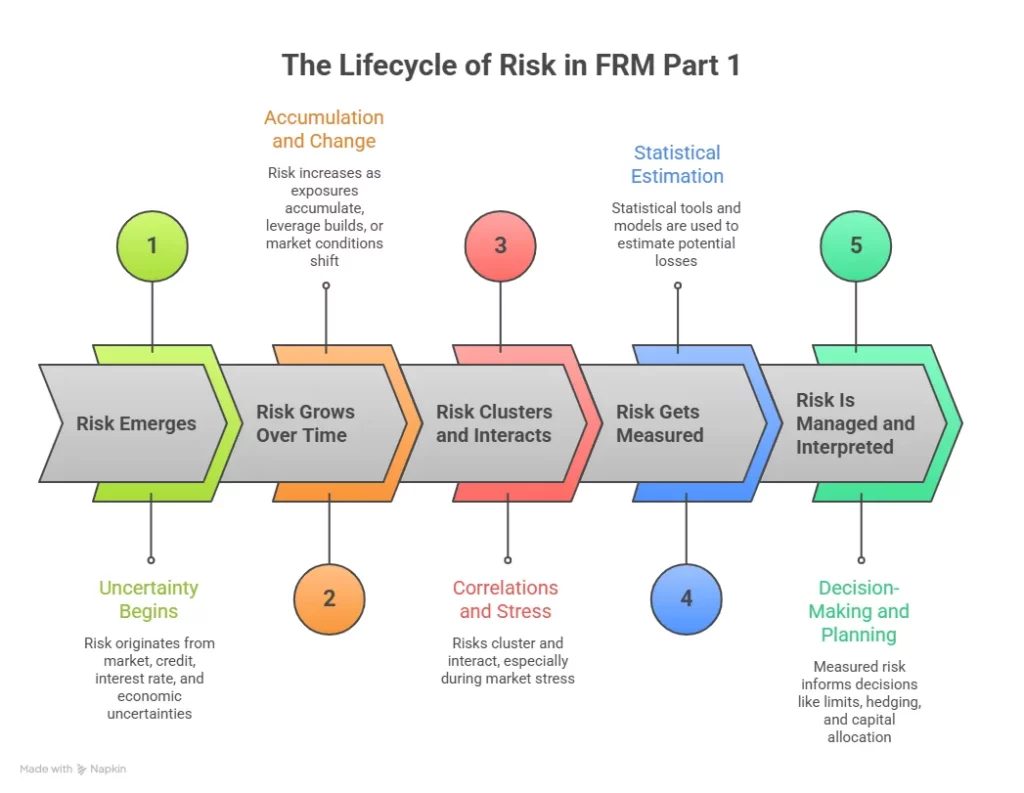

FRM stands for Financial Risk Manager. It is awarded by the Global Association of Risk Professionals and is recognised across major financial markets. The designation signals that a professional can:

- Analyse financial risks in lending and investments

- Understand how markets behave under stress

- Build models that estimate potential losses

- Apply global regulatory standards

These are not academic ideas. They are used in daily decisions across banks and financial firms. Because these decisions affect profits and losses directly, the FRM salary reflects that responsibility.

Where FRM Fits In The Finance Ecosystem

Every financial institution has multiple teams. Some focus on generating returns. Some focus on financial accounting and reporting. Risk teams ensure that the business remains stable while it grows. Here is how FRM fits into the larger structure.

| Function | Role of FRM professionals |

| Banking | Assess credit and loan risk |

| Investment firms | Measure market and portfolio risk |

| Fintech | Analyse fraud and transaction risk |

| Consulting | Advise clients on compliance and risk frameworks |

| Insurance | Evaluate underwriting and claim risk |

This wide application is one reason why the FRM salary in India remains stable across market cycles.

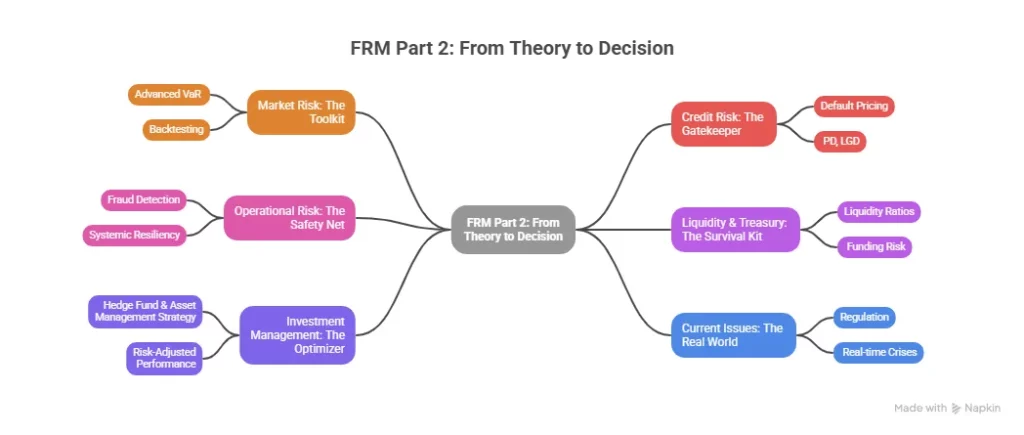

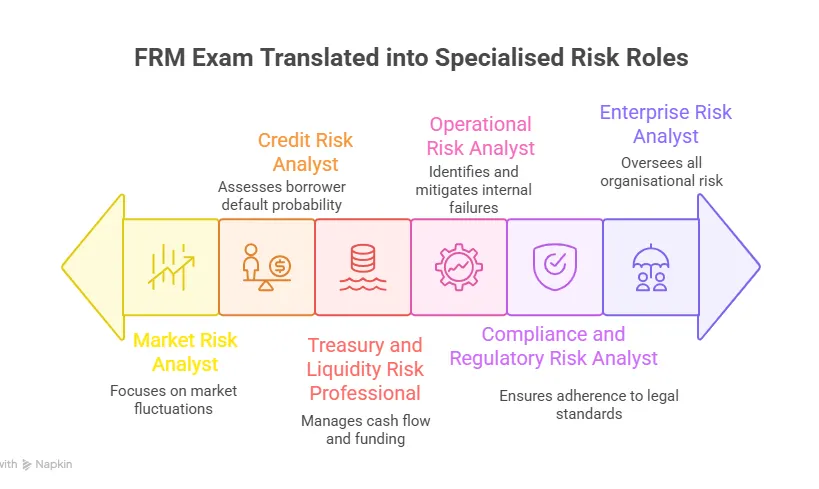

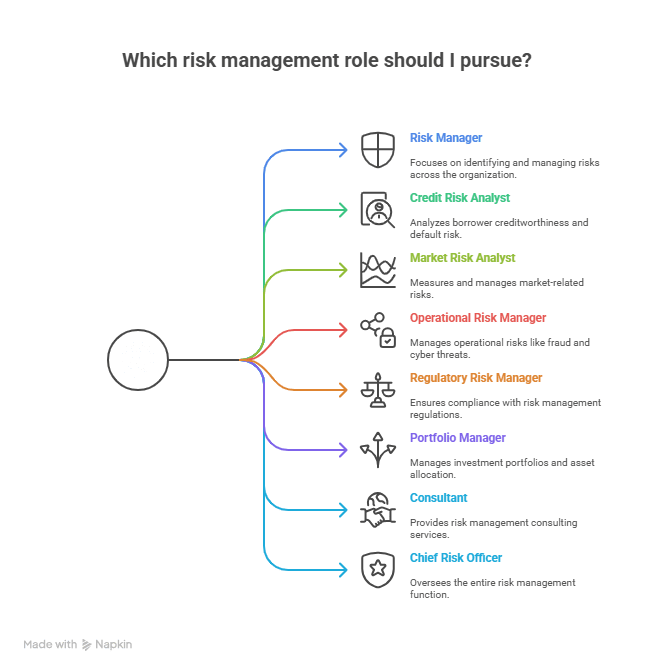

How These Skills Convert Into Job Roles

Once the concepts are applied in real work, they open up multiple career paths. Common roles include:

- Credit risk analyst

- Market risk analyst

- Risk modelling analyst

- Enterprise risk consultant

- Liquidity risk manager

Each of these roles has its own salary band and growth path. As professionals gain experience and move into decision-making roles, their income grows accordingly. In India, the typical range sits between ₹6 lakh and ₹18 lakh per year for most roles in the first few years. Senior roles go much higher. Here is a clean snapshot so you can see the range at a glance.

Average FRM salary in India

| Level | Annual Range | Monthly Range |

| Fresher | ₹6-10 LPA | ₹50K to ₹80K |

| 2 to 5 years | ₹10-18 LPA | ₹80K to ₹1.5L |

| 5 to 10 years | ₹18-35 LPA | ₹1.5L to ₹3L |

| Senior leadership | ₹35-80 LPA+ | ₹3L to ₹6L+ |

When someone asks me about the FRM average salary in India, I usually explain it like this. Think of it as a staircase. You start at a strong base, and the steps grow faster after a few years of experience.

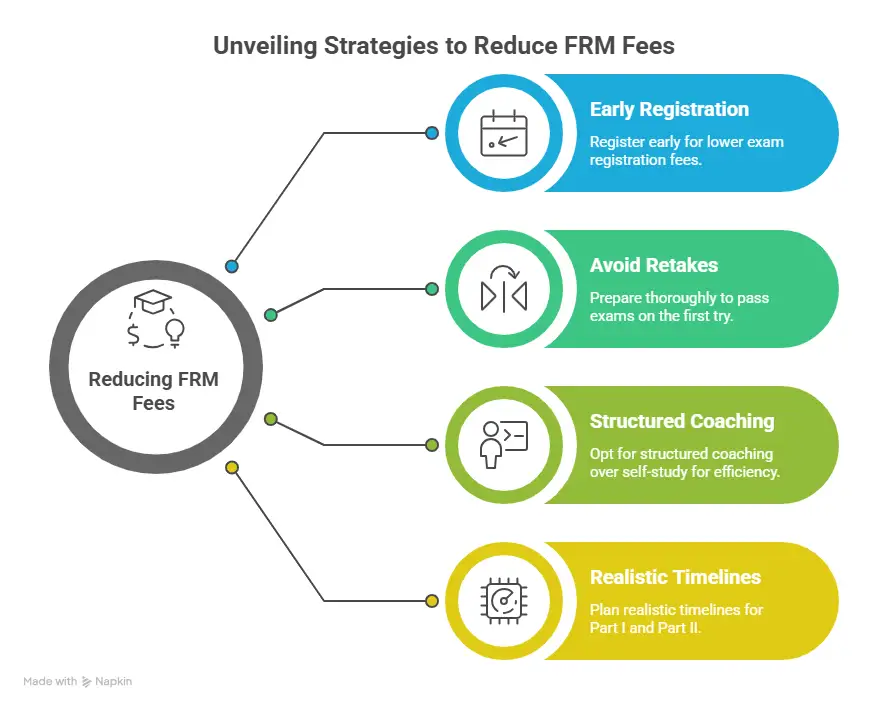

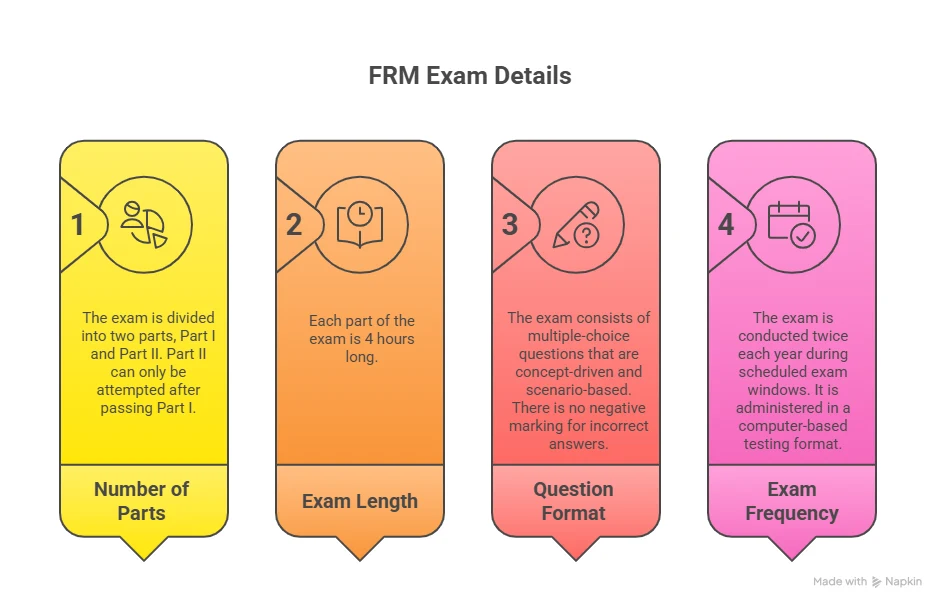

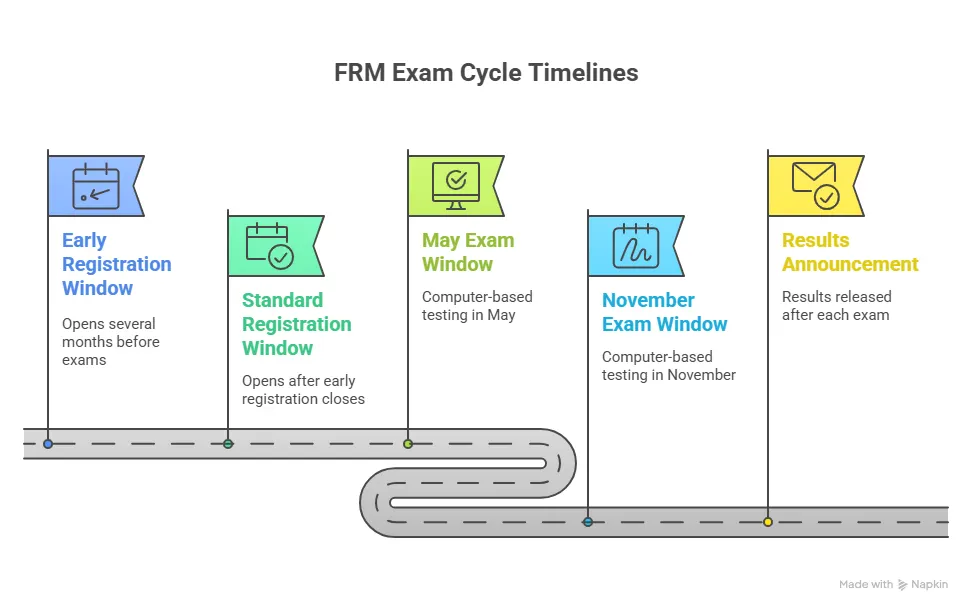

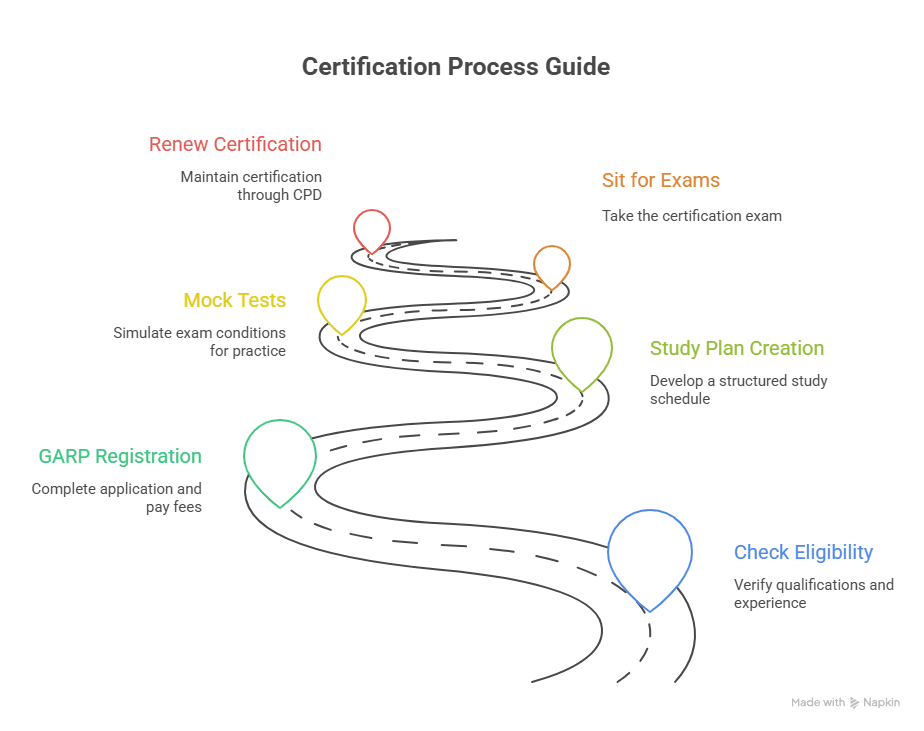

A complete view of the FRM journey often becomes clearer when you break it into its core elements. From understanding who is eligible and how long the preparation usually takes, to how the exam structure is designed and what the overall cost looks like, each factor shapes your decision in a practical way.

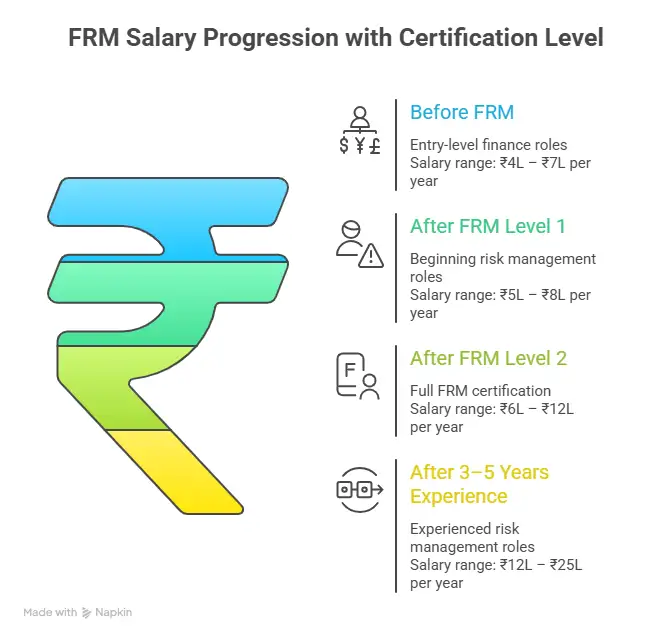

Frm Fresher Salary In India

At the freshers level, I have seen students focus too much on the starting number. What matters more is the speed of growth. The FRM fresher salary in India usually ranges between ₹6 lakh and ₹10 lakh per year. The role can be:

- Risk analyst

- Credit risk associate

- Market risk analyst

- Treasury risk analyst

These are strong entry points. Within two to three years, many professionals move to higher-paying roles. A simple example. A fresher analyst may start at ₹7 lakh. With strong skills in data and modelling, one can move to ₹12 lakh in two years.

FRM Salary In India Per Month

Monthly income helps most students relate better. Rent, EMIs, and savings are all planned monthly. Here is a closer view of the FRM salary in India per month.

- Entry level roles earn around ₹50,000 to ₹80,000 per month

- Mid-level roles cross ₹1 lakh per month

- Senior managers cross ₹2 lakh per month

- Leadership roles cross ₹5 lakh per month

This is similar to how a pilot earns. Early years are stable. As flying hours grow, income rises fast. Risk managers also see strong growth with experience.

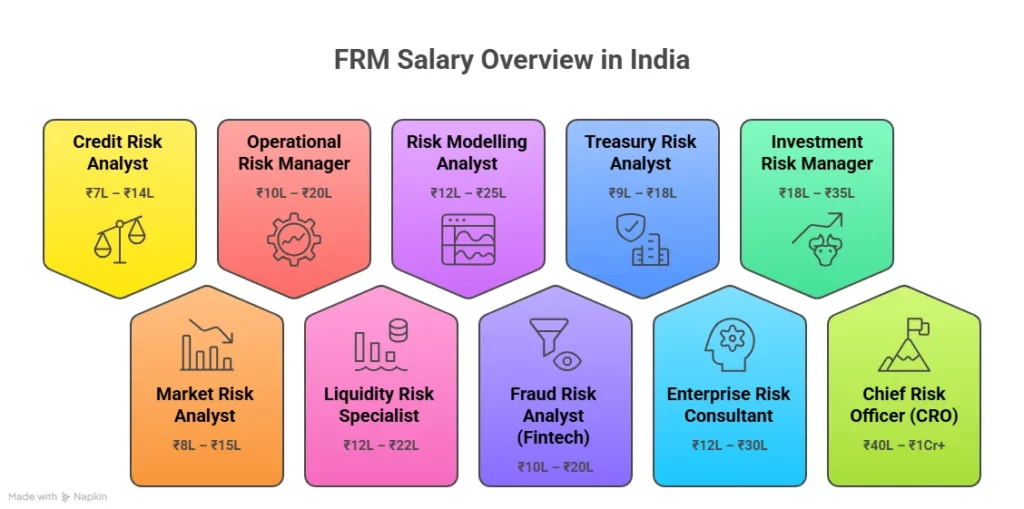

How Job Role Changes Your FRM Salary

Salary depends heavily on the role you pick. Risk is a wide field. Some areas pay more due to demand. Here is a role-wise breakdown.

FRM salary by job role in India

| Role | Salary Range |

| Market Risk Analyst | ₹8-15 LPA |

| Credit Risk Analyst | ₹7-14 LPA |

| Operational Risk Manager | ₹10-20 LPA |

| Liquidity Risk Specialist | ₹12-22 LPA |

| Risk Modelling Analyst | ₹12-25 LPA |

| Chief Risk Officer | ₹40 LPA to ₹1Cr+ |

If I explain it in simple terms, roles that involve numbers and models usually pay more. Roles that involve reporting and compliance pay slightly less in the early years.

Also Read: Why FRM Certification is the Best Career Option for Finance Experts

FRM Salary in Dubai and Global Markets

Global markets offer a different pay scale. When I compare India and the Middle East, the gap is clear. The FRM salary in Dubai ranges from AED 180,000 to AED 420,000 per year. That is roughly ₹40 lakh to ₹95 lakh. Here is a quick global snapshot.

FRM salary across countries

| Country | Salary Range |

| India | ₹6-35 LPA |

| UAE | ₹40-95 LPA |

| USA | $85K to $200K |

| UK | £60K to £140K |

| Singapore | SGD 90K to SGD 180K |

If someone plans to work abroad, FRM becomes a strong advantage. It is recognised in most global markets.

Did you know?

Over 70% of global banks use risk models based on frameworks taught in FRM, according to GARP.

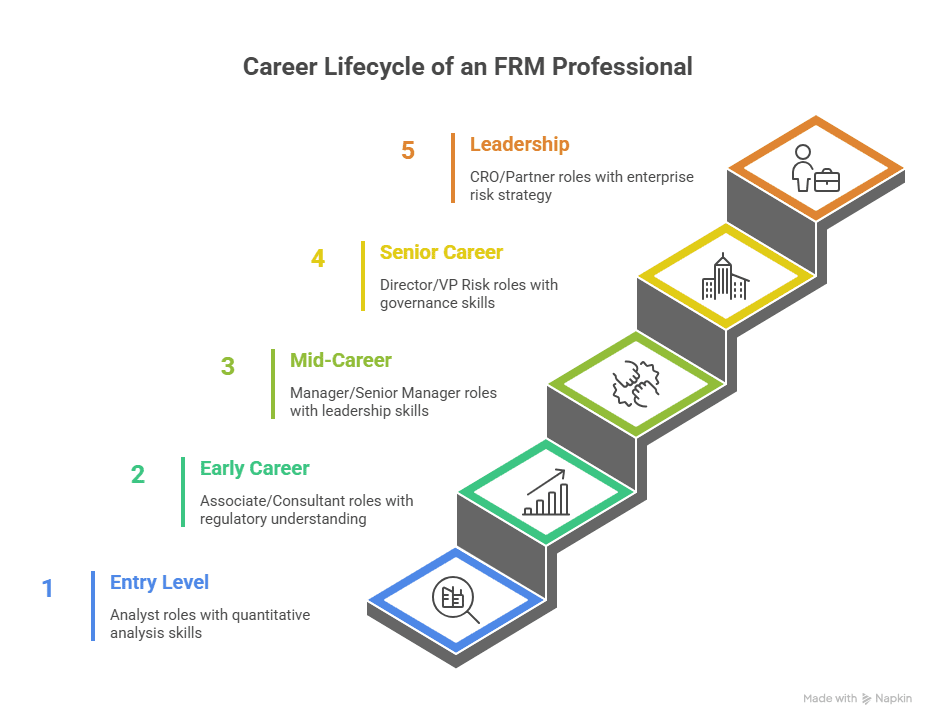

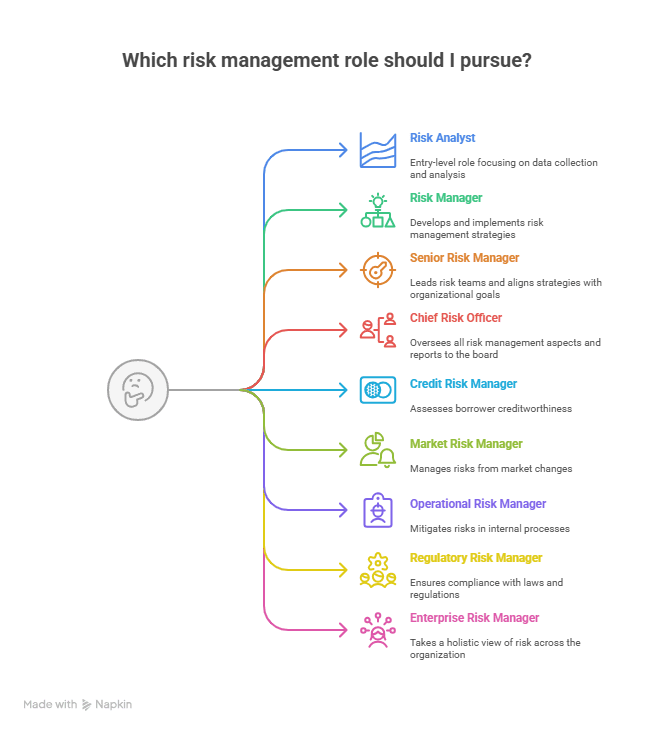

FRM Salary Growth Curve

Salary growth in risk management careers is steady and predictable. A normal path looks like this:

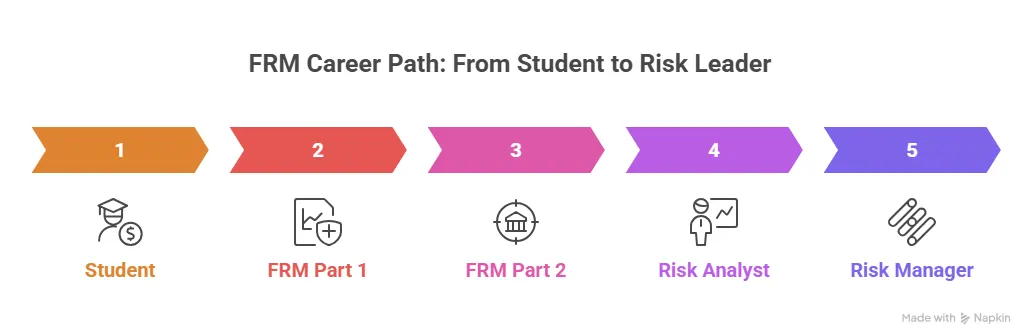

Fresher → Analyst → Senior Analyst → Manager → Head of Risk → Chief Risk Officer (CRO)

At each step, compensation increases sharply.

- Analyst to senior analyst jump gives 30 to 50% growth

- A senior analyst to manager gives another 30% jump

- Manager to leadership can double compensation

That is why long-term career value matters more than just the first salary. To understand income properly, I like to see it across time. A career is a long journey. Income grows step by step.

Here is how an FRM salary typically evolves across stages.

Career and salary growth path

| Stage | Experience | Typical Salary |

| Entry analyst | 0 to 2 years | ₹6-10 LPA |

| Risk analyst | 2 to 4 years | ₹10-16 LPA |

| Senior analyst | 4 to 7 years | ₹15-25 LPA |

| Risk manager | 7 to 12 years | ₹25-45 LPA |

| Head of risk | 12+ years | ₹45L to ₹1Cr+ |

The curve is smooth in the early years. The jump becomes sharper once a professional moves into management roles. I like to compare this with a tree. Early years are about building roots. Later years bring strong growth.

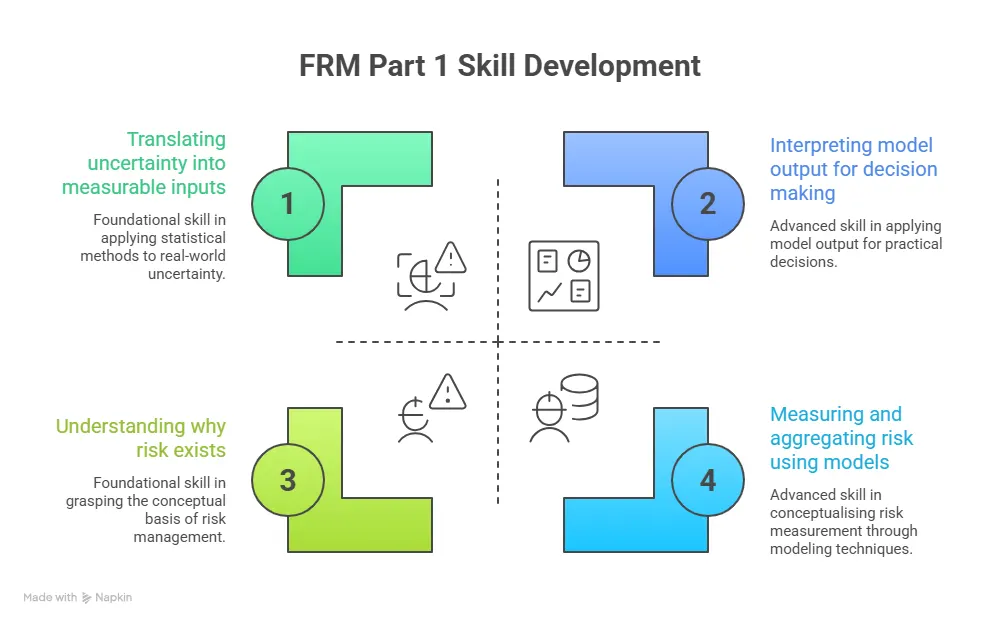

What Skills Increase Your FRM Salary

Salary is not only about the certification. Skills make a major difference. Here are skills that boost income faster.

- Python for risk modelling

- SQL for data extraction

- Excel advanced modelling

- Basel regulations knowledge

- Value at Risk models

- Credit risk scoring

When these skills combine with FRM, employers value the profile more. Say, there are two candidates, both holding an FRM. One knows Python. The other does not. The one with Python may get 20% higher pay.

FRM vs CFA Salary and How The Career Paths Differ

Many learners compare risk management with investment roles. It is a valid comparison because both careers sit inside finance, but they solve different problems.

When I explain the FRM vs CFA salary difference, I use a simple analogy. A CFA professional focuses on growing money. An FRM professional focuses on protecting money. Both are important for any financial system. Here is a clear comparison.

FRM vs CFA salary comparison in India

| Parameter | FRM | CFA |

| Entry salary | ₹6-10 LPA | ₹7-12 LPA |

| Mid career | ₹12-25 LPA | ₹15-30 LPA |

| Senior roles | ₹30-80+ LPA | ₹35L to ₹1Cr+ per annum |

| Domain | Risk and compliance | Investment and portfolio |

| Typical roles | Risk analyst, risk manager | Equity analyst, portfolio manager |

In the early years, both paths offer similar pay. Over time, CFA roles can go higher in asset management firms. FRM roles grow strongly in banks, fintech firms, and consulting firms.

CFA FRM Salary In India When Both Are Combined

A powerful combination in finance is holding both certifications. The CFA FRM salary in India usually sits higher because the profile becomes multi-skilled. These professionals understand investments and risk together. That makes them useful for complex roles. Here are roles where both qualifications create higher pay:

- Portfolio risk strategist

- Quantitative research analyst

- Investment risk manager

- Structured products analyst

- Treasury risk specialist

Salary impact of CFA and FRM together

| Role | Salary Range |

| Investment risk manager | ₹18-35 LPA |

| Portfolio strategist | ₹20-40 LPA |

| Quant analyst | ₹25-50 LPA |

When I explain this in simple terms, I say it is like knowing both driving and navigation. You can drive the car and also choose the best route.

CFA and FRM Together Salary In Global Markets

The CFA and FRM together salary is even stronger in global markets. Employers in the US and UK value multi-skilled profiles. Here is a quick snapshot.

| Country | Combined Salary Range |

| USA | $120K to $250K |

| UK | £80K to £180K |

| Singapore | SGD 120K to SGD 220K |

These roles often involve managing large portfolios with strong risk controls.

Also Read: What are the essential Risk Management Skills Taught in the FRM Program

FRM Course Salary vs Other Finance Courses

Many learners compare FRM with MBA finance, CA, and CFA. Here is a simplified comparison.

Course salary comparison

| Qualification | Entry Salary | 5 Year Salary |

| FRM | ₹6-10 LPA | ₹18-30 LPA |

| CFA | ₹7-12 LPA | ₹20-35 LPA |

| MBA Finance | ₹6-14 LPA | ₹18-28 LPA |

| CA | ₹7-12 LPA | ₹15-25 LPA |

The FRM course salary stands strong because risk is a niche skill. Fewer professionals choose this path, so demand remains high.

Also Read: What is the FRM Course Structure and Exam Format?

Companies That Hire FRM Professionals

Risk professionals are hired across many sectors.

Top hiring sectors

- Investment banks

- Commercial banks

- Consulting firms

- Fintech companies

- Insurance firms

- Asset management firms

Global companies hiring risk professionals

- JPMorgan

- Goldman Sachs

- Morgan Stanley

- HSBC

- Deloitte

- PwC

Many of these companies also hire in India through global capability centres.

A clear look at whether the FRM path makes sense in today’s finance landscape often comes down to three things: demand for risk professionals, the earning trajectory across roles, and how transferable the skill set is across industries and countries. When these trends are mapped with career progression and long-term earning potential, it becomes easier to evaluate if the FRM journey aligns with your goals in 2026 and beyond.

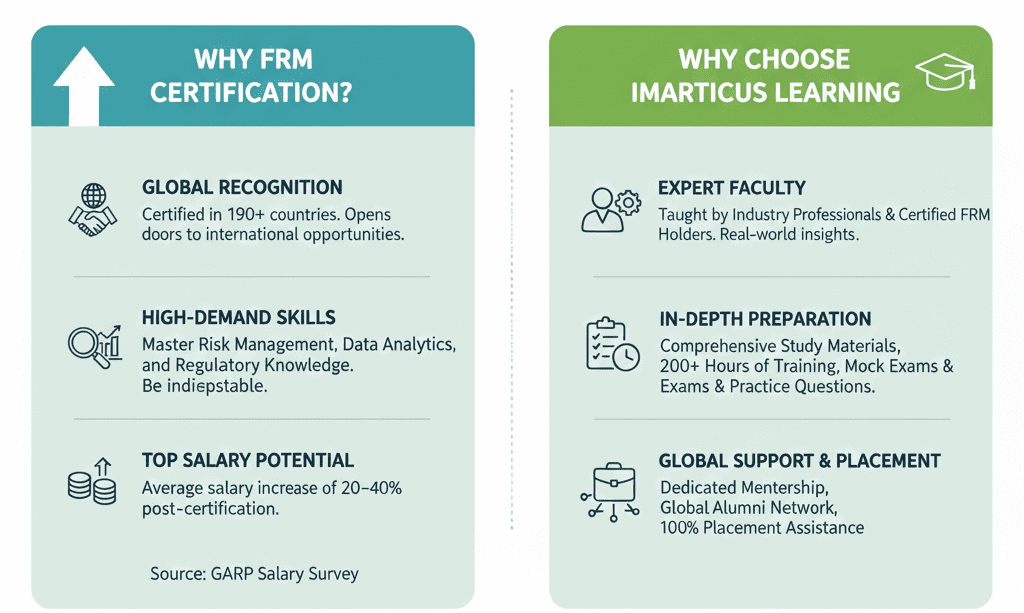

Why Prepare for FRM with Imarticus Learning

Preparing for FRM is not only about covering the syllabus. It is about how well you understand concepts, apply them in real situations, and stay consistent until the exam. A structured learning ecosystem makes a big difference here. The FRM Course offered by Imarticus Learning is designed to align with how the exam is tested and how the industry actually works, which helps bridge the gap between theory and application.

Below are the key aspects that make the learning experience more effective and outcome-oriented.

Key highlights of the Imarticus FRM program:

- GARP-approved prep provider: Imarticus Learning is a GARP-approved prep provider, which means the training is aligned with the official FRM curriculum and global standards.

- Access to Analyst Prep study resources: Learners receive Analyst Prep material that includes question banks, mock exams, and guided study tools designed for FRM preparation.

- Expert-led training with structured preparation: The program includes faculty guidance, structured study plans, and a clear roadmap that takes learners from basics to exam readiness step by step.

- Money-back assurance for exam confidence: The course includes a pass assurance feature where a portion of the fee is refunded if the learner does not clear the exam.

- Mentorship and continuous academic support: The program includes doubt-solving sessions, revision support, and exam strategy guidance throughout the preparation journey.

- Industry exposure through case studies and projects

Learners gain exposure to real scenarios and case studies aligned with industry practices, which helps them understand how risk is managed in real organisations.

This combination of structured learning, global study resources, and practical exposure helps learners prepare not only for the exam but also for the roles that shape long-term FRM salary growth.

FAQs on FRM Salary

When someone evaluates a career in risk, these are the most frequently asked questions that usually come up before making a decision. From starting pay to hiring companies and long-term growth, each answer below helps you read the real picture of FRM salary and what it can look like across different stages of your career.

What is the salary of an FRM?

The FRM salary varies by experience, location, and role. In India, most professionals start between ₹6 lakh and ₹10 lakh per year and can grow to ₹25 lakh or more with experience. Professionals who train through structured programs such as those offered by Imarticus Learning often build strong technical skills, which can help them move into higher-paying roles faster.

Who earns more, CFA or FRM?

When comparing roles, both careers offer strong income potential, but they serve different functions. The FRM salary is linked to risk management roles in banks and financial firms, while CFA roles are linked to investments and portfolio management. Some learners from Imarticus Learning choose to combine both paths to expand their career options and increase long-term income potential.

Is FRM in demand in India?

Yes, demand for risk professionals is rising due to banking regulations, fintech growth, and global compliance needs. The FRM salary has seen steady growth because companies need experts who can manage financial risk. Structured learning platforms like Imarticus Learning help candidates gain practical skills that align with current industry needs.

Does Big 4 hire FRM?

The Big 4 firms Deloitte, PwC, EY, and KPMG hire risk professionals for consulting and compliance roles. The FRM salary in these firms depends on experience and project exposure. Candidates trained with strong analytical skills through institutes like Imarticus Learning often find good opportunities in consulting roles.

Do investment banks hire FRM?

Yes, investment banks hire FRM professionals for market risk, credit risk, and liquidity risk roles. The FRM salary in investment banking is usually higher because of the complexity of work and global exposure. Many candidates prepare for these roles through structured programs such as those offered by Imarticus Learning to improve job readiness.

Does Google hire FRM?

Technology companies like Google hire risk professionals for financial risk, fraud analytics, and compliance roles. The FRM salary in such companies can be competitive due to the technical nature of the work. Candidates with data and analytics skills built through Imarticus Learning programs are often well-suited for such roles.

What is the basic starting salary of an FRM-certified professional?

The basic starting range for an entry-level role usually falls between ₹6 lakh and ₹10 lakh per year. The FRM salary at this level depends on skills and internship exposure. Candidates who train with practical projects at Imarticus Learning often improve their chances of securing better starting packages.

What is the amount of salary a candidate gets after the FRM Level 1 Exam?

After clearing Level 1, candidates can apply for entry-level risk roles. The FRM salary at this stage may range from ₹5 lakh to ₹8 lakh per year, depending on skills and experience. Completing practical training with institutions such as Imarticus Learning can help candidates move into higher-paying roles even before finishing the full certification.

Start Building your FRM Salary Path Today

A career in risk management offers steady growth and strong income potential. The numbers show a clear path. Entry-level roles start at a healthy base. Mid-career roles bring strong jumps. Senior roles can reach leadership-level pay across India and global markets. The FRM salary reflects the value of professionals who can understand and manage financial risk in a fast-changing world.

This path rewards consistency. The more you build skills in data, regulations, and financial markets, the stronger your earning curve becomes. It is similar to building a long-term investment portfolio. Small steps taken early create a strong outcome over time.

If you are exploring this path, the focus should be on building both conceptual clarity and practical skills. Structured preparation helps you stay consistent and confident through the journey. The FRM Course prep offered by Imarticus Learning gives you guided learning formats to help you stay on track, practice real-world scenarios, and prepare for roles that align with industry needs.

The opportunity is clear. The demand is rising. With the right preparation and steady effort, you can build a rewarding career in risk management and grow your earning potential step by step.