Finance courses have been a top favorite for students wanting a stable career for a long time. That is true for both in and out of India. However, with the progress of the field, a lot of new courses have been introduced to the masses over the years, such as Financial Technology, Blockchain Technology, New Age Banking, Financial Modelling course, Financial Planning, and Analysis courses.

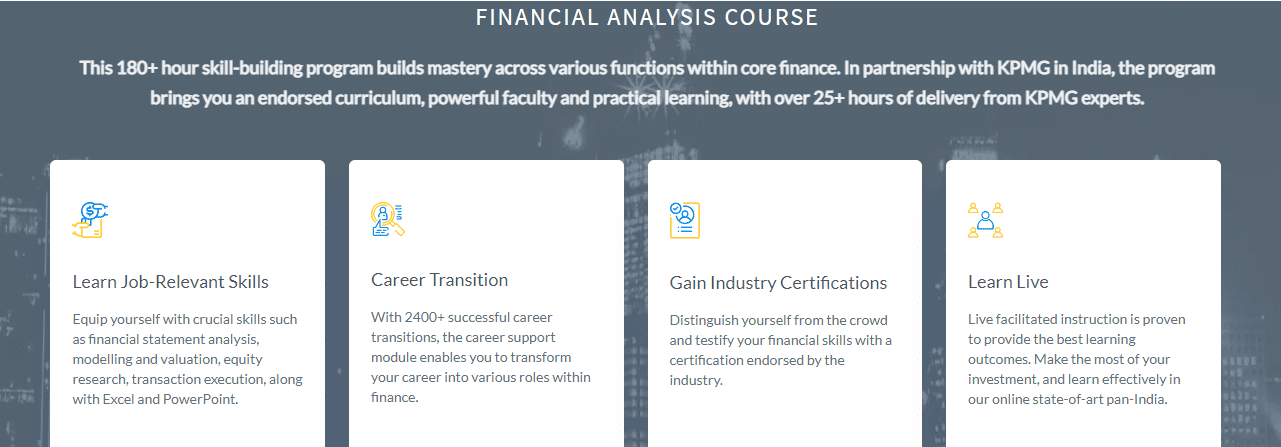

The financial planning and analysis course has gained popularity among students in a short time. This is why a lot of institutes in India offer a financial analyst course. Imarticus Learnings as always has come through with a compact Financial Analysis prodegree with job interviews offers. If you want a chance to boost up your career, then go ahead and check it out.

Here, we are going to talk about what financial planning and analysis courses entail, how they can help you to become a financial planning lead, and the all-around advantages a financial planning and analysis course can have over your career.

Here, we are going to talk about what financial planning and analysis courses entail, how they can help you to become a financial planning lead, and the all-around advantages a financial planning and analysis course can have over your career.

What Does a Financial Planning Course Entail?

A financial planning course basically teaches students the skillset needed to chalk out any financial situations successfully relating to today’s economic scenario. Here, we are going to discuss the objectives of a financial planning course:

- To prepare students for real-world economic scenarios with proper case studies

- To nurture the analytical and strategic skills needed for a financial planning career

- To train them accordingly so that they can meet the needs of the demanding industry

How Does it Help you Become a Financial Planning Lead?

The job of financial planners basically involves chalking out the financial goals of companies or individuals and guiding them into achieving them. They are hired by financial planning firms and are one of the most in-demand as well as highest-paying jobs nowadays.

As a financial planning and analysis course provides the necessary training needed for a career in any sort of financial services, it obviously automatically increases your chance of becoming a financial planning lead.

All-around Advantages in Your Career of a Financial Planning and Analysis Course

There are numerous advantages of a financial planning course in your career. Here are a few of them:

- There are a lot of career options for you to choose from such as broker/dealer, investment advisor, wealth management officer, customer services, and asset management.

- You can utilize your financial planning course in your start-up as well. It will save a lot of money to use your own skills as a financial planner instead of hiring one.

- It is one of the most in-demand courses right now, so a stable career is guaranteed.

- It is also one of the highest-paying jobs nowadays.

Conclusion

Just like all other corporate sectors, the finance one being possibly the most important has progressed quite dramatically in the last few years. And, to progress it even further, more and more financial planners are needed.

This is why it is the golden time to get enrolled in a financial planning and analysis course and secure your future. Imarticus Learnings is providing you with a golden opportunity to boost your career with its financial analysis course that is sure to put you leagues beyond your peers.

If you are confused about what to learn in finance, get guidance at Imarticus Learning. We offer a range of

If you are confused about what to learn in finance, get guidance at Imarticus Learning. We offer a range of

We recommend joining online finance courses, particularly those that offer financial analyst training and placement.

We recommend joining online finance courses, particularly those that offer financial analyst training and placement.