The introduction of AI tools has caused a significant change in all industries. In the banking and finance sector, AI and ML have proven to be highly reliable support tools. It has lessened the workers’ grunt workload and in turn, has let them focus on the finer aspects of their profession that AI is still unable to perform. It is the same when it comes to credit risk assessment.

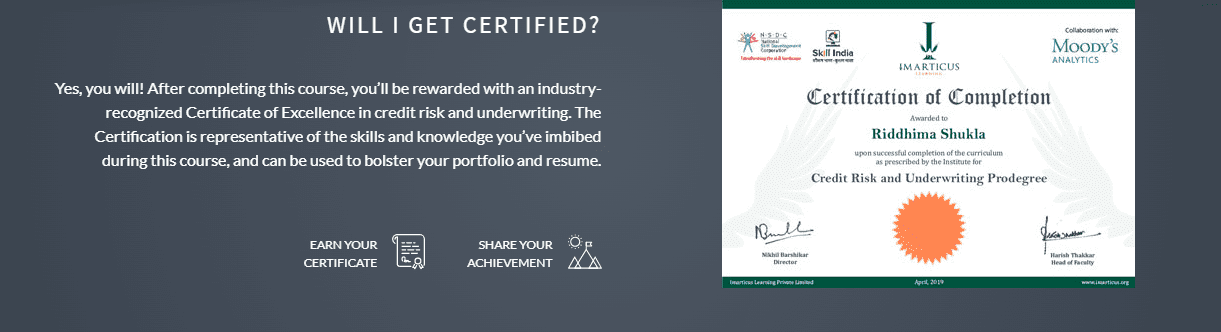

With the help of AI tools, the predictability of the underwriting risks is a lot closer to the actual numbers. A lot of institutions in India provide good credit risk underwriting courses. A credit risk analyst course is the only way if you are thinking about pursuing a career in this profession. Imarticus Learning as always has come forward with a marvelous credit risk analyst certification course that will give you the necessary boost for your career.

In this article, we are going to talk about what credit risk underwriting is, how AI tools help to manage it better, and some other things that should be kept in mind.

What is credit risk underwriting?

There is a chance when a financer offers a loan, that the interest, as well as the capital amount, might not be repaid. It negatively impacts the underwriter or financer financially. Predicting the lapse in the repayment of the contractual amount and the ensuing loss faced by the financer or underwriter is what credit risk assessment is about. And underwriting risks are what the financer or underwriter has to bear while offering contractual loans. A credit risk analyst course helps you hone the necessary skills required for assessing such situations.

Benefits of AI tools

The application of AI tools in managing credit risk underwriting is still blossoming. However, many companies have already put themselves one step ahead by comparing and accepting the benefits brought forth by AI tools. The major benefits of this are:

- Older systems are unable to keep track of the massive amount of data and decipher the finer aspects of a contract which could impact the credit risk negatively. In this scenario, the application of AI and ML tools to collect bank data increases the accuracy of the model significantly

- AI tools are excellent at detecting patterns swiftly even through big data. In this way, it is possible to detect potential risks to the contractual agreement.

Key points to keep in mind

There are a few things, though, that should be kept in mind when it comes to credit risk underwriting, such as:

- The process should be supervised regularly as financial companies are now supposed to be a lot more transparent and auditable.

- Adjustments should be made in the framework development of the risk management process, as an unpredictable model could cause more harm than benefits.

- A lot more focus should be kept on the standardization, accuracy, and validity of data processing. As these tools are extremely data-sensitive, the whole process might fall short without a proper flow of information.

Conclusion

With the increase of AI tools in all corporate sectors, the need for AI smart professionals has increased. Especially so for a sector as data-sensitive as finance. This is high time to look for good credit risk underwriting courses. Check out Imarticus Learning’s credit risk analyst certification course.

If you are thinking of pursuing a career in this field. It is undoubtedly one of the best institutions out there, and it will help elevate your skills to the next level.