The CPA certification is the highest level of expertise in the field of accounting around the globe, and it is a highly sought-after and versatile certificate for accountants.

Certified Public Accountants is the full form of the acronym CPA. It is an exam administered by the American Institute of Certified Public Accountants (AICPA). It is a worldwide recognised qualification for which the applicants must successfully pass the Uniform CPA Examination. In India, the Chartered Accountant (CA) designation is comparable to CPA.

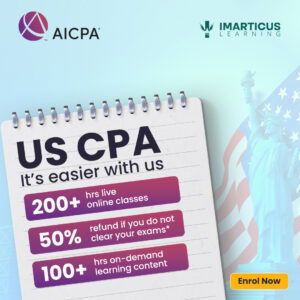

With over a decade of expertise, Imarticus Learning is your best choice when looking for prominent accounting employment options in India. Our tailored US CPA course and certification curriculum accelerate your achievement while complimenting your prior education. Join us to acquire top-tier opportunities in India’s burgeoning job market and meet your goal of becoming a CPA.

Career Path of CPA

With US CPA course you can master your skills in Financial Accounting, Financial Reporting, Financial Analysis, Audit & Attestation, Tax Planning and Business Regulations.

The designation of CPA opens the door to a broad spectrum of career opportunities. After obtaining your CPA certification, you will have the option of working in several accounting sectors such as international accounting, consulting services, internal and external auditing, forensic accounting, taxation, assurance services, financial planning, etc. In many nations, you will find the best places to work because of its reputation and recognition around the world.

Course Duration and Fee of CPA

- The US CPA course offered by Imarticus takes a minimum of 12 to 18 months.

- The CPA course fee is INR 1,20,000. The CPA exam price is $1000, while the international testing fee is $1500. In addition, $225 is required as evaluation expenses. Thus, the entire cost is $2750, or nearly INR 2,00,000, excluding training expenses.

Eligibility Criteria

CPA exams are conducted by the AICPA, the world’s biggest accounting association. The AICPA provides membership to all hopefuls who pass all four CPA tests. However, CPA licences are awarded by the 55 state boards of accountancy in the US that are members of NASBA. Each state board has distinct qualifying requirements for aspirants to take the US CPA examinations.

- Master’s degree in any of the fields of commerce, accounting or finance.

- An aspirant requires 120 credits to take the US CPA tests, and 150 credits to obtain his CPA licence.

- A year of university study in India is equivalent to 30 credits of schooling in the United States.

- In some situations, first-class graduates of three-year degrees from NAAC-A-certified Indian colleges are eligible to take the US CPA examinations.

CPA Curriculum

- Current Curriculum

It includes 4 mandatory subjects:

- Audit & Attestation (AUD)

- Financial Accounting & Reporting (FAR)

- Taxation & Regulations (REG)

- Business Environment and Concepts (BEC)

- New Curriculum

The CPA Evolution Program establishes a new structure for US CPA certification, which includes a rewritten curriculum. Beginning in January 2024, the revised CPA curriculum will apply to all tests.

The new CPA Evolution Course framework consists of six papers, four of which must be successfully passed. These six papers are separated into two sets of three papers each.

The first group, referred to as the ‘CORE’ papers, is required for all applicants:

- Core 1 – Audit & Attestation (AUD)

- Core 2 – Financial Accounting & Reporting (FAR)

- Core 3 – Taxation & Regulations (REG)

The second group is referred to as the ‘Discipline’ papers. The aspirants must select one out of the three subjects on the basis of their preferences:

- Discipline 1 – Business Analysis & Reporting (BAR)

- Discipline 2 – Information Systems & Control

- Discipline 3 – Tax Compliance & Planning (TCP)

Career Prospects of US CPA in India

- The US CPA credential offers great potential as a lucrative professional option in India and abroad. With their distinguished reputation, CPAs are in great demand among global firms operating in the country.

- CPAs’ extensive accounting knowledge and skills in International Accounting Standards enable them to flourish not just locally, but also internationally.

- As a result, CPAs are sought after for a variety of positions in the financial services business. Employers actively recruit and value CPAs in India, demonstrating a rise in demand for their services.

- With Imarticus, you also get the opportunity of free placement boot camp.

Salary

A CPA professional in India can expect to earn an average salary ranging between INR 12,50,000 and INR 20,50,000 per year. Once someone has more than 10 years of experience in a field, they usually move on to another one.

Final words

For CPA admission, an aspirant must have experience in accounting and business for at least five years. CPAs are accredited public accountants who act as strategic business advisers.

Imarticus offers an all-inclusive Certified Public Accountant course designed to help you find your full potential and launch a successful career in accounting and finance.