A Certified Public Accountant, or a CPA, is a globally accepted term for finance and accounting professionals. While the world is gearing up for increased demand for finance professionals with skills, becoming a CPA comes prior to when there can be a guarantee of global acceptability, well-paying professional roles, as well as professional growth. Awareness of CPA course eligibility, however, is where it is a lucrative career.

CPA eligibility criteria differs in each state and nation, and hence the aspirants must confirm in depth if they are meeting the educational as well as the professional eligibility criteria. The procedure is conducted by completing some of the requirements for CPA courses such as accounting degree for CPA, credit hours, and experience.

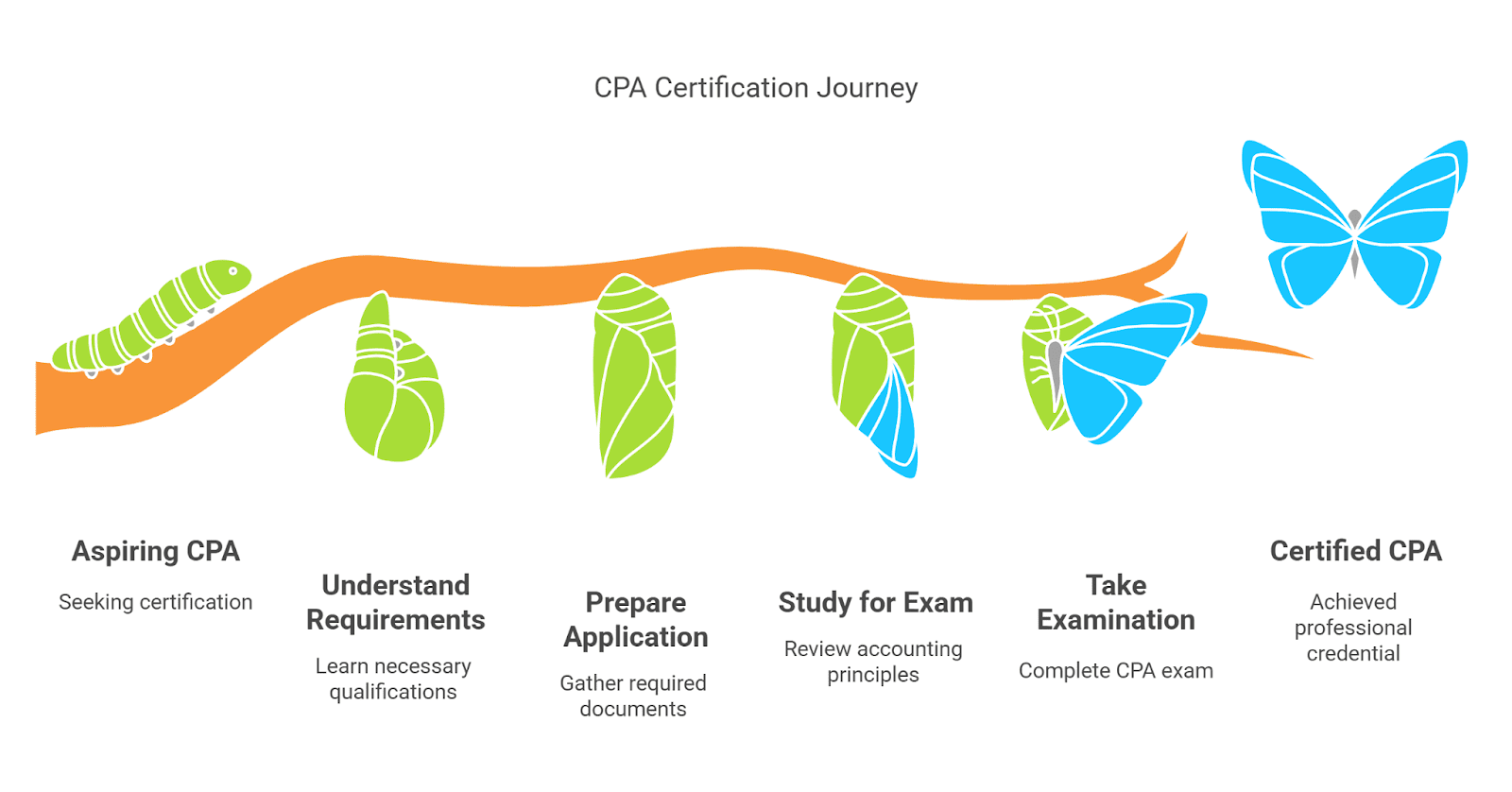

Here we will explain step by step in detail CPA admission prerequisites, eligibility tips, and how to move ahead to become a CPA for future accountants successfully.

1. What is CPA Certification?

American Institute of Certified Public Accountants (AICPA) provides the Certified Public Accountant (CPA) certification and is one of the most recognized accounting and finance certifications globally. The CPA professionals are financial auditors, tax advisors, forensic accountants, and best corporate finance.

Key Benefits of CPA Certification:

- Global recognition with adequate job opportunities in the US, Canada, India, UAE, and Europe

- Add salary, ₹12.50 to 20.50 LPA

- Professional education in taxation, risk management, and investment banking

Considering these benefits, most accounting professionals try to gather details about the process of eligibility for CPA and initiate their journey towards CPA.

2. CPA Course Eligibility: Who Can Apply?

Prior to sitting for CPA, the candidates are required to fulfill some educational as well as professional requirements. NASBA is among the prominent members in handling qualification for the CPA path but varies in qualification requirement based on various states of America.

General CPA Eligibility Criteria:

- Educational Qualification:

- Bachelor’s degree in business administration, accounting, or finance from a highly esteemed institution.

- 120-150 college-level hours of coursework is the state-dependent prerequisite for qualification.

- Work Experience Requirement:

- 1-2 years’ experience under a certified CPA is required in some US states prior to certification

- Ethics Exam:

- The candidates should pass an ethics examination prior to issuing the CPA certificate in some jurisdictions.

Since each jurisdiction is different in eligibility, prospective applicants are asked to verify eligibility with NASBA or state boards of accountancy prior to registration.

3. CPA Course Requirements: Educational and Work Experience

Educational Qualifications for CPA Eligibility

CPA course requirements have educational requirements, and these are typically business and accounting courses. Below is what is supposed to be detailed by the registrants:

| Requirement | Details |

| Bachelor’s Degree | Must be in accounting, finance, or business-related fields |

| Credit Hours | 120–150 credit hours depending on state regulations |

| Relevant Courses | Financial Accounting, Taxation, Business Law, Auditing |

Accounting Degree for CPA: Do You Qualify?

Indian applicants do not know if their CPA accounting accountancy degree is acceptable. Generally:

- A B.Com will not get you to the 150-credit mark alone.

- Other master’s degrees, CA, CMA, or MBA (Finance) can substitute for missing credits.

- US states receive some with less hours but have more classes afterward.

Work Experience for CPA Certification

- States expect 1-2 years’ experience working with a certified CPA, ideally in the following roles:

- Public accounting firms (Big 4 – Deloitte, PwC, EY, KPMG)

- Corporate finance and taxation

- Government and regulation bodies

- Experience will be certified and attested by a CPA mentor.

- Experience and education need to be fulfilled to become CPA eligible.

4. How to Meet CPA Eligibility as an Indian Candidate?

Indian applicants also have a process of how they can become qualified for the CPA course because there are different systems of education. This is how they can become qualified for that:

Step 1: Evaluate Your Credit Hours

- Three-year B.Com is succeeded by 90-120 credit hours.

- Foreign applicants may be required to undertake M.Com, CA, or CPA Bridge Course for 150 hours.

Step 2: Choose the Right State Board

- There are some favorable conditions for foreign applicants in some states, such as Montana and New Hampshire.

- It is always wise to look for state-specific conditions to be a CPA.

Step 3: Gain Required Work Experience

- Gain experience by working under the guidance of CPA-approved professional in audit, taxation, or finance.

- Gain internships with Big 4 firms to gain proper exposure.

- By this method, Indian applicants can approach CPA eligibility requirements with confidence.

5. CPA Admission Prerequisites: Application and Exam Process

After determining the eligibility for CPA courses, the following admission procedure must be adopted by the applicants:

Step 1: Select the Right Jurisdiction

- Admission procedures for US state boards differ, and the applicants should apply accordingly.

Step 2: Submit Educational Documents

- Transcripts must be stamped or certified by NASBA or a pre-approved credentialing organization.

- Degree equivalency must be in accordance with state CPA requirements.

Step 3: Apply for the CPA Exam

- Register with NASBA and pay examination fees.

- Obtain an Authorization to Test (ATT) and schedule a test appointment.

Step 4: Prepare for the CPA Exam

- Subscribe to the CPA prep courses and study materials of Imarticus Learning, Becker, Wiley, or Gleim.

By following all these steps, the candidates will clear the CPA admission process and start their CPA career.

6. Tips for Aspiring CPAs: How to Qualify Faster?

Candidates can make their CPA faster with these insider tips:

- Plan Ahead Your Studies – Get a 150 credit hours degree.

- Right Decision with CPA Review Courses – Select structured courses to achieve higher pass rates.

- Gain Pratcal Experience – Arrange a meeting with a CPA company for practice of work requirements.

- Strategy-based Approach to the CPA Exam – Get yourself ready in a state that is suitable for your qualification in order to get eligible.

Prospective accountants can speed up CPA certification and land high-paying jobs with proper strategy.

FAQs

1. What are the educational requirements to become CPA eligible?

Candidates must possess a 120-150 credit hour finance, accounting, or business bachelor’s degree as required by the state board.

2. Can a B.Com graduate be CPA eligible?

A B.Com graduate can, under certain circumstances, need other diplomas or courses like CA, CMA, or M.Com to be CPA eligible in a 150-credit scenario.

3. Is experience necessary to get CPA certified?

1-2 years work experience as staff or assistant to a public accounting, taxation, or corporate finance CPA certified professional is required in most states.

4. Is it possible for Indian students to take the CPA exam in India?

Yes, now the CPA exam is also conducted in India, and thus no foreign travel will be required for the exam.

5. CPA certification fee?

The fee for the CPA exam is ₹2.5 to ₹3.5 lakhs, which covers application, assessment, and exam charges.

Conclusion

CPA course eligibility is the gateway to becoming a Certified Public Accountant. Once all the CPA eligibility requirements like education, experience, and exam are completed, one is capable of securing better job profiles with higher-grade global companies.

Emerging CPAs must focus on the right choice of jurisdiction, CPA admission process, and strategic preparation for the exam. With proper training and direction from experienced professionals, a CPA certificate can be a career booster. If you are willing to start your CPA journey, join Imarticus Learning’s CPA program to get expert guidance, live simulations, and placement support!