It is hard to think of a world without coins or bills. Our journey through the history of money begins long before the clinking of metal or the rustle of paper.

The earliest form of exchange was not money at all, but a system of barter. This method of exchange was simple trades such as farmers trading baskets of wheat for a blacksmith’s tools or a skilled weaver exchanging a length of cloth for a basket of fish.

Barter systems, though seemingly basic, laid the foundation for the concept of value exchange. Let us learn more about money and banking, the building blocks of finance and economics.

What is Money and Banking?

Over time, societies transitioned from bulky and inconvenient goods to more standardised forms of currency. Commodity money emerged, where objects with inherent value, like salt bars or cattle, became the medium of exchange. These commodities were not only useful but also relatively scarce and easy to transport, making them a more practical alternative to bartering a basket of apples for a new pair of sandals.

The next step in our evolution was the rise of representative money. Think of a society where instead of lugging around cumbersome sacks of salt, people use tokens or coins representing a specific amount of salt stored in a secure location. These tokens, often made of precious metals like gold or silver, held their value because they were backed by a real commodity. Gold and silver coins became the dominant form of currency for centuries, not only for their inherent value but also for their durability and divisibility (easily broken down into smaller units for transactions).

Fast forward to the modern era and we encounter a new concept, the fiat currency. Unlike commodity or representative money, fiat currency has no inherent value. These government-issued bills and coins derive their value solely from the trust and legal backing of the issuing authority. The rise of fiat currency allowed governments to exert greater control over their economies and facilitated easier trade and financial transactions.

Introduction to Money and Banking Concepts

Money is not just a cold, hard object. Throughout history, different cultures have developed unique and fascinating forms of currency that reflect their values and resources. Pacific island cultures used intricately carved shells (wampum) as a form of payment, while ancient Chinese civilisations employed salt bars shaped like knives. These diverse forms of currency offer a glimpse into the historical ingenuity and cultural significance of money beyond its function as a medium of exchange.

Banks: The Foundations of Modern Economies

Think of a world where your extra cash sits under your mattress, and borrowing money to buy a house or start a business is nearly impossible. This might have been the reality for our ancestors, but today, banks play a vital role in keeping our economies humming. Let us delve into the core functions that make banks the power behind the purse.

At their heart, banks serve three critical functions:

- Depositors’ Haven: People entrust their money to banks by opening savings or checking accounts. These deposits act as a safe and accessible way to store your hard-earned cash.

- Lending Powerhouse: Banks do not just store money, they put it to work. By granting loans to individuals and businesses, banks act as a bridge between those with surplus funds (depositors) and those who need capital for investment or growth. Loan repayments, along with interest, allow banks to generate profit.

- Payment Facilitator: Gone are the days of lugging around sacks of gold. Banks provide a secure and efficient system for transferring funds electronically, allowing you to pay bills, send money to friends, or make online purchases with a few clicks.

But the world of banking is not a one-size-fits-all operation. Different types of banks cater to specific needs:

- Commercial Banks: These are the institutions you are most familiar with, offering everyday banking services like checking and savings accounts, debit cards, and consumer loans.

- Investment Banks: These financial powerhouses deal in larger transactions, helping businesses raise capital through stock offerings or mergers and acquisitions. They also manage investment portfolios for wealthy individuals and institutions.

- Central Banks: Acting as the backbone of a nation’s financial system, central banks set monetary policy, regulate commercial banks, and issue the national currency.

A Historical Look at Banking’s Evolution

The concept of banking has a rich and fascinating history. Early money changers, operating centuries ago, exchanged currencies and offered safekeeping services for valuables. These rudimentary institutions laid the foundation for the modern banking system. Over time, banks played a pivotal role in financing major historical events. From funding wars and exploration voyages to fueling the Industrial Revolution, banks have been instrumental in shaping the economic landscape throughout history.

But how do banks create the money they lend? This is where the concept of fractional reserve banking comes in. Banks do not lend out every single dollar deposited. Instead, they keep a portion (reserve requirement) on hand to meet client withdrawals and lend out the remaining amount. This allows banks to create credit in the economy, essentially multiplying the money supply and stimulating economic activity. However, fractional-reserve banking is a complex concept with its own set of regulations and potential risks. These are essential concepts of money and banking.

Demystifying Money

Financial literacy empowers us to take control of our money and navigate the exciting, yet sometimes complex, world of personal finance. After being able to control your own money, you will be able to manage your client’s money even better as a banker. Let us break down some essential concepts to equip individuals for financial success:

Income: The Foundation

Our income is the money we earn. It can come from various sources, including:

- Salary: A fixed amount of money you receive for your work, typically paid bi-weekly or monthly.

- Wages: An hourly rate of pay, often seen in part-time or freelance jobs.

- Investments: Earnings generated from our investments in stocks, bonds, or real estate.

- Net Income: Our Take-Home Pay

Understanding our net income is crucial. This is the amount of money we actually have available to spend after taxes and other deductions are withheld from our gross income (total earnings). Knowing our net income is essential for creating a realistic budget.

Expenses: Where Does Our Money Go?

Expenses are the costs we incur to maintain our lifestyle. Categorising our expenses helps us track our spending habits and identify areas for potential savings. Here is a basic breakdown:

- Fixed Expenses: These expenses remain relatively constant each month, such as rent/mortgage, utilities, car payments, and minimum debt payments.

- Variable Expenses: These expenses can fluctuate each month, including groceries, transportation (beyond car payments), entertainment, and dining out.

Budgeting: The Roadmap to Financial Freedom

A budget is our financial roadmap. It helps us allocate our net income towards our expenses and savings goals. By creating a budget, we gain control over our money and avoid wasteful spending. There are various budgeting methods, from the traditional 50/30/20 rule (50% needs, 30% wants, 20% savings) to more flexible approaches.

Savings: For the Future

Saving is essential for achieving our financial goals, whether it is a down payment on a house, a dream vacation, or a secure retirement. Here are some popular savings vehicles:

- Savings Accounts: Offer easy access to our money with a modest interest rate.

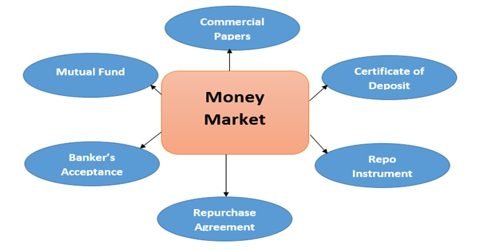

- Certificates of Deposit (CDs): We commit our money for a fixed term in exchange for a higher interest rate.

- Retirement Accounts: These accounts offer tax advantages for saving specifically for retirement.

Debt: A Double-Edged Sword

Debt is not inherently bad. Used responsibly, it can help us finance major purchases like a house or education. However, it is crucial to differentiate between good debt and bad debt:

- Good Debt: Debt used for investments that appreciate in value over time, like a mortgage or student loan for a high-demand field.

- Bad Debt: Debt used for depreciating assets or unnecessary expenses, like credit card debt with high-interest rates.

Demystifying Money Management: Equipping Yourself for Client Success

The world of money and banking thrives on a fundamental principle, understanding your client’s financial needs. As you embark on your career in money and banking, you must grasp these essential concepts of personal finance, equipping you to effectively serve and empower your clients.

Beyond the Basics: Deepening Your Financial Expertise

As you navigate the ever-evolving world of money and banking, here are some additional areas to explore and strengthen your financial knowledge:

- Investing Basics: Equipping yourself with a solid understanding of investment vehicles (stocks, bonds, mutual funds) is crucial. Learn how these instruments work, their risk-reward profiles, and how to develop sound investment strategies for your clients with varying risk tolerances and long-term goals.

- The Power of Interest Rates: Interest rates significantly impact both borrowing and saving decisions. Master the concept of simple and compound interest, and how fluctuations in interest rates affect loan payments, savings account yields, and overall investment returns.

- The Global Financial Ecosystem: The world of finance transcends borders. Gain a basic understanding of international trade, foreign exchange (currency exchange rates), and the role of global financial institutions like the International Monetary Fund (IMF) and the World Bank. This knowledge can be invaluable when advising clients involved in international transactions or managing global investment portfolios.

- Building Financial Literacy Champions: Empowering your clients requires readily available resources. Curate a list of reputable websites, books, or financial literacy programs you can recommend to clients seeking to deepen their understanding of personal finance management.

By delving into these additional areas of money and banking, you will not only enhance your professional expertise but also position yourself as a trusted financial partner, capable of guiding your clients towards achieving their financial goals with confidence and a well-rounded understanding of the financial landscape.

A Journey Through the Client’s Mind: Income, Expenses, and Budgeting

Understanding Income Sources: Your clients come from diverse backgrounds with varying income streams. Grasp the concept of salary, wages, and investment income to better understand their financial footing.

Categorising Expenses: Clients incur fixed expenses (rent, utilities) and variable expenses (groceries, entertainment). This knowledge allows you to tailor financial products and services to their specific needs.

The Power of Budgeting: A cornerstone of financial literacy, budgeting empowers clients to allocate income towards expenses and savings goals. Being familiar with budgeting methods equips you to guide clients in creating a personalised financial roadmap.

Financial Tools in Your Arsenal: Accounts, Cards, and Debt Management

- Account Options: Checking and savings accounts serve different purposes. Understanding the pros and cons of each empowers you to advise clients on selecting the right fit for their needs.

- The Power of Plastic: Debit cards offer immediate access to funds, while credit cards provide a line of credit. Educate clients on responsible credit card use and strategies for managing debt effectively.

- Savings Vehicles: From traditional savings accounts to certificates of deposit (CDs) and retirement accounts, understanding various savings options allows you to recommend the most suitable vehicles for your client’s goals.

Tailoring Solutions for Different Life Stages

- Young Adults: Financial independence beckons. Equipping young adults with budgeting tools and knowledge on building emergency funds positions you as a trusted advisor.

- Mid-Career Professionals: Debt repayment, retirement planning, and potentially saving for children’s education become priorities. Understanding these life-stage challenges allows you to offer targeted financial products and guidance.

- Pre-Retirees: Retirement planning takes centre stage. Advise clients on diversifying investment portfolios, reviewing retirement income sources, and adjusting spending plans for a secure future.

The Rise of Digital Banking and Fintech

Online banking and mobile banking apps are the new normal. Familiarise yourself with these platforms to guide clients and troubleshoot any challenges they might encounter. Also, fintech companies offer innovative solutions like mobile payments and peer-to-peer lending. Stay informed about these trends to stay ahead of the curve and potentially integrate these services into your client offerings.

The Key to Success: Building Trust and Communication

By demystifying personal finance as well as money and banking for your clients, you build trust and establish yourself as a valuable resource. Effective communication is paramount and you should explain financial concepts in clear, jargon-free language. Actively listen to your clients’ concerns and tailor your advice to their unique financial landscape.

Remember, you are not just selling products and services, you are empowering your clients to achieve their financial goals. By becoming a financial literacy champion, you will foster successful relationships and contribute to the overall well-being of your clients.

Wrapping Up

In this article, we explored the fascinating history of money and banking, the vital role banks play in the economy, and the core financial concepts that underpin personal finance management. By understanding these elements, you can help your clients make informed financial decisions and achieve their financial goals.

Financial literacy is the cornerstone of financial well-being. As a banker, you have the opportunity to be a champion for financial literacy, guiding your clients on their financial journeys. Consider enrolling in a dedicated investment banking course to further hone your expertise and stay ahead of the curve in the ever-evolving world of finance.

Remember, the success of your clients is your success. By fostering a culture of financial literacy and offering tailored financial solutions, you will contribute to a more secure financial future for both your clients and your institution.

If you are looking for solid investment banking courses that can take your career to the next level, you can enrol in Imarticus Learning’s Certified Investment Banking Operations Professional programme by Imarticus Learning. This is one of the most comprehensive investment banking courses out there that will teach you all the essential finance and banking concepts.

Frequently Asked Questions

How can I better understand my clients’ financial needs?

Grasp core personal finance concepts (income, expenses, budgeting) and tailor your advice to their life stage (young adult, mid-career, pre-retiree).

What are the key financial tools I should be familiar with?

Understand checking and savings accounts, debit and credit cards, and various savings vehicles (CDs, IRAs) to recommend the best fit for each client’s needs.

How can I stay relevant in the digital age of banking?

Become well-versed in online and mobile banking platforms and emerging Fintech solutions like mobile payments and peer-to-peer lending.

What is money and banking?

Money is the widely accepted medium of exchange we use to buy goods and services. It makes trade easier than bartering directly. Banks are institutions that deal with money. They accept deposits from people and lend out that money to borrowers, acting as intermediaries between savers and spenders. This system helps keep money flowing through the economy. This is just the introduction to money and banking and there are many more things behind these two essential components of economics and finance.

Once the dirty money is cleaned via money laundering, criminals can use it to finance criminal activities.

Once the dirty money is cleaned via money laundering, criminals can use it to finance criminal activities.