If you’re exploring careers in high-growth finance fields, one path that consistently stands out is investment banking. It’s fast-paced, analytical and deeply connected to real business decisions. But here’s something many students realise early: getting into this field requires more than just a degree. That’s where an investment banking certification starts to make a real difference.

An investment banking certification helps you move beyond textbook knowledge and understand how finance actually works inside companies, advisory firms and global banks. Instead of only learning theory, you begin to work with financial models, valuation techniques, deal structures and market analysis – the same skills professionals use daily.

Whether you’re a commerce graduate, an MBA aspirant, or a working professional looking to switch into finance, certification courses in investment banking provide a structured path to build job-ready skills. Today, many students aim to pursue the best investment banking certification to help them improve their career prospects.

If you are on the journey of exploring the right certification for you, through this guide, I’ll provide everything you need to know, right from:

What is an investment banking certification?

Why does it matter for your career?

Best certification courses for investment banking

Free and paid options

Career benefits and salary scope

How to choose the right certification?

Did you know?

An investment banking certification helps you build practical skills early and stand out during internships and job interviews.

Why Investment Banking Certifications Matter Today

Before choosing any certification, you should understand: What is Investment Banking Certification? Think of it as a bridge between academic knowledge and real industry work.

The finance industry has changed significantly over the past decade. Recruiters no longer look only at academic qualifications. They want candidates who understand tools, concepts and real business scenarios. This is where an investment banking certification course becomes valuable.

Helps you stand out in competitive hiring

Investment banking roles attract thousands of applicants. A certification shows recruiters that you’ve taken extra steps to build relevant skills.

Builds practical knowledge

Most certification courses in investment banking include:

- Financial modelling training

- Company valuation methods

- Mergers and acquisitions analysis

- Excel and financial tools

- Case studies and projects

These are the same skills used in entry-level roles.

Improves interview readiness

Investment banking interviews often include technical questions on:

- Valuation

- Financial statements

- Corporate finance

- Market analysis

A structured certification course helps you prepare for these questions confidently.

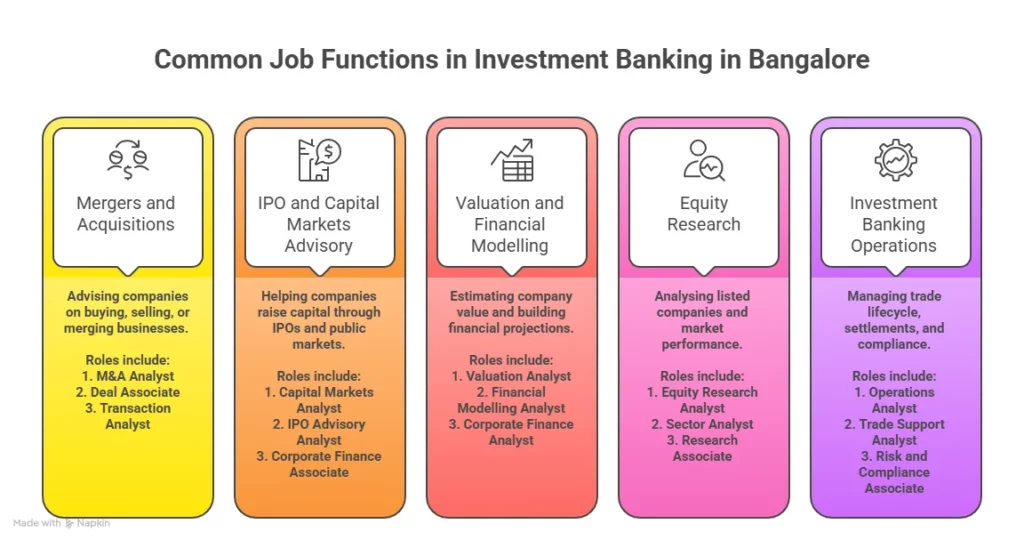

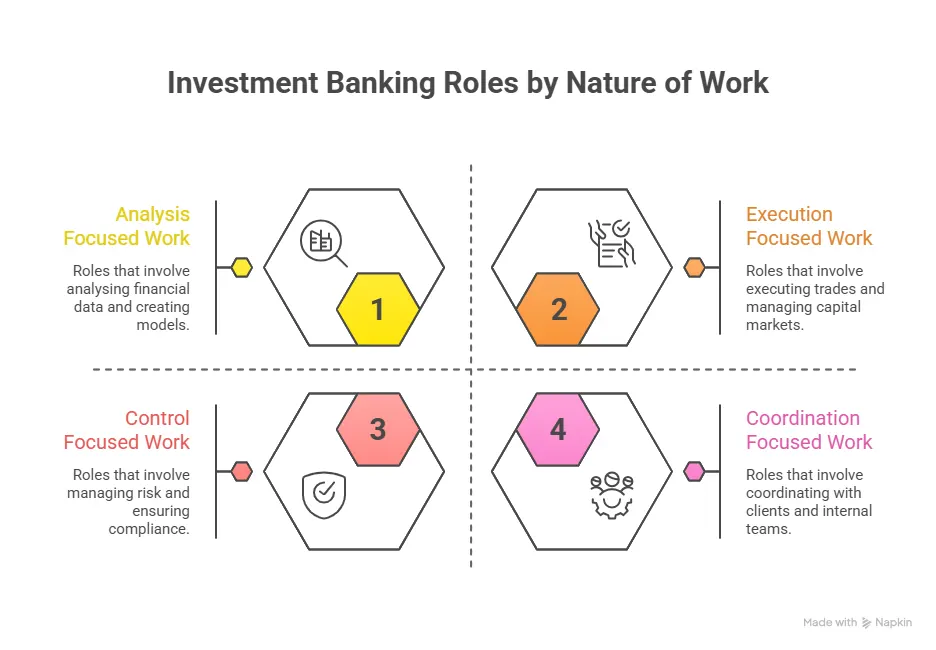

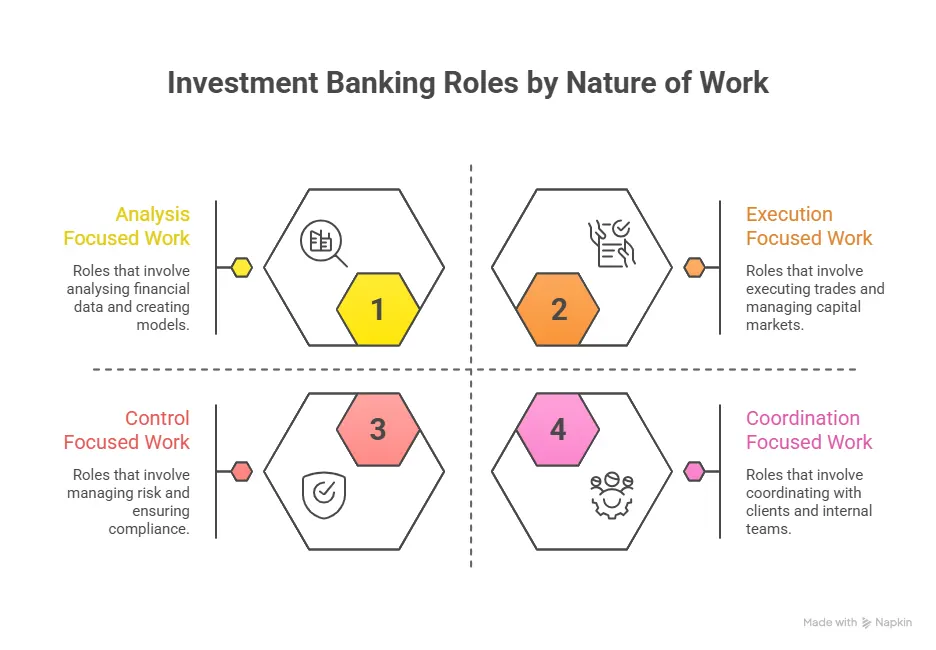

Useful for multiple finance careers

Even if you don’t enter investment banking directly, the skills you learn are valuable in:

- Corporate finance

- Equity research

- Consulting

- Financial analysis

- Private equity

This makes an investment banking operations certification useful across finance careers.

This quick video explains the core roles, functions and responsibilities of investment bankers in a simple and easy-to-follow way – from raising capital and managing mergers to advising companies on major financial decisions.

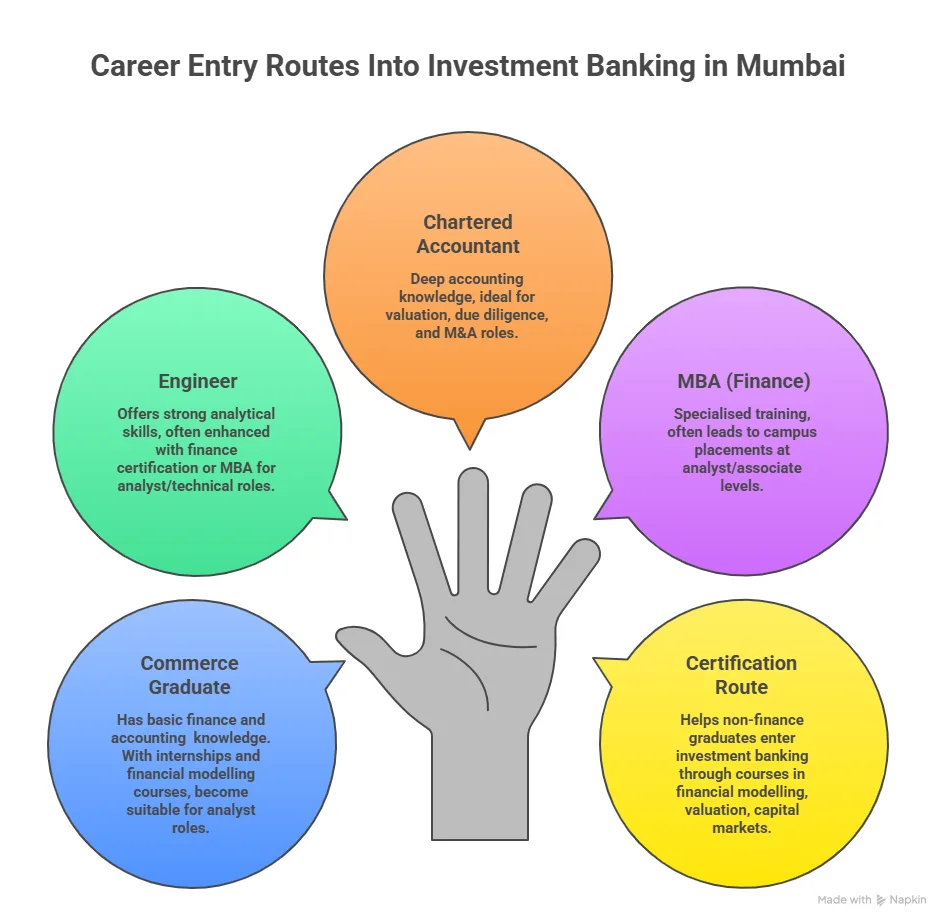

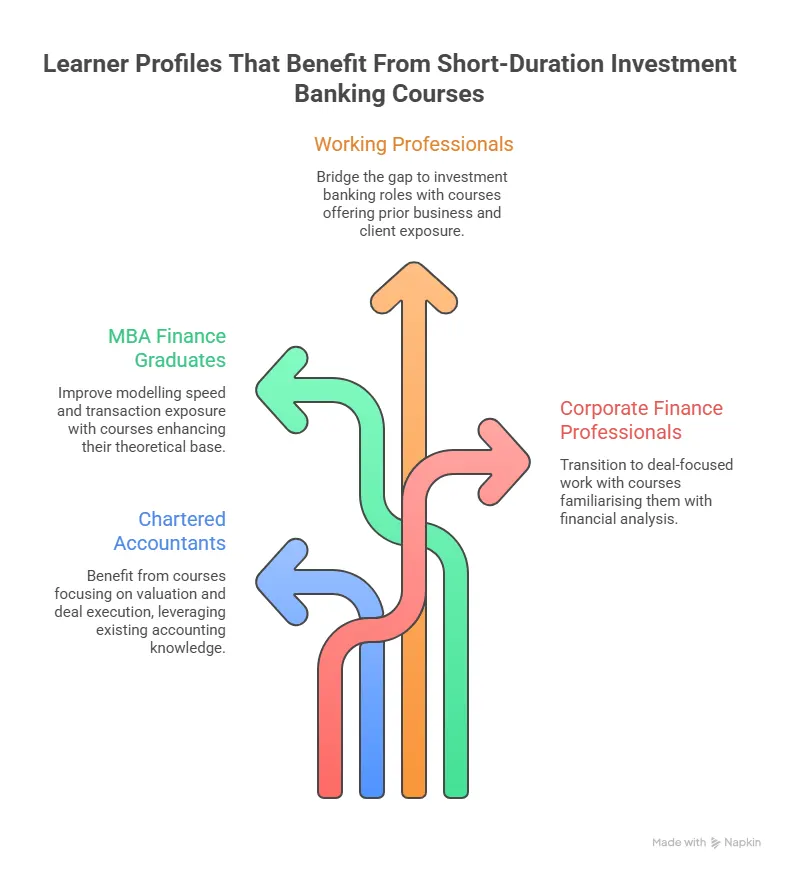

Who Should Consider an Investment Banking Certification?

An investment banking certification isn’t limited to one type of learner. It can benefit students, graduates and professionals at different stages. Before enrolling in any certification, it is important to check investment banking eligibility to know your starting point.

Students exploring finance careers

If you’re pursuing BCom, BBA, MBA or finance-related courses, a certification helps you build practical exposure early.

Graduates preparing for finance jobs

Fresh graduates often use investment banking certification courses in India to improve employability and prepare for interviews.

Working professionals switching careers

Many professionals in accounting, operations, or IT transition into finance roles through an investment banking online certification.

MBA and finance aspirants

A certificate program in investment banking operations strengthens your profile for internships and placements.

In simple terms, anyone interested in finance, corporate strategy or markets can benefit from a structured certification program.

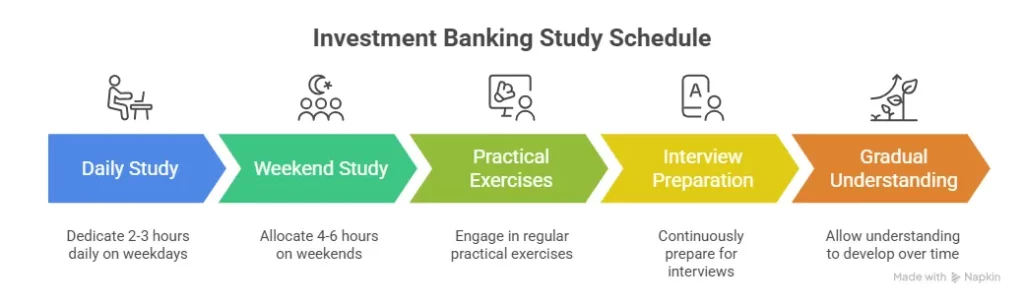

Why Structured Learning Makes a Difference for Investment Banking Certification

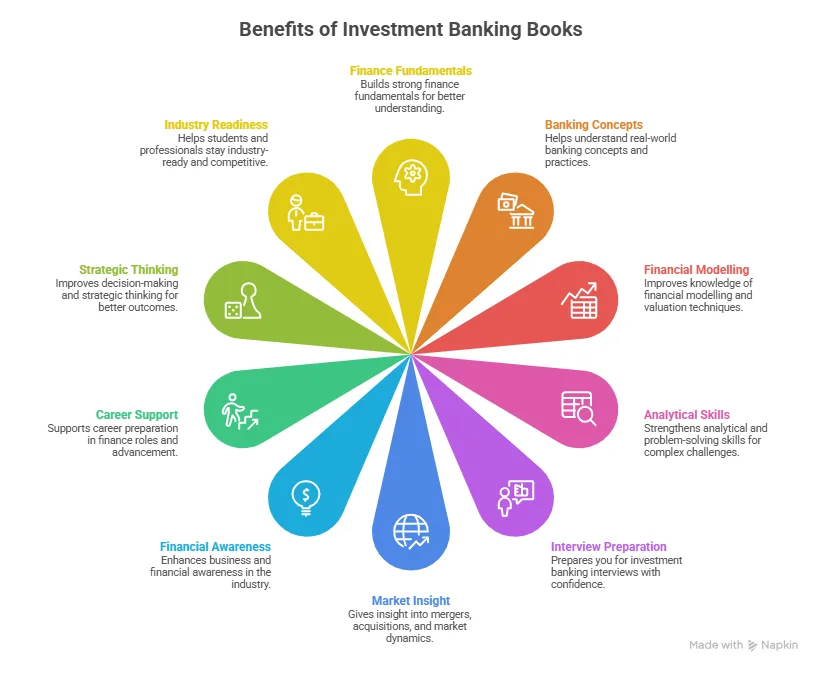

Self-learning is possible with investment banking books, but it often lacks direction. Structured certification programs save time and confusion.

A good investment banking operations certification gives you:

- A clear learning roadmap

- Step-by-step skill building

- Regular practice and revision

- Mentor guidance

- Career support

Instead of wondering what to study next, you follow a clear path aligned with industry needs.

Also Read: What you actually get for paying investment banking course fees.

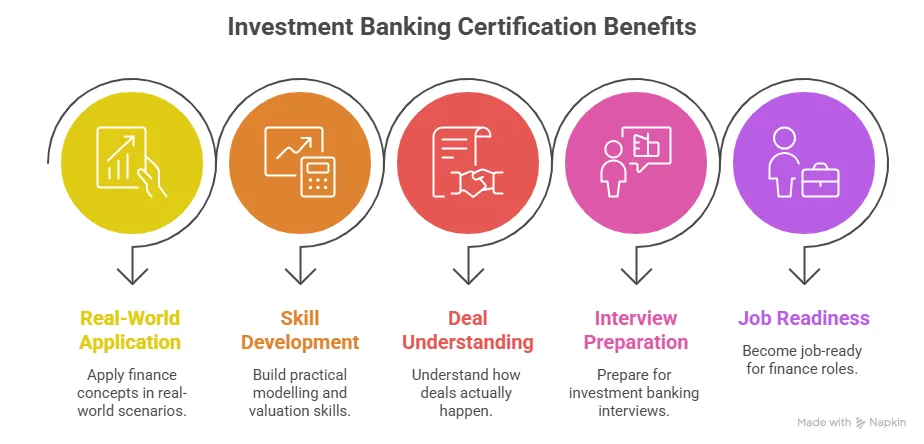

Skills You Gain Through an Investment Banking Certification

A well-designed investment banking certification focuses on practical and analytical skills used in real investment banking roles.

Financial Modelling

You learn to build Excel models to analyse company performance, forecast revenue and estimate future growth.

Valuation Techniques

Certification programs teach methods like:

- Discounted cash flow (DCF)

- Comparable company analysis

- Precedent transactions

These help estimate a company’s value.

Mergers and Acquisitions Basics

Understanding how companies merge, acquire or raise funds is a key part of investment banking.

Financial Statement Analysis

You learn to read balance sheets, income statements and cash flow statements to understand business performance.

Market and Industry Analysis

Investment banking professionals constantly analyse markets and industries before making recommendations.

These skills form the core of most investment banking certification courses online and offline.

Also Read: Why financial modelling is a must have skill for investment banking and finance careers.

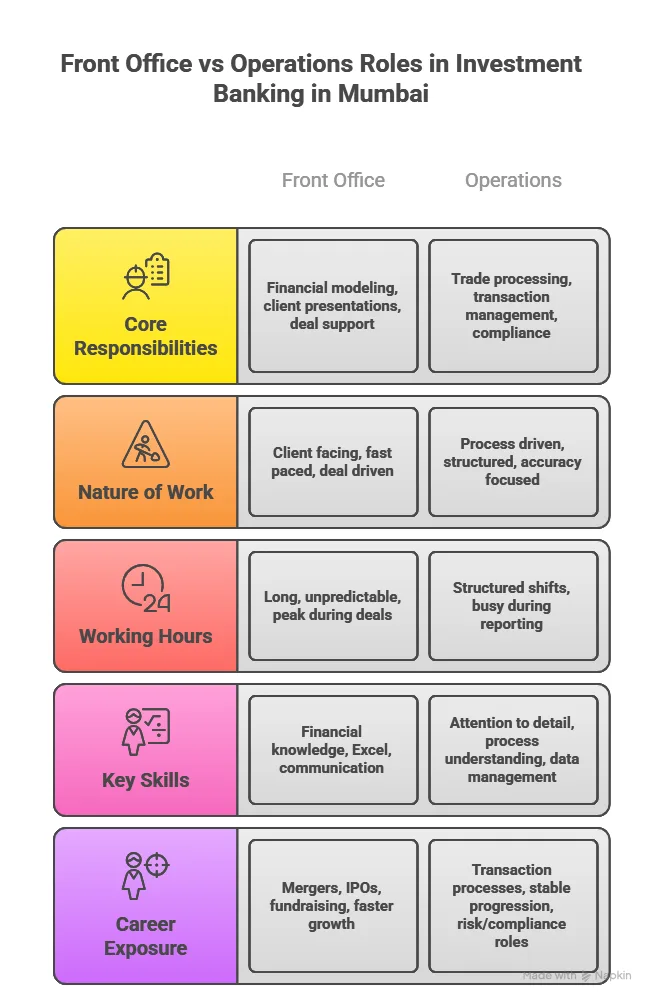

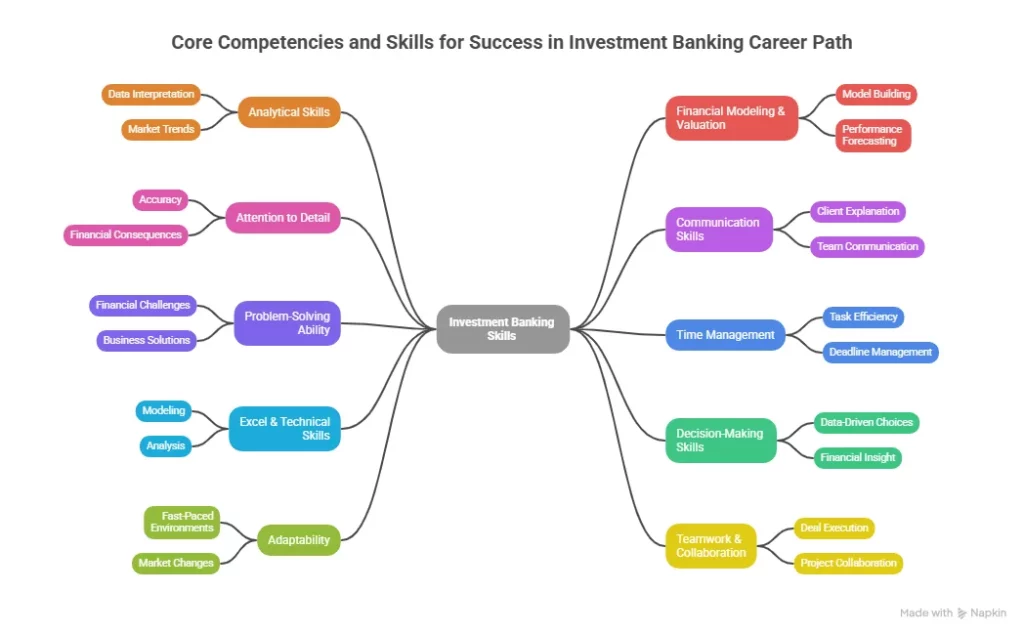

Skills Recruiters Look For After Certification

The best certifications for investment banking alone aren’t enough. Recruiters look for practical skills along with certification.

Technical skills:

- Financial modelling

- Valuation

- Excel and analytics

- Financial statement analysis

- Market research

Soft skills:

- Communication

- Attention to detail

- Analytical thinking

- Problem-solving

- Presentation skills

Combining certification with these skills required in investment banking improves employability.

If you’re still trying to understand what investment bankers actually do and how the role fits into the finance industry, this short video breaks it down. It explains the responsibilities of investment bankers, the kind of work they handle and how they support companies in raising capital, managing mergers and making strategic financial decisions.

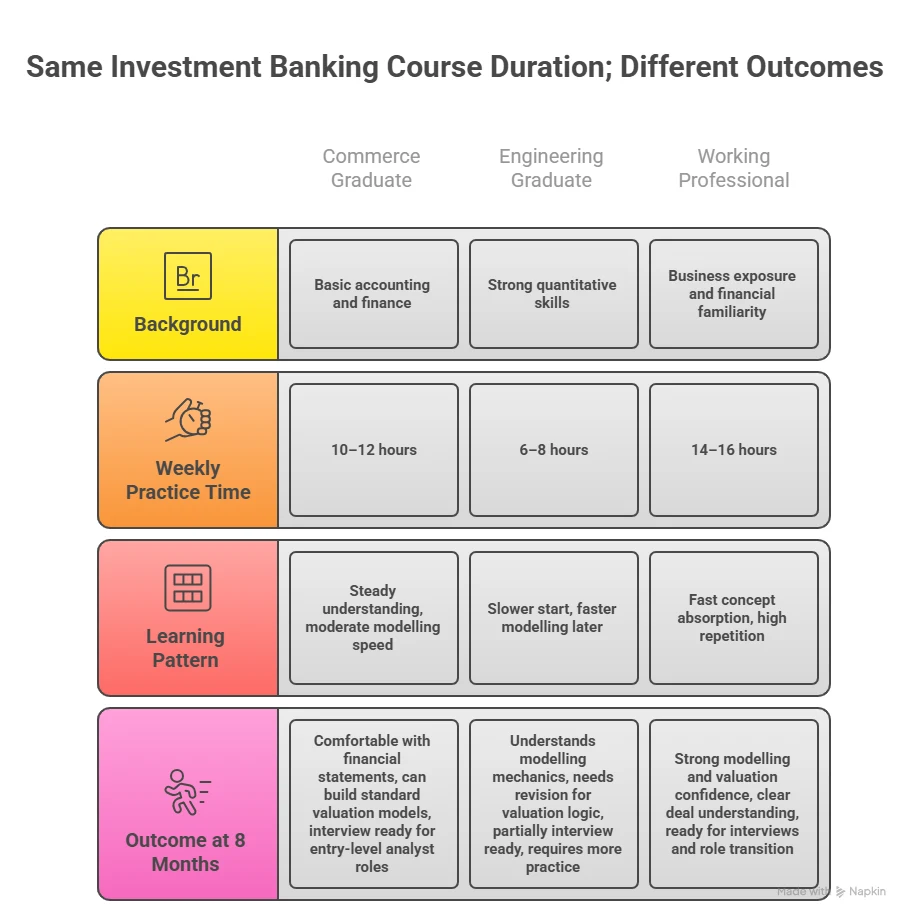

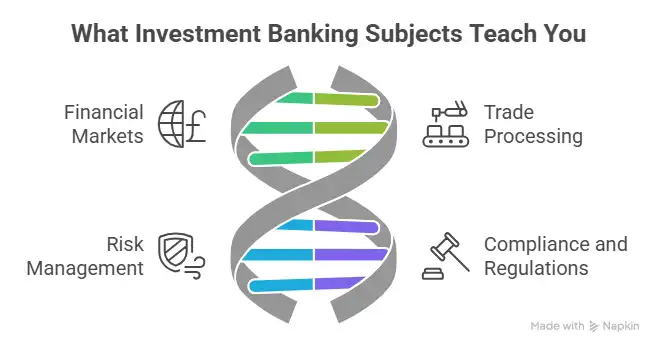

Types of Investment Banking Certification Courses

When exploring options for an investment banking career path, you’ll find different types of certification courses for investment banking. Choosing the right one depends on your goals and experience level.

Short-term certification courses

These are usually 2-4 months long and focus on core concepts like valuation and financial modelling. Good for beginners.

Advanced certification programs

These include detailed training, projects and case studies. Often preferred by students preparing for finance careers.

Postgraduate certificate in investment banking

These are comprehensive programs covering:

- Corporate finance

- Financial modelling

- Capital markets

- Risk management

- Deal analysis

They are suitable for those serious about entering investment banking.

Investment banking operations certification

Some courses focus specifically on operations roles such as trade lifecycle in investment banking, compliance and transaction processing.

Online certification courses

Investment banking certification courses online offer flexibility for students and working professionals.

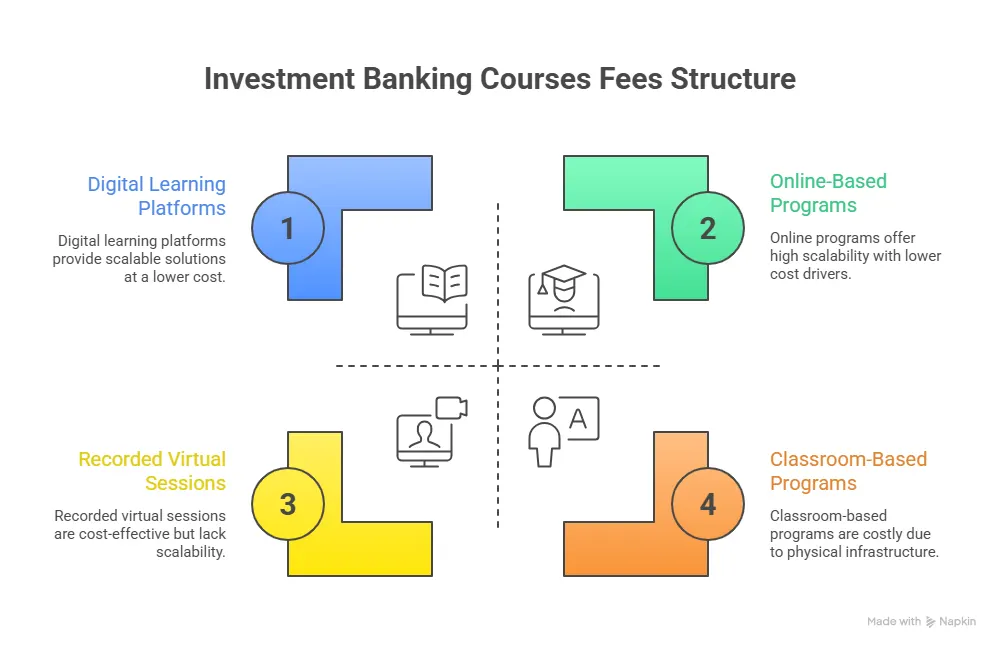

Free vs Paid Investment Banking Certification

Many learners search for free investment banking certification option before investing in paid programs. Both have their advantages.

Free online investment banking courses with a certificate help you:

- Understand basics

- Explore interest in finance.

- Learn introductory concepts

However, they may lack depth, projects and investment banking placement support.

Paid certification programs with a structured investment banking professional certification usually include:

- Detailed curriculum

- Real case studies

- Mentor guidance

- Mock interviews

- Placement support

For serious career goals, paid programs often provide better outcomes.

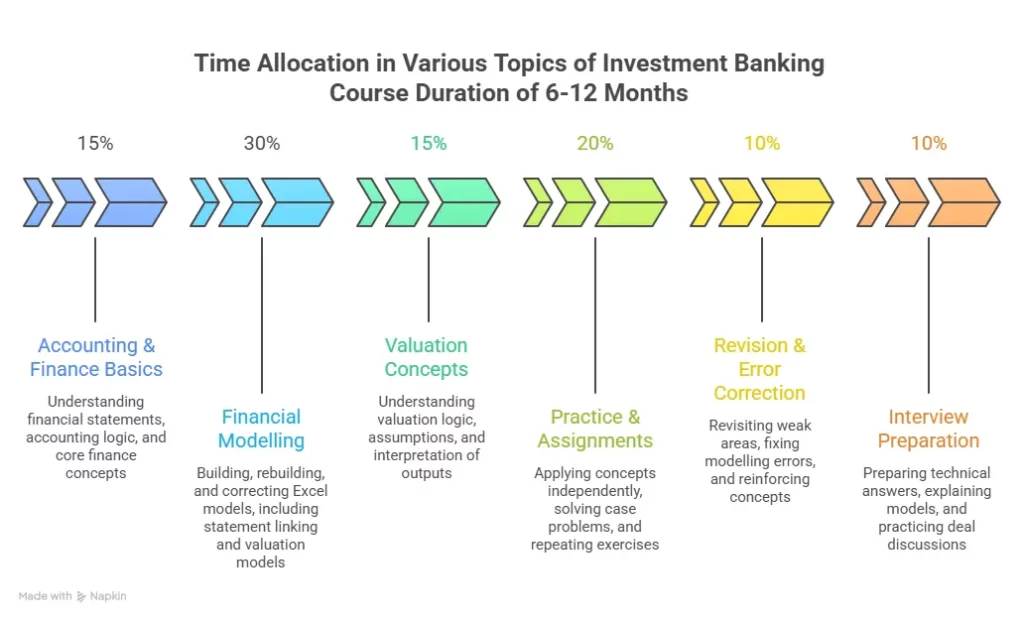

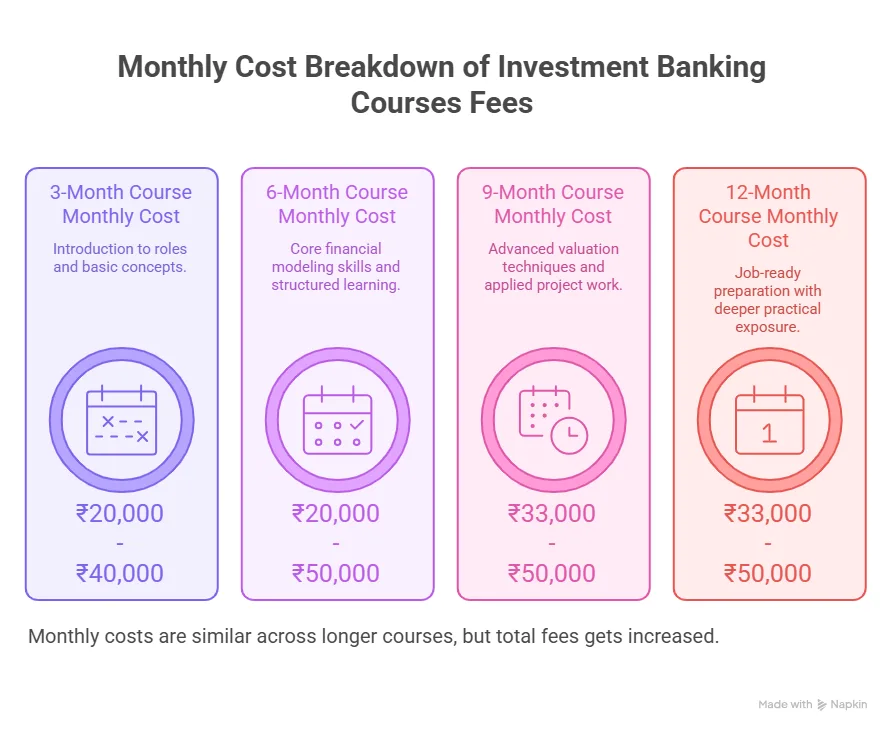

Also Read: Investment banking course duration and what to expect at each stage.

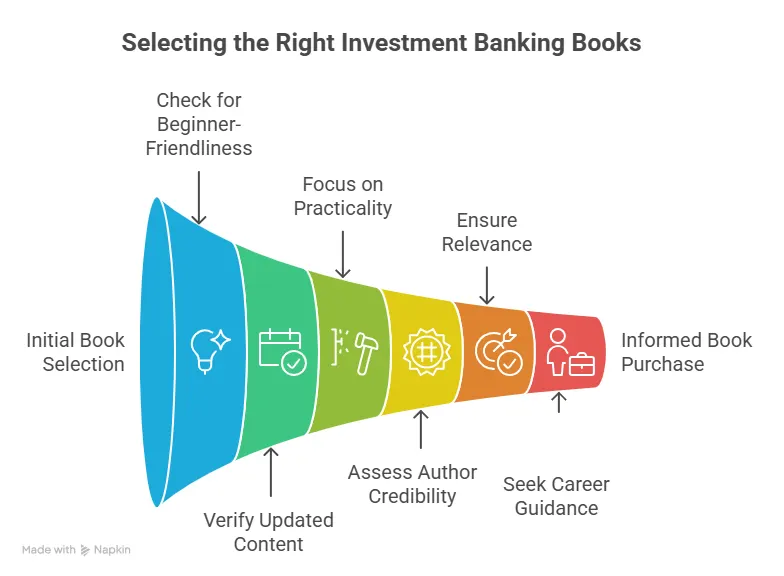

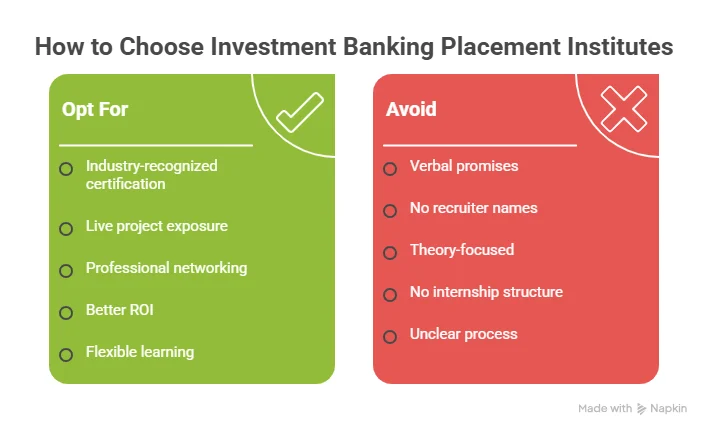

How to Choose the Best Investment Banking Certification

If you are trying to figure out how to become an investment banker? Not all certification courses offer the same value. Choosing the best certification for investment banking requires careful evaluation.

| What to Look For in an Investment Banking Course | Why It Matters |

| Check curriculum relevance | Ensure the course covers financial modelling, valuation, M&A basics, capital markets, Excel and financial tools needed in real investment banking roles. |

| Look for practical training | Courses with case studies, live projects and simulations help you build real-world investment banking skills and improve job readiness. |

| Faculty and mentorship | Learning from industry professionals makes complex finance concepts easier to understand and apply in practical scenarios. |

| Placement and career support | Some programs offer resume building, interview preparation and job assistance to help you transition into investment banking roles. |

| Flexibility | If you’re studying or working, choose an investment banking online certification with flexible learning options so you can learn at your own pace. |

Selecting the right certification can make your preparation smoother and more effective.

This quick video gives a realistic look at the skills, preparation and mindset needed to break into the industry. It also shares practical tips on building the right profile and standing out during recruitment.

Best Investment Banking Certification Courses

Choosing the best certification for investment banking can feel confusing and is a hassle because there are so many options available today. The key is to pick a certification that aligns with your career goals.

Let’s break this down clearly.

Investment Banking Certification Courses in India

India has seen a strong rise in demand for finance professionals with practical skills. As a result, several institutes now offer investment banking certification courses in India designed for students and working professionals.

These courses usually focus on:

- Financial modelling and valuation

- Capital markets and corporate finance

- Mergers and acquisitions

- Excel and analytics

- Case studies and real-world projects

Many learners choose the best certifications for investment banking in India because they:

- Matches Indian finance industry requirements

- Prepares them for domestic and global roles

- Includes placement or internship support

If your goal is to target investment banking jobs in India’s finance sector or global capability centres, an India-focused investment banking professional certification can be very useful.

Global Investment Banking Certifications

Some candidates prefer globally recognised programs. These are useful if you want international exposure or plan to work with global firms.

Popular global certification paths include:

- Corporate finance and valuation certifications

- Financial modelling certifications

- Capital market certifications

- Postgraduate certificate in investment banking programs

A global investment banking certification helps you:

- Understand international finance standards.

- Work with global clients

- Apply for multinational finance roles.

- Build a globally recognised profile.

Many professionals combine a local certification with global finance courses for broader exposure and a higher investment banking salary.

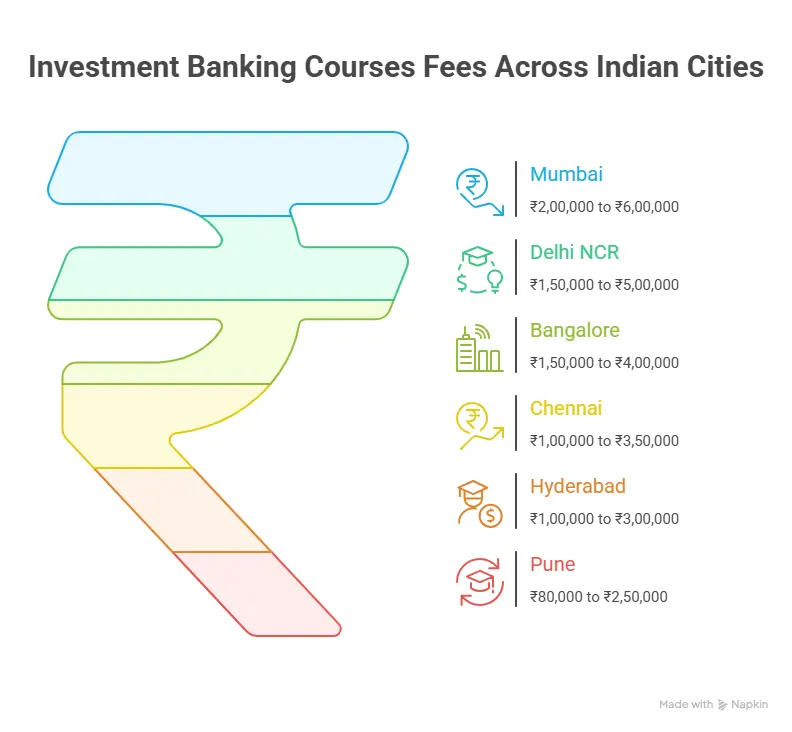

Also Read: Benefits of pursuing investment banking in Mumbai you shouldn’t miss.

Investment Banking Certification Courses Online

Online learning has made finance education more accessible than ever. Many students and professionals now prefer an investment banking online certification because of its flexibility.

Benefits of online certification:

- Learn at your own pace.

- Access recorded sessions

- Balance studies with college or work

- Learn from global faculty.

- Work on projects remotely.

Online certification courses in investment banking are ideal for:

- College students

- Working professionals

- Career switchers

- MBA aspirants

However, choose structured programs with practical training rather than only theoretical content.

Free Online Investment Banking Courses with Certificate

Many learners start with investment banking courses free with certificate to explore the field before committing to a paid investment banking degree.

- Free courses usually cover:

- Basics of corporate finance

- Introduction to financial markets

- Fundamentals of valuation

- Excel basics

They are useful for beginners who want to understand whether investment banking suits their interests.

While helpful, free certifications often have limitations:

- Offer limited depth

- Lack of real projects

- Don’t include mentorship.

- Don’t provide placement support.

If your goal is serious career preparation, you may eventually need a structured investment banking certification program.

Preparing for investment banking interviews can feel intense, especially when you’re not sure what kind of questions recruiters actually ask. This quick video walks you through some of the most common investment banking interview questions, along with tips on how to approach them confidently.

Certifications Required for Investment Banking Careers

Many students ask: What certifications are needed for investment banking? While there is no single mandatory certification, pursuing certain qualifications can help to strengthen your profile significantly.

Common certifications for an investment banking career:

- Investment banking certification programs

- Certificate program in investment banking operations

- Financial modelling and valuation certifications

- CFA (for deeper finance knowledge)

- Corporate finance certifications

- Capital market certifications

A strong investment banking professional certification combined with practical skills can significantly improve job opportunities.

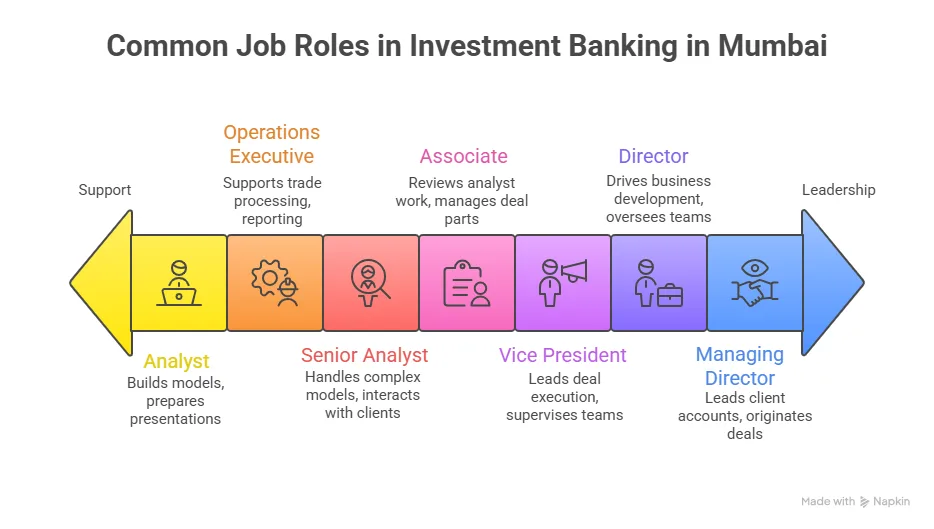

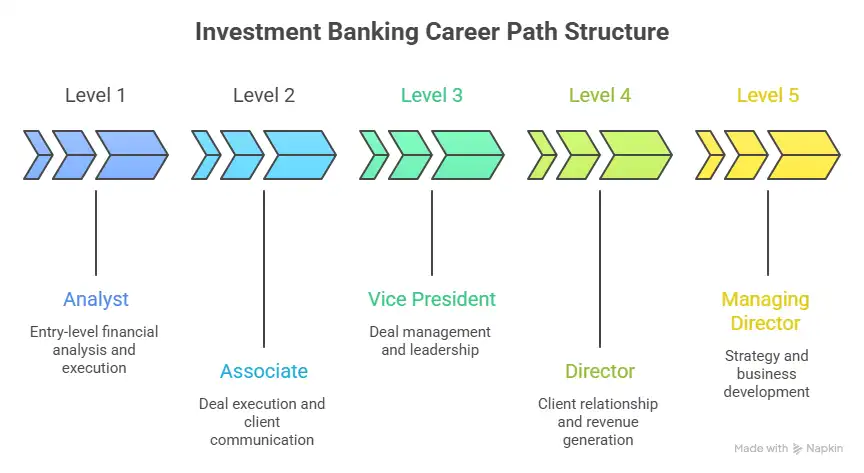

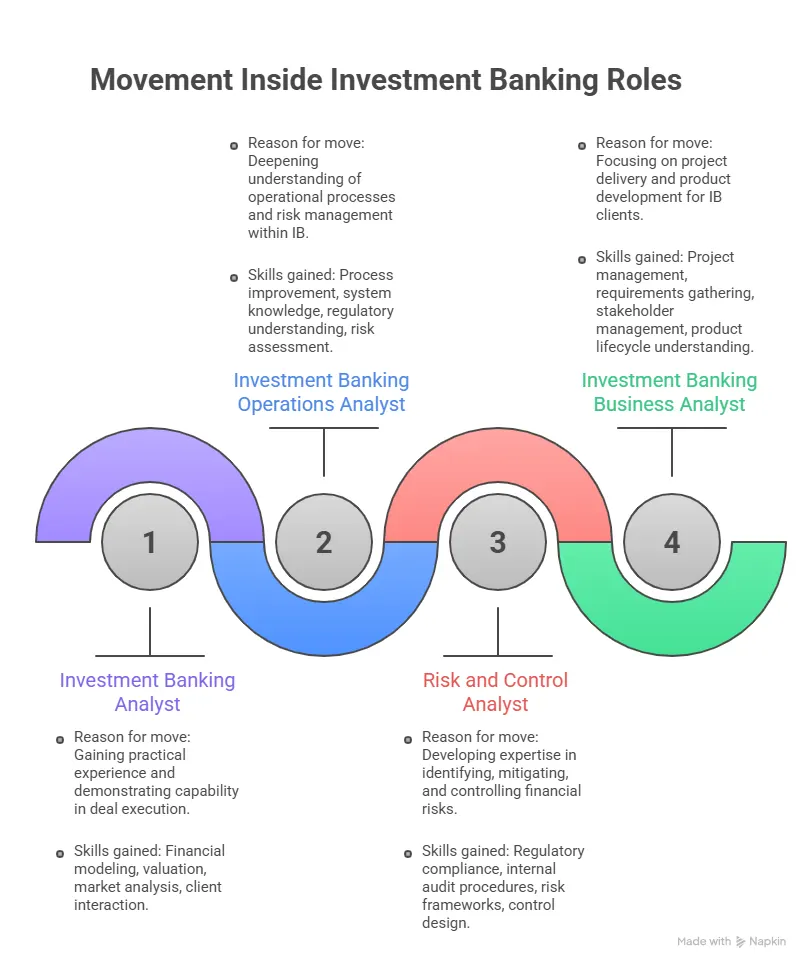

Career Opportunities After an Investment Banking Certification

Completing an investment banking certification opens doors to several finance roles. You don’t necessarily start as an investment banker immediately, but you enter the finance ecosystem.

| Category | Career Opportunities | Where You Can Work |

| Entry-level roles | Financial Analyst, Investment Banking Analyst, Corporate Finance Analyst, Equity Research Analyst, Deal Support Analyst | Investment banks, consulting firms, corporate finance teams, and financial advisory firms |

| Mid-level roles (with experience) | Associate, Valuation Consultant, M&A Analyst, Corporate Finance Manager | Investment banks, private equity firms, consulting firms, large corporates |

| Industries hiring certified candidates | Roles across finance, valuation, M&A and corporate strategy | Investment banks, consulting firms, private equity firms, and financial advisory firms |

An investment banking certification helps you build the foundation required for these roles.

Salary After Investment Banking Certification

Investment Banking salary in India depends on skills, location and role. However, completing a strong investment banking certification improves earning potential.

- Entry-level salary: Freshers with certification can expect ₹5-10 LPA in India (average range). It is higher in metro cities and global firms.

- With 2-5 years of experience: Professionals with strong modelling and deal experience may earn ₹12-30 LPA or more.

- Senior roles: With experience and performance, salaries increase significantly due to Bonuses, Deal incentives, and Promotions.

An investment banking career remains one of the highest-paying finance careers, especially for skilled professionals.

Also Read: Does an Investment Banker earn more than a CA?

How an Investment Banking Certification Improves Interview Performance

Interviews in finance are not just about answering questions. They test how you think. Candidates with certification training usually perform better because they:

- Understand valuation logic clearly.

- Can explain financial statements confidently

- Handle technical questions calmly.

- Structure answers logically

- Demonstrate real-world exposure

This is one of the biggest advantages of certification courses in investment banking – they prepare you for actual hiring conversations, not just investment banking exams.

Investment Banking Certification for Career Switchers

If you’re working in accounting, operations, audit, consulting or even IT, switching into finance can feel intimidating. An investment banking certification course makes this transition smoother.

It helps career switchers by:

- Bridging knowledge gaps

- Teaching finance from the ground up

- Providing structured learning

- Offering practical projects

- Building confidence for interviews

Many professionals successfully move into finance roles through an investment banking online certification combined with consistent practice.

Did you know?

According to the CFA Institute and leading global investment banks, successful investment banking professionals are expected to have strong foundations in financial analysis, valuation and market understanding even before entering the industry.

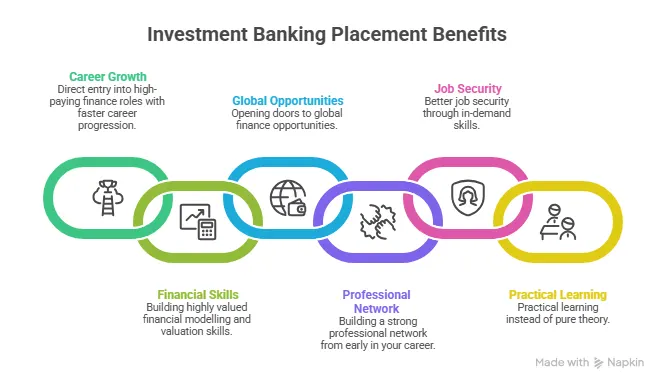

Is an Investment Banking Certification Worth It?

If you’re serious about finance careers, then an investment banking course in India is definitely worth it. An investment banking certification helps you:

| Features | How It Helps Your Career |

| Build job-ready skills | Learn financial modelling, valuation and core finance skills required by recruiters |

| Improve interview performance | Gain practical knowledge that helps you answer technical finance interview questions confidently |

| Practical finance exposure | Work on real-world case studies, projects and deal scenarios used in investment banking |

| Strengthen your CV | Adds credibility and makes your profile stand out for finance and investment roles |

| Global career opportunities | Opens doors to roles in investment banking, corporate finance and consulting across markets |

| Faster career growth | Helps students and professionals move into better finance roles with stronger growth potential |

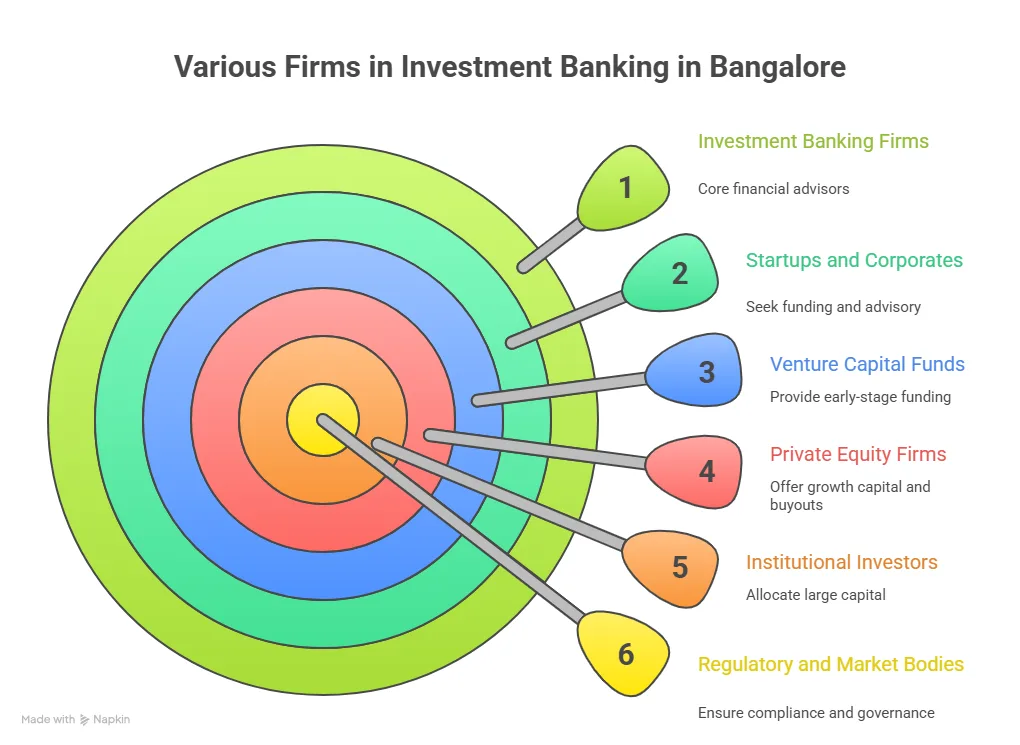

Also Read: Discover how investment banking in Bangalore offers strong career opportunities.

Why Investment Banking Certification Matters for Long-Term Career Growth

If you look beyond your first job, an investment banking certification plays a much bigger role than most people realise. Investment banking is a skill-driven field. It’s not only about landing an entry-level role. It’s about building a career path that grows steadily over time.

So, as you move forward, your responsibilities increase from analysing numbers to advising clients and structuring deals. A strong certification foundation helps you grow into these roles with confidence.

Here’s how a certificate of investment banking supports long-term career growth:

- You develop a strong understanding of investment banking subjects and finance fundamentals early.

- You learn how real deals are structured and executed.

- You adapt faster when moving into advanced finance roles.

- You gain credibility when switching companies or roles.

- You open doors to global finance opportunities.

Over time, professionals who invest in structured learning tend to progress faster than those who rely only on on-the-job exposure.

Why Learning Investment Banking with Imarticus Learning Can Make Your Journey Easier

If you’re serious about building a career in finance, choosing the right learning support alongside your investment banking program can make the journey much smoother.

Here’s why students prefer Imarticus Learning:

- Mentorship makes learning easier – The expert faculty-led training and mentorship enrich your learning experience.

- Practical training approach– You typically get exposure to Financial modelling and Excel-based analysis, Valuation techniques used in real deals, Capital markets and corporate finance concepts, and Case studies based on real business scenarios.

- Experiential Learning – The curriculum is aligned with industry standards and evolves with industry needs. This kind of learning helps you understand not only what to do, but how things work in real finance roles.

- Job-relevant skills – You master core and industry-specific skills in Investment Banking operations and gain expertise in securities, wealth and asset management.

- Comprehensive career support and 100% job assurance – The program includes placement assistance with at least 7 guaranteed interview opportunities to help students begin their careers with strong industry connections in leading investment banking companies.

FAQs About Investment Banking Certification

If you’re exploring investment banking for the first time, from understanding whether an investment banking certification is worth it to knowing how it helps your career, most students and professionals want clarity before getting started. Here are a few frequently asked questions:

Can I do an investment banking certification online?

Yes. Many investment banking certification courses online offer flexibility, recorded sessions and practical projects. Top finance training institutes like Imarticus Learning offer an online learning format, which helps you balance your academics and work.

How long does it usually take to complete an investment banking certification?

In most cases, a certificate for investment banking takes about three to six months to complete. But honestly, it’s not just about the duration – it’s about how well you understand what you’re learning. Some people move faster if they’re studying full-time, while others take a little longer because they’re balancing college, work or other commitments.

Is an investment banking certification useful for beginners?

Yes, it’s very useful. A good certificate of investment banking is designed to start from the basics and gradually build your understanding of finance, valuation and financial modelling. Even if you’re new to finance, you can begin learning step by step.

Can an investment banking certification help me get internships?

Yes. Many companies prefer candidates who understand financial concepts and tools. Having a certificate for investment banking on your resume shows that you’ve developed practical knowledge, which can improve your chances of securing internships and entry-level roles.

Are free investment banking certification courses enough?

Free courses are great for understanding the basics and exploring your interest in finance. But it does not help you land a job. So, opting for a structured certification program, which usually offers deeper learning, projects and career guidance that help you become job-ready.

Do I need a commerce or finance background to pursue investment banking certification?

Not always. While commerce students may find some topics familiar, many programs are beginner-friendly. Students from engineering, management or other backgrounds can also learn investment banking concepts with consistent practice.

Is investment banking certification worth the effort?

If you’re planning a career in finance, it’s definitely worth it. The skills you gain stay useful across many roles like corporate finance, consulting, analytics and investment banking. Over time, this knowledge can open up better opportunities.

What skills will I learn through an investment banking certification?

You’ll typically learn financial modelling, valuation techniques, Excel for finance, financial statement analysis and basic corporate finance concepts. These skills are widely used in finance and consulting roles.

Is Investment Banking Certification Worth Your Time?

If you’re serious about building a career in finance, waiting until the last moment rarely works. The finance industry rewards people who prepare early, build practical skills and stay consistent.

An investment banking certification gives you that early advantage. It helps you understand how finance works in the real world by preparing you for interviews and building confidence in handling financial concepts. Whether your goal is investment banking, corporate finance, consulting or analytics, the skills you gain stay valuable throughout your career.

The sooner you begin, the stronger your foundation becomes. The right Investment Banking Course can be the foundation that shapes your finance career for years to come.