Why does a finance degree often fall short in the real world?

You study balance sheets, learn a few ratios, and walk out with a degree. But then reality hits. Recruiters don’t just want a finance graduate. They want someone job-ready, globally aware, and highly skilled in analysis, ethics, and portfolio decisions. That’s where the CFA Course flips the script.

Becoming a CFA: The Real Foundation

The Chartered Financial Analyst programme is a postgraduate professional qualification awarded internationally by the US-based CFA Institute to professionals in investment and finance.

The CFA Course gives structure to your ambition. It’s not just another degree. It’s a practical route to build portfolio management skills, improve investment strategies, and grow into high-stakes roles.

You won’t just learn theory. The Chartered Financial Analyst certification is designed to prepare you for the pace and demands of modern finance roles. From wealth advisory to investment banking, the CFA badge speaks louder than a general MBA when it comes to credibility and depth.

Why CFA Course Prepares You for a Global Career

The appeal of a Chartered Financial Analyst certification is that it’s accepted and respected around the world. India’s finance talent is in demand globally, and the CFA makes that transition smoother.

Employers from New York to Dubai know the rigour behind this qualification. It’s built on a foundation of ethics, discipline, and intense study. Unlike traditional programmes, the CFA pushes you to handle real-time data, think independently, and apply models hands-on.

This matters especially for Indian professionals who want to go beyond domestic boundaries and aim for hedge funds, equity research firms, and global asset managers.

The CFA programme continues to grow in popularity across India, driven by a rising need for skilled finance professionals and the global recognition of the CFA charter. Below is an overview of pass rates among Indian candidates for each level:

- Level I: Indian candidates usually record pass rates between 20% and 45%.

- Level II: Pass rates for Level II generally fall between 30% and 55%.

- Level III: Candidates tend to achieve pass rates ranging from 35% to 55%.

Investment Banking Career Path: Is CFA Worth It?

An investment banking career path is not about being flashy. It’s about trust, risk handling, and big decisions. The CFA Course helps shape the kind of mindset banks, MNCs, and institutions look for.

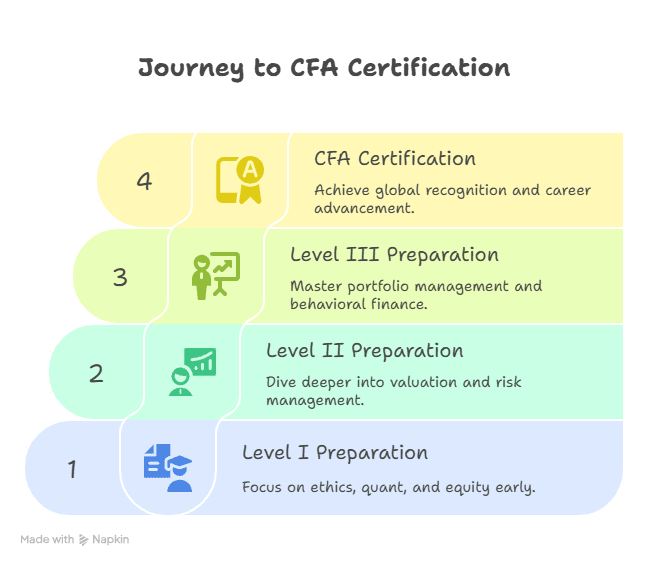

Many Indian candidates aim for top-tier IB roles and discover quickly that just clearing interviews isn’t enough. You need conviction. You need solid technical knowledge. The CFA equips you for that with three tough levels that go deep into valuation, risk, ethics, and behavioural finance.

CFA vs Other Finance Certifications in India

| Criteria | CFA Course | Other Finance Certifications in India |

| Global Recognition | Yes | Limited |

| Focus on Investment Roles | Strong | Medium |

| Difficulty Level | High | Moderate |

| Job Placement in Global Roles | Strong | Low to Medium |

| Industry Preference | Investment Banks, Hedge Funds | Mixed Fields |

Don’t start the CFA journey blindly. Everyone talks about long hours, but smart preparation wins. Break down the syllabus. Focus on ethics, quant, and equity early. Use question banks.

Join forums or study groups. Stick to the CFA Institute’s curriculum but add an Indian context through local market analysis. That will train your brain for real-world scenarios.

You’ll fail if you memorise. You’ll pass if you apply. That’s the basic difference with this exam.

Portfolio Management Skills: The Career Definer

Ask any recruiter, technical skills come second. What matters first? Decision making. That’s where portfolio management skills come in. The CFA dives into asset allocation, investor profiling, risk modelling, and forecasting.

Once you’re confident in these areas, you’ll stand apart in interviews, case rounds, and analyst meetings. Indian employers in wealth firms, and even family offices, give weight to candidates who’ve done the CFA.

These are not just textbook skills. They help you handle actual portfolios, client expectations, and risk-return frameworks.

Choosing Your Next Move: Who Should Take the CFA Course?

Still unsure if the CFA Course is your thing?

If you’re a finance grad tired of repetitive roles or a working professional stuck in back-end operations, it’s time to pivot. The CFA is intense, yes. But it’s structured to reward dedication, not genius.

Engineers, economists, and accountants all backgrounds work. What matters is your mindset. If you want global exposure, role mobility, and better pay, this route gives you the push.

Why Imarticus Learning Is the Smart Choice for Your CFA Journey

Imarticus Learning is India’s first and only authorised prep provider for the world’s top four certifications in accounting and finance, including the prestigious CFA Course. If you’re looking to break into high-impact finance roles, this globally respected qualification gives you the edge.

Imarticus Learning’s structured CFA programme equips you with real skills that go far beyond theory. It’s designed to raise your game in the real world of finance.

- Average Pay (India): ₹7.5 Lakhs

- Average Pay (International): $79,000

Imarticus Learning prepares you for these roles with hands-on training and real-world exposure. You won’t just pass exams, you’ll be ready for the job. The financial analyst role isn’t about crunching numbers alone. It’s about finding meaning in financial trends, writing clear reports, and guiding strategy.

- Kaplan Schweser study material: Globally respected content including books, practice tests, and notes.

- Expert Instructors: Faculty with years of teaching and industry experience.

- Dual-Teacher Model: One teacher teaches live classes, the other offers 24/7 support for queries and one-on-one mentoring.

- Live Doubt-Solving Sessions: Run by actual CFA Charterholders who understand what it takes to succeed.

- Placement Assistance: When you pass CFA Level 1, you receive job assistance, resume review, mentorship, and mock interviews.

Imarticus Learning supports its programme with a money-back guarantee. CFA charter is not easy. The competition is thus too. The course comes as an ecosystem with Imarticus Learning.

Start your CFA journey with Imarticus Learning today!

FAQ

- How does the Chartered Financial Analyst certification help my career?

It gives you credibility, practical finance skills, and access to better-paying roles in portfolio management, equity research, and more. - Is the CFA Course good for an investment banking career path?

Absolutely. Many investment banks in India prefer CFA-qualified candidates for analyst roles because of their strong valuation and risk knowledge. - Any practical CFA exam preparation tips that actually work?

Focus early on Ethics and Quant. Stick to the CFA Institute curriculum, use practice papers, and build a regular study routine. Also, avoid cramming! - Which finance certifications in India compare to CFA?

While India offers options like FRM and CFP, the CFA Course is widely seen as the gold standard for investment and portfolio-focused careers. - Do I need work experience to start the CFA Course?

No, you can begin without experience. But to become a charterholder, you’ll need four years of work experience related to investment decision-making. - What kind of portfolio management skills does the CFA teach?

You’ll learn asset allocation, client profiling, and investment strategies, skills that are crucial in real finance roles.

Final Thoughts

The finance job market is changing. Traditional courses aren’t enough anymore. If you’re serious about high-growth roles like asset management or investment banking, the CFA Course is a solid bet.

Whether it’s portfolio management skills, CFA exam preparation tips, or exploring a new investment banking career path, this programme gets you job-ready. Not just for India, but globally.

So stop browsing. Start building.

Explore the CFA journey with Imarticus Learning today!