Interviews can be daunting and nightmares for an underprepared candidate. One can never be fully aware of what is going to pop up in the interview, thus there can be no hard and fast rule for preparation. As far as an interview for Capital Market beginners is concerned, there isn’t any set formula. To start with the preparation for the interview, you have to research, analyze and make proper framework. Your strategies will decide how well you will perform in the interview.

Finance is an ever-changing, stress bringing industry and the interviewer aims to test if you can handle the heat. Just being aware of technicalities is not enough, you will be tested for your problem-solving attitude, behavioral ability, management skill and so on. Here are a few tips that can go handy, fairly giving you ideas to boost up your preparation,

Know Your Resume:

It is your resume that presents you in front of the interviewers, much before you face them. They are free to judge you by your resume. Hence, you ought to have command over it. It is up to you to make the best use of it by highlighting your strengths and area of interests. It becomes really important that you don’t brag in your resume and prepare it skilfully.

Be aware of the current market scenario:

Even though you are a Capital Market Beginner, it is expected of you to be aware of what is happening in the market. Questions will pop up about trends and happenings in the related field.

Have Clear viewpoints:

If you are a beginner, you may not know the correct and exact answers to the question, but you must have a clarity of view. The interviewer will not like to see to you juggle from one viewpoint to another. You need to have a clear head which shows your confidence level.

Know the technical aspects:

The finance sector is full of technical details and you need to have a fair idea about the basic jargons and knowledge of the subjects. Academic excellence is always required in this field along with personality excellence. So, have command over accounting and finance topics.

Focus on the soft skills:

Leadership abilities, teamwork ability, your strategies, and problem-solving skills, commitment level, creative thinking, analytical thinking and personality, all come under the soft skills that the interviewer surely looks out for. They may try to stress you out, or give you situation based problems just to check your patience and calmness.

Research about the organization:

Every organization has a certain ideology which you need to dig out. Once you know about the belief of the organization, you can give them those pleasing and impressive replies.

Examine the requirements:

When applying, you need to know about what the interviewers are seeking. These can be about qualifications, qualities, and background of the candidates. Align yourself with these details and show yourself as a deserving option. These descriptions may also give you ideas about the questionnaire.

There are several options available out in the open that will help you prepare for the training interview. This information can be found on your fingertips and are well suited for the purpose. Methods can be opted to be prepared for the interview are :

Capital Market Courses:

There are several certified courses in capital Market that are not time taking but will help you gain a basic idea about Capital Market. These courses are certified and can be availed both online and offline.

Blogs and Sites:

There are numerous blogs and websites dedicated to preparing the candidate for the interview. They provide fair knowledge about the questions that can be asked and how to respond.

Videos:

With just one click you gain access to several videos focusing on the tips and tricks to excel in the interview. Some of these videos feature experienced and veterans of this field who share their knowledge and experiences to guide the candidates.

Mock Interviews:

Mock interviews are a great way to overcome the interview phobia. Several sites run these mock interviews to give the candidate a realistic experience of the interview.

Prepare well, be learned about the financial news and trends and know the academics thoroughly. Besides, never forget to shape up your analytical and thinking ability. Don’t show the rush to answer. Take your time, allow the interviewer to judge your thinking process and then, answer with confidence. And with proper preparations, you can ace the interview.

For more details, in brief, you can also contact our career counselor. For that, you contact us through the Live Chat or can contact on – info@imarticus.com or 1-800-267-7679 or can even visit one of our training centers based in – Mumbai, Thane, Pune, Chennai, Hyderabad, Delhi, Bangalore, Gurgaon, and Ahmedabad.

Tag: Capital Market Tutorial

What is The Role Of Capital Market in Economic Development?

What Is The Role Of the Capital Market in Economic Development?

Capital Markets play a crucial role to keep the economy functioning and the economy would collapse without it. The most advanced economies have the most efficient capital markets.

So, how does the capital market work and why is it so important for the country’s development?

Literally, the capital market is the kind of financial marketplace that facilitates the buy and sell of a wide range of long-term financial securities such as equity and debt along with short term funds such as treasury bills. The market where these securities are created is called the primary market and where already existing securities are traded is called a secondary market. Capital markets are the most important components and form a considerable proportion of the present-day economy.

Well-functioning markets ensure that both corporations and investors get or receive fair prices for their securities.

An effective financial sector is vital for economic growth in a modern new-age digitized economy. It pools together the domestic savings to mobilize and provide capital for productive growth-related projects and industries. In the absence of such a system, most industries would never be able to grow and would fail for want of funds and thus growth and development would be directly affected and impacted.

The basic channels connecting the economy to the capital market discussed in any Capital market course are thus also connected to the economic growth, growth, and development of industries or facilities and economic measures for funding such growth.

Such financing methods are:

Direct financing: Here the agents facing a money deficit interact and deal with those agents with a monetary surplus without intermediaries.

Indirect financing:

In this method intermediaries function between the two agents and ensure the fund’s needs are catered to. Such intermediaries could take the form of banks, insurance companies, investment funds, NBFCs, pension funds, and such. They not only provide funds but also securitize investments and purchase of assets in a major move to better capital demands.

Any capital market course should begin with answering questions related to what the Debt CM is. Most companies prefer to turn to DCM markets when they need funds for expansion but do not want to trade in their private ownership tag.

The DCM market is ideal since they deal with the sale of units called bonds. For the investors in bonds, this is a fixed-income investment where on redemption they get their money back along with attractive interest. The investment is low-risk and earns a fixed interest rate. Such funds are a short-term boon for firms needing funds for expansion without the dilution of ownership. It’s a win-win deal for both.

The different types of bonds:

The bond types are risk-of-default related and can be categorized as

- The government bonds are at low risk for default.

- The companies that issued investment bonds are also fairly safe from default.

- The bonds that are high-yield are susceptible to risk and hence offer a better rate of returns.

The DCM also handles debt-equity issuances for several purposes. At times on reaching debt-maturity bonds are refinanced or reissued. At other times the expanding company may be looking to reduce cost-to-company capital.

Role of capital markets as economic growth drivers:

The capital market is an effective tool to drive economic development and growth.

Here’s why…?

The capital market effectively transfers monetary purchase power from surplus funds of investors to those with deficits for a fixed period in exchange for greater future purchasing power. They play a major role in recapitalizing and privatization of large infrastructure projects and industries. The privatization of banks, insurance companies, real-estate sectors, etc is a good example of this strategy.

The capital market channelizes and increases long-term savings to fulfil the monetary demands of companies with deficit funds to form long-term investments like pension funds, funeral expense covers, individual fixed investments, etc. This is especially useful for companies who wish to avail funds for a small price without going in for a change in ownership rights from private holding to equity holding etc.

Capital markets help provide equity for infrastructure development needs which tremendously impacts and provides for water and sewer systems, development of roads, energy, housing, telecommunications, socio-economic benefits provisions, public transport, and many more. Government bonds are the present means of financing such needs and provide the investors with low-risk appetites a guaranteed pay-back after the fixed term with an attractive interest rate.

Empowers the government strategy of social inclusion and economic growth by providing platforms and thrust areas wherein industries can compete globally, forge private-public partnerships, use capital efficiently, increase domestic productivity and spur growth, global integration, and better economic development.

The capital market mechanism provides for regulating the markets, covering risks according to appetites, ensuring good investor returns, and preventing the complete decay of stock market policies.

Importance of Capital Market for an Economy

It is only with the help of the capital market, that long-term funds can be raised by the business community.

Existing companies, because of their performance will be able to expand their industries and also go in for diversification of business due to the capital market.

Capital markets help individuals generate wealth and invest in their future. It provides an opportunity for the public to invest their savings in attractive securities which provide a higher return.

Also, the capital market provides an opportunity for the investing public to know the trend of different securities and the conditions prevailing in the economy.

The DCM and ECM offer various job roles in the banking sector for capital markets. The investment banking course at Imarticus Learning is specially designed to help you hit the ground running.

It has modules for resume building, personality development, and interview facing techniques besides a robust financial Capital Market Tutorial curriculum. You will need classroom training, mentorship, certification, and experience to help you stand out from the many IB career aspirants. Enrol immediately at Imarticus today!

Trade life cycle in Capital Markets

Trade life cycle in Capital Markets

Any financial instrument traded in the market is determined by its supply and demand in the capital market. First, let us try to understand what are financial instruments and capital market. A financial instrument is a certificate of ownership for any kind of monetary contract between parties. It can be company shares or bonds or any stock owned by a person after a monetary arrangement and paid to the respective parties.

And a capital market refers to the place where different institutions and entities trade these financial instruments. For instance, the stock market in India is one of the biggest capital markets in the world, and the Bombay Stock Exchange (BSE) is the oldest in Asia. For better understanding, one can opt for Capital Market Course and capital market tutorial provided by experts in the domain.

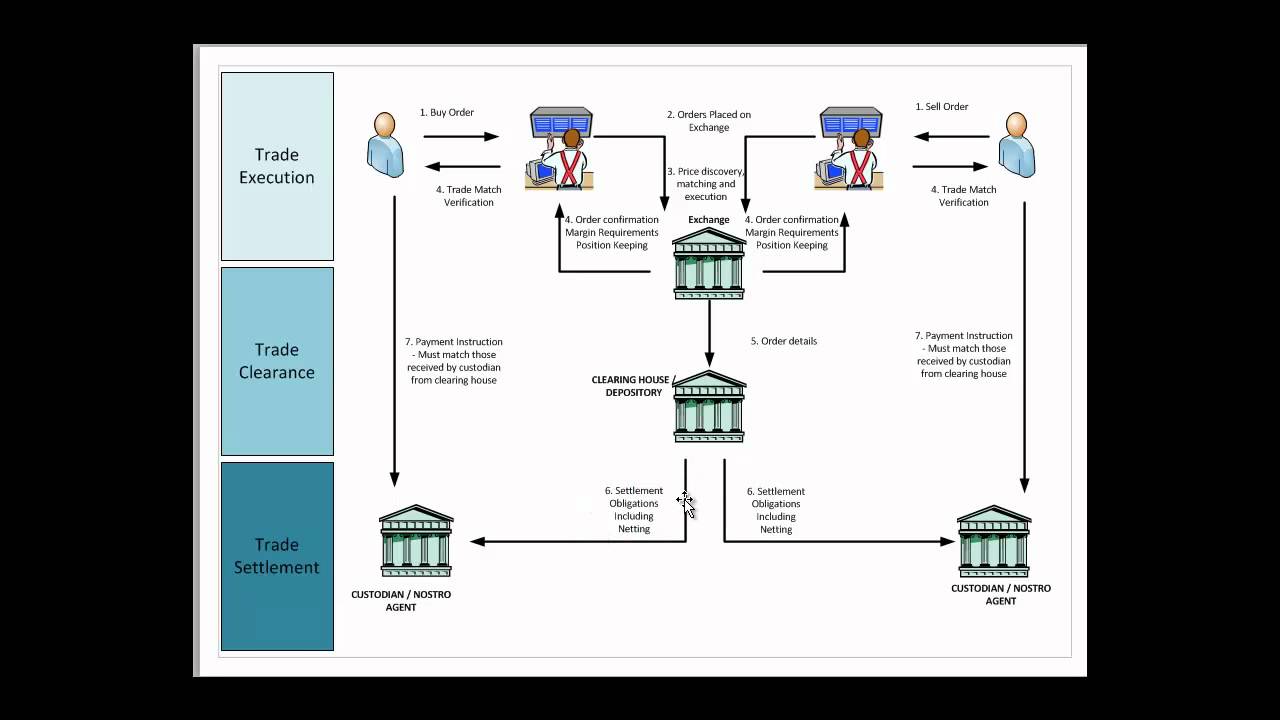

In order to understand how these financial instruments are traded, we first need to know the process of the trade life cycle. It follows the following steps:

1. Order Initiation and Delivery

The main idea behind any trade is the profit that one generates within a stipulated time though their investment. Similarly, in the stock market, an order is initiated by a retail client or an institutional investor through a broker or an agency, keeping in mind the perception of the movement of the share market. These orders are placed through the brokers with the help of online trading or through phone calls.

By market order, we mean the buy or sell or share or stocks of listed companies in the share market. When orders are placed, the broker or agencies record and process them carefully and allocate the shares or stocks to their respective clients.

2. Risk Management and Order Processing

In buying and selling shares by the investor, the broker places a query to verify whether sufficient balance is being maintained in the client’s account or whether sufficient stocks are available, respectively. Upon confirmation on the same, the order is placed while the order receipt is being generated. Any default by the investor has to be made good by the agency to the clearing institution. Therefore, the risk management by brokers or agencies comes at a price, called a margin which is levied by the clearing institute, and their responsibility to recover the same from their clients.

3. Order Matching and Trade Conversion

Once orders are collated by the broker from their clients with their respective quantity, amount, date and time, they are sent to the exchange for verification and to allot respective shares and volume accordingly. The clients are charged a minimum commission as a brokerage fee by the agencies and an official order confirmation through mail or post are being forwarded in the form of a contract note. The client details are recorded by the broker and are assigned a unique customer ID for each of them for trade convenience.

4. Trade Confirmation and Validation

An agency called a custodian is engaged by every institution in order to assist them in the clearance and settlement processes. The institution, with the assistance of their fund manager, sends details to the custodian about the order allocation including the type of securities, quantity, and price for the respective orders. This process prepares him to be aware of the trade details he is soon expected to receive from the broker along with their commission charges.

The custodian thus compares and validates the trade details and forwards an affirmation note to the broker. To know the basics of online trading and how it functions, nowadays it has become much easier as there are organizations offering capital market course and capital market tutorial by experts at reasonable rates.

5. Trade Settlement and Clearance

Trades executed are being collated and are settled 2 days after the transaction i.e. T 2 days. Once the clearing institute or corporation informs regarding their obligations to the investors on their securities and funds, the balance of payments are executed.

This follows the allocation of shares and funds in the respective demat accounts of the investors. Share amounts are credited to their linked accounts as sales proceed, and respective shares allocated for their volumes being invested. The detailed report is again forwarded by clearance houses to the guardian and to the exchange offices for records purpose.

Other Resources:

What Modeling Skills are Needed For an Analyst Working in Debt Capital Market?

At the very onset, let us tell you that one does not need to have extensive skills in modeling especially in a debt- capital- markets job role when working for such a firm. However, modeling skills will be required if your data needs cleaning, formatting and then analysis. Most firms use databases on equity research that are procured from other sources as well as in-house databases and the need for financial modeling is a bare minimum.

It is important though to track the indices for outstanding debt, share repurchases, cash, pending acquisitions, etc. since they foretell debt retirement, future issuances and such which may be required when advising clients.

Any capital market tutorial should begin with answering questions related to what the DCM actually is. Most companies prefer to turn to DCM markets when they need funds for expansion but do not want to trade in their private ownership tag.

The DCM market is ideal since they deal with the sale of units called bonds. For the investors in bonds, this is a fixed-income investment where on redemption they get their money back along with attractive interest. To explain this Capital Market Courses concept assume you buy a bond of 1000Rs face-value with a redemption date of 1 year.

After a year the bond can be redeemed at 100Rs plus the interest rate which may vary. When bond prices fall the interest rate moves up and vice versa. If you get 1100 Rs your interest rate is 10% and is much higher than the FD rate of 6-7 %. The investment is low-risk and earns a fixed interest rate. Such funds are a short-term boon for firms needing funds for expansion without the dilution of ownership. It’s a win-win deal for both.

The different types of bonds:

The bond types are risk-of-default related and can be categorized as

- The government bonds are at low-risk for default.

- The companies issued investment bonds also fairly safe from default.

- The bonds that are high-yield susceptible to risk and hence offering a better rate of returns.

The DCM also handles debt-equity issuances for several purposes. At times on reaching debt-maturity bonds are refinanced or reissued. At other times the expanding company may be looking to reduce cost-to-company capital. A quick look at the statistics espoused by Dealogic shows the bond markets are huge in comparison to issuances.

In 2013 alone, the DCM market figures showed debt-deals worth 6.1 trillion $ versus the 832.2 billion $ equity issuance markets. Compared to its value in 2012 there was a reported surge of 25 percent upwards.

How to get a DCM job and why?

The DCM job is part of the investment banker’s portfolio. This is a highly prestigious and well-paying job with a lot of hard work and challenges thrown in like the inordinately long work hours, the need for classroom and paid training to get placements as IBs and the long attributes list required of an IB.

DCM is way larger than the ECM and banks or firms find this large volume low-returns market needs constant new-deals to be worked on. ECM thrives in sectors like mining, aerospace, etc. The need to generate profits from large volumes of new-deals means more IBs to pitch the issuances and provide services for both investors and clients.

Further half the volumes of debt-issues are from the financial institutions.

Hence, in larger firms, there could be separate CM and ECM divisions, private firms, and public companies divisions, or corporate and government debt markets divisions. The plus point is that a lot of debt-issuances ensure you are not just a salesperson of equity issuance.

The normal workday of the FA is to convince investors and clients for deals. You will need to track trends, make presentations, draft pitches, create models, meet HNI clients, or work in inter-bank funds syndication. No matter where expect 80-100 hours of stress-laden work per week. No wonder then that nearly half the aspirants for IB jobs quit within 3 years. For the persistent expect to move up every 2-3 years from Analyst to Associate, VP, Director, and CFO or MD.

Conclusion:

The DCM and ECM are areas that cover the various roles of an investment banker in capital markets. The Capital Market Training at Imarticus Learning is specially designed to help you hit the ground running.

It has modules for resume building, personality development and interview facing techniques besides a robust financial Capital Market Tutorial curriculum. You will need classroom training, mentorship, certification and experience to help you stand out from the many IB career aspirants. Enroll at Imarticus today.