If there’s one credential that has truly erased the boundaries of finance, it’s the ACCA Qualification. Recognised in over 180 countries, the ACCA (Association of Chartered Certified Accountants) opens the gateway to a world of opportunities, literally.

From London’s financial district to Singapore’s fintech hubs, ACCA professionals are in demand for their deep technical expertise, ethical grounding, and ability to navigate international regulations.

The qualification has over 240,000 members and 600,000 students globally, forming one of the largest professional communities in finance. Whether you aim to work for the Big 4 firms, consult across emerging markets, or lead corporate finance divisions, ACCA sets a foundation that’s as globally relevant as the career aspirations it fuels.

In this blog, we’ll break down how the ACCA Qualification opens doors to global career opportunities, helping finance professionals work across 180+ countries with recognised credibility and limitless growth potential.

What is the ACCA Qualification?

The ACCA Qualification is a professional accounting credential awarded by the Association of Chartered Certified Accountants (ACCA), a UK-based global body established in 1904. The goal of the ACCA course is to produce well-rounded finance professionals who not only excel in accounting principles but also understand technology, sustainability, and ethics, skills that define the modern finance leader.

At a Glance

| Element | Details |

| Founded | 1904 (London, UK) |

| Exam Levels | Applied Knowledge, Applied Skills, Strategic Professional |

| Practical Experience | 36 months (documented via the ACCA PER Tool) |

| Ethics Module | Ethics and Professional Skills (EPSM) |

| Recognition | Accepted in 180+ countries |

| Members Worldwide | 240,000+ professionals |

| Students | 600,000+ globally |

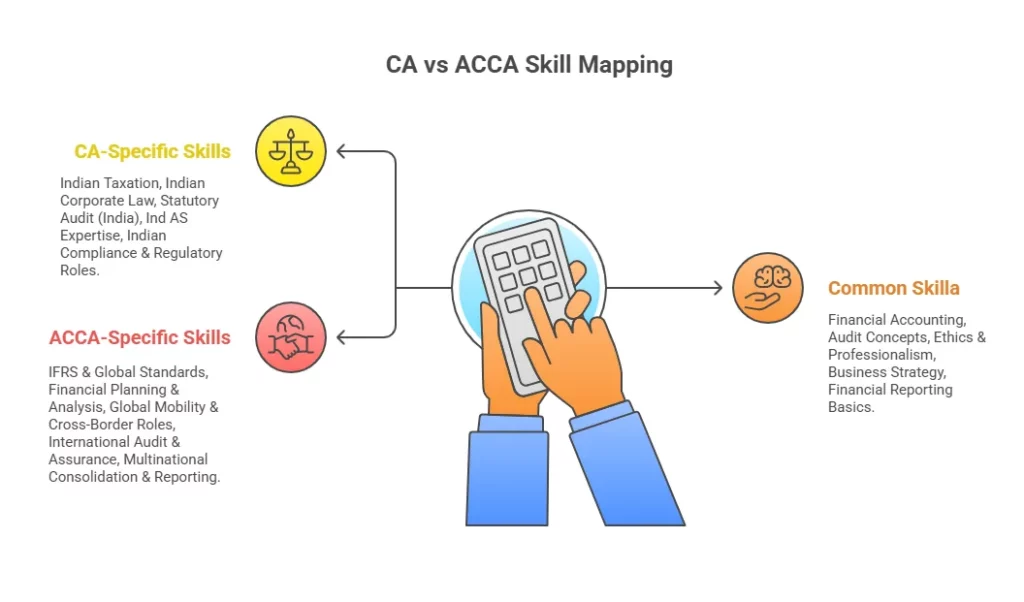

After understanding what is ACCA, it is important to know that ACCA’s syllabus integrates traditional finance disciplines like audit and taxation with new-age subjects like digital transformation, data analytics, and sustainability reporting – ensuring members remain relevant in an evolving economy.

Here is a video to distil down the ACCA course details in an engaging manner for you –

Why the ACCA Qualification Matters in 2025

Finance roles today demand agility across regulation, automation, and sustainability. Employers want professionals who can interpret IFRS standards, manage ESG disclosures, and make tech-driven financial decisions.

That’s why the ACCA Qualification continues to rank among the top global finance credentials. It’s not just an exam; it’s an evolving benchmark that shapes accountants into strategic business partners.

The ACCA framework also supports hybrid and remote learning, allowing candidates to prepare through online programs.

ACCA Eligibility 2025: Who Can Register

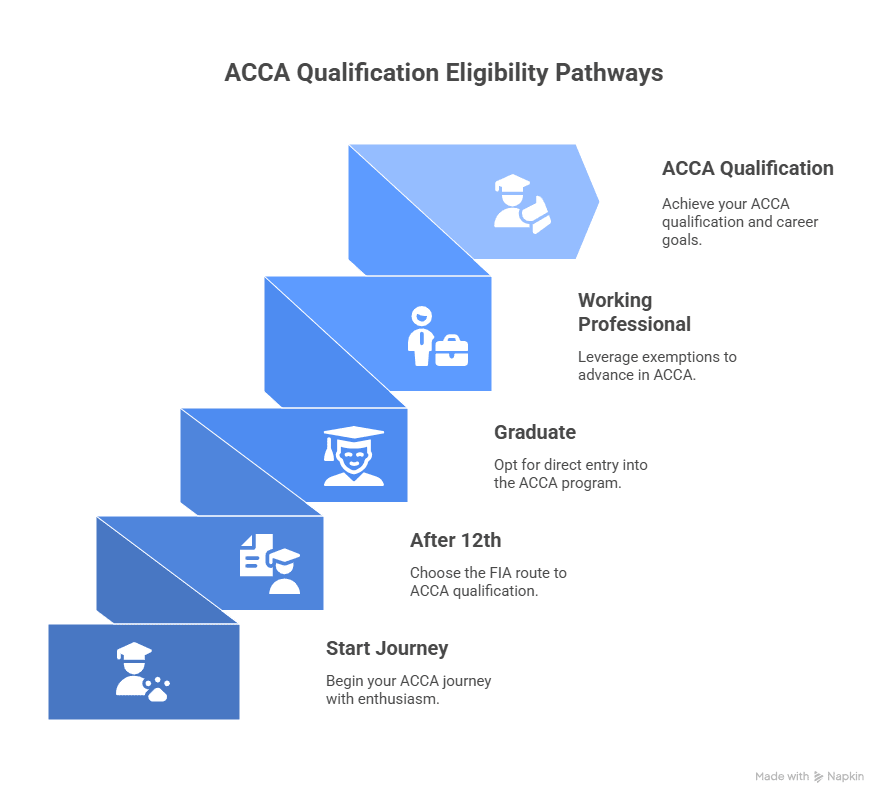

Before you begin your ACCA journey, understanding the eligibility criteria is crucial. ACCA welcomes learners at various stages: students, graduates, or professionals seeking a global credential.

Eligibility Routes

The ACCA Qualification is designed to be inclusive; whether you’re a school-leaver, a graduate, or a working professional, there’s a pathway suited to your background. Each route outlines the academic qualifications, exemptions, and preparatory options available, helping you choose the most efficient start toward earning your ACCA credential.

| Candidate Type | Requirements |

| School-Leavers | Minimum of 3 GCSEs and 2 A-Levels (or equivalent) in five subjects, including Maths and English. |

| Graduates | Recognised degree holders may receive up to 9 paper exemptions |

| Mature Students | It can begin with the Foundations in Accountancy (FIA) and then transition to the full ACCA. |

| English Proficiency | IELTS, TOEFL, or equivalent certification (if prior education wasn’t in English). |

| Minimum Age | 16 years old on the date of first exam registration. |

This flexible eligibility framework ensures inclusivity and adaptability, one of ACCA’s strongest appeals. Here is a snapshot to help you understand better.

Check your exemptions eligibility with this free calculator:

ACCA Course Structure and Syllabus

The ACCA Qualification is structured across three distinct stages, each progressively deepening your technical and strategic acumen.

1. Applied Knowledge (3 Papers)

A foundational stage that introduces core business and finance principles:

- Business and Technology (BT) – understanding business structures and digital integration

- Management Accounting (MA) – planning, budgeting, and performance measurement

- Financial Accounting (FA) – recording and reporting financial transactions

2. Applied Skills (6 Papers)

Bridges conceptual learning with practical skills:

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial Reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

3. Strategic Professional

At this level, ACCA moulds you into a leader and decision-maker.

Compulsory Papers:

- Strategic Business Leader (SBL)

- Strategic Business Reporting (SBR)

Optional Papers (Choose any 2):

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance (AAA)

Alongside, you must complete:

- Ethics and Professional Skills Module (EPSM) – a real-world ethics simulator focused on judgment and integrity.

- Practical Experience Requirement (PER) – 36 months of verified professional experience in finance or audit roles.

Global Recognition of ACCA in 180+ Countries

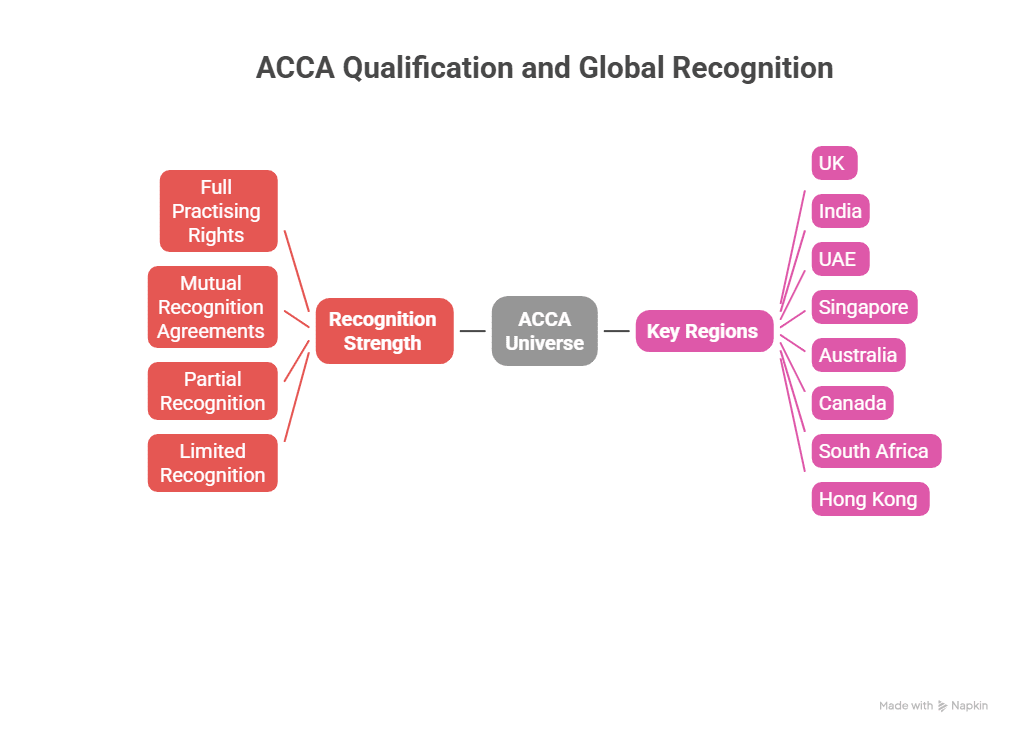

Few qualifications rival ACCA’s worldwide acceptance. Through Mutual Recognition Agreements (MRAs) and partnerships with top professional bodies, ACCA ensures its members can work or register locally in nearly every major economy.

| Region | Partner/Recognition | Notes |

| UK & Europe | Full practising rights through ICAEW & ICAS | Recognised as a Chartered Certified Accountant |

| Australia & New Zealand | CPA Australia & CA ANZ | Reciprocal membership agreements |

| Middle East | UAE, Qatar, Saudi Arabia | ACCA is recognised by financial authorities |

| Asia-Pacific | Hong Kong, Singapore | Registration through local boards |

| North America | CPA Canada | Direct entry route post-qualification |

| Africa | South Africa, Nigeria | MRAs & exemptions available |

This level of portability makes the ACCA Qualification ideal for professionals who want career flexibility without needing multiple national certifications.

The Real-World Advantage: Salaries and Roles

The global demand for ACCA professionals translates into strong pay packages across geographies.

| Country | Average ACCA Salary |

| India | ₹6–20 LPA |

| UK | £35,000–£70,000 |

| UAE | AED 180,000–300,000 |

| Singapore | SGD 60,000–100,000 |

| Australia | AUD 80,000–120,000 |

Sources:

Naukri.com, Glassdoor India, Prospects UK, GulfTalent, JobStreet Singapore, Seek Australia

With senior finance positions exceeding ₹20 LPA in India and £100,000 in the UK, the earning potential mirrors the qualification’s global prestige.

Building the Future-Ready ACCA Professional

The finance world has evolved far beyond the cubicle. Today’s accountants are no longer bound by physical offices or city-based firms; they work across time zones, tools, and digital ecosystems. The ACCA Qualification fits perfectly into this global shift.

A Fresh Perspective: The Remote-Ready Accountant

The ACCA curriculum’s inclusion of modules in Digital Finance, Data Analytics, and Sustainability Reporting reflects how the profession itself has transformed. The future finance professional isn’t just crunching numbers; they’re interpreting data through platforms like Power BI, automating workflows through RPA, and advising management on environmental disclosures.

A remote-ready accountant can:

- Collaborate with international audit teams via cloud-based software like CaseWare and Xero

- Provide virtual CFO services to startups scaling across geographies

- Leverage AI tools to optimise tax filings and forecasting

- Participate in online board meetings and financial reviews seamlessly

With the ACCA’s global syllabus and flexible examination system, professionals can qualify while working remotely or studying online.

Why Employers Value ACCA in the Hybrid Economy

The pandemic taught global organisations that accounting systems must be agile. Firms like EY, Deloitte, and KPMG have since prioritised hiring finance professionals trained in global reporting standards (IFRS) and capable of using digital audit tools, both hallmarks of ACCA graduates.

According to ACCA Global’s 2024 survey, 82% of multinational employers said they prefer ACCA-qualified candidates for roles requiring cross-border reporting and sustainability insights.

That’s because an ACCA Qualification doesn’t just represent exam success — it symbolises analytical thinking, business strategy understanding, and ethical decision-making.

These attributes collectively explain why the ACCA credential has become synonymous with future-ready finance leadership.

ACCA Qualification and the Global Job Market

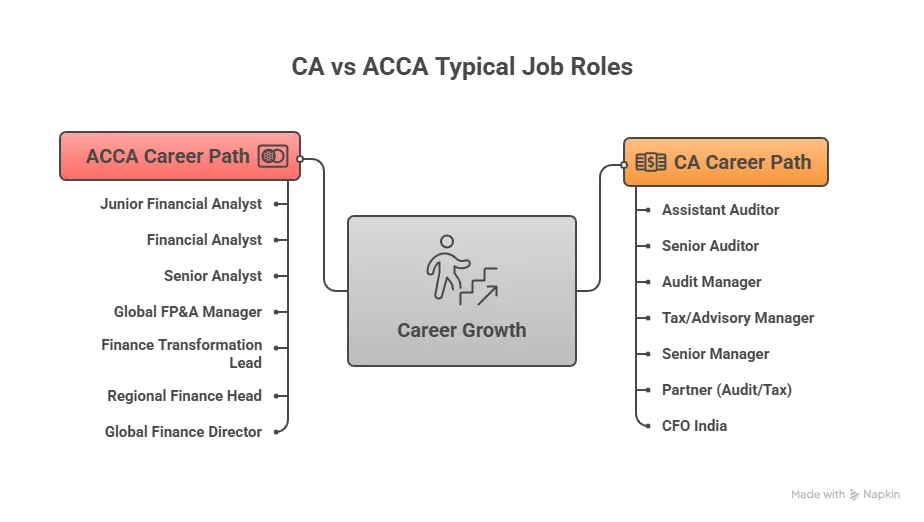

Every economy needs credible, ethical finance professionals, which is precisely why the ACCA India Talent Trends 2025 data shows. This makes the ACCA qualification so relevant in global hiring. In 2025, top roles for ACCA members include:

- Financial Analyst – evaluating investment opportunities and corporate performance

- Audit Manager – leading statutory audits under IFRS frameworks

- Tax Consultant – managing direct and indirect taxes for multinational clients

- Risk Manager – identifying and mitigating market or operational risks

- Management Accountant – supporting business strategy with financial insights

- ESG Finance Specialist – preparing sustainability and climate disclosures

Regional Demand Snapshot (2025)

| Region | Hiring Trend | Typical Roles |

| India | Rapid growth in Big 4 hiring and fintech | Analyst, Auditor, Finance Controller |

| UK | Consistent demand for IFRS and ESG roles | Senior Accountant, Reporting Manager |

| Middle East | Preference for ACCA in MNC finance divisions | FP&A, Internal Audit, Treasury |

| Asia-Pacific | Growth driven by digital finance startups | Management Accountant, Data Analyst |

| Africa | Increased public sector and NGO adoption | Compliance Officer, Budget Manager |

The takeaway: wherever finance flows, ACCA follows.

ACCA in India: Rising Scope and Demand

The ACCA Qualification has witnessed exponential growth in India, driven by the country’s increasing integration with global financial systems.

Indian firms adopting IFRS-based reporting and global outsourcing hubs for audit and consulting are fuelling this trend. The Big 4 firms (EY, PwC, Deloitte, and KPMG), as well as multinational banks like HSBC and Barclays, are among the largest recruiters of ACCA-qualified professionals.

India’s demand for ACCA-certified professionals is continually on the rise, along with finance certifications like the CMA and CPA.

Top Cities Hiring ACCA Professionals in India

Major financial hubs like Mumbai, Bengaluru, and Delhi NCR have become hotspots for ACCA-qualified talent, with opportunities spanning audit, taxation, consulting, and corporate finance.

| City | Average Salary (₹ LPA) | Key Recruiters |

| Mumbai | 8–30 LPA | Deloitte, EY, PwC |

| Bengaluru | 8–28 LPA | KPMG, HSBC, Flipkart |

| Delhi NCR | 7–25 LPA | PwC, Genpact, Barclays |

| Hyderabad | 7–23 LPA | Amazon, Deloitte, ICICI |

ACCA professionals in India often start as finance associates, analysts, or internal auditors and quickly transition into managerial positions within 3–5 years.

The value of ACCA in India isn’t just in the paycheque — it’s in the global exposure and flexibility it offers. Whether you wish to work from Mumbai for a Singapore client or relocate to London for a Big 4 role, the qualification ensures mobility.

ACCA’s 180+ Accepted Countries: Your Global Career Passport

When you hold an ACCA credential, you’re not confined to one geography. You can:

- Apply for finance and accounting roles across 180+ countries

- Easily convert membership under MRAs to practice locally

- Access the ACCA Careers Portal, which lists global openings across industries

- Enhance your work visa profile with a recognised international qualification

One of the most compelling aspects of the ACCA Qualification is its worldwide recognition.

The ACCA 180 countries list includes key economies like:

- United Kingdom

- Australia

- Canada

- Singapore

- United Arab Emirates

- Malaysia

- South Africa

- India

- Qatar

- Hong Kong

This global acceptance is supported by Mutual Recognition Agreements (MRAs) that allow ACCA members to:

- Register as CPAs in Australia and Canada

- Obtain audit rights under UK laws

- Join local accounting bodies (e.g., CA ANZ, ICAEW, ICAS)

- Apply for work visas with professional status recognition

In essence, the ACCA Qualification acts as your finance passport; one that needs no translation wherever you go.

Why ACCA Professionals Earn More

Employers reward qualifications that deliver tangible results. The ACCA Qualification signals global readiness, technical proficiency, and leadership potential — qualities that command competitive salaries worldwide.

Entry Level: ₹6–10 LPA

Mid-Level (3–5 years): ₹12–20 LPA

Senior Level: ₹25–35 LPA+

In international markets, these figures climb even higher:

- UK: £35,000–£70,000

- Australia: AUD 80,000–120,000

- Singapore: SGD 60,000–100,000

- UAE: AED 180,000–300,000

(Source- ProspectsUK, Seek Australia, JobStreet Singapore, GulfTalent)

What’s particularly interesting is the sectoral spread. ACCA professionals are not limited to audit or tax — they work in consulting, fintech, investment management, and sustainability finance. This diversification shields their career from economic fluctuations and opens multiple revenue channels over time.

ACCA vs. the Future: Where the Profession Is Headed

The next decade will redefine accounting as technology merges with financial decision-making. Artificial Intelligence will handle routine reconciliations, while human accountants will focus on strategy, risk, and innovation.

That’s precisely the mindset ACCA promotes, turning accountants into digital strategists.

Through its updated syllabus, ACCA ensures members are fluent in:

- Automation and Data Analytics: Using tools like Power BI, Tableau, and Excel Power Query

- Sustainability Reporting: Interpreting ESG metrics and climate disclosures

- Strategic Decision-Making: Aligning financial goals with long-term business objectives

This evolution has made the ACCA credential future-proof, a continuous investment in adaptability.

Why Choose Imarticus Learning for ACCA

Navigating global qualifications can feel complex, but Imarticus Learning simplifies this through the structured ACCA Program in Collaboration with KPMG in India.

Key Program Highlights

- Gold Status Learning Partner: Imarticus Learning is recognised as an approved learning partner for ACCA UK, ensuring its curriculum, materials, and training align with ACCA’s global standards.

- Collaboration with KPMG in India: The ACCA programme is delivered in partnership with KPMG in India, offering real-world case studies, internships for top performers, and expert masterclasses from industry practitioners.

- Kaplan-powered content: Your study materials are sourced from Kaplan (official ACCA-approved content provider), giving you high-quality books, question banks, live and on-demand modules, aligned with the latest ACCA syllabus.

- Placement / Internship Guarantee: Even after completing the early levels, students gain access to internships; after two levels of the ACCA route, Imarticus offers a 100% placement or internship guarantee (or money-back option) for selected batches.

- Pass Guarantee / Money-Back Assurance: The programme offers strong student success backing, such as the ability to retake sessions without extra cost and, in some cases, refunding fees if professional-level exams are not cleared.

- Flexible learning for working professionals: With live online classes, recorded sessions, personalised mentors and modular batches, Imarticus supports both full-time students and working professionals pursuing the ACCA Qualification.

- Global career focus: Since ACCA is recognised in 180+ countries, Imarticus ensures its programme emphasises international mobility. Their brochures highlight salary ranges, global job roles and accepted countries.

By enrolling through Imarticus Learning, candidates benefit from mentorship that blends exam mastery with career readiness, ensuring every learner emerges not just qualified, but employable.

Key Takeaways

- Global Reach: Recognised in over 180 countries through MRAs

- Flexible Pathways: Start after 12th, during graduation, or as a working professional

- High Earning Potential: Senior ACCA professionals earn ₹20-35 LPA in India and six-figure salaries abroad

- Digital & Ethical Edge: Curriculum integrates analytics, automation, and sustainability reporting

- Career Mobility: Enables relocation and recognition across continents

FAQs on the ACCA Qualification

If you’re planning to start your global accounting journey, it’s natural to have a few questions about the ACCA Qualification. From who can apply and how many exams there are, to where it’s recognised and what salary you can expect, this section answers the most common queries students and professionals have.

What is the qualification ACCA?

The ACCA Qualification (Association of Chartered Certified Accountants) is a globally recognised professional accounting credential headquartered in the UK. It certifies expertise in financial management, auditing, taxation, and business strategy under international standards like IFRS. The qualification includes three levels – Applied Knowledge, Applied Skills, and Strategic Professional – along with 36 months of practical experience and an Ethics & Professional Skills module.

Who is eligible for the ACCA exam?

To register for the ACCA Qualification, candidates must be at least 16 years old and have completed five subjects at the high school level, including Maths and English. Graduates with recognised degrees can claim up to nine exam exemptions, while those without formal education can begin with the Foundations in Accountancy (FIA) route. With Imarticus Learning, students receive end-to-end guidance on eligibility, exemptions, and registration to ensure a seamless start to their ACCA journey.

Is ACCA harder than CA?

The ACCA Qualification is not inherently harder than the Chartered Accountancy (CA) course; it’s structured differently. ACCA emphasises applied learning, international standards, and flexibility with multiple annual exam sessions. Since it follows global accounting frameworks like IFRS, professionals aiming for international roles find ACCA a more globally portable choice. With Imarticus Learning’s guided ACCA training, students can navigate the syllabus efficiently and gain clarity on complex IFRS concepts.

Can I take ACCA after 12th?

Yes, students can start the ACCA Qualification immediately after completing Class 12 (or equivalent). You’ll begin with the Applied Knowledge Level, which covers business, management, accounting, and financial accounting fundamentals. Imarticus Learning offers guided batches specifically for school-leavers, making the transition from academic learning to professional qualification smooth and structured.

Is ACCA full of math?

No, the ACCA Qualification focuses more on logic, analysis, and business application than advanced mathematics. While you’ll use arithmetic and financial formulas, the course prioritises understanding financial systems, corporate decisions, and ethical implications. Anyone comfortable with basic numerical reasoning can succeed with structured guidance and consistent practice.

What is the ACCA salary per month?

Salaries for ACCA professionals vary across countries and experience levels. In India, freshers typically earn between ₹50,000 and ₹1,00,000 per month, while mid-level professionals can make ₹1.5–2.5 lakh monthly. Internationally, average monthly pay ranges from £3,000 in the UK to AED 15,000 in the UAE. These figures reflect the premium attached to the ACCA’s global reputation.

How many levels are in ACCA?

The ACCA Qualification consists of three levels:

- Applied Knowledge (3 papers)

- Applied Skills (6 papers)

- Strategic Professional (4 papers: 2 compulsory + 2 optional)

Additionally, candidates must complete the Ethics & Professional Skills Module and a 36-month Practical Experience Requirement (PER) to achieve full membership status.

What is the 7-year rule in ACCA?

The 7-year rule in the ACCA Qualification refers to the time limit to pass all exams at the Strategic Professional level. Once you pass your first paper at that level, you have seven years to complete the remaining papers. The Applied Knowledge and Applied Skills levels have no time limits, ensuring flexibility during your early ACCA journey.

Is ACCA in demand in India?

Absolutely. The ACCA Qualification is gaining immense traction in India due to the country’s adoption of IFRS-aligned accounting standards and the rise of global service centres. Top employers such as Deloitte, PwC, and HSBC actively hire ACCA professionals for cross-border finance roles. Through Imarticus Learning’s offering of ACCA prep, learners can build the global skills employers seek and position themselves for high-demand opportunities in India.

Conclusion: From Classroom to Global Boardroom

Earning the ACCA Qualification is more than a milestone; it’s a mindset. It’s about preparing to think globally, act ethically, and lead strategically. In an economy where borders blur and industries evolve overnight, this credential gives you the professional currency to thrive anywhere.

Through structured mentorship, live classes, and global accreditation, Imarticus Learning transforms ACCA aspirants into competent professionals ready to step into international finance roles.

Begin your journey toward becoming a globally recognised Chartered Certified Accountant today — visit the Imarticus Learning ACCA page and start your global career.