The Association of Chartered Certified Accountants (ACCA) opens the gateway to a global accounting career – a qualification recognised in over 180 countries that equips finance professionals and aspirants alike with the tools to excel in auditing, taxation, management accounting, and financial consultancy.

And yet: before you jump in, one question looms –

Am I eligible?

And can my current degree help me skip a few steps?

Good question, because the answer could help you save both time and money. That’s exactly what we’ll walk you through today: eligibility, exemptions, and how to map your path.

Whether you’re a Class 12 student aspiring to become a global finance professional or a working accountant wanting to expand your international credentials, understanding ACCA course eligibility and its exemptions can dramatically shape your journey.

What is ACCA?

If you are still wondering what is ACCA? The Association of Chartered Certified Accountants (ACCA) qualification is a globally respected and recognised qualification that equips you for roles in accounting, audit, taxation, management, and financial consultancy.

You can think of ACCA as your global accounting passport. ACCA is offered by the UK-based Association of Chartered Certified Accountants. It has built a syllabus that spans across three levels: Applied Knowledge → Applied Skills → Strategic Professional.

The table below shows a comprehensive overview of the ACCA subject list:

| Level | Focus Area | Papers / Modules |

| Applied Knowledge | Basics of Finance & Business | Business & Technology (BT), Management Accounting (MA), Financial Accounting (FA) |

| Applied Skills | Technical & Analytical Finance skills | Corporate & Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit & Assurance (AA), Financial Management (FM) |

| Strategic Professional | Advanced Strategy, Leadership & Specialisation | Essentials: Strategic Business Leader (SBL), Strategic Business Reporting (SBR); Optional (Choose 2): Advanced Financial Management (AFM), Advanced Performance Management (APM), Advanced Taxation (ATX), Advanced Audit and Assurance (AAA) |

The ACCA course syllabus covers core areas like finance, taxation, management accounting, and auditing – ensuring well-rounded professional expertise.

Each level builds your technical base, professional insight, and strategic decision-making ability, culminating in a globally recognised credential that commands premium positions in multinational corporations and Big Four firms alike.

The program’s global structure and industry alignment make it highly sought-after in regions like India, the UAE, Singapore, the UK, and other financial hubs.

Here’s a detailed video guide to help you understand what ACCA is and how to map your career path:

Why ACCA Stands Out

- Recognised in 180+ countries

- Over 800,000 members and future members globally

- Endorsed by 7600+ approved employers

- Offers flexible study modes (full-time, part-time, online)

- Delivers strong ROI and excellent placement opportunities

ACCA distinguishes itself not just as a qualification but as a career accelerator – a passport to international career mobility and financial leadership.

So if you’re thinking, “I want to build a finance or accounting career that isn’t restricted to India”, ACCA becomes a smart choice.

Why Choose ACCA in 2025?

The world of finance is borderless. With ACCA, you’re not just limited to one country, but have:

- Global recognition, enabling cross-border job opportunities.

- The ability to leverage your prior qualifications – any degree or diploma is not wasted, but becomes your leverage for faster progress.

- With ACCA, you get the flexibility to work across industries like audit, consulting, corporate finance, taxation, and risk management.

Who Can Apply for ACCA?

The ACCA qualification requirements are designed to ensure students have a strong grasp of business, accounting, and finance fundamentals before progressing to advanced strategic papers.

Anyone passionate about unlocking career potential in finance or accounting can apply for ACCA, provided they meet basic educational standards. ACCA eligibility in India depends on your educational background and work experience. Here’s where it gets interesting – your past education and experience matter, because they determine your starting point and options for exemptions.

ACCA Eligibility After 12th Commerce

Pursuing ACCA after 12th is one of the best ways to start early and build a strong international accounting foundation. If you’ve finished 10+2 (Class 12), you can kick off your ACCA journey—here’s what you need to meet the eligibility requirements:

- Maths or Accounts as a subject

- English proficiency

- 65% marks in Maths/Accounts and 50% marks in other subjects

Pro Tip: If you have completed the 10th grade or do not meet the marks requirements or are a Non-commerce student, you may need to start with the Foundations in Accountancy (FIA) route before progressing to the full ACCA qualification.

Once you complete this, you can smoothly transition into the full ACCA qualification.

This flexibility is what makes ACCA truly global – it adapts to your educational background rather than restricting you.

If you are a BCom graduate looking to leverage your career with ACCA, this video will help you with a clear approach:

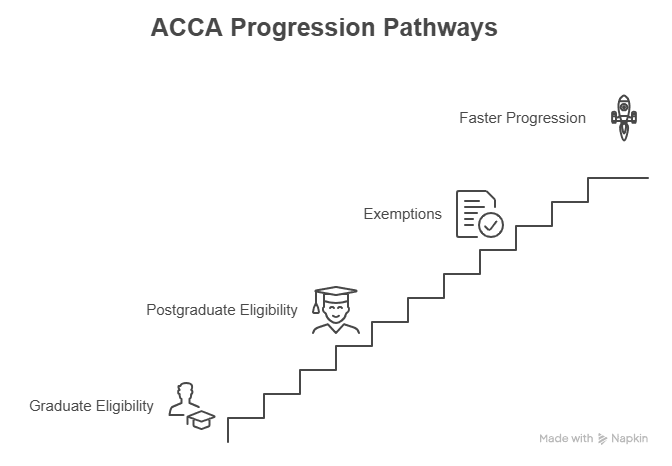

ACCA Eligibility After Graduation or Post-Graduation

If you’re considering ACCA after graduation, your degree gives you a major advantage – allowing for possible exemptions and faster progression.

Choosing ACCA after graduation or post-graduation helps you save time since your academic background often qualifies you for exemptions from foundational papers.

ACCA also offers exemptions for candidates who have cleared the CA intermediate or IPCC exams.

ACCA Eligibility for Working Professionals

Professionals with experience in finance or accounting can apply for ACCA, leveraging both their academic qualifications and work experience to accelerate the path. Individuals with finance or commerce experience are equally eligible.

Qualifications-wise Eligibility and Exemptions Overview

The ACCA Exemptions system allows candidates to bypass certain exam papers based on prior qualifications, making it possible to save time and effort while progressing through the ACCA qualification.

| Candidate Type | Eligibility Requirements | Pathway | Exemptions Available |

| Class 12 (Commerce) | 65% in Maths/Accounts and English; 50% in other subjects | Direct ACCA registration | None (must attempt all papers) |

| Class 12 (Non-Commerce) | Completed Class 12, may lack commerce subjects | Start with the Foundations in Accountancy (FIA) route | Exemptions start post-FIA |

| Graduate (Commerce/Finance) | Bachelor’s in relevant fields (B.Com, BBA, BA Hons) | Direct ACCA registration with exemptions | Typically, 4-6 papers are exempted |

| Postgraduate (Finance) | CA Inter, M.Com, MBA Finance | Direct registration with more exemptions | Up to 6 papers |

| Working Professionals | Relevant academic qualifications + work experience | Accelerated entry possible | Varied by qualification |

ACCA Exemptions Explained (India 2025)

Here’s the good part: ACCA Exemptions in India mean you don’t have to sit certain ACCA exams. If you’ve already covered some ground, you might skip certain papers because your previous qualification covers similar content. It saves time, effort, and cost.

| Qualification | Exemptions Available (up to) |

| B.Com / BBA (Finance) | 4 papers in Applied Knowledge & Skills |

| MBA (Finance) / M.Com | 6 papers |

| CA Inter / IPCC | 5 papers |

| Chartered Accountant (India) | 9 papers |

| CMA / CPA / CIMA | Varies based on issuing body and syllabus match |

Remember: All exemptions are subject to ACCA UK’s verification through its official exemption calculator, and documentation (transcripts, degree certificates) must be uploaded for review.

How to Apply for ACCA Exemptions

The ACCA exemption process is designed to be convenient and transparent:

Here’s the step-by-step:

- Visit the official ACCA Exemption Calculator on the ACCA Global website.

- Enter your qualification details to check available exemptions.

- Upload academic certificates, mark sheets, or professional credentials.

- Await confirmation and an official exemption offer from ACCA.

Once approved, you can begin your ACCA journey directly from the next eligible paper- skipping earlier modules you have already covered in your studies.

Tip: Keep your documents ready (transcripts, mark-sheets) so you don’t delay this step.

Are you a qualified CA, wishing to pursue ACCA? This video will give you a brief overview:

ACCA Course Duration and Fees: Exam Pattern Explained

Before planning your timeline, get familiar with the ACCA course syllabus so you can prioritise subjects and leverage exemptions smartly.

When diving into the ACCA journey, it’s important to understand the ACCA course duration and fees clearly – this helps you plan well and budget effectively. The ACCA qualification involves a total of 13 papers spread across three different levels: Applied Knowledge, Applied Skills, and Strategic Professional. Typically, most students finish this journey in about 2 to 3 years, but if you’re eligible for exemptions because of previous qualifications, this duration can be significantly shorter.

- Number of Exams: 13 papers in total across three levels (Applied Knowledge, Applied Skills, Strategic Professional)

- Duration: Average completion time varies from 2 to 3 years, shortenable via exemptions.

- Exam Pattern: Computer-based with quarterly exam sessions worldwide.

- Passing Marks: 50% per paper required to pass.

Here’s a detailed breakdown of the levels, how many papers each has, the exam duration, format, and passing marks:

| Level | Number of Papers | Exam Duration | Format | Passing Mark |

| Applied Knowledge | 3 | 2 hours each | Multiple Choice Questions (MCQs) | 50% |

| Applied Skills | 6 | 2 – 3 hours each | Mix of Objective & Written Answers | 50% |

| Strategic Professional | 4 (2 compulsory + 2 options) | 3 – 4 hours | Case Studies, Essays, Reports | 50% |

Did you know?

Your degree becomes a springboard to reach higher ACCA levels faster.

Fast-track ACCA Options for Graduates and Professionals

Understanding ACCA exemptions in India helps you fast-track your qualification, reduce costs, and start working sooner. Exemptions aren’t just about skipping exams – they’re about accelerating your career. For example, a B.Com graduate can fast-track their ACCA journey significantly:

- Without exemptions – 13 exams (approx. 3 years)

- With exemptions – As few as 9 exams (can finish in just 1.5 – 2 years)

The ACCA Exemption Calculator, available on the official ACCA website, is the definitive tool to determine exact exemptions based on your individual qualifications. It compares your prior academic or professional credentials against the ACCA syllabus to identify courses you can skip. This is highly recommended before registration to optimise your study plan and reduce exam load.

This acceleration saves substantial time and reduces tuition and exam costs – ideal for students eager to enter the job market early or professionals aiming for rapid advancement.

| Candidate Category | Number of Exams | Approximate Duration | Remarks |

| Without Exemptions | 13 | 3 years | Full syllabus |

| With Exemptions (B.Com) | Around 9 | 1.5 – 2 years | Leverages prior qualifications |

| CA Qualified Candidates | Around 4 | 1 – 1.5 years | Maximum number of exemptions |

If you are confused between going for a postgraduate commerce degree or ACCA, this video will demystify your career path:

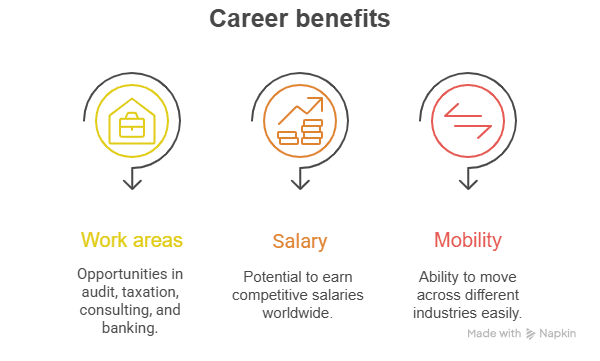

Global Career Advantages of Becoming an ACCA

Once qualified, ACCA members enjoy numerous professional advantages that go beyond a single country or region.

Global Mobility

As an international qualification, ACCA allows easy transition between continents for roles across auditing, consulting, taxation, or finance management.

High-Value Designations

ACCA professionals can work as Auditors, Controllers, Tax Advisors, Management Accountants, or Financial Consultants with global firms like Deloitte, PwC, EY, and KPMG.

Salary Leverage

Their earning potential surpasses local norms – thanks to global acceptance and cross-border career options. ACCA professionals earn competitive packages starting from ₹7-10 LPA in India, scaling higher globally depending on experience.

Career Flexibility

You can switch seamlessly between industries – finance, fintech, consulting, or corporate strategy because ACCA builds both analytical and management proficiency.

Professional Prestige

Being an ACCA member connects you to a network of finance leaders and influencers, reinforcing your credibility wherever you work.

Why Choose Imarticus for ACCA in 2025

Partnering with Imarticus Learning, an official ACCA learning facilitator, can elevate your ACCA preparation experience with structured mentorship, global content, and assured outcomes.

Key Advantages of ACCA with Imarticus:

- Guaranteed placement after completing two ACCA levels.

- No-limit passing guarantee with free reappear sessions.

- Pre-placement bootcamps and interview preparation for job readiness.

- Simulation-based global curriculum

- Dual certification: ACCA + QPA (Qualified Professional Accountant)

- Course content powered by Kaplan – an ACCA Gold Approved Learning Partner

This combination of international curriculum and domestic career support ensures you emerge with both technical skills and practical employability.

Are you confused between pursuing an MBA and ACCA for accelerated career growth? This video will guide you to understand which career is the best for you:

How an Accounting Degree Strengthens Your ACCA Journey

Holding a degree in commerce, business, or finance is an enormous advantage because it creates overlap with ACCA’s foundational papers. This overlap results in:

- Recognition of prior learning reduces study load.

- Exemption from foundational papers cuts time and cost.

- Early exposure to advanced strategic modules sharpens career readiness.

- Employers value your combined academic and professional training.

Essentially, it means your academic background empowers you to skip redundancy and focus on higher-value skill-building.

FAQs on ACCA Course Eligibility

Before wrapping up, let’s clear up a few frequently asked questions about ACCA course eligibility in India that students have.

Who is eligible for the ACCA degree?

Anyone who has passed Class 12 with the required marks in Maths or Accounts, and English can apply for ACCA. Graduates, postgraduates, and even professionals from commerce or non-commerce backgrounds are also eligible, though your entry level and ACCA exemptions in India will depend on your previous qualifications.

What qualifications do I need for ACCA?

Before applying, it’s essential to understand the ACCA qualification requirements, which vary depending on your academic background and experience. To start ACCA, you need to have completed Class 12 with at least 65% marks in Maths/Accounts and English, plus 50% in other subjects. If you don’t meet these requirements, you can begin with the Foundations in Accountancy (FIA) levels and then transition to ACCA.

How many levels are there in ACCA?

The ACCA course syllabus is structured into three key levels: Applied Knowledge, Applied Skills, and Strategic Professional. Each level progressively builds your technical knowledge and leadership capabilities to prepare you for senior finance roles, making it ideal for those planning ACCA after graduation or even while pursuing a commerce degree.

Can commerce graduates apply directly?

Yes, commerce graduates like B.Com or BBA holders can apply directly and are often eligible for ACCA exemptions in India from foundational ACCA papers. This allows them to fast-track their studies and benefit from a shorter ACCA course duration and fees compared to starting from the foundation level.

Is there an age limit?

The minimum age limit to enrol in ACCA in India is typically 16 years, but most students join after completing Class 12 when they meet the basic academic requirements outlined under ACCA course eligibility.

What if I am a non-commerce student?

Yes, non-commerce students can still pursue ACCA after 12th, but they might need to start with the Foundations in Accountancy (FIA) route before moving to the full ACCA qualification. This flexible entry ensures ACCA eligibility in India is open to learners from diverse educational backgrounds.

How do I check exemptions?

You can easily check ACCA exemptions in India by using the official ACCA Exemption Calculator available on their website. You will need to enter your prior qualifications and institute details, so ACCA can assess which exams you can skip.

How long does ACCA take?

Typically, the ACCA course duration is about 2 to 3 years to complete all exams, but this can be shortened significantly with exemptions based on your previous qualifications and your study pace. Students pursuing ACCA after graduation can often complete the program faster due to prior learning credits.

Can I finish ACCA in 1 year?

While it’s ambitious and challenging, finishing ACCA in one year is possible if you qualify for maximum exemptions and can dedicate full-time study. However, for most candidates, a timeframe of 18-24 months is considered more realistic, depending on ACCA qualification requirements and study intensity.

Is ACCA tougher than CA?

ACCA and CA have different structures and syllabus focuses. The ACCA course syllabus is globally oriented with flexible exam schedules, while CA is India-specific and traditionally more rigorous. The difficulty depends on your goals and learning style. ACCA after graduation often gets smoother due to a strong understanding of familiar concepts and flexible exam scheduling. ACCA offers exemptions for prior qualifications recognised by the institute. Whereas, CA does not offer exemptions except for exemptions on clearing the papers in a particular group.

What is the attempt limit for ACCA?

There is no limit on the number of attempts for ACCA exams in India. You can keep retaking papers until you pass, supported by flexible exam dates. You might need to take the exams according to the sessions held per year. The ACCA exams are held in 4 sessions per year, which means you can take 8 exams per calendar year – making it easier to manage ACCA course duration and fees efficiently.

Can I do ACCA without maths?

Yes, you can pursue ACCA after 12th, even without a strong maths background, since the program focuses more on practical accounting and finance skills. However, a basic understanding of numbers, analysis, basic arithmetic and algebraic operations is necessary and will help you navigate the ACCA qualification requirements smoothly.

Accelerate Your Career with ACCA

Whether you start ACCA after 12th or later in your career, the qualification gives you flexibility and recognition across borders to take charge of your career on your terms. It’s not just about exams – it’s about making your education work for you, saving time, cutting unnecessary costs, and fast-tracking your ambitions. Understanding ACCA course eligibility and exemptions is like having a map: it shows you the smartest path forward, tailored to what you’ve already achieved. No guesswork, no wasted effort – just a clear route to becoming a globally recognised finance professional.

Working with a trusted learning partner like Imarticus Learning takes this even further. With personalised mentorship, practical guidance, and structured preparation, you’re not just studying – you’re preparing for real-world success. From placement support and interview coaching to dual certification with KPMG India, every step is designed to give your profile that extra edge. With Kaplan-powered ACCA Gold-standard content, rigorous academics meet career readiness. The result? You transform your degree into a launchpad for a high-value, international career, moving confidently from learner to sought-after finance professional.

Start your ACCA journey today and step into a borderless financial future where your degree does more than open doors; it builds bridges across the global accounting landscape.