Many professionals feel stressed even with a regular income. Maybe you’re juggling EMIs, rent, and family expenses and still unsure about savings or retirement.

What if an unexpected event drained your savings? Or you couldn’t fund your child’s education or your own medical emergency?

That’s where personal financial planning helps. If you’ve ever wondered what is personal financial planning or why it matters, this post will break it down. We’ll cover the steps, the importance of each stage, and a simple framework that fits your life, Income, and goals.

What is Personal Financial Planning?

Personal finance means managing your money, whether as an individual or a family, by budgeting, saving, and spending in a planned way while keeping financial risks and future needs in mind.

Personal financial planning is the process of managing your Income, expenses, savings, & investments to achieve life goals. It helps you make smart money decisions like how much to spend, save, invest, or insure so you’re financially secure today and tomorrow.

Unlike casual budgeting, personal financial planning follows a structured path. It’s not just about how much you earn but how you use it wisely. Whether you’re 25 or 50, this process stays useful and relevant.

Why You Need Financial Planning, Even If You’re Doing Fine

The “100 minus age” rule helps decide how much of your investment portfolio should go into equities. According to this approach, you should allocate (100 minus your age) per cent to equities and place the remaining amount in debt instruments.

You might think, “I’m earning okay. I’ve got a savings account and an LIC policy. Why plan more?”

Let’s clear that up. The importance of personal financial planning isn’t just about wealth-building. It’s about clarity.

Here’s what it helps with:

- Be ready for emergencies (like medical bills)

- Plan large expenses (weddings, home, kids’ education)

- Avoid lifestyle debt traps

- Retire with comfort

- Sleep better at night

So, if your money decisions happen without a plan, you’re gambling with your future.

Understanding the Personal Financial Planning Process

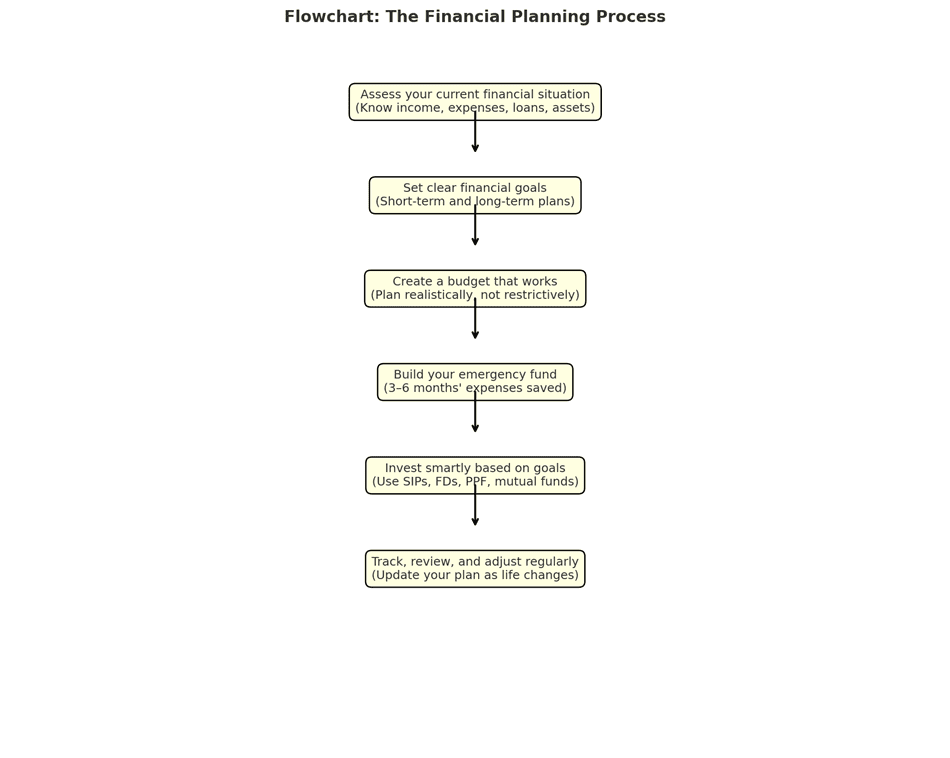

Here’s a simplified overview of the standard personal financial planning process. Think of it like building a house: one step leads to the next.

The Financial Planning Process

We’ve simplified it below for easy understanding:

- Assess your current financial situation

(Know your Income, expenses, loans, and existing assets) - Set clear financial goals

(Short-term and long-term: a house, retirement, travel, etc.) - Create a budget that works.

(Don’t restrict the plan realistically) - Build your emergency fund

(Ideally, 3–6 months of expenses in a savings account) - Invest smartly based on goals

(Choose SIPs, FDs, PPF, and mutual funds based on your timeline) - Track, review, and adjust regularly

(Life changes, so your plan should evolve, too)

Tip: Many Indians miss Step 4 (emergency fund) and jump to investments; don’t skip it.

Breaking Down Each Step Further

Let’s look deeper into each step so you know how to apply them.

1. Assess Your Financial Status

Before anything else, note down:

- Your income sources

- Monthly expenses (fixed and variable)

- Existing loans, EMIs, credit card dues

- Savings and investments

This snapshot tells you what’s possible and what’s not. You’ll be surprised how many people don’t track this monthly.

2. Define Your Goals Clearly

Think long-term and short-term. Retirement? A house in 5 years? A Goa trip next year?

Name it. Price it. Timeline it.

Without a deadline and amount, it’s just a wish, not a goal.

3. Build a Realistic Budget

A budget isn’t a restriction. It’s a spending plan.

Start with the 50-30-20 rule:

| Category | % of Income | Example Use |

| Needs | 50% | Rent, bills, groceries |

| Wants | 30% | Travel, dining out, subscriptions |

| Savings & Investments | 20% | SIPs, PPF, insurance |

Tailor it to your lifestyle. But track your spending weekly.

4. Save for Emergencies First

This should be your first goal even before investing. A good thumb rule: three to six months of monthly expenses.

Keep it in a high-interest savings account or liquid fund.

Many Indians overlook this and take loans for emergencies later.

5. Choose the Right Investments

Pick based on your goals, risk appetite, and timeline.

Here’s how:

- Short-term (1–3 yrs): Fixed deposits, debt funds

- Mid-term (3–5 yrs): Balanced funds, PPF

- Long-term (5+ yrs): Mutual funds, equity, NPS

Avoid chasing quick returns. Avoid the herd mentality. Do what suits you.

6. Review and Update Regularly

Got a promotion? Had a baby? Did you buy a house?

Your financial plan should adapt, too. Every 6 months, take 30 minutes to:

- Update Income and expenses

- Track goals

- Adjust investments

Fast-Track Your Finance Career with the Postgraduate Programme in Banking and Finance

If you’re planning to build a career in finance or understand the real-world aspects of money better, Imarticus Learning’s Postgraduate Programme in Banking and Finance can be a great place to start.

This 190+ hour interview-guarantee programme focuses on Retail Banking, NBFCs, and FinTech. You’ll go through 2 months of practical online training, followed by 1 month of intensive job prep.

You’ll learn directly from experts with 20+ years of experience covering sales, banking operations, communication, and customer service through case studies and roleplays.

On completion, students receive ₹8,000 as a fellowship and gain access to top BFSI job roles offering salaries up to ₹6 LPA.

So whether you’re a fresh graduate or looking to pivot into the booming BFSI space, the Postgraduate Programme in Banking and Finance can fast-track your entry.

Explore the Postgraduate Programme in Banking and Finance by Imarticus Learning today!

FAQs

1. Why should I bother with personal financial planning?

I plan my money to avoid nasty surprises like unexpected bills and to make sure I hit my targets, such as clearing debts or growing my savings for the future.

2. How do I begin the personal financial planning process?

Start by listing your Income, expenses, & debts. Then, set clear goals, draw up a realistic budget, and build an emergency fund before you move on to investing.

3. Can personal financial planning help me clear my debts faster?

Yes. By budgeting effectively and prioritising high-interest debts, you can repay what you owe more quickly while still saving for tomorrow.

4. How does a banking course support my financial plan?

A banking course teaches you real-world money management, covering topics like lending, budgeting, and risk management so you make smarter choices for your own finances.

5. Is budgeting the same as personal financial planning?

Not quite. Budgeting is one part of personal financial planning. The full plan includes setting goals, saving, investing, and conducting ongoing reviews, not just tracking spending.

6. Who benefits most from personal financial planning?

Anyone with Income, whether you’re a graduate, a mid-career professional, or self-employed, can gain from planning. It brings clarity and confidence, whatever your financial situation.

Conclusion: Take Control Today

You don’t need to be rich to start financial planning. You just need a plan. And the sooner you begin, the more freedom you’ll create for yourself. Financial freedom isn’t about luck. It’s about choices. One at a time.

Start small. Track better. Invest smarter.

And if you’re serious about learning the importance of personal financial planning or exploring a banking course, you already know where to begin.