Last updated on October 8th, 2024 at 07:07 am

With governments increasingly moving towards digital platforms worldwide, paying taxes has become more straightforward and accessible. No more standing in line or checking emails! Online tax payments help you stay informed, stay on track, avoid penalties, and keep your financial records organised.

These online platforms streamline the payment process and provide a secure way to track and manage financial obligations efficiently, ensuring accuracy and reliability for taxpayers.

Now, how do you pay taxes online?

We will cover the specifics in this online tax payment guide 2024.

Why Choose Online Tax Payments?

Online tax payments offer a range of benefits that simplify this crucial financial task:

- Convenience and flexibility: File and pay your taxes anytime, anywhere, 24/7, eliminating the constraints of traditional methods.

- Secure and faster processing: Benefit from secure online payment gateways and faster transaction processing times, ensuring timely payments and peace of mind.

- Reduction in paperwork and easier tracking: Transition to a paperless system, minimising administrative burdens and simplifying financial record management.

- Availability of payment options: Choose from a variety of payment methods – including credit/debit cards, bank transfers, and digital wallets – to suit individual preferences.

Prerequisites for Making Online Tax Payments

You have the option to pay your taxes using the ‘Payment Gateway’ in two modes: Pre-login (before logging into the e-Filing portal) or Post-login (after logging in).

Pre-login Requirements:

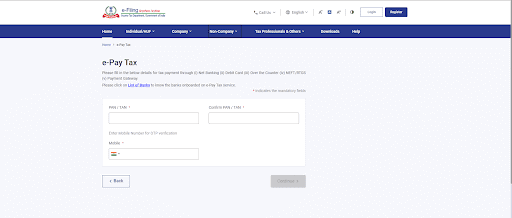

- A valid PAN/TAN for which the tax payment is being made.

- Access to a Debit Card, Credit Card, Net Banking, or UPI for making the payment.

- A valid mobile number – to receive the One-Time Password (OTP) for verification.

Post-login Requirements:

- You must be a registered user on the e-filing portal: www.incometax.gov.in.

- Available payment methods include Debit Cards, Credit Cards, Net Banking, or UPI.

Step-by-Step Online Tax Payment Guide 2024

Step 1: Access the Official Tax Portal

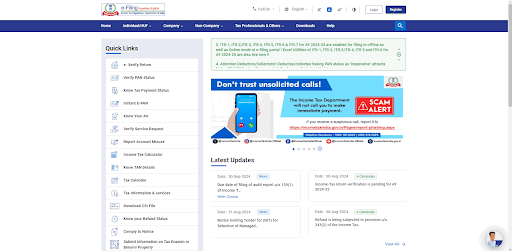

First and foremost, make sure you are a registered user. If not, log in to http://www.incometax.gov.in and click on e-pay tax from the home page.

Step 2: Provide Your Tax Information

On the secure e-Pay Tax page, you’ll be asked to enter some key details to calculate your tax liability. Fill out the required fields accurately and then click ‘Continue’ to proceed.

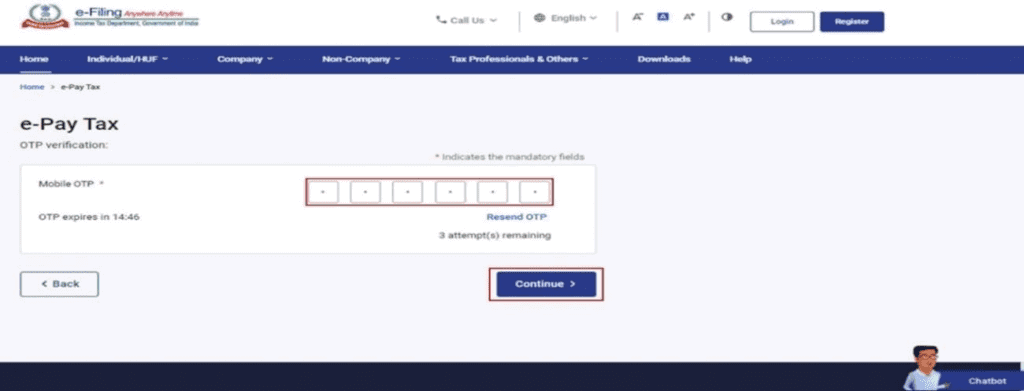

Step 3: Verify Your Identity

To ensure the security of your transaction, a 6-digit OTP (One-Time Password) will be sent to the mobile number you provided earlier. Retrieve the OTP from your messages and enter it on the ‘OTP Verification’ page. Once you’ve entered the code correctly, click ‘Continue’ to proceed.

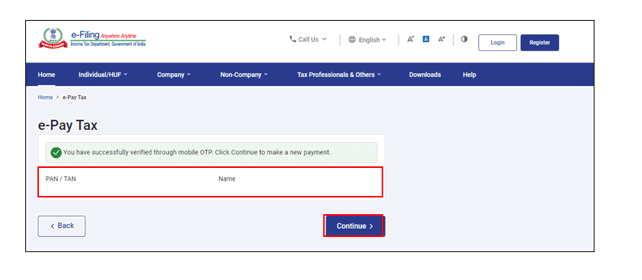

Step 4: Confirmation and Payment Selection

After successful OTP verification, you’ll see a confirmation message displaying a masked version of yourname and PAN/TAN. Click ‘Continue’ to move forward with your online tax payment.

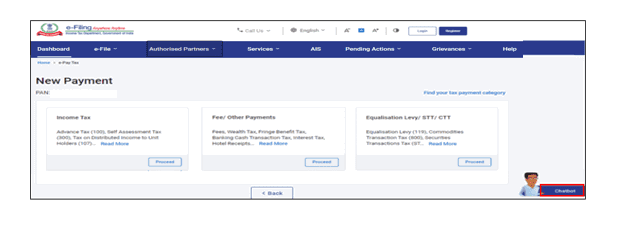

Step 5: Choose Your Tax Payment Category

Select the tax payment category that applies to you from the options provided. This ensures your payment is correctly allocated.

Step 6: Provide Payment Details

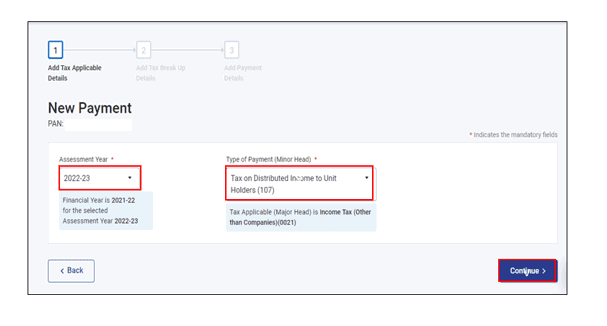

To calculate the precise tax amount, you’ll be asked to provide some additional details:

- Assessment Year: Choose the relevant assessment year for your tax payment.

- Minor Head: Select the specific tax category or ‘minor head’ under which you are making the payment.

- Other Details: Provide any additional information requested, which might vary based on the selected tax category.

Once you’ve filled in all the necessary details, click ‘Continue.’

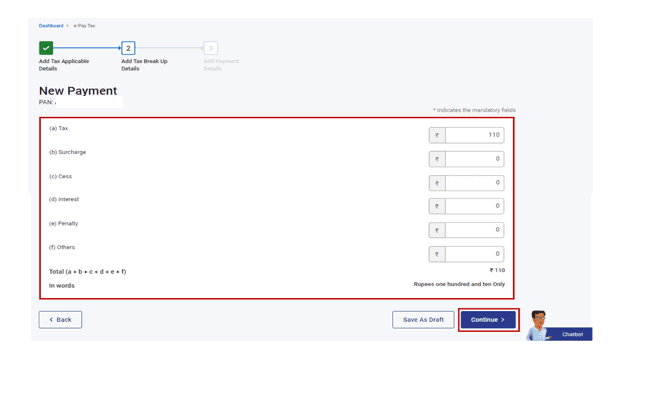

Step 7: Breakdown Your Tax Payment (If Applicable)

On the ‘Add Tax Breakup Details’ page, you can optionally break down your total tax payment into different components. This step helps provide a clear and organised record of your payment. Click ‘Continue’ after entering the details.

Step 8: Choose Your Payment Method

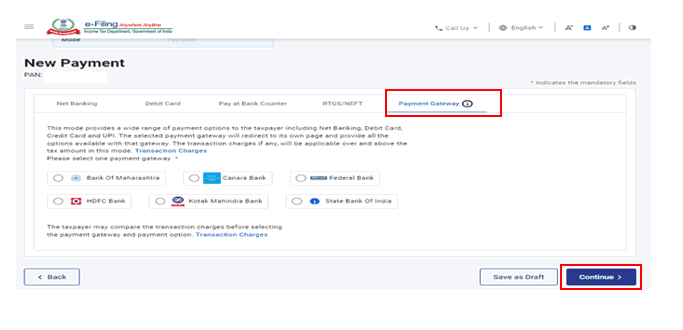

Select your preferred mode of payment from ‘Payment Gateway’ and click ‘Continue.’

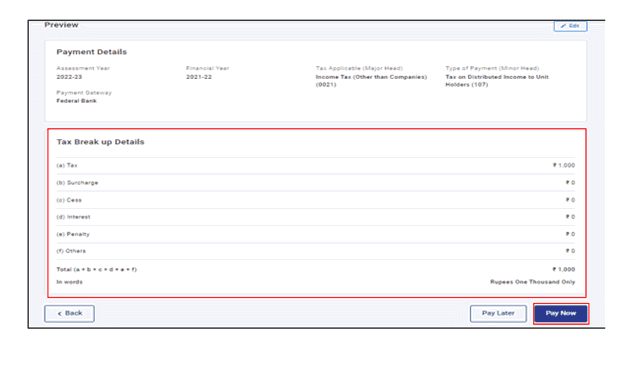

Step 9: Review and Confirm Payment

Carefully review your payment details, including the tax breakup (if applicable). If everything is accurate, click ‘Pay Now’ to proceed.

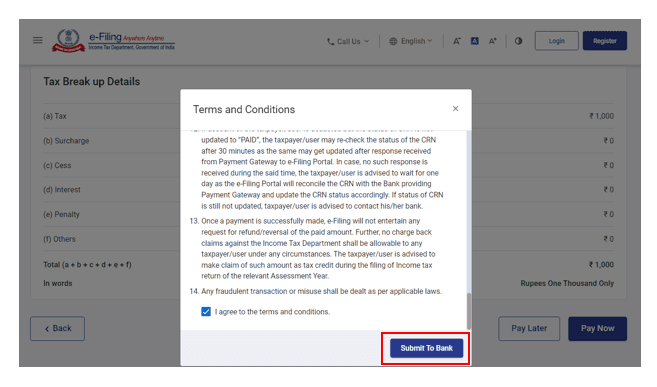

Step 10: Make Payment Through the Secure Gateway

Once you have confirmed all the details, click Submit to Bank. You’ll be redirected to a secure payment gateway where you can:

- Log in: If you already have an account with the payment gateway.

- Enter Payment Information: Provide your Net Banking details, Debit/Credit card information, or UPI ID to make the payment.

You can compare transaction charges associated with each payment gateway before selecting your preferred option.

Confirmation of Online Tax Payment and Next Steps

After a successful online tax payment, you will receive:

- Confirmation Email: Sent to the email address registered with the e-filing portal.

- Confirmation SMS: Sent to the mobile number registered with the e-filing portal.

You can download your Challan Receipt for future reference. Both payment details and your Challan Receipt will also be accessible under the ‘Payment History’ tab on the e-Pay Tax page after you log in.

Summing Up

Paying taxes is a fundamental civic duty that contributes to essential public services we all rely on. By embracing the ease and efficiency of online tax payments, you’re taking control of your finances and contributing to a functioning society.

This guide has walked you through the process step-by-step, from gathering your information to receiving confirmation of your payment. Now, if you are someone looking forward to learning the intricacies of financial accounting or want to expand and hone your knowledge of financial accounting, a robust financial accounting course can be beneficial!

The Postgraduate Financial Accounting and Management Program from Imarticus Learning provides a practical, hands-on approach to mastering the economic, technical, and institutional foundations of the field. Graduates gain in-demand skills for data-driven decision-making that drives growth and business success across industries.

FAQs

How to make an income tax challan online?

To make an income tax challan online, go to the Income Tax Department’s official e-filing portal, select the relevant challan (e.g., ITNS 280 for income tax), provide your details, choose a payment method, and complete the transaction. You’ll receive a challan identification number as confirmation.

How to pay tax online through a bank?

Once you complete all the required steps, you’ll be taken to the payment gateway. Select the bank from the list and use NetBanking, Debit Card/ Credit Card, or UPI to pay your taxes.

What is the challan expiry date?

Your challan usually has a validity of 15 days from the date of generation.

What is CBDT tax payment?

A CBDT tax payment refers to any tax payment made to the Central Board of Direct Taxes (CBDT) in India. This includes various direct taxes like income tax, corporate tax, wealth tax, and gift tax.