Have you ever thought about why money in your pocket today feels more valuable than receiving it tomorrow?

You probably notice how saving money seems harder each day because prices keep rising. And your salary? It rarely matches the pace.

The reality is managing your finances without understanding the time value of money might hold you back in your career or personal life.

So, what is time value of money, and how can a CMA USA course empower you to use it better?

Stick around because, in this post, you’ll see how simple financial knowledge can change your life forever.

What is Time Value of Money (TVM)?

The time value of money means the money you get today is worth more than the same money tomorrow. It’s not rocket science. If you have money now, you can invest it and make more money. You can use it instantly to meet your immediate needs.

The time value of money means that it’s usually better to get money now than to get the same amount in the future. This happens because you can use money today or invest straight away. It’s a simple idea that shows people often prefer to have money sooner rather than later.

For instance, a CMA USA course by Imarticus Learning teaches you exactly how to use TVM in real-life finance and accounting jobs. This makes you industry-ready and helps you handle complex finance easily.

How Does TVM Work in Everyday Life?

You often use TVM without even realising it. Think of your EMI payments on a house loan. The interest you pay is well calculated using the time value of money. The bank charges interest because you’re using their money today and paying it back over time.

In investing, TVM also guides decisions. Investing early in life means you earn interest for longer periods.

That’s exactly why financial planners always advise early investment.

· Helps You Plan Better

Time value of money (TVM) helps you set clear money goals. It shows you how much you need to save or invest to reach them.

· Helps You Choose Investments

TVM makes it easier to compare different investment options. You can see which one gives better returns and decide where to put your money.

· Helps You Understand Loans

If you take a loan, TVM shows you the true cost of borrowing. If you lend money, it helps you fix the right interest rate.

· Helps You Think About Risk

It also helps you think about how things like inflation or changing interest rates can affect your money in the future.

TVM is the base of all smart money choices. Once you understand that your money today is worth more than the same amount in the future, you’ll want to make better use of it. This can help you grow your money and protect it from price increases. So, learning this simple idea helps you make better decisions for a strong and safe financial future.

Here’s a simple example to see it clearly:

| Situation | Today’s Value | Future Value |

| Investing money now | High (You earn interest) | Higher over time |

| Investing money later | Lower (You lose time) | Comparatively lower |

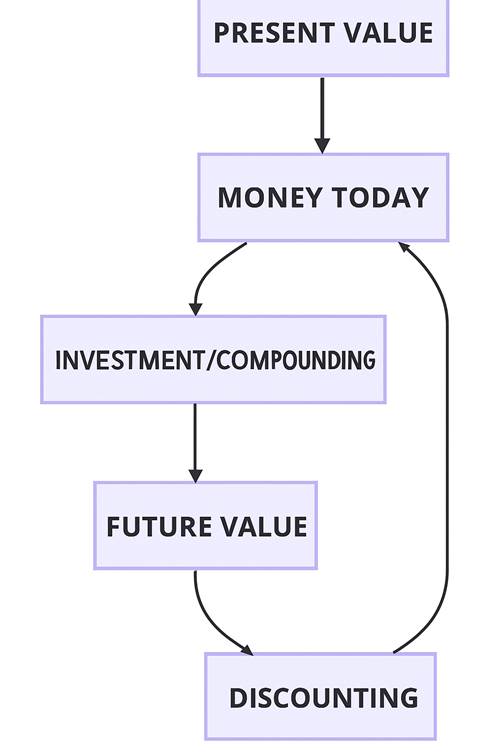

Breaking Down Key Terms of TVM

You need to know a few important terms clearly:

- Present Value (PV): The current worth of future money.

- Future Value (FV): The value your money will have in the future after earning interest.

- Interest Rate (r): The percentage your money earns annually.

- Period (n): How long you keep money invested or borrowed.

These four terms are the backbone of TVM. The good news? A CMA USA course makes these concepts simple and clear through practical lessons and examples.

TVM Calculation: How Does It Really Work?

You don’t need a PhD to calculate TVM. Online tools like a time value of money calculator easily handle this task.

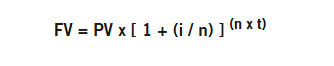

To find out how much your money will grow in the future, you can use this formula:

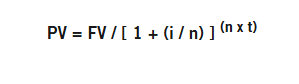

If you already know how much money you’ll receive in the future and want to know how much it’s worth today, then use this version:

Here’s what each part means in the time value of money formula:

· FV = The amount your money will become in the future

· PV = The amount your money is worth right now

· i = Interest rate (for future value) or discount rate (for present value)

· n = How many times interest is added each year

· t = Total number of years

Practical Uses of TVM

Businesses constantly use TVM in their decisions. From choosing projects to loans, it helps them calculate accurate returns. A CMA-certified professional easily calculates and helps make these decisions.

Some common examples include:

- Calculating returns on investment (ROI)

- Deciding lease versus buy

- Retirement planning for employees

- Project budgeting and forecasting

Real-life Case Study: Saving Early Vs. Saving Late

Look at a practical case. Suppose two friends invest the same amount of money, but one starts at 25, the other at 35. The first friend earns significantly more, thanks to TVM. Early investments always grow faster and bigger.

Example Case Table:

| Age You Start | Amount Invested | Years Invested | Final Amount |

| 25 | Fixed amount | 40 | Larger amount |

| 35 | Fixed amount | 30 | Smaller amount |

Constraints and Challenges in Using TVM

TVM isn’t perfect. Inflation, taxes, changing rates, they all make it complicated. Also, future market changes are hard to predict. CMA courses like the one at Imarticus Learning train you to navigate these complexities easily and efficiently.

Imarticus Learning – Your Pathway to CMA Success

The CMA USA course by Imarticus Learning gives you an edge in finance. It makes complex ideas like TVM easy to understand through practical learning.

At Imarticus Learning, our Certified Management Accountant course ensures your career success. Our programme offers guaranteed placements or a 50% refund if you can’t pass the CMA exams, reflecting confidence in our teaching methods.

Imarticus Learning ensures you land interviews with global firms. Our placement boot camp provides resume-building, soft skills training, and interview preparation. Our study materials powered by Surgent include books, practice papers, MCQs, flashcards, and live interactive classes.

Expert mentors with CMA, CA, CFA, and CPA qualifications guide you personally. Additionally, practical tools like MS Excel and financial modelling prepare you to excel not just in exams but also in your finance career.

Enrol in Imarticus Learning’s CMA USA course today and secure your career!

FAQs

What is the time value of money?

It means money today is worth more than the same money received later.

How can I calculate TVM easily?

Use an online time value of money calculator for quick results.

Is TVM important for the CMA USA course?

Yes, it’s essential and thoroughly covered in Imarticus Learning’s CMA USA course.

Can the CMA USA course help me understand financial concepts better?

Yes, Imarticus Learning simplifies complex finance concepts practically.

Is TVM affected by inflation?

Yes, inflation greatly impacts TVM calculations.

Why should I choose Imarticus Learning’s CMA USA course?

It provides expert mentors, practical tools, and guaranteed placements.

Conclusion

The concept of time, when applied to money, allows you to utilise money in a smarter manner. It makes you learn that one rupee now is more valuable than having one rupee tomorrow in the same quantity. Assuming that you are saving, investing, or borrowing, the concept helps you plan the right way and make no mistakes.

Enrol in the CMA USA course at Imarticus Learning and begin the successful career path to becoming an accounting and finance professional.