Last Updated on 4 months ago by Imarticus Learning

Preparing for the next leap in your finance career? If you’ve been thinking about becoming a CFA Charterholder, one thing quickly becomes clear – the CFA course syllabus isn’t just another list of topics. The CFA course syllabus is your full roadmap designed to turn you into a world-class finance professional. Whether your goal is to break into investment banking, portfolio management, equity research, or wealth advisory, the CFA curriculum is built to give you the precise skills that the industry looks for.

I’ll admit – the syllabus can definitely feel overwhelming at first glance. But that’s completely normal. The CFA program is built to challenge you, push your analytical thinking, and help you build real expertise step by step across all three levels.

In this guide, I’ll walk you through the CFA course syllabus, dissecting each level and explaining not just what you’ll study but how each level builds your finance foundation and how it shapes your approach to real-world finance. We’ll break down practical study tactics, prototypical career tracks, and advice that helps you go beyond passing exams to thriving as a finance leader. If you want to master the CFA syllabus like a pro, start here.

What is the CFA Program?

When people ask, “What is the CFA?” I ask them to imagine being recognised globally as a trusted investment professional. That’s the CFA credential – granted by CFA Institute – respected by banks, asset managers, consulting firms, and fintech giants alike. With over 190,000 charterholders spanning 160+ societies, the CFA badge isn’t just a line on your resume. It’s proof you’ve mastered ethics, investment analysis, and the science of portfolio management.

As the CFA Institute states, “The CFA charter represents the highest standard of professional excellence in the investment management industry.” This commitment to ethics and excellence resonates through its robust syllabus.

As legendary investor Warren Buffett said, “The best investment you can make is in yourself.” Pursuing the CFA certification embodies this principle – investing in yourself to build a finance career with credibility and impact.

Pursuing the CFA means you’re preparing for real financial decision-making. You’ll be challenged on everything from global markets to ethical dilemmas to asset allocation. This is why the CFA Program stands out from general MBAs: it’s deeply specialised, industry-aligned, and focused on creating confident, ethical finance leaders.

The Structure: Three Levels, Three Mindsets

The CFA course syllabus is tiered into three distinct levels. Each level isn’t just harder – it tests a new kind of thinking:

- CFA Course Syllabus Level I: Start with the basics – understand concepts, get the formulas right, and build the foundation you’ll use for every job in finance.

- CFA Course Syllabus Level II: Now you analyse, critique, and apply ideas in realistic scenarios – often with complex calculations, item sets, and valuation models.

- CFA Course Syllabus Level III: This is the boardroom. You integrate everything you’ve learned about portfolio construction, risk, and wealth management, making real strategic decisions.

Robert Shiller, Nobel laureate and finance professor, noted, “Understanding finance is essential to effective decision-making in all facets of life.” The CFA’s tiered approach reflects this broad necessity, building competence from foundational literacy to leadership.

Here’s a step-by-step CFA Level 1 study plan from top performers who cleared the exam on their first attempt to help you get started on the right note.

CFA Course Syllabus Overview

Understanding the full scope of the CFA journey and gaining clarity on the CFA course details, its curriculum, exam structure, and how it shapes your career can give you a clearer picture of what to expect along the way.

The CFA course syllabus is divided into 10 core subjects, which appear across all three levels with increasing depth.

- Ethics & Professional Standards

- Quantitative Methods

- Economics

- Financial Reporting & Analysis (FRA)

- Corporate Issuers

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management & Wealth Planning

As CFA Institute CEO Margaret Franklin reminds candidates, “Success is earned in the preparation.” Understanding the syllabus depth at each level will help you prepare strategically.

When planning your CFA journey, understanding the detailed breakdown of the CFA course fees is essential to budget effectively and avoid surprises along the way.

For more on how to weigh the cost of CFA certification against its career returns, check out this detailed analysis: CFA Certification Cost.

CFA Course Syllabus Level I (Foundation & Fundamentals)

This level ensures you understand how finance works before you start analysing it deeply. Think of Level I as your finance grammar toolkit. You won’t just memorise formulas – you’ll start applying them to small problems that echo real business issues.

Key Topics in CFA Course Syllabus Level I

Level I introduces you to the fundamental tools of finance. If you’re coming from accounting, commerce, engineering, or economics, this level brings everyone to the same baseline. Level I is where you master the language of finance. You’ll cover:

| Topics | Focus |

| Ethics | Code of Ethics, Standards of Practice |

| Quant Methods | Time value of money, statistics, probability |

| Economics | Micro + macro fundamentals |

| FRA | Financial statements, ratios, and cash flow analysis |

| Corporate Issuers | Capital budgeting, cost of capital |

| Equity & Fixed Income | Market structures, valuation basics |

| Derivatives | Intro to forwards, futures, options |

| Alternatives | Real estate, private equity basics |

| Portfolio Management | Risk, return, diversification |

Focus: Understanding concepts + basic application.

Think of Level I like learning city planning basics. Before you build skyscrapers or complex road systems, you need to understand the land, zoning laws, and the essentials of utilities – just like grasping the basics of finance concepts and tools before deep analysis. For a detailed preparation pathway, refer to our comprehensive CFA Level 1 Prep Guide.

CFA Course Syllabus Level II (Advanced Analysis & Application)

Level II is often considered the toughest because it pushes you into real analytical work – just like an analyst at an investment firm. Here’s where you apply what you’ve learned and start thinking critically.

Key Topics in CFA Course Syllabus Level II

Level II is famous for its item sets – groups of questions based on detailed vignettes. It’s the most analytical stage, and many students say it’s the toughest, because you have to think like an analyst in the real world. Think of Level II as the “investment analyst level.”

| Topics | Focus |

| Ethics | Situational judgement. Still crucial – now with deeper complexity |

| Quant Methods | Regression, machine learning basics |

| Economics | FX, economic growth, market cycles |

| FRA | Intercorporate investments, pensions, multinational operations |

| Equity | Advanced valuation (DCF, residual income, comparables) |

| Fixed Income | Yield curves, term structure, and credit models |

| Derivatives | Pricing, valuation, and hedging strategies |

| Alternatives | Commodities, hedge funds, and PE valuations |

| Portfolio Management | Multifactor models, portfolio construction |

Focus: Valuation, financial modelling, deep analysis.

Imagine planning a wedding where you must juggle numerous vendors, budgets, timelines, and unexpected changes between guests’ preferences and the weather. You apply your foundational knowledge to navigate complex scenarios – just as you analyse investments through detailed case studies at Level II.

CFA Course Syllabus Level III (Portfolio Management & Decision-Making)

Level III shifts from analysing companies to managing money for real clients. This is where you learn to think like a portfolio manager. Level III is the leadership stage – where you integrate the toolkit you’ve built so far. Here’s the deep dive:

Key Topics in CFA Course Syllabus Level III

Level III finally brings everything together into client-driven investment decisions. The exam features essay-style constructed response questions alongside item sets. Real CFA success here means not just knowing the material but being able to explain, apply, and defend your recommendations – just like a portfolio manager or consultant.

| Topics | Focus |

| Ethics | More case-based learning |

| Behavioural Finance | Investor biases, decision patterns |

| Private Wealth Management | IPS, tax-efficient portfolios |

| Institutional Investors | Pension funds, insurance, and foundations |

| Capital Market Expectations | Forecasting, Modelling |

| Asset Allocation | Strategic vs tactical allocation |

| Fixed Income & Equity | Active vs passive investing |

| Derivatives | Risk management strategies |

| Alternative Investments | Portfolio integration |

| Risk Management | Monitoring, evaluation, performance reporting |

Focus: Portfolio construction, wealth planning, real-world scenarios

Consider booking a multi-city travel itinerary where you must allocate time, budget, and activities optimally for different locations and clients’ preferences. You use your prior experience on individual destinations (Levels I & II) but now coordinate and manage the entire journey holistically – mirroring portfolio management at Level III.

This video demystifies all myths about the CFA exams and gives you an overview of eligibility and study tips.

CFA Course Syllabus Weightage

Understanding the relative importance of each topic in the CFA course syllabus and CFA course breakdown across the three CFA exam levels is key to creating a strategic study plan.

The table below shows the approximate weightage percentages allocated by the CFA Institute to each subject area at Levels I, II, and III, helping you prioritise your efforts efficiently.

| Topic | Level I | Level II | Level III |

| Ethics | 15-20% | 10-15% | 10-15% |

| Quant | 8-12% | 5-10% | – |

| Economics | 8-12% | 5-10% | 5-10% |

| FRA | 13-17% | 10-15% | – |

| Corporate Issuers | 8-12% | 5-10% | – |

| Equity | 10-12% | 15-20% | 10-15% |

| Fixed Income | 10-12% | 10-15% | 15-20% |

| Derivatives | 5-8% | 5-10% | 5-10% |

| Alternatives | 5-8% | 5-10% | 5-10% |

| Portfolio Management | 5-8% | 5-10% | 35-40% |

Each exam is set ~6 months apart, with most candidates studying 300-400 hours per level.

How to Build a Winning CFA Study Plan

Creating a structured study plan around the CFA course syllabus is key to staying organised, covering all topics effectively, and boosting your chances of exam success.

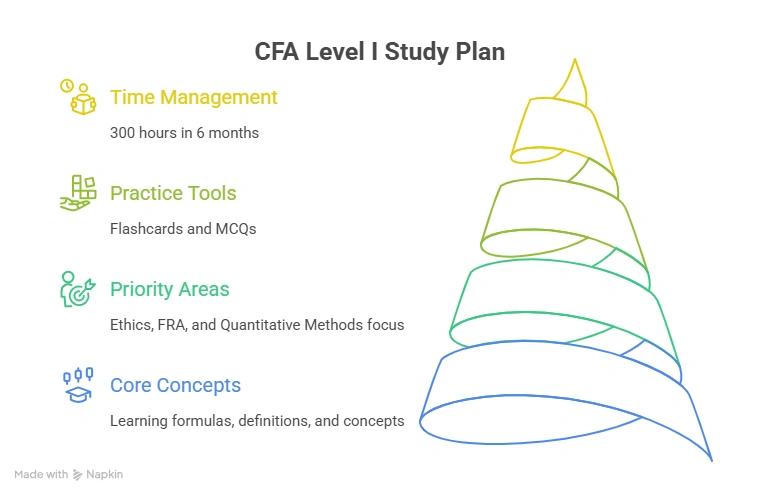

CFA Level I:

Dedicate 300 hours over ~6 months for the CFA Level 1 Exam. Carve out daily study time, focus hard on Ethics, FRA, and Quant Methods, and use flashcards for key terms. Practice MCQs; review why you got ones wrong.

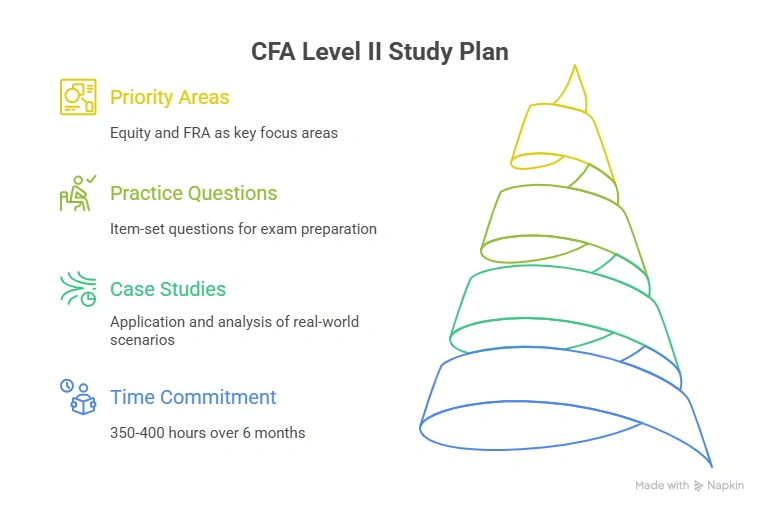

CFA Level II:

Book 350-400 hours. Practice item sets, prioritise equity and FRA, and use case studies. Try to mimic real analyst scenarios – justify every answer based on factual analysis.

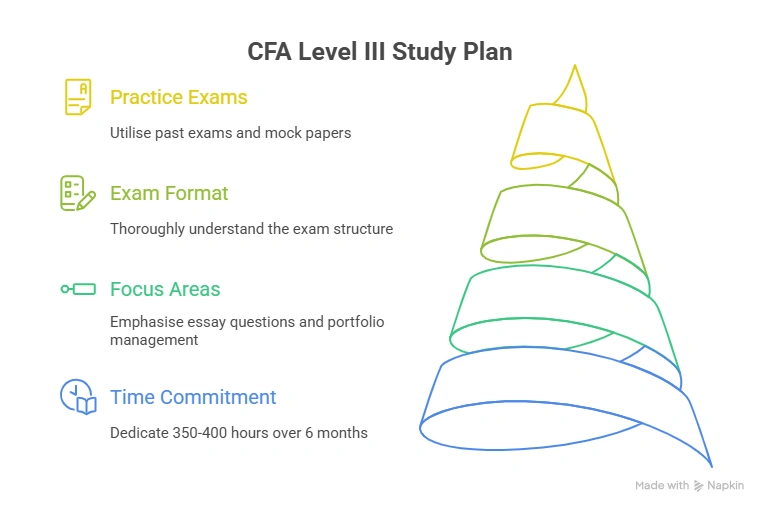

CFA Level III:

Also, 350-400 hours. Now focus on essay writing, case analysis, and integrating multiple concepts. Review past exams and mocks, and understand how portfolio managers actually build strategies.

Balancing a full-time job while preparing for the CFA Level 1 exam can be tough. This short video shares three proven strategies to help you manage your time effectively, stay focused, and pass the CFA Level 1 exam on your first try:

Why Understanding the CFA Course Syllabus Matters!

The CFA program rewards smart planning – not random studying. When you understand how each topic fits into the bigger picture, you:

- Study smarter, not harder.

- Prioritise high-weightage topics.

- Build confidence.

- Study strategically, create a realistic and effective preparation plan.

- Manage your time better.

- Avoid unnecessary stress and overwhelm.

- Maximise and improve your overall score.

The syllabus truly becomes your biggest asset – not a burden.

Tips to Master the CFA Course Syllabus

Mastering the CFA course syllabus can feel overwhelming, but with the right strategies and focus, you can tackle it efficiently and confidently.

Here’s what actually works for most candidates:

- Build your plan backwards from exam dates. Block time every week – consistency beats last-minute cramming. Break the syllabus into weekly targets.

- Use the CFA blueprints to prioritise weightage.

- Use the CFA Institute curriculum, but diversify with prep providers and study groups. Fresh perspectives help. Ethics boosts borderline scores. It is your make-or-break topic; never neglect it.

- Consistency beats cramming – especially for the CFA.

- Schedule frequent mocks (timed and full-length). Analyse your weak spots after every session, and double up on revision on tough areas. Start mock tests 6-8 weeks before the exam.

- Join CFA societies, webinars, or online classes to gain peer support and share doubts.

- Practice topic-wise questions every day.

- Review formulas weekly.

“Those who pursue the CFA charter demonstrate remarkable commitment to knowledge, ethics, and professional excellence – a trio of qualities that define the finance leaders of tomorrow.”

– Margaret Franklin (CEO, CFA Institute)

Career Outcomes: Where Does CFA Take You?

Completing the CFA program opens exciting doors across global finance sectors. For a detailed look at the diverse job roles, industries, and real-world career paths that CFA charterholders typically pursue, check out our comprehensive guide on CFA certification career opportunities:

- Financial Analysis

- Credit Research and Quantitative Analysis

- Investment and Risk Analysis

- Equity Research

- Portfolio Management

- Investment Banking

- Corporate Finance Management

- Asset Management

- Risk Management

- Consulting

Charlie Munger, vice chairman of Berkshire Hathaway, once said about deep financial knowledge: “Spend each day trying to be a little wiser than you were when you woke up… Knowledge builds up like compound interest.” The CFA course embodies this compound growth in skills, knowledge, and career opportunities.

CFA charterholders report average salary increases of up to 192% compared to pre-CFA roles, especially in top markets. The credential signals global readiness and enhanced value in organisations.

For a detailed look at the earning potential and real-world impact of the CFA credential in India, you can explore our in-depth guide on CFA Salary in India.

Why Choose Imarticus for Your CFA Preparation?

Getting through the CFA course syllabus is challenging, but every step is mapped for your growth as a finance professional. Use the curriculum not just as exam prep but as a guide to thinking like an analyst, strategist, and trusted advisor. With consistent effort, top learning partners, the right resources, and strong ethical grounding, you’ll not only pass – you’ll be ready for leadership roles in global finance.

How Imarticus Learning Supports Your CFA Success:

With a comprehensive support system that combines expert guidance, practical resources, and career-focused mentorship, Imarticus Learning ensures that you’re fully prepared not just to pass the CFA exams but to excel and stand out in the competitive finance industry.

✅Mentor-Led Guidance: Experienced mentors offer personalised support, helping you to grasp complex CFA concepts and providing real-world insights to guide your learning journey.

✅Tailored Resources: Get study materials, practice exams, and mock tests aligned with the CFA Course syllabus, designed to help you understand and apply the material effectively.

✅Targeted Workshops: Focused workshops dive deep into key CFA course syllabus topics, giving you hands-on practice and the chance to refine your skills with peers.

✅Ethical Foundation: Ethics are at the core of the CFA program. Imarticus emphasises this, ensuring you’re not just exam-ready but also prepared to lead with integrity in the finance world.

✅Community & Networking: Connect with fellow candidates and industry professionals through events and get valuable insights from top mentors to help you succeed.

Imarticus Learning’s Programs offer mentor-led guidance, targeted workshops, and tailored resources to make your CFA journey strategic and successful. Be sure to check in regularly for syllabus updates, community events, and insights from top industry mentors.

FAQs About CFA Course Syllabus

Navigating the CFA course syllabus often raises many questions among candidates. Below are some of the most frequently asked questions that clarify common doubts and provide insights to help you prepare smarter and more confidently.

What areas are covered by the CFA?

The CFA course syllabus covers ethics, quantitative methods, economics, financial reporting, equity and fixed-income, derivatives, alternatives, and portfolio management. Imarticus Learning breaks this broad syllabus into manageable sections, helping you grasp concepts and apply them confidently in real-world finance.

Which CFA level is the toughest?

CFA Level II tends to be the most demanding. That’s because it focuses heavily on applying concepts through case studies and item-set questions, requiring deeper analytical thinking. The CFA course syllabus at this stage really pushes you to connect theory with practical scenarios, and Imarticus Learning offers targeted support to help you master this critical level.

How many study hours do I need?

Candidates who have cleared CFA recommend 300-400 hours per level on average. But it really depends on your starting point and how comfortable you are with the CFA course syllabus and subjects. Imarticus Learning guides you in creating a paced study plan that keeps you on track without feeling overwhelmed – it’s like having a road map for your CFA journey.

How Long Does It Take to Complete the CFA Course Syllabus?

Most candidates take 300 to 400 hours per level and 2.5 to 3 years to complete all three levels of the CFA course syllabus. Your timeline may vary depending on your background, work schedule, and study consistency.

Can I work full-time while preparing?

Absolutely! Many CFA candidates balance full-time work with their studies. It’s no cakewalk, but with disciplined time management and daily planning – skills we emphasise through dedicated mentorship at Imarticus – focusing on a few quality study hours every day beats last-minute cramming any day.

How should I approach mock exams?

Treat mock exams seriously like the main exams. Time yourself, mimic exam conditions, and deep dive into your results afterwards. Identify weak spots and review them regularly. Imarticus Learning’s mock exam platform and detailed feedback turn mistakes into valuable learning moments that boost both confidence and scores.

What are the CFA pass rates?

Pass rates tend to be tough but fair: globally, around 36% for Level I, 45% for Level II, and 56% for Level III. These stats remind us that the CFA is challenging, but with smart, consistent prep and strategy – just like what we offer at Imarticus – you can absolutely succeed.

Is the CFA worth the effort?

Without question. If you’re aiming for a finance career in investment analysis, portfolio management, or capital markets, the CFA charter is the gold standard. Imarticus Learning supports you beyond just passing the exam – we equip you with practical, real-world insights that fast-track your career in finance and set you up for long-term success.

Your CFA Journey Starts With Mastering the Syllabus

Mastering the CFA course syllabus is your first step towards earning the CFA charter. Whether you’re aiming for investment banking, asset management, equity research, or wealth advisory, the CFA curriculum gives you the exact skills employers look for.

Once you understand how each level works, your preparation becomes a lot more structured and less stressful. With the right study plan, good materials, and consistent effort, you can absolutely clear all three levels of the CFA course and build the global finance career you’re aiming for.

Your journey to a successful finance career begins with mastering the CFA course syllabus, but it doesn’t stop there. Enrol with Imarticus Learning today, where expert mentorship, tailored resources, and a supportive community will guide you every step of the way. Don’t just dream about the future – you can create it. Start your CFA certification preparation now and turn your career aspirations into reality. Your success story begins today – are you ready?