Last Updated on 5 days ago by Imarticus Learning

Investment banking and commercial banking are the critical financial pillars of a modern economy. Offering unique services, investment banks help large corporations and institutional investors with mergers and acquisitions (M&A) or financing large-scale business projects. On the other hand, commercial banks serve the general public and businesses by accepting deposits, offering commercial loans for business, and safeguarding assets.

Think of it like this→

If a small restaurant needs a working capital loan to keep operations running, it approaches a commercial bank. If a large food chain wants to acquire ten smaller brands across countries, it approaches an investment bank. One supports daily business life. The other shapes the long-term business strategy.

This difference becomes even clearer when you look at how value is created. Commercial banking grows through trust, deposits, and lending. Investment banking grows through strategy, deal-making, and market timing. One is built on relationships with customers. The other is built on relationships with capital.

I often ask a simple question when comparing commercial banking and investment banking certification. Where do you want to create impact? Do you want to help individuals and businesses manage money and grow steadily? Or do you want to work on large financial deals that reshape industries? Your answer quietly points you toward one path.

As you read ahead, you will see how commercial banks vs investment banks differ in services, salary, clients, balance sheets, and career paths. Each section will break down a piece of the puzzle so you can make a confident decision about where you fit in the world of finance.

Did you know?

India’s banking system contributes nearly 70% of the total credit supply to the economy. (Source: Reserve Bank of India).

More About Investment Banking

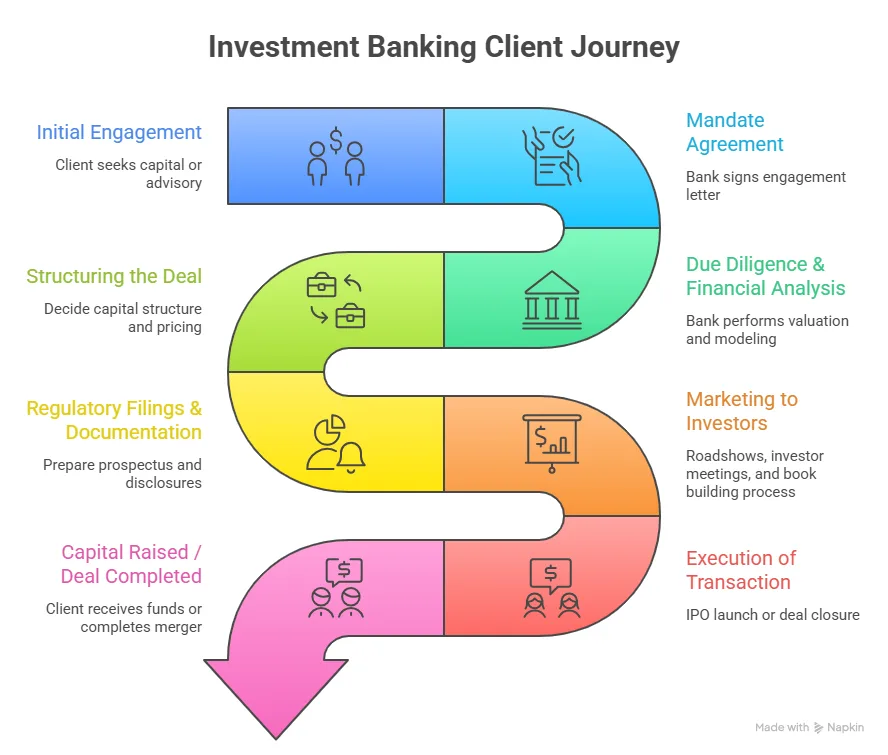

To understand the full scope of services and career roles in this field, it helps to first build a clear conceptual foundation of “What is investment banking?” At its core, it involves advising organisations on raising capital, managing complex financial transactions, and supporting large strategic decisions such as mergers and acquisitions and market listings. This foundational clarity makes it easier to connect the functions, roles, and types of investment banks discussed above with the real work done in the industry.

Investment banking involves handling any financial work during large projects for corporations and investors. This can include offering financial capital, issuing securities, advising on stocks, and facilitating M&A transactions.

Notably, there are four types of investment banks, including bulge bracket (Goldman Sachs, Deutsche Bank, and Morgan Stanley), regional boutique (specialising in personal investment management and mergers and acquisitions), middle market, and elite boutique (offering asset management and restructuring services).

Besides, investment banks include banking analysts, research associates, capital market analysts, trading specialists, and others.

Understanding how investment banking works adds an important layer to this comparison. It brings clarity on what investment bankers actually do on a daily basis, how they handle deals, and how their role fits into the larger financial system. This context makes it easier to connect the responsibilities, skills, and career path discussed earlier with the real work done inside investment banking teams.

More About Commercial Banking

Commercial banking involves managing client (individuals and small- to medium-sized businesses) bank accounts and providing loans and financial advice. For commercial banks (like State Bank of India and HDFC Bank), interest on loans, service charges and transaction fees generate the profit. Notably, many commercial banks operate as local businesses in a town.

Usually, commercial banks have branch managers, loan officers, tellers, sales associates, technical programmers, and trust officers.

Also Read: A Comprehensive Overview of the Functions of Investment Banking

Key Differences Between Commercial Bank And Investment Bank

The difference between a commercial bank and an investment bank becomes clearer when seen through daily life examples.

If I want a home loan, I walk into a commercial bank. If a company wants to raise ₹1000 crore for expansion, it goes to an investment bank.

When it comes to the investment banking vs. commercial banking debate, the key differences are related to products and services provided, the amount of money in transactions, the clientele served, and the regulations that must be followed. Let’s have a look!

| Investment Banking | Commercial Banking |

| Role: Help businesses make a profit from investments and secure funding for large-scale projects | Role: Facilitate daily financial transactions and provide advice |

| Clients: Large corporations, governments and institutional investors | Clients: The general public (consumers) and small- and medium-sized businesses |

| Products and Services: Wealth and asset management, M&A-related services, financial advisory and auditing, and security underwriting | Products and Services: Accept deposits, safeguard assets, make loans, manage bank accounts, provide credit cards, and offer online banking, etc. |

| Revenue Generation: Make money on investment services provided, like helping a company issue stocks in an initial public offering | Revenue Generation: Earnings through interest, fees, and other charges |

| Approach to Capital: Obtain capital for clients (find suitable investors to buy stocks and raise capital for clients) | Approach to Capital: As commercial banks have funds in reserve, they can sanction loans for all types of purposes |

| Risk Involved: Volatile and involves high risk due to the nature of the clients | Risk Involved: Low-risk model and government regulations make it safe |

| Salary: High-paying jobs | Salary: Not as high as investment banking jobs |

| Others: Competitive and often involves long working hours | Others: Better work-life balance |

Also Read: What are the Top Tools Every Aspiring Investment Banker Must Master?

How Banking Functions In Real Life

Understanding commercial banking vs investment banking becomes easier with daily life situations.

Example 1: Starting A Business

If I open a small bakery, I approach a commercial bank for a loan.

If a large food chain wants to expand globally, it hires an investment bank to raise capital from investors.

Example 2: Savings vs Investing

My salary account sits in a commercial bank.

My mutual fund IPO investment is structured by an investment bank.

Example 3: Company Expansion

A company like Reliance may use investment banks to issue bonds or raise equity.

A local textile unit may use a commercial bank to get working capital.

These simple examples explain commercial banking and investment banking without heavy jargon.

Types Of Clients Served

To understand commercial banks vs investment banks, look at who they serve.

Commercial Bank Clients

- Individuals

- Startups

- MSMEs

- Retail customers

- Local businesses

Investment Bank Clients

- Large corporations

- Governments

- Private equity firms

- Institutional investors

The difference between investment bank and commercial bank clients shows why their services differ so much.

Also Read: How to Break into Investment Banking: A Step-By-Step Guide for Students?

What Makes Each Bank Unique

To understand the difference between the two, it helps to look at what each type of bank is built to do at its core. Each one serves a distinct purpose in the financial system, operates with a different mindset, and creates value in its own way. Looking at what makes each bank unique brings clarity to how their roles, services, and career paths naturally differ.

Investment Banks

- Focus on capital markets

- Help in IPOs

- Advice on mergers

- Manage trading and risk

Commercial Banks

- Manage savings and deposits

- Offer loans and credit cards

- Support daily payments

- Provide retail banking services

This explains the core difference between commercial banks and investment banking in very simple words.

Where Each Bank Earns Money

To understand commercial vs investment banking, look at revenue models.

Commercial Bank Revenue

- Interest on loans

- Processing fees

- ATM and transaction charges

Investment Bank Revenue

- Advisory fees

- Underwriting fees

- Trading commissions

This shows how commercial banking vs investment banking works at a business level.

Also Read: What is the Scope of Investment Banking: Careers & Trends?

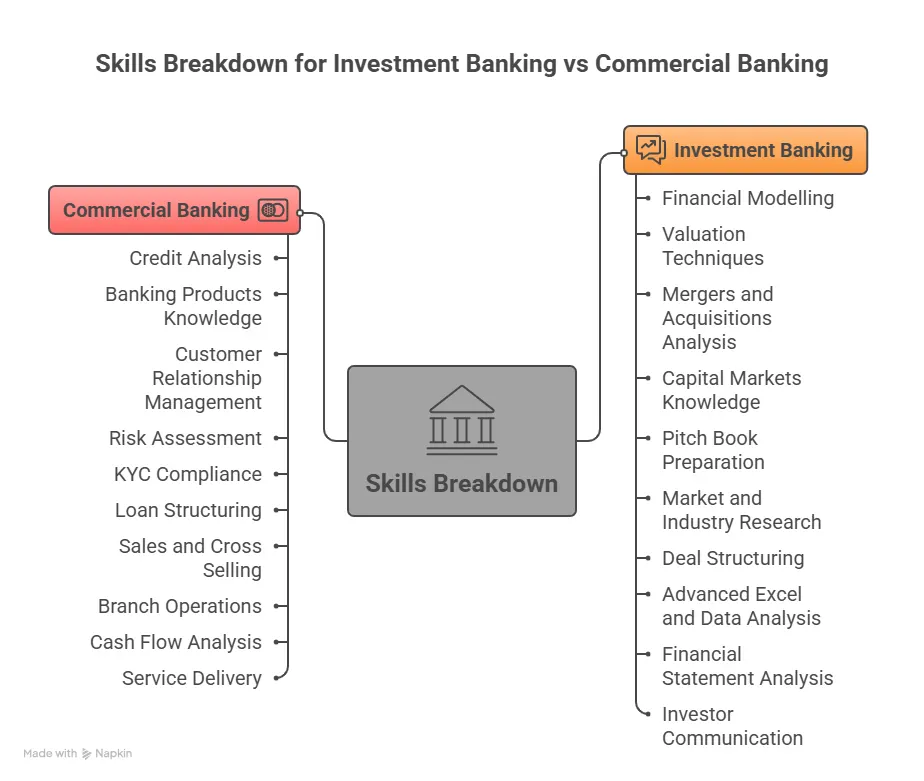

Skills Required In Each Field

Success in each field depends on a specific set of skills shaped by the type of work involved. The technical depth, client interaction, and daily responsibilities vary between the two, so the skill mix also changes. Looking at the skills required in each field makes it easier to understand what you need to learn and where your strengths may fit best.

Investment Banking Skills

- Financial modelling

- Valuation techniques

- Excel and data skills

- Market analysis

Commercial Banking Skills

- Customer service

- Credit analysis

- Risk assessment

- Sales and communication

The commercial banking vs investment banking career path depends on these skill sets.

Commercial Banking vs Investment Banking Salary In India

Salary is one of the biggest deciding factors when I compare commercial banking vs investment banking. The gap can be large. It also depends on role, city, and experience.

Before looking at numbers, it helps to understand why the pay is different. Investment banking deals involve large transactions. Fees from a single deal can be very high. Commercial banking income comes from interest and service charges. These grow steadily but are not as large per deal.

| Role Level | Commercial Banking Salary | Investment Banking Salary |

| Entry Level Analyst | ₹3 LPA to ₹6 LPA | ₹8 LPA to ₹18 LPA |

| Associate | ₹6 LPA to ₹12 LPA | ₹18 LPA to ₹35 LPA |

| Vice President | ₹12 LPA to ₹25 LPA | ₹35 LPA to ₹80 LPA |

| Director | ₹25 LPA to ₹50 LPA | ₹80 LPA to ₹2 Cr+ |

Salary data is based on aggregated insights from platforms like Glassdoor and AmbitionBox. This table clearly shows the commercial banking vs investment banking salary difference across levels.

Why Investment Banking Salaries Are Higher

The difference between the commercial bank and investment bank pay comes from the nature of the work.

- Investment bankers work on high-value deals

- Work hours are long and intense

- Bonuses are linked to deal success

- Skills required are highly specialised

Commercial banking offers stability. Investment banking offers upside potential.

Also Read: Investment Banking Pay Compared to Other Finance Career Options

Commercial Banking vs Investment Banking Career Path

Career growth is very different in both fields. I find it useful to look at the ladder step by step.

Commercial Banking Career Path

- Bank Clerk or Relationship Executive

- Assistant Manager

- Branch Manager

- Regional Head

- Senior Banking Executive

This path focuses on operations, sales, and credit management.

Investment Banking Career Path

- Analyst

- Associate

- Vice President

- Director

- Managing Director

This investment banking career path focuses on deals, markets, and advisory services. The commercial banking vs investment banking career journey shows that one is process-driven and the other is deal-driven.

Stepping into an investment banking career requires more than academic knowledge. It takes a clear understanding of hiring expectations, skill requirements, and how to position yourself for competitive roles. Gaining insight into these aspects helps you move from learning about the field to actually preparing for and securing opportunities within it.

Commercial Banking vs Corporate Banking vs Investment Banking

Many people confuse these three. I used to find them confusing, too. Here is a simple breakdown.

| Type | Client Type | Main Function |

| Commercial Banking | Individuals and small businesses | Loans, deposits, savings |

| Corporate Banking | Large companies | Large loans and treasury services |

| Investment Banking | Corporations and investors | Capital raising and M&A |

This table explains commercial banking vs corporate banking vs investment banking in a clean way.

Also Read: CIBOP Course Benefits For Your Investment Banking Career

Investment Bank vs Commercial Bank Examples

Real-world examples make the difference easier to grasp because they show how each type of bank operates in practice. Looking at well-known institutions in each category helps connect the theory with actual services, clients, and scale of operations in the financial system.

Investment Bank Examples

- Goldman Sachs

- Morgan Stanley

- JP Morgan

- Barclays Investment Bank

Commercial Bank Examples

- State Bank of India

- HDFC Bank

- ICICI Bank

- Axis Bank

These examples clarify investment bank vs commercial bank examples for real-world understanding.

Also Read: Top 10 Investment Banking Companies in India and Their Operations

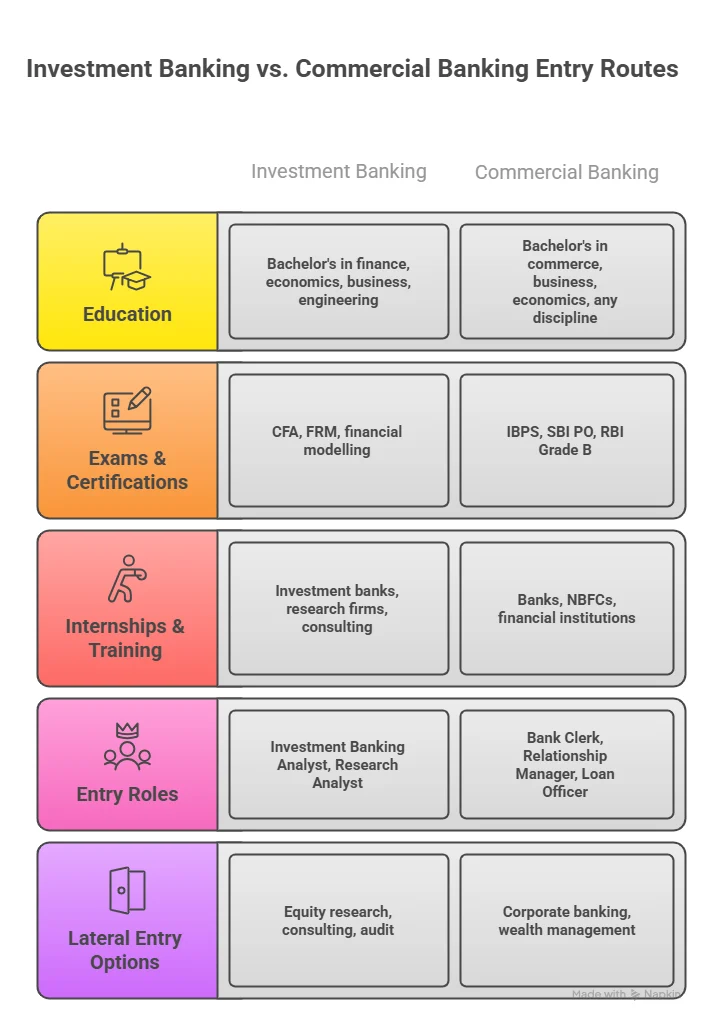

Entry Requirements For Each Field

The path into each field starts with a different set of entry requirements shaped by the roles and responsibilities involved. Education, exams, internships, and skill exposure all play a part in getting started. Looking at these requirements side by side helps you understand what it takes to enter each domain and how to prepare in advance.

Commercial Banking Entry

- Graduate degree

- Bank exams or interviews

- Sales aptitude

Investment Banking Entry

- Finance degree or MBA

- Strong analytical skills

- Internships

- Knowledge of financial markets

Courses from Imarticus Learning can help bridge the skill gap for students entering investment banking roles.

Which Field Has Better Long-Term Growth

Long term growth depends on how each sector evolves with the economy, hiring demand, and the nature of financial services. When I compare commercial banking vs investment banking, I look at salary progression, global exposure, industry expansion, and how roles change over time.

Understanding commercial banking vs investment banking career growth, along with trends in commercial banking vs investment and the broader difference between commercial bank and investment banking degree, helps me see where each path can lead over the next decade.

Commercial banking offers:

- Stability

- Predictable promotions

- Government sector opportunities

Investment banking offers:

- Higher earning potential

- Global exposure

- Faster career growth

This is why commercial vs investment banking is a personal decision based on lifestyle and ambition.

Future Scope Of Both Industries

The future of commercial banking and investment banking continues to grow with technology and digital finance.

Commercial Banking Future

- Digital payments growth

- Fintech partnerships

- SME lending expansion

- Rural banking reach

India’s digital payments crossed billions of transactions per month, as reported by NPCI.

Investment Banking Future

- IPO market growth

- Cross-border mergers

- Private equity deals

- Startup funding ecosystem

India saw record IPO activity in recent years, according to SEBI reports. These trends show a strong long-term scope for commercial banking vs investment banking careers.

Which Path Is Better For You?

When I think about commercial vs investment banking, I do not look at one as better than the other. I look at fit. Each path suits a different personality, risk appetite, and life goal.

If You Prefer Stability

Commercial banking works well when I want:

- predictable income

- structured work hours

- long-term job security

- local or regional career growth

This path suits people who enjoy customer interaction and steady progress.

If You Prefer High Growth

Investment banking is a better fit when I want:

- high income potential

- fast promotions

- global exposure

- deal-driven work

This path suits people who enjoy analytics, markets, and high-intensity environments.

How To Switch From Commercial Banking To Investment Banking

Many professionals move from commercial banking into investment banking after gaining experience. The transition is possible with the right steps.

Step-by-Step Path

- Build finance fundamentals

Learn valuation, financial statements, and capital markets. - Learn financial modelling

Practice Excel, DCF models, and scenario analysis. - Gain certification

Courses from institutes like Imarticus Learning can help build job-ready skills. - Network with professionals

Connect with investment bankers and attend finance events. - Apply for analyst or associate roles

Highlight transferable skills such as credit analysis and risk assessment.

This path makes the commercial banking vs investment banking career transition practical and achievable.

Skills That Help You Switch Careers

To move into investment banking, I focus on:

- Excel and financial modelling

- Accounting and valuation

- Market research

- Deal structuring

- Presentation skills

These skills bridge the gap between commercial banking and investment banking roles.

Why Choose Imarticus Learning For An Investment Banking Operations Course

Breaking into investment banking operations takes more than just theory. It needs hands-on exposure to real processes, an understanding of how global markets work, and the confidence to step into a role from day one. The Investment Banking Course by Imarticus Learning is designed with this exact goal in mind. It focuses on building practical, job-ready capabilities in securities, asset management, and financial market operations so that learners can transition smoothly into industry roles.

What Makes The Cibop Programme Stand Out

- 180+ hours of in-depth training covering investment banking products, processes, and operations for real job readiness.

- Specialisation pathways in buy-side and sell-side operations are aligned to industry hiring demand.

- Practical learning approach with case studies, projects, and real-world simulations of banking workflows.

- Job assurance with a minimum of 7 guaranteed interview opportunities with hiring partners.

- Dedicated career support, including resume building, interview training, and soft skills development.

- Curriculum designed with industry experts covering securities operations, wealth and asset management, financial markets, risk, and AML.

- Flexible learning formats with weekday and weekend classroom or live online options for working learners.

- Industry-recognised certification that strengthens credibility with global financial institutions and recruiters.

- Experiential learning environment with exercises, puzzles, and case-based pedagogy that mirrors real investment banking operations.

- Strong placement track record over the years with career outcomes in operations, KYC, research, and asset management roles.

These features together make the programme a structured pathway into investment banking operations for students who want a clear and practical entry into the industry.

FAQs On Investment Banking vs Commercial Banking

This section answers the most frequently asked questions that arise when comparing investment banking vs commercial banking, helping you clear doubts around roles, competition, career growth, and real-world applications before you make an informed decision.

How is investment banking different from commercial banking?

The core difference in investment banking vs commercial banking lies in the nature of services and clients served. Investment banks help large corporations raise capital, manage mergers, and handle complex financial transactions. Commercial banks focus on deposits, loans, and everyday financial services for individuals and businesses. Training programmes from Imarticus Learning often explain these differences through real case studies and practical finance tools that help learners understand how each sector operates in real life.

Is the investment banking industry less competitive than the commercial banking industry?

In the discussion of investment banking vs commercial banking, investment banking tends to be more competitive due to limited roles, high salary potential, and global demand. Commercial banking offers more roles across branches and cities, which makes entry easier but still competitive in top banks. Imarticus Learning provides structured pathways and skill-based training to help candidates prepare for competitive roles in both sectors.

Which banking is better, investment banking or commercial banking?

When comparing investment banking vs commercial banking, the better option depends on personal goals. Investment banking offers higher earnings and faster growth, while commercial banking offers stability and balanced work hours. Many learners explore both options through programmes at Imarticus Learning to decide which path aligns with their career plans and lifestyle preferences.

Is it possible to switch from commercial banking to investment banking?

Yes, switching is possible in investment banking vs commercial banking with the right skills and certifications. Professionals often build knowledge in valuation, modelling, and capital markets before making the move. Imarticus Learning provide specialised programs that help bridge this transition with practical projects and placement support.

What is the future scope of investment banking compared to commercial banking?

The future outlook of investment banking vs commercial banking remains strong for both sectors. Investment banking will grow with capital markets and global deals, while commercial banking will expand with digital lending and financial inclusion. Skill-based education from Imarticus Learning helps professionals stay updated with industry changes and future trends in both domains.

Is Goldman Sachs a commercial or investment bank?

Goldman Sachs is mainly known as an investment bank in the context of investment banking vs commercial banking. It focuses on advisory services, capital markets, and trading. Over time, it has also expanded into consumer banking, but its primary identity remains rooted in investment banking activities.

What are the 4 types of commercial banks?

Within investment banking vs commercial banking discussions, commercial banks are commonly classified into public sector banks, private sector banks, foreign banks, and regional rural banks. Each type serves a different segment of customers and contributes to financial inclusion and credit growth in the economy.

Which are the top 5 investment banks?

When analysing investment banking vs commercial banking globally, some of the top investment banks include Goldman Sachs, Morgan Stanley, JP Morgan, Bank of America Merrill Lynch, and Barclays. These institutions handle large-scale financial deals, global mergers, and capital raising activities across markets.

Make The Right Career Move In Investment Banking vs Commercial Banking

For a modern society, both investment and commercial banks are vital. While investment banks offer fiscal services for larger enterprises and institutional investors, commercial banks cater to the everyday banking needs of consumers and small businesses. Also, both banks make excellent career choices. But additional skills are needed if you want to make a shift from commercial banking to the investment banking domain. Notably, investment bankers need to have a thorough understanding of spreadsheets and knowledge of building financial models.

If you want to work in an investment bank, then you need to have an undergraduate degree (not necessarily in finance) along with relevant work experience in the banking industry. Also, internship stints in large financial institutions and investment banks can help. Further, you can acquire relevant skills by pursuing a reputable course like the Indian Institute of Management Calcutta’s Executive Programme in Investment Banking and Capital Markets. If you have any queries related to this course or the Investment Banking program offered by Imarticus Learning, then you can reach out to Imarticus Learning.