Last updated on September 1st, 2025 at 03:52 pm

Sustainability has become a cornerstone of modern corporate strategy in the rapidly evolving business landscape. This shift has given rise to green accounting, a field that integrates environmental costs into financial decision-making. It is a pivotal step in our collective striving towards a green economy. Understanding ‘what is green accounting’ and its implications is crucial for businesses aiming to balance economic growth with ecological responsibility.

What is Green Accounting?

Green accounting, also known as environmental or sustainable accounting, extends traditional accounting practices by incorporating environmental and social factors into financial analyses. The primary goal is to reflect the true cost of business activities, including their environmental impacts, thus promoting sustainable business practices. By accounting for the depletion of natural resources and environmental degradation, green accounting provides a more comprehensive view of a company’s performance and its long-term sustainability.

Components of Green Accounting

Now that we have briefly discussed green accounting meaning let’s move to the essential components of this new-age accounting.1. Full Cost Accounting (FCA)

Full Cost Accounting (FCA) is an accounting method that considers both direct and indirect costs associated with business activities. Direct costs include materials, labour, and overhead, while indirect costs encompass environmental and social costs. By incorporating these costs, FCA provides a comprehensive view of the true financial impact of business operations, helping organisations make informed decisions that account for their environmental footprint.

2. Environmental Management Systems (EMS)

Environmental Management Systems (EMS) are frameworks that enable organisations to manage their environmental impacts systematically. EMS involves developing environmental policies, setting objectives and targets, implementing programmes to achieve these goals, and conducting regular audits to monitor performance. This systematic approach ensures continuous improvement in environmental management and compliance with regulations.

3. Life Cycle Assessment (LCA)

Life Cycle Assessment (LCA) is a methodology used to evaluate the environmental impacts of a product or service throughout its entire life cycle. This includes stages from raw material extraction to manufacturing, distribution, use, and disposal. LCA helps identify opportunities to reduce environmental impacts at various stages, promoting sustainable practices and decision-making.

4. Environmental Reporting and Disclosure

Environmental Reporting and Disclosure involve communicating an organisation’s environmental performance and impacts to stakeholders such as investors, regulators, and the public. This can take the form of sustainability reports, environmental impact assessments, and other disclosures. Transparent reporting fosters accountability and can enhance an organisation’s reputation and stakeholder trust.

5. Environmental Performance Indicators (EPI)

Environmental Performance Indicators (EPI) are metrics used to measure and report on various aspects of environmental performance. Common EPIs include greenhouse gas emissions, energy consumption, water use, and waste generation. These indicators help organisations track their progress towards environmental goals, identify areas for improvement, and demonstrate their commitment to sustainability.

6. Environmental Auditing

Environmental Auditing is a systematic process of reviewing an organisation’s environmental performance to ensure compliance with environmental regulations and identify areas for improvement. Audits can be conducted internally or by external parties and typically involve evaluating processes, policies, and environmental management practices. The goal of environmental auditing is to enhance environmental performance and ensure adherence to regulatory requirements.

Securing a role as a financial accountant in a Fortune 500 company now necessitates keeping abreast of these changes in the field. Enrolling in a Financial Accounting & Management course like the one provided by Imarticus can help accounting professionals secure offers from top companies.

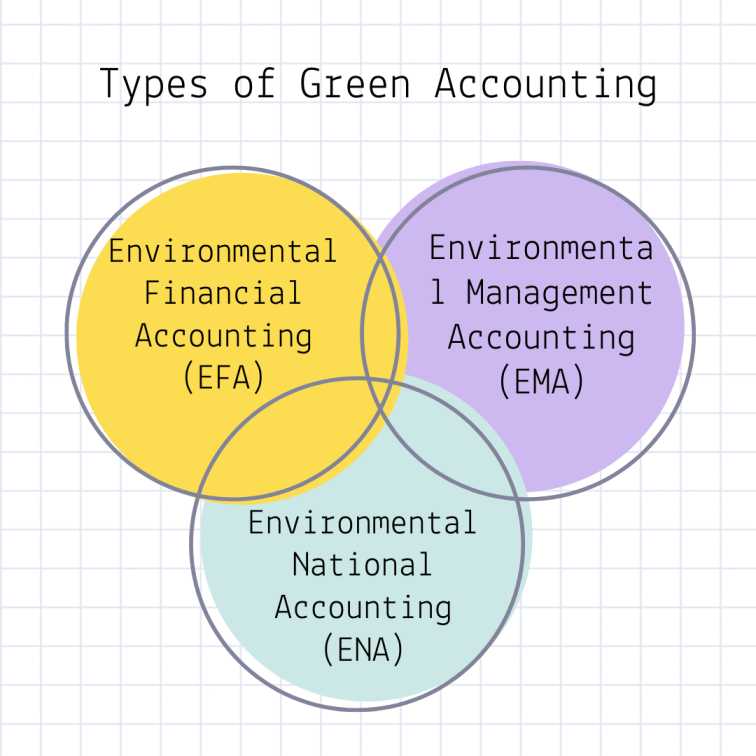

Types of Green Accounting

Environmental Financial Accounting (EFA)

- Tracks environmental costs: EFA focuses on identifying and reporting environmental costs and liabilities.

- Integration with traditional accounting: It integrates environmental costs into standard financial statements.

- Compliance: Ensures compliance with environmental regulations and standards.

- Decision-making: Provides data for better decision-making regarding environmental impacts and investments.

Environmental Management Accounting (EMA)

- Internal use: Primarily used for internal decision-making and management purposes.

- Cost tracking: Tracks both direct and indirect environmental costs, such as waste management and resource usage.

- Performance improvement: Aids in improving environmental performance and efficiency.

- Resource allocation: Helps in allocating resources more effectively to minimise environmental impacts.

Environmental National Accounting (ENA)

- National level: Focuses on incorporating environmental costs and benefits into national accounts.

- Sustainability measurement: Measures the sustainability of a nation’s economic activities.

- Policy-making: Provides data to inform national environmental policies and strategies.

- Natural capital: Accounts for natural resource depletion and degradation.

Green Accounting Meaning and Principles

The meaning of green accounting lies in its approach to quantifying environmental costs associated with business operations. This includes costs related to waste management, pollution control, resource depletion, and environmental restoration. The principles of green accounting can be summarised as follows:

- Environmental Cost Identification: Recognising direct and indirect environmental costs, such as waste disposal, emissions, and resource extraction.

- Monetary Valuation: Assigning monetary values to environmental costs and benefits, enabling their inclusion in financial statements.

- Integration with Financial Accounting: Incorporating environmental costs into traditional accounting frameworks to reflect the true cost of business activities.

- Transparency and Reporting: Providing clear and comprehensive reports on environmental impacts and sustainability efforts to stakeholders.

The Role of Account Management Green Dot in Green Accounting

While green accounting focuses on environmental costs, effective account management Green Dot services can enhance a company’s ability to manage these costs efficiently. Green Dot, a US-based financial technology company, offers tools for account management that can help businesses streamline their financial operations, including the integration of environmental accounting practices. Companies can better track and manage environmental expenditures by using these services, ensuring they align with overall financial goals.

Environmental Impact of Business Activities

Understanding the environmental impact of business activities is crucial for implementing green accounting practices. Here are some key areas where businesses must consider their environmental footprint:

- Resource Consumption: The extraction and use of natural resources, such as water, minerals, and fossil fuels, have significant environmental impacts. Green accounting helps quantify these impacts and promotes the adoption of sustainable resource management practices.

- Waste and Emissions: Business activities often result in waste production and emissions that can harm the environment. Green accounting encourages the identification and reduction of these pollutants through better waste management and cleaner production processes.

- Biodiversity Loss: Industrial activities can lead to habitat destruction and biodiversity loss. By including these factors in financial analyses, businesses can adopt strategies to mitigate their impact on ecosystems.

- Climate Change: The emission of greenhouse gases contributes to climate change, posing risks to both the environment and business operations. Green accounting helps companies measure and reduce their carbon footprint, supporting global efforts to combat climate change.

Illustrating the Benefits of Adopting Green Accounting

Implementing green accounting offers numerous benefits for modern businesses by integrating environmental and social factors into their financial decision-making processes. Here are some key advantages:

- Enhanced Sustainability: Green accounting helps businesses track their environmental impact, encouraging the adoption of sustainable practices. This not only reduces the ecological footprint but also aligns with global sustainability goals.

- Improved Decision-Making: By factoring in environmental costs, businesses can make more informed decisions that consider long-term ecological impacts. This leads to more responsible resource use and minimises negative environmental consequences.

- Cost Savings: Implementing green accounting can identify areas where waste and inefficiencies occur, leading to cost savings through reduced resource consumption and waste management expenses.

- Enhanced Reputation: Companies that adopt green accounting practices often enjoy a better public image and increased trust among consumers and stakeholders. This can lead to a competitive advantage in the marketplace.

- Regulatory Compliance: Green accounting ensures that businesses adhere to environmental regulations and standards, thereby avoiding legal penalties and fostering a culture of compliance and accountability.

- Attraction of Investment: Investors are increasingly looking for companies that prioritise sustainability. Green accounting demonstrates a commitment to environmental responsibility, attracting investment from socially responsible investors.

The Future of Green Accounting

The growing awareness of environmental issues and the increasing demand for corporate transparency are driving the adoption of green accounting. As more businesses recognise the value of sustainable practices, green accounting will play a pivotal role in shaping the future of corporate responsibility. By integrating environmental costs into financial decisions, companies can achieve a balance between profitability and sustainability, ensuring long-term success in a changing world.

Summarising

Green accounting meaning extends beyond mere financial metrics to encompass the broader impact of business activities on the environment. By embracing the principles of green accounting and leveraging account management Green Dot services, modern businesses can navigate the complexities of sustainability and build a resilient future.

The Postgraduate Financial Accounting & Management Course by Imarticus is the perfect gateway for ambitious financial professionals to achieve a top position in a leading financial institution. Right from learning job-relevant skills from industry experts to being job-ready with meticulously designed placement sessions, individuals get the best-in-class support to achieve their professional goals.

Visit Imarticus for more course details.

FAQs

- What is the principle of green business?

Green businesses operate on the principle of seeking a balance between generating profit and the health of the planet. They integrate sustainable practices into their business decisions to minimise any negative impact their business may have on the global or local environment.

- What is the difference between environmental accounting and green accounting?

Environmental Accounting focuses on measuring and reporting the environmental costs of a company’s activities. It primarily deals with the impact of business operations on the environment, including costs related to pollution, waste management, and resource depletion. Whereas, green accounting extends beyond environmental accounting by incorporating the economic, environmental, and social costs and benefits of business activities into financial analysis and decision-making processes. It aims to provide a more comprehensive view of sustainability by including factors such as carbon emissions and social impacts.

- What are the challenges of implementing green accounting?

A shortage of environmental information, a lack of awareness, steep adaptation costs and unclear guidelines are some of the challenges of green accounting.

- Name some of the laws associated with green accounting in India.

Some laws that are directly associated with green accounting in India are Water (Prevention and Control of Pollution) Act 1974, Water Biomedical Waste (Management and Handling) Rules 1998, (Prevention and Control of Pollution) Act 1974, the Public Liability Insurance Act, etc.