Last updated on March 26th, 2024 at 10:57 am

Last Updated on 2 years ago by Imarticus Learning

The equity market has been on an upward trajectory in the past decade, with many analysts predicting that this will not end anytime soon. The demand for equity research analysts courses will also increase in the next few years as they are tasked with understanding global trends and predicting how these trends will impact the financial markets.

In order to meet this increased need, a number of universities have begun offering courses in finance and equities research analysis. Read on to see the global trends dictating the equity markets in 2021.

In order to meet this increased need, a number of universities have begun offering courses in finance and equities research analysis. Read on to see the global trends dictating the equity markets in 2021.

Here are the global trends of equity markets in 2021

– The demand for analysis and equity research is projected to increase in 2021. This could be attributed to the increasing need for financial information investors from various sectors due to changing market dynamics. This trend is also reflected in the increasing need for equity-research analysts as companies seek more detailed information before investing in a new project or making an acquisition.

– In 2021, it is estimated that the demand for equity research analysts will be fueled by an increase in mergers and acquisitions. With higher spending on technology, companies are expected to pursue bolder growth strategies through mergers and acquisitions. This trend suggests a strong need for a financial analysis before these transactions can take place.

– The global equity markets in 2021 will see a shift in focus from developed countries to emerging economies. This trend is supported by investors’ growing interest in companies that are more capable of generating higher returns on investments and less vulnerable to economic recessions.

– The equity markets in 2021 will be characterized by more risks due to the continued existence of high volatility. This trend is supported by increased demand for passive investment strategies as investors are seeking low-cost alternatives with greater stability.

– In 2021, it is projected that companies will continue focusing on talent management through effective succession planning and developing their top-performing employees. This trend will positively impact the demand for experienced equity analysts who can help identify and retain talented individuals within their organization.

– In 2021, it is estimated that global investors will continue to embrace passive investment strategies as they are usually lower risk with low volatility compared to active management approaches, which tend to be more expensive and more exposed to market risk.

– The demand for equity research analysts is expected to be driven by the growth of technology companies in 2021. This trend can be attributed to their increasing investment in innovation and development, especially in artificial intelligence (AI).

– In 2021, it is estimated that millennials will continue leading active management strategies as they seek more personalized and active management of their investments. This trend is supported by the increasing popularity and usage of Robo-advisors which provide more personalized financial advice to investors in an automated fashion.

Learn and grow as an equity research analyst with Imarticus Learning

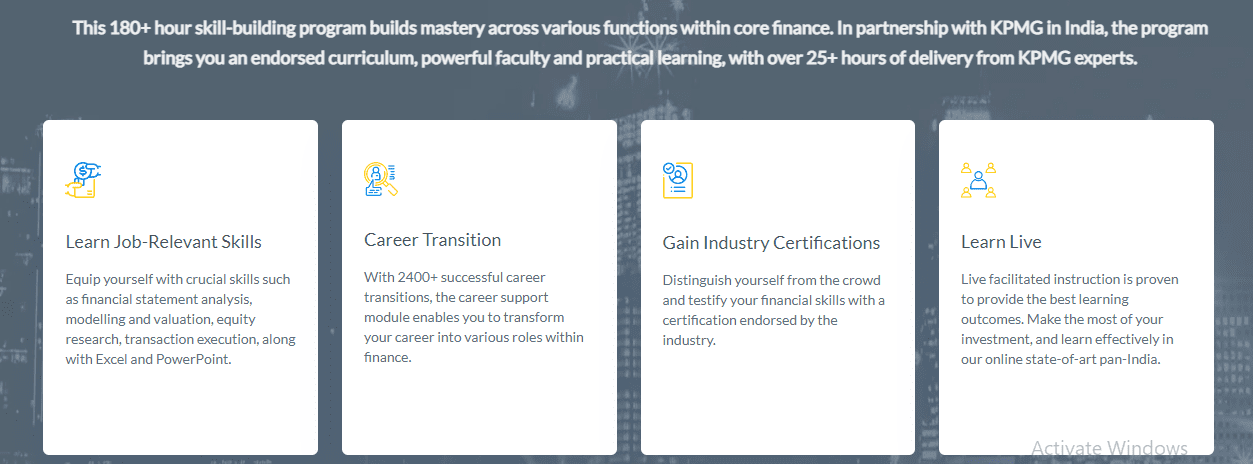

Imarticus has been at the forefront of equipping students with the skills and knowledge required to be a successful equity research analyst. Imarticus offers certification courses in equity research, investment banking & capital markets. Imarticus offers best-in-class training by industry experts through online training and classroom coaching programs for students across India.

Some course USPs:

- Comprehensive 360-degree learning of the finance industry

- Tech-enabled learning

- Industry-oriented curriculum designed/delivered in collaboration with industry veterans and leading firms.

For more insights, contact us through the Live Chat Support system or visit our training centers in Mumbai, Thane, Pune, Chennai, Bengaluru, Hyderabad, Delhi, and Gurgaon.