Enterprise Value Calculation is the most important yet least understood concept in finance. A good understanding of this metric is important for finance professionals in India—it could mean the difference between educated financial analysis and simply failing to achieve it.

Enterprise Value, or EV, measures a company’s overall value. It considers the total market value rather than the equity value, including all ownership interests and asset claims from equity and debt.

Let us try to understand this Enterprise Value Formula and why it is important in a valuation skills spectrum.

What Is Enterprise Value?

Enterprise value (EV) is an economic statistic calculated as a company’s market value (rather than its market price), indicating the value of its stocks and other assets and liabilities.

This is the total of all the claimants’ claims against the company (at all creditor and shareholder levels, including preferred or common). Enterprise value is an important general metric for corporate valuation, financial analysis, accounting, portfolio analysis, and risk assessment.

Why is Enterprise Value Important?

The reason EV is so important:

- EV is useful as it combines a company’s equity and debt – thus giving a clearer picture of its financial health than just looking at its market capitalisation.

- It is an important indicator in M&A transactions because it helps buyers estimate the cost of acquiring a firm, including loans and cash reserves.

- EV accounts for a company’s cash holdings and debt, making it more accurate than simply examining the stock price in determining the underlying value of the business.

- EV allows financial professionals to make better investment decisions by knowing a company’s worth beyond its equity.

Breaking Down the Enterprise Value Formula

Understanding the Enterprise Value Formula is key to mastering EV.

Enterprise Value = MC + Total Debt – C

Here:

- MC is market capitalisation

- Total debt

- C is Cash and Cash Equivalents

This formula is often adapted depending on the business’s specific circumstances, and that’s where things get interesting for finance professionals.

Sometimes, additional adjustments may be required, such as accounting for preferred stock or minority interests. Understanding how to adjust the formula based on the context is a skill that distinguishes good finance professionals from great ones.

How Enterprise Value (EV) Works?

The EV might be negative in some circumstances if the company’s cash and cash equivalents totals surpass the combined equity market value and debt. This may point to ineffective operation in managing the assets where the firm was holding lots of cash as an asset.

Such surplus funds could be better used for dividends, stock repurchases, expansion, research and development, facility maintenance, employee incentives, or debt repayment.

Valuation Techniques in Finance: A Broader Perspective

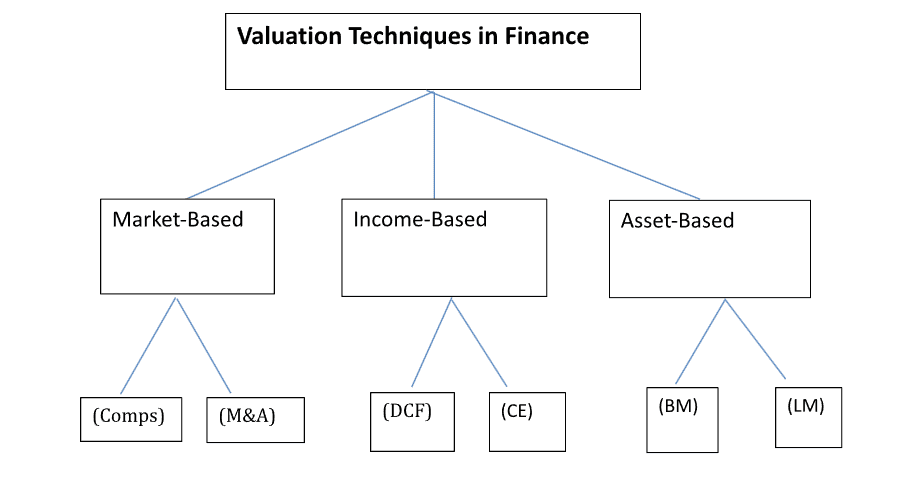

Enterprise value calculation is only one aspect of valuing a firm.

You should be familiar with many valuation techniques in finance if you’re a finance expert.

For instance, these can include more standard methodologies, such as discounted cash flow (DCF), market comparables, and precedent transactions. Each technique gives you a different perspective on the organisation.

Here

Comps: Comparable Companies

M&A: Precedent Transactions

DCF: Discounted Cash Flow

CE: Capitalised Companies

BM: Book Value Method

LM: Liquidation Method

If you seek to further your competency in financial analysis and valuation, a financial analysis course with robust training on EV (and other valuation) techniques is exactly what you need to step up your skills.

Enterprise Value Calculation: Real-World Application

And you might ask: ‘But how does this work in the real world?’

Let’s take a quick example.

The company has a market cap of ₹500 crore, a total debt value of ₹50 crore, and cash reserves of ₹20 crore. Plugging these figures into the formula, you get:

EV = ₹500 crore + ₹50 crore – ₹20 crore = ₹530 crore

So, the business’s total value, including its debt, is ₹530 crore. This makes it easier for investors and possible buyers to see the company’s value beyond its market capitalisation.

Why Mastering Enterprise Value Matters: Imarticus Learning Postgraduate Financial Analysis Programme

Enterprise Value is much more than that: It’s a small window into a company’s finances. As finance professionals, we calculate it to understand what it means and why it generally results in corporate valuation.

The 200-hour postgraduate financial analysis course by Imarticus Learning is for those who have graduated with less than three years of professional experience in finance. With over 45000 career transformations, Imarticus Learning has led the journey of transformational career transformation of aspiring finance role countrymen and prepared them for the CFA level 1 role in industry.

Learn skills around financial statement analysis, equity research, valuation, and transaction execution. You’ll also learn Excel and PowerPoint, crucial skills when playing a finance game. Get experience in finance with simulation tools that simulate real-world scenarios.