Last updated on November 12th, 2025 at 04:10 pm

Before you can master strategy and leadership, you first need to build the core skills that define a world-class finance professional. The 9 ACCA exams form this foundation; they’re where every ACCA journey begins. Covering areas like business technology, performance management, taxation, and financial reporting, these papers shape your understanding of how organisations operate, make decisions, and maintain financial integrity.

Together, the 9 ACCA exams under the Applied Knowledge and Applied Skills levels act as the building blocks of the qualification. They ensure that before you move to the strategic stage, you’ve already developed the analytical, technical, and ethical mindset that the ACCA qualification is known for.

In this guide, I’ll walk you through each of these ACCA exams: what they cover, how they connect to real-world finance, and how you can prepare effectively to clear them with confidence.

Considering ACCA?

Get personalized guidance on your ACCA journey—eligibility, exam roadmap, and career outcomes in a 15-minute call with our expert counsellor.

No commitment required • 200+ students counselled this month

What Is ACCA? How Do ACCA Exams Build the Foundation for a Global Finance Career?

Whenever someone asks me, “What is ACCA?” I tell them to picture a skyscraper. You can’t build something tall and enduring without a solid base, and that’s exactly what the Association of Chartered Certified Accountants (ACCA) gives you in your finance career. Each of the ACCA exams acts like a floor in that structure: carefully planned, skillfully layered, and designed to take you higher, one level at a time.

The ACCA course is one of the most respected global credentials in accounting and finance. It’s recognised in over 180 countries, trusted by top employers, and valued by professionals who want to go beyond bookkeeping to real financial leadership. Through its structured pathway, from Applied Knowledge to Strategic Professional, ACCA trains you to understand how businesses actually work: how money moves, how value is created, and how ethical decisions shape organisations.

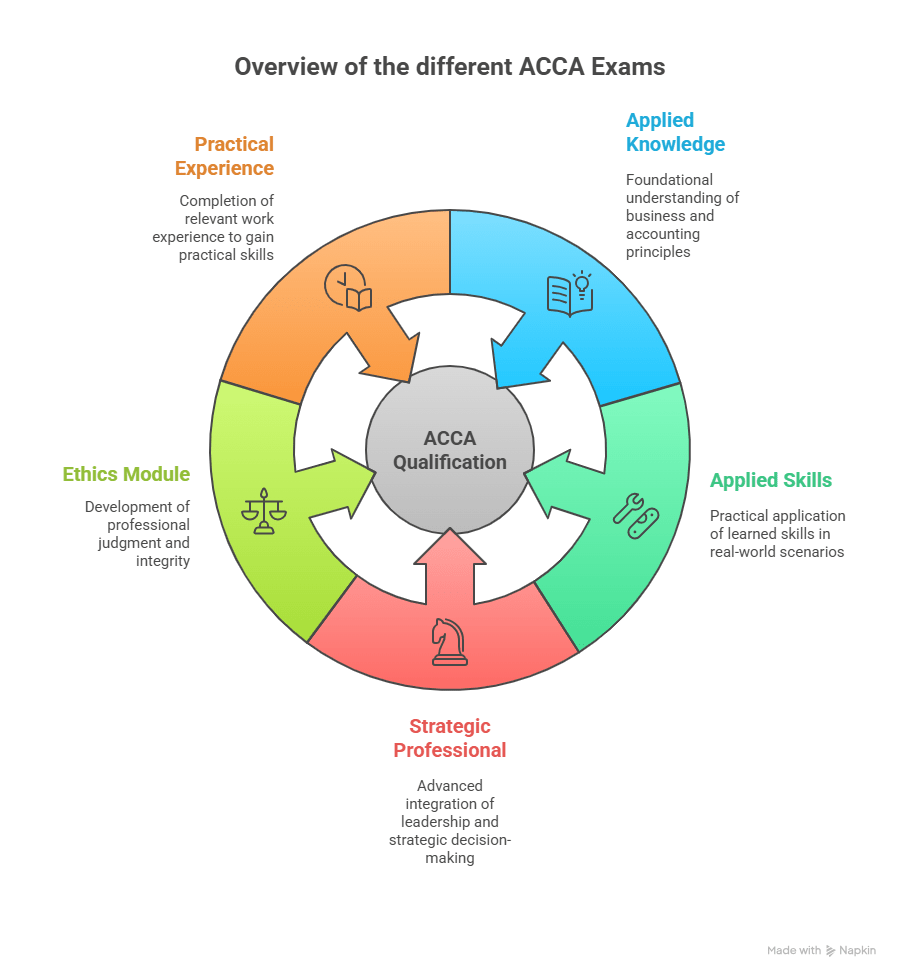

Here is a visual overview of the various ACCA exams that you have to master as you sign up for this credential. Each of these is discussed in detail as we move ahead in this blog.

The foundation begins with concepts like business and technology, performance management, and financial reporting. As you move up, you reach the strategic levels, where you’re learning to think like a CFO, design global strategies, and advise on financial decisions that can transform entire companies.

To simplify, imagine building a skyscraper in a fast-growing city. You need architects, engineers, planners, and strong materials. In the same way, the ACCA exams equip you with technical knowledge, analytical tools, and ethical grounding, the essential materials to build a career that stands tall in any economy.

But what makes ACCA special is how universal it is. Whether you study in Mumbai or Manchester, the standards are the same. It prepares you not just to do accounting, but to understand business; a language that every global organisation speaks.

Watch this video to get a thorough understanding of what the ACCA qualification means for a global finance career:

Structure of ACCA Exams

The structure of ACCA exams is designed to take you from mastering the fundamentals of accounting to becoming a strategic finance leader. Instead of overwhelming students with theory, ACCA builds knowledge in progressive layers, starting with core business concepts and gradually moving into complex analysis, reporting, and decision-making.

The qualification is divided into three key levels:

- Applied Knowledge

- Applied Skills

- Strategic Professional

Each serves a specific purpose in shaping your professional capability. The early levels focus on understanding how businesses function and how financial systems work, while the later ones prepare you to interpret, advise, and lead with financial insight.

| Level | No. of Papers | Exam Mode | Focus Area |

| Applied Knowledge | 3 | Computer-Based | Core business & financial literacy |

| Applied Skills | 6 | Computer-Based / Paper-Based | Practical accounting and financial management |

| Strategic Professional | 4 | Computer-Based | Advanced strategy, leadership, and reporting |

The first 9 ACCA exams cover everything from business technology to taxation and audit. These aren’t just subjects; they’re simulations of real-world decision-making.

Breakdown of the Applied Knowledge Level

The Applied Knowledge Level is where every ACCA journey begins, covering the fundamentals of business, management accounting, and financial reporting. These initial ACCA exams build the conceptual base for everything that follows.

While there are some challenging ACCA subjects, consistent practice, smart time management, and guided mentoring make mastering this level completely achievable.

Paper F1 (BT): Business and Technology

This paper introduces you to the modern business ecosystem. You learn not just accounting systems, but how technology, governance, and ethics shape a company’s financial behaviour.

For example, understanding how automation changes auditing standards isn’t theoretical; it’s a real scenario many ACCA candidates face in their first roles.

Skills built:

- Understanding business structures

- Recognising ethical dilemmas

- Using digital tools for finance

Paper F2 (MA): Management Accounting

This one turns you into the “numbers whisperer.” You’ll build models to help managers plan budgets, analyse costs, and optimise performance.

To visualise it: if a company produces 10,000 units and wants to find its break-even point, you’ll be the one designing that cost model.

What you’ll master:

- Budgeting and variance analysis

- Decision-making with cost behaviour

- Short-term vs long-term financial planning

Paper F3 (FA): Financial Accounting

You’ll dive into the language of business and accounting standards. This ACCA exam trains you to prepare and interpret financial statements that investors and auditors rely on.

| Core Concepts | Practical Use Case |

| Double-entry bookkeeping | Maintaining general ledgers |

| IFRS and IAS compliance | Corporate reporting |

| Trial balance and adjustments | Financial accuracy |

Takeaway → If you’ve ever looked at a balance sheet and wondered, “How does this all connect?”, F3 is where you learn that logic.

Breakdown of the Applied Skills Level

Once you’ve laid your foundation, the next six ACCA exams (F4–F9) focus on decision-making, ethics, taxation, and reporting.

Paper F4: Corporate and Business Law (LW)

Law is the invisible skeleton of every business. In this paper, you’ll understand contracts, company structures, and liabilities. Knowing when a company director is legally accountable or how to interpret regulatory updates is key for global accountants.

💡 Fun fact: Over 70% of corporate disputes involve contract ambiguity; ACCA equips you to prevent those before they happen.

Source: IFAC Legal Insights Report

Paper F5: Performance Management (PM)

Imagine running a business unit. How do you know if your team is performing efficiently? F5 trains you to measure that using quantitative and qualitative performance indicators.

You’ll build metrics, interpret variances, and link performance outcomes to business strategy.

What makes this ACCA exam important:

- Real-world case analysis

- Use of key performance ratios

- Scenario-based decision frameworks

Paper F6: Taxation (TX)

If finance is a body, taxation is its circulatory system. This paper takes you through how tax systems operate: personal, corporate, and international.

You’ll learn:

- Income tax computations

- VAT and corporate tax planning

- Ethical considerations in tax management

For example, when advising an SME on depreciation or allowable expenses, the principles from F6 decide the financial strategy.

Paper F7: Financial Reporting (FR)

The FR paper is where you become fluent in IFRS. You’ll learn to consolidate statements, interpret financial disclosures, and apply international accounting standards.

ACCA Subject Highlights:

- Frameworks for financial reporting

- Consolidated accounts and disclosures

- Interpretation of statements for decision-making

Paper F8: Audit and Assurance (AA)

In today’s data-driven world, auditors are the gatekeepers of trust. This paper teaches you how to evaluate evidence, understand audit risks, and build internal control systems.

Exam focus:

- Audit procedures and sampling

- Internal control evaluation

- Auditor’s ethical responsibilities

Paper F9: Financial Management (FM)

This ACCA exam is the bridge between theory and boardroom decisions. You’ll learn how to make financing, investment, and dividend decisions under uncertainty.

| Key Concepts | Application in Business |

| Cost of capital | Deciding between debt vs equity |

| Investment appraisal | Evaluating new projects |

| Risk management | Hedging and sensitivity analysis |

Real-World Application: From Classroom to Career

Here’s a practical example:

Imagine you’re analysing whether your company should acquire a new warehouse.

- F2 helps you model the cost.

- F4 ensures your contract is legally sound.

- F7 lets you account for the asset correctly.

- F9 tells you if the investment is worth it financially.

That’s how the ACCA exam papers connect theory with strategy; one reason global employers trust this qualification.

Breakdown of the Professional Level of ACCA Exams

If the first nine ACCA papers build your technical foundation, the Strategic Professional Level is where your skills meet leadership.

This level has four ACCA exams: two compulsory and two optional. Every ACCA candidate must complete these to earn the full certification.

Unlike the foundational levels that focus on what and how, this stage asks why. Why does a business pursue a certain strategy? Why does one reporting decision change investor perception? That’s the maturity ACCA expects at this level.

ACCA Subjects List: Strategic Professional Level

| Category | Paper Code & Name | Type | Exam Duration |

| Core Papers | SBL – Strategic Business Leader | Mandatory | 4 hours |

| Core Papers | SBR – Strategic Business Reporting | Mandatory | 3 hours 15 mins |

| Optional Papers | AFM – Advanced Financial Management | Choose any 2 | 3 hours 15 mins |

| Optional Papers | APM – Advanced Performance Management | ||

| Optional Papers | ATX – Advanced Taxation | ||

| Optional Papers | AAA – Advanced Audit and Assurance |

📚 Source: ACCA Global Exam Overview

Strategic Business Leader (SBL)

If you could sit in a CEO’s chair for four hours, that’s what this paper feels like. It evaluates your ability to lead, make decisions under pressure, and communicate with clarity.

Instead of theoretical questions, you’ll be given a 20-page business case study with multiple exhibits like financial reports, news clippings, emails, and board notes. You must respond as if you’re a senior manager presenting to stakeholders.

You’ll be tested on:

- Integrating strategy, leadership, and risk

- Corporate governance and ethics

- Business communication and stakeholder management

Strategic Business Reporting (SBR)

SBR is the evolution of the earlier Financial Reporting paper. But now, you don’t just prepare reports: you interpret, analyse, and justify reporting choices.

For example, you might need to explain how a company’s fair value adjustments impact investor decisions. That’s why employers value SBR; it shows your ability to defend financial logic at a leadership level.

| Skill Tested | Example Scenario |

| Ethical application of IFRS | Reporting mergers or asset impairment |

| Professional judgment | Advising the board on disclosure impacts |

| Analytical communication | Writing investor reports or audit summaries |

💡 Expert Tip for Learners:

When you plan your ACCA papers list, never attempt SBL and SBR together if you’re working full-time. Their integrated nature demands separate mental bandwidth. Instead, pair one core paper with one optional (like SBR + AFM).

Breakdown of the Optional ACCA Papers

Every business needs different kinds of financial minds: strategists, auditors, tax planners, or performance consultants. The optional ACCA exams let you specialise accordingly.

AFM: Advanced Financial Management

Think of this as the paper for aspiring CFOs. You’ll learn capital structure planning, foreign exchange risk management, and advanced investment appraisal.

Real-world application? Evaluating whether your firm should issue bonds, seek equity funding, or hedge against currency exposure.

APM: Advanced Performance Management

This is for those who enjoy connecting numbers with strategy. You’ll study performance evaluation frameworks like Balanced Scorecards, strategic KPIs, and behavioural performance management.

🎓 In global corporates, APM-qualified professionals often move into Business Analyst or Management Consultant roles, bridging finance and strategy.

ATX: Advanced Taxation

Designed for tax specialists, this ACCA exam deep-dives into cross-border tax issues, inheritance tax, and group taxation. You’ll develop advisory skills to guide clients or employers on complex tax implications.

AAA: Advanced Audit and Assurance

If you’re drawn to risk, ethics, and forensic detail, this one’s for you. AAA tests how you handle complex audits, group audits, and assurance engagements beyond financial audits, such as ESG or sustainability assurance.

Global Career Paths After Each Optional ACCA Exam

The optional ACCA exams at the Strategic Professional level let you shape your career based on your interests: whether it’s financial management, auditing & taxation, or performance strategy. Each paper opens distinct global career paths, helping you specialise in the areas most valued by multinational firms and Big 4 employers.

| ACCA Paper | Top Global Career Roles |

| AFM | Corporate Finance, Treasury, Investment Banking |

| APM | Performance Analyst, Strategy Consultant |

| ATX | Tax Consultant, International Tax Planner |

| AAA | Audit Partner, Risk Advisory, Compliance Lead |

Watch this video to explore free resources to help boost your ACCA preparations:

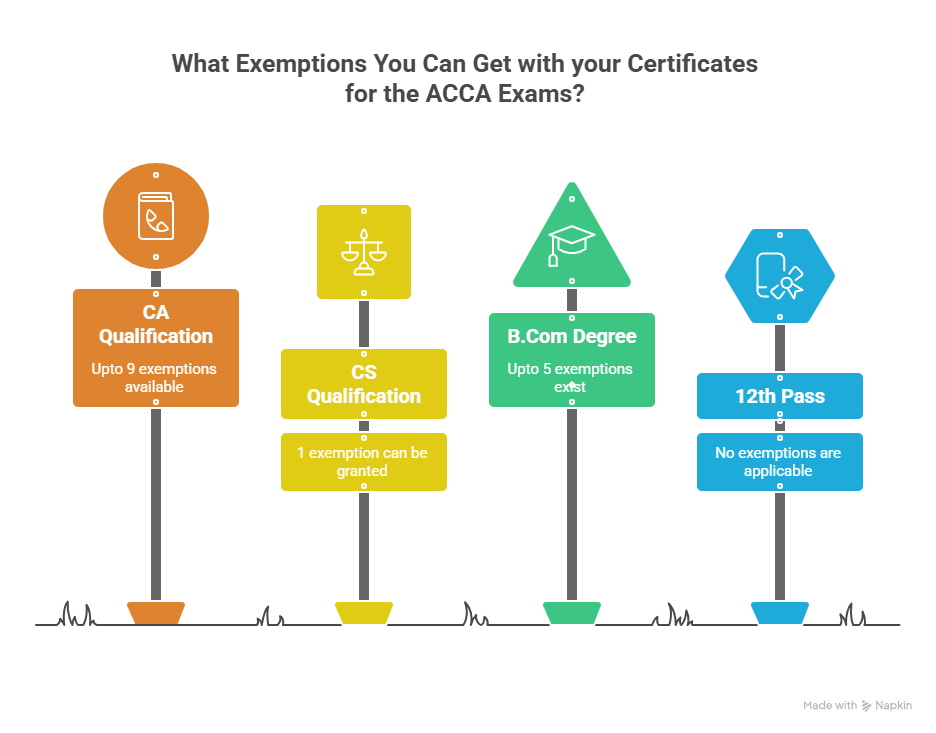

ACCA Exam Exemptions Explained: Who Can Skip Which Papers

One of the biggest advantages of the ACCA exams is that they recognise your prior qualifications. Depending on your background, you may be exempted from some or all of the nine Applied Knowledge and Applied Skills papers.

If you’re a Chartered Accountant (CA), Company Secretary (CS), or B.Com graduate, you could skip multiple foundational papers like Business and Technology (BT) or Financial Accounting (FA). Even certain postgraduate degrees in commerce or finance can grant exemptions, meaning you can fast-track your ACCA journey.

You can check your eligibility through the official ACCA Exemption Calculator, which matches your existing qualifications with applicable exemptions.

This system saves time, reduces costs, and lets experienced learners focus directly on higher-level ACCA exams that strengthen their global finance credentials.

Explore through this visual which ACCA exams you can get exempted from if you hold certain certifications:

ACCA Exam Structure

All ACCA exams are conducted four times a year in March, June, September, and December, and can be attempted through both computer-based testing and session-based exams, depending on location.

| ACCA Exam Type | Format | Passing Marks | Duration |

| Applied Knowledge | Objective + Case | 50% | 2 hours |

| Applied Skills | Scenario + Short Questions | 50% | 3 hours |

| Strategic Professional | Case-Based | 50% | 3–4 hours |

Key Takeaway → You can attempt a maximum of 8 papers a year, with up to 4 in one session. (Source)

Watch this video to explore the ACCA Exam Structure in depth:

Life After ACCA Exams

Today, the finance world is evolving faster than ever: automation, ESG reporting, fintech, and cross-border compliance are reshaping what it means to “work in finance.” And that’s where ACCA professionals stand out. With their deep grounding in international standards and practical decision-making, they aren’t just keeping pace, they’re driving the change.

Whether you see yourself decoding complex mergers, leading a risk advisory team at a Big 4 firm, or shaping financial strategy for a tech startup, your ACCA qualification gives you the flexibility and credibility to do it anywhere, from Mumbai to London to Dubai. According to the ACCA Global Talent Trends 2025, salaries reflect that global premium, with ACCA members often commanding higher packages for their analytical and cross-functional expertise.

But let’s go beyond the usual narrative of “career opportunities.” Here’s what the real landscape looks like today:

Top Career Roles After Completing ACCA Exams

Clearing your ACCA exams opens doors to some of the most rewarding roles in global finance. From auditing and taxation to financial strategy and consulting, here’s a look at the top career paths you can pursue after becoming ACCA-qualified.

| Career Path | Core ACCA Papers Linked | Typical Job Titles |

| Financial Reporting & Analysis | F3, F7, SBR | Financial Analyst, Reporting Manager |

| Audit & Assurance | F8, AAA | Auditor, Internal Control Specialist |

| Tax & Compliance | F6, ATX | Tax Consultant, Compliance Officer |

| Investment & Risk | F9, AFM | Treasury Analyst, Risk Consultant |

| Strategy & Performance | F5, APM, SBL | Business Analyst, Strategy Lead |

These roles often become stepping stones to Finance Controller, CFO, or Partner-level positions within 8–10 years.

ACCA Salary Trends in India and Abroad

One of the most common questions students ask after completing their ACCA exams is, “What kind of salary can I expect?” The truth is, your earning potential as an ACCA-qualified professional is shaped by a mix of factors like where you work, the industry you enter, and the experience you build.

In India, ACCA members often start with roles such as Financial Analyst, Statutory Auditor, or Tax Associate, earning competitive salaries comparable to Indian CAs.

Abroad, ACCA-qualified professionals are recognised across 180+ countries, including the UK, UAE, Singapore, and Canada. This international recognition translates into higher compensation bands and accelerated career mobility, particularly in finance hubs where global reporting and IFRS expertise are valued.

Below is a quick look at the average ACCA salary range after clearing ACCA exams:

| Country | Average Salary Range | Top Employers |

| India | ₹6 LPA – ₹25 LPA | KPMG, Deloitte, EY, PwC |

| UK | £35,000 – £70,000 | Barclays, BDO, HSBC |

| UAE | AED 120,000 – AED 280,000 | EY, Mashreq, Emirates NBD |

| Singapore | SGD 45,000 – SGD 100,000 | DBS, OCBC, Accenture |

| Canada | CAD 60,000 – CAD 120,000 | RBC, TD, KPMG |

Did you know? In 2025, almost 51% of people who took the ACCA Exams were mid-level management professionals. (Source)

Global Mobility and Demand for ACCA Professionals

The biggest value of the ACCA qualification isn’t just its depth, it’s its passport. Unlike local certifications (such as CA or CPA, limited by geography), ACCA exams give you recognition with high-paying global finance jobs.

Countries where ACCA professionals are in high demand:

- United Kingdom

- India

- Singapore

- UAE

- Canada

- Malaysia

- South Africa

Each of these markets values ACCA for one key reason: it aligns with International Financial Reporting Standards (IFRS), which are used by over 140 nations.

💬 “The digital landscape presents significant opportunities for accountancy and finance professionals to achieve meaningful work experiences – ones that are driven by purpose and which afford the potential to stretch oneself in new and fulfilling ways.”

Mark Millar, Head of Education Partnerships, ACCA Global (Source)

Why Choose Imarticus Learning for Your ACCA Journey

As you work through the phases of the ACCA course, you’ll quickly realise two things: one, that the exams demand more than rote learning; and two, that the environment you prepare in makes a huge difference.

Imarticus Learning helps you prepare not just for the papers, but for the role, and the fact that we partner with KPMG in India and integrate globally-recognised content adds real strength.

Imarticus ACCA Program Highlights:

- Live mentorship by industry experts

- AI-powered performance tracking

- Kaplan-published content and mocks

- Job assurance with top-tier firms

- Option for full or hybrid learning

- 100% Pass Guarantee and 100% Job Guarantee

FAQs About ACCA Exams

The following section answers some of the most searched and frequently asked questions about ACCA exams: from exam structure and eligibility to exemptions, costs, and career scope. Whether you’re just beginning your ACCA journey or planning your next level, these FAQs cover everything you need to understand how the ACCA qualification works

What are the 13 exams in ACCA?

The ACCA Exams consist of 13 papers divided into three levels: Applied Knowledge, Applied Skills, and Strategic Professional.

- Applied Knowledge: Business and Technology (BT), Management Accounting (MA), Financial Accounting (FA)

- Applied Skills: Corporate and Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit and Assurance (AA), Financial Management (FM)

- Strategic Professional: Strategic Business Leader (SBL), Strategic Business Reporting (SBR), and two optional papers from Advanced Financial Management (AFM), Advanced Performance Management (APM), Advanced Taxation (ATX), and Advanced Audit and Assurance (AAA).

Each paper is designed to progressively develop your technical and strategic expertise in accounting and finance. With Imarticus Learning, you get structured guidance, mentor-led sessions, and access to Kaplan study materials that help you master each of these 13 exams efficiently.

How many exams are there for ACCA?

There are 13 ACCA Exams in total, spread across foundational and advanced levels. However, depending on your prior qualifications (like a B.Com, CA, or CS), you may be eligible for exemptions for some ACCA papers. This flexibility allows professionals and students to fast-track their certification journey. To navigate these exemptions and design a smart study plan.

What are the 9 ACCA exams?

The 9 ACCA exams at the fundamentals level form the backbone of your accounting and business acumen. They include BT, MA, FA, LW, PM, TX, FR, AA, and FM. These exams test your grasp of concepts like management accounting, taxation, financial reporting, and business law. Scoring well at this stage requires consistency and clarity, both of which Imarticus Learning helps you build through live sessions, mock tests, and performance analytics.

What is an ACCA exam?

An ACCA exam is a globally recognised assessment conducted by the Association of Chartered Certified Accountants (UK). Each exam evaluates your theoretical understanding, analytical reasoning, and practical problem-solving abilities in accounting, audit, taxation, and finance. The exams are conducted quarterly, offering flexibility for working professionals. With Imarticus Learning’s online classes, you can prepare strategically for each exam cycle through a blend of live teaching, self-paced learning, and Kaplan’s adaptive resources.

Is ACCA costlier than CA?

The total cost of pursuing the ACCA qualification can range between ₹3–4 lakhs, depending on exemptions and exam attempt frequency. While this is generally higher than the initial CA registration costs, ACCA provides global recognition, access to international roles, and flexible scheduling. Imarticus Learning offers cost-effective ACCA training with EMI options and placement support, making international accounting education more accessible without compromising on quality.

What is the 7-year rule in ACCA?

The 7-year rule in ACCA Exams applies to the Strategic Professional Level, meaning you must pass all four professional papers within seven years of your first pass at that level. This ensures that your knowledge remains current and relevant to the evolving global accounting standards.

Can ACCA earn 1 crore?

Yes, ACCA-qualified professionals can earn ₹1 crore or more annually, especially in senior finance, investment banking, and international audit roles. Salaries depend on experience, location, and domain specialisation. Firms like Big 4s (KPMG, Deloitte, PwC, EY) and multinational banks often seek ACCAs for leadership roles.

Can I finish ACCA in 2 years?

Yes, it’s possible to complete the ACCA Exams in two years if you plan effectively and qualify for a few exemptions. Most students, however, complete it in 2.5 to 3 years. A disciplined study plan and access to the right study material are key. Imarticus Learning’s structured training enables accelerated completion through expert mentorship, performance tracking, and focused revision cycles tailored for quick progression.

Is ACCA closing in 2026?

No, ACCA is not closing in 2026. The ACCA qualification continues to grow in global demand, with employers worldwide recognising its value. The association regularly updates its syllabus to reflect emerging trends in finance, technology, and sustainability. Imarticus Learning keeps its ACCA course aligned with these updates, ensuring students prepare for the most current exam structure and industry expectations.

Will ACCA be replaced by AI?

While AI and automation are transforming the accounting landscape, the ACCA qualification is evolving to include technology, data analytics, and sustainability reporting in its syllabus. This ensures ACCA professionals remain indispensable for strategic decision-making.

How many attempts for ACCA in a year?

Students can attempt ACCA Exams four times a year: March, June, September, and December. You can appear for up to four papers in one session and eight papers in a year, giving enough flexibility to manage your workload and goals. With Imarticus Learning’s expert support, students receive personalised guidance on when to appear for which paper to balance efficiency and exam readiness.

Is ACCA losing its value?

Absolutely not. The ACCA qualification continues to be one of the most globally respected accounting credentials, recognised in over 180 countries. As global financial systems become more complex, ACCA’s emphasis on ethics, technology, and strategic analysis makes it even more valuable today.

Summing Up the ACCA Exams

The ACCA qualification isn’t just a set of exams; it’s a global benchmark that shapes accountants into strategic decision-makers. Each of the 9 ACCA exams builds essential skills in reporting, taxation, performance management, and leadership, creating professionals who can adapt to global standards and digital finance.

In today’s world of automation and analytics, ACCA-qualified professionals are valued for their ability to combine financial insight with ethical and technological awareness. It’s not just about passing exams; it’s about mastering a mindset built for the future of finance.

If you’re ready to take this step, the ACCA course offered by Imarticus Learning in collaboration with KPMG in India, with expert mentorship from industry leaders, is built to help you clear every paper confidently and launch a career that spans borders.