Last updated on December 3rd, 2025 at 03:13 pm

If you’re planning a serious career in accounting or finance and do not want to get into the traditional Chartered Accountant course, you’ve probably found yourself stuck between two powerful options: CMA vs CPA.

Both certifications are globally respected and open doors to high-paying careers. But what most people overlook is that CMA and CPA prepare you for very different professional lives. But here’s the thing most people won’t tell you – CMA and CPA are designed for completely different career journeys.

Some people thrive in corporate strategy and business decision-making. While some are passionate about audit, taxation, and regulatory work. Neither path is better than the other. They’re just different.

In this blog, I’ll break down CMA vs CPA in simple, practical terms – covering syllabus, eligibility, career scope, salary potential, and most importantly, how to choose what suits you, so you can clearly understand the difference between CPA and CMA before shaping your accounting career.

Understanding CMA and CPA

Before comparing CMA vs CPA, let’s get clear about what each certification actually means in the real world.

What is CMA?

When people ask me what is CMA, I usually explain it like this: Certified Management Accountant (CMA course) is built for people who want to work inside businesses, helping leadership teams make smarter financial decisions using financial data. It focuses on:

- Budgeting and forecasting

- Cost management

- Performance analysis

- Financial planning

- Strategic business decisions

A CMA professional helps answer questions like:

- Where are we losing money?

- How can we reduce costs without hurting growth?

- Which project gives better returns?

In simple words, CMA prepares you to run businesses better from the inside.

What is CPA?

When it comes to what is CPA, I describe it as a path for people who enjoy structure, rules, and accuracy. Certified Public Accountant (CPA) is designed for professionals who want to ensure that financial information is correct, compliant, and trustworthy.

CPA prepares you for work in:

- Auditing

- Taxation

- Financial reporting

- Compliance

- Public accounting

This path suits people who enjoy:

- Regulations

- Statutory reporting

- Tax laws

- External financial accuracy

A CPA professional helps answer questions like:

- Are these financial statements legally correct?

- Are taxes filed properly?

- Is the company compliant with accounting standards?

In short, a CPA prepares you to protect financial integrity and ensure compliance from the outside.

CMA vs CPA: Core Differences at a Glance

When it comes to CMA vs CPA, the right choice depends on the kind of work you want to do. Choosing between CPA and CMA can feel confusing because both are respected accounting qualifications. But both CPA and CMA are built for different career paths.

Here’s a simple snapshot to help you understand the difference between CPA and CMA:

| Factor | CMA | CPA |

| Primary Focus | Corporate finance & strategy | Auditing, taxation & compliance |

| Best For | Internal management roles | Public accounting & audit firms |

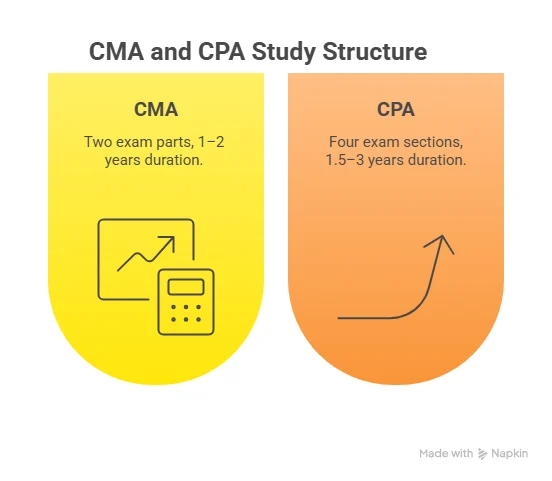

| Exam Structure | 2 Parts | 4 Sections |

| Typical Duration | 1-2 years | 1.5-3 years |

| Recognition Strength | Strong in corporate roles | Strong in audit & regulatory roles |

| Skill Orientation | Business-focused | Regulation-focused |

On average, the CMA course duration is around 1 to 2 years, which makes it a faster option for students who want to enter the workforce sooner.

If you’re trying to understand where a US CPA qualification can take your career, this video breaks it down clearly across different global markets. It walks you through the most in-demand job roles and real salary ranges for US CPAs in India and globally.

CMA vs CPA: Eligibility Requirements

When it comes to CMA vs CPA, the right choice really depends on the kind of work you want to do. Choosing between CMA and CPA can feel confusing because both are respected accounting qualifications – but they’re designed for very different career paths.

CMA Eligibility

You can pursue CMA if:

- You hold a bachelor’s degree (any stream), or you are in your final year of graduation.

- Relevant work experience is completed before/after the exams.

Even non-commerce students can pursue CMA with structured preparation. The flexible CMA eligibility criteria make it accessible to candidates from diverse academic backgrounds.

CPA Eligibility

You can pursue a CPA if:

- You meet specific credit hour requirements (varies by US state board).

- You hold a bachelor’s degree (usually in commerce/accounting-related fields).

CPA eligibility is more credit-structure dependent, which makes planning slightly more technical.

CMA vs CPA: Syllabus Structure

The CMA vs CPA debate becomes much easier when you look at what each syllabus actually covers. The structure of the subjects gives you a clear idea of the kind of work you’ll be prepared for.

CMA Syllabus Overview

The CMA syllabus is built around real-world business and finance skills. It’s practical and career-focused, helping you understand how businesses actually manage money, strategy, and performance.

| CMA Part | Title | Key Topics Covered |

| Part 1 | Financial Planning, Performance & Analytics | Budgeting, Forecasting, Cost Management, Internal Controls, Performance Measurement, Analytics |

| Part 2 | Strategic Financial Management | Financial Statement Analysis, Corporate Finance, Risk Management, Investment Decisions, Professional Ethics |

CPA Syllabus Overview

The CPA syllabus is designed to build strong expertise in accounting standards, auditing, and regulatory frameworks, preparing you for roles that deal with compliance and public accounting.

| CPA Section | Title | Primary Focus Areas |

| Section 1 | Auditing & Attestation | Audit procedures, internal controls, professional responsibilities, assurance services |

| Section 2 | Financial Accounting & Reporting (FAR) | Financial statements, GAAP/IFRS concepts, reporting standards |

| Section 3 | Regulation (REG) | Taxation, business law, ethics, and compliance requirements |

| Section 4 | Business Environment & Concepts (BEC) | Business processes, economics, IT, finance concepts, and corporate governance |

CMA vs CPA: Time Commitment and Study Load

Choosing between CMA vs CPA isn’t only about the subjects. It’s also about the time and effort you’re ready to commit. Here’s a quick breakdown of how their timelines compare.

| Aspect | CMA | CPA |

| Study Hours (Approx.) | 150-200 hours per part | 200-300+ hours per section |

| Overall Duration | 1-2 years | 1.5-3 years |

In general, the CPA course duration ranges from 18 months to 3 years, depending on your exam schedule, credit eligibility, and how quickly you clear each section. If you prefer:

- Faster completion → CMA feels more manageable.

- Deep regulatory knowledge → CPA feels more aligned.

CPA and CMA Career Opportunities

When you compare CMA vs CPA, the real difference shows up in the kind of careers each one leads to. Understanding the CMA CPA difference makes it easier to see which roles, industries, and long-term paths match your career goals.

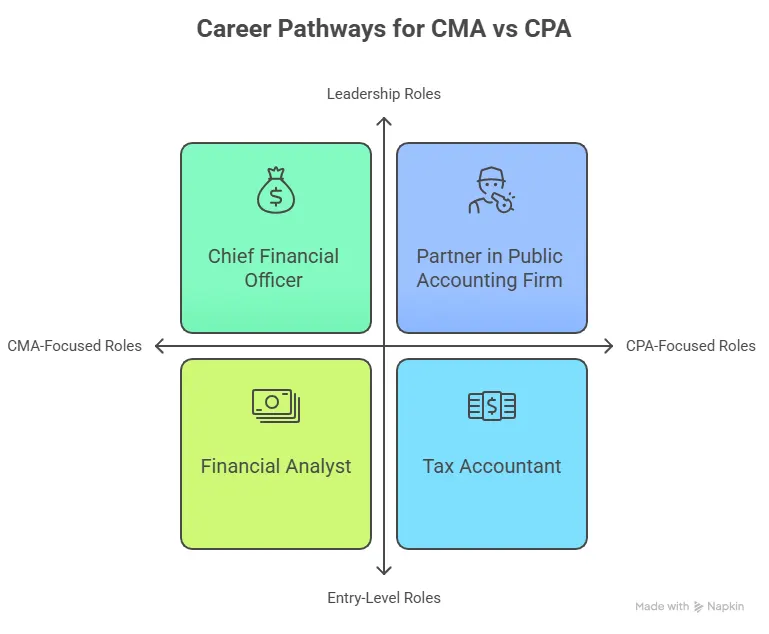

CMA Career Paths

CMA-focused careers are centred around cost and management accounting, business operations, strategy, and internal financial decision-making. The CMA CPA difference becomes clear here, as CMA prepares you for leadership-oriented roles inside organisations. Many CMA jobs are in high demand because companies need professionals who can improve performance, manage costs, and guide strategic decisions.

CMA professionals typically grow into roles like:

- FP&A Analyst/Manager

- Corporate Finance Manager

- Finance Controller

- Strategy and Business Finance Roles

- CFO-track leadership positions

CMA fits perfectly in:

- MNCs

- Corporate finance teams

- Internal decision-making roles

CPA Career Paths

CPA career paths lean more towards regulatory, compliance, and external financial reporting. This is where the CMA CPA difference becomes very visible, as CPA prepares professionals for audit-heavy and statutory roles.

CPA professionals typically grow into:

- Auditor roles

- Tax consultants

- Public accounting firm roles

- Compliance and regulatory positions

- Internal/external audit roles

CPA fits best in:

- Audit firms

- Tax advisory firms

- Statutory compliance roles

If you’re still evaluating the merits of US CMA vs US CPA, watching different perspectives can really help. For instance, check out this video that explores career opportunities, salary expectations and job-market outcomes for each credential in countries like Canada and the US:

CMA vs CPA Salary Outlook: What Can You Expect?

When you compare CMA vs CPA, salary is often one of the first things people think about. While both certifications can lead to strong pay, your actual earnings depend a lot on your experience, role, and the kind of company you work for.

CMA Salary Range

To understand CMA and CPA salary differences, it helps to look at the typical earning range for CMA professionals across different career stages. The CMA salary in India is generally considered rewarding, especially as professionals move into corporate finance, FP&A, and leadership-oriented roles.

| Level | India Salary | Global Salary (Approx.) |

| Entry | ₹5-9 LPA | $45k-60k |

| Mid | ₹10-20 LPA | $60k-100k |

| Senior | ₹25 LPA+ | $120k+ |

These figures are indicative and may vary based on location, industry, and experience.

CPA Salary Range

When comparing CMA and CPA salary insights, CPA professionals also see strong pay growth as they move into specialised audit, tax, and compliance roles. The CPA salary in India is generally seen as rewarding, especially for professionals working with Big 4 firms, MNCs, and global clients.

| Level | India Salary | Global Salary (Approx.) |

| Entry | ₹6-10 LPA | $50k-65k |

| Mid | ₹12-22 LPA | $70k-110k |

| Senior | ₹25 LPA+ | $120k+ |

Reality check: Both offer strong salary growth, and your long-term earning depends more on experience, company, and skills than just the certification.

If you want a quick, realistic look at US CMA salaries in India vs the USA, this video breaks down actual salary data across experience levels and explains where CMAs tend to see the best long-term ROI.

CMA vs CPA: Which One Is Harder?

When it comes to CMA vs CPA, many students want to know which one is more difficult. The truth is, the CMA CPA difference lies in the kind of challenge each exam presents – not in which one is better or worse. Both are challenging, just in different ways.

CPA can feel harder because:

- You need to clear four separate sections.

- It includes complex technical tax, law-heavy content, and business regulations.

- There are strict academic credit requirements before you can even sit for the exams.

- Questions test technical precision and deep understanding of laws and standards.

CMA can feel difficult because:

- The exam is heavily application-based.

- You must think like a business decision-maker, not just an accountant.

- Questions are often scenario-based, complex, and strategic.

- You are tested on how you apply knowledge, not just remember it.

In reality:

If you like rules, structure, and theory, CMA may feel easier.

If you like strategy and real-world problem-solving, a CPA may feel more interesting.

Neither is easy – they’re simply hard in different ways.

Who Should Choose CMA?

If you’re trying to decide based on the difference between CPA and CMA, CMA is usually the better fit for people who enjoy business strategy, corporate finance, budgeting, performance management, and internal decision-making.

You should consider CMA if you:

- Want a faster, more practical career path.

- See yourself in leadership roles inside companies.

CMA is the right choice if you see yourself working for multinational corporations, driving financial strategy and business decisions.

You are a good CMA fit if: You enjoy analysing business performance, want to become a finance leader, and like the idea of influencing business growth rather than checking compliance.

Who Should Choose CPA?

Once you know the difference between CPA and CMA, CPA makes more sense for people who are drawn towards auditing, taxation, regulations, standards and legal compliance-focused careers. CPA is ideal for professionals who enjoy rules, structure, and regulatory work.

You should consider CPA if you:

- Want a career in public accounting or audit firms.

- Prefer structured, rule-driven work.

You are a good CPA fit if: You enjoy working with laws, guidelines, and financial reporting, and want to build your career in auditing, taxation, or compliance-based roles.

Can You Do Both CMA and CPA?

Yes – and many finance professionals actually choose to do both. But it’s important to understand: doing both is not for everyone.

For some, it makes a lot of sense when you want broad exposure across the finance world. That said, doing both isn’t just grabbing two certificates. It demands serious time, discipline, and clarity of purpose. You’ll need to manage long-term academic pressure while balancing work or other commitments. If your main goal is to quickly bump up your pay or just get one qualification out of the way, going for both might not be worth the effort.

In short: doing CMA + CPA works best when you want depth and breadth – when you’re aiming for high-level finance roles that require both corporate finance strategy and audit/compliance expertise.

CMA vs CPA: Which Is Better for You?

There is no universal winner here – and that’s actually a good thing. CMA and CPA are both powerful accounting and financial credentials, but they are powerful in very different ways. The right choice depends on the kind of work you enjoy and the kind of professional life you want to build.

| Goal / Preference | CMA | CPA |

| Work inside businesses | ✅ | ❌ |

| Drive financial strategy | ✅ | ❌ |

| Grow into leadership roles. | ✅ | ❌ |

| Work in audit, tax, and compliance | ❌ | ✅ |

| Build authority in regulatory work. | ❌ | ✅ |

| Grow within public accounting. | ❌ | ✅ |

The right choice depends on your interests, working style, and long-term vision.

Why Imarticus Learning Is the Right Partner for Your CMA or CPA Journey

Choosing between CMA vs CPA is already a big decision. The crucial step is to figure out how you prepare for it – and that can feel overwhelming if you try to do it all alone.

That’s where the right kind of guidance really matters.

Imarticus Learning focuses less on just finishing the syllabus and more on helping you actually understand how finance works in the real world. Instead of learning through heavy theory alone, students get a more practical, structured approach that feels closer to what they’ll experience in real jobs.

What makes the learning journey smoother is the kind of support students get:

- Trainers who have real experience working in finance, not just teaching it.

- Structured study plans that help you stay consistent rather than burnt out.

- Guidance with resumes, interviews, and career planning – not just exams.

Whether you eventually choose the CMA course or CPA, having the right mentor and a clear roadmap can make the journey feel much less stressful and a lot more achievable.

Sometimes, it’s not about choosing the harder or better course – it’s about choosing the right support system to walk the path with you.

FAQs About CMA vs CPA

Choosing between CMA vs CPA often comes with a lot of doubts and second thoughts. That’s completely natural. Both qualifications are powerful, and both lead to strong careers, but in different directions.

To help you make a clearer, more confident decision, here are the most frequently asked questions about CMA and CPA, answered in simple, practical terms.

Who earns more, a US CPA or a US CMA?

There is no fixed winner when it comes to earnings between a US CPA and a US CMA. On average, US CPAs tend to earn slightly more in roles related to auditing, taxation, and public accounting. However, US CMAs can earn equally well – and sometimes more – in corporate finance, FP&A, business strategy, and leadership roles.

CPA or CMA – which is better in terms of career growth?

When students ask a CPA or CMA which is better, the honest answer is that both can lead to excellent careers, but in different directions. CPA is stronger for audit, tax, and compliance roles, while CMA is stronger for corporate finance and leadership roles inside companies. The “better” option depends on your long-term career goals.

What is the CPA and CMA difference in real-world jobs?

The CPA and CMA differences become very clear in real job roles. CPA professionals often work in audit firms, tax consulting, and compliance roles. CMA professionals usually work in corporate finance teams, FP&A, strategy, and leadership roles inside companies. This practical difference between CPA and CMA helps you decide based on your work preferences.

Can I do CPA and CMA together?

Yes, you can – and many professionals actually do. People often choose to pursue CPA and CMA together when they want strong expertise in both corporate finance and regulatory accounting. Imarticus Learning helps manage both certifications.

Which is more difficult: CPA or CMA?

When it comes to CPA vs CMA, difficulty depends on your strengths. CPA can feel harder because it has four sections and involves detailed tax and legal concepts. CMA can feel challenging because it is heavily application-based and focuses on real-world business decision-making. Both are demanding, just in different ways.

What is the salary of a CMA and CPA?

The CPA and CMA salaries do not differ much in the long run. Both offer strong earning potential. CPA professionals may earn more in specialised audit, tax, and compliance roles, while CMA professionals often see strong growth in corporate finance and leadership roles. Your experience, industry, and company matter more than just the qualification.

CMA vs CPA – The Right Choice Is the One That Fits You

CMA vs CPA isn’t about which course is better – it’s about which path fits you. If you enjoy corporate finance and business strategy, CMA may feel right. If audits, taxation, and compliance excite you, a CPA could be your path. Take time to reflect on where you want to go, and choose the qualification that aligns with your goals, not trends.

CMA is built for people who enjoy understanding how businesses work from the inside – analysing performance, planning budgets, and helping leaders make smarter decisions. CPA is better suited for those who enjoy working with rules, audits, taxation, and ensuring that financial information is accurate and compliant.

Both are strong qualifications. Both open doors. They just prepare you for very different professional lives.

As companies increasingly look for finance professionals who can add insight, not just reports, skills like forecasting, cost control, and strategic thinking are becoming more valuable. That’s why many people who enjoy problem-solving and business thinking find the CMA journey more aligned with how modern finance teams operate.

If you see your future in roles that interpret numbers to drive direction, rather than simply ensure accuracy, the CMA pathway may offer a more aligned journey. And if you want structured guidance that reflects real industry expectations, exploring a focused CMA course preparation with Imarticus Learning can be a strong first step.