Last updated on October 31st, 2025 at 10:34 am

Last Updated on 4 months ago by Imarticus Learning

When you hear that a Chartered Financial Analyst (CFA) can earn up to ₹50 LPA or more, it’s tempting to think – “Is that even real, or just for people on Wall Street?”

Fair question. Because in today’s world of fancy LinkedIn titles and glossy finance reels, salary expectations can feel confusing. But here’s the truth – the CFA certification isn’t just another finance credential. It’s a career accelerator. Whether you dream of managing big investment portfolios, decoding equity markets, or rising to the top of corporate finance, the CFA gives you the toolkit to get there. And yes, it pays off handsomely.

If you’re eyeing a career at the forefront of finance, few credentials match the global recognition and premium earning potential of the Chartered Financial Analyst Charter. The CFA designation is not just a ticket for high-profile jobs – it’s fast becoming the gold standard for ambitious professionals in India seeking to break into investment management, equity research, and top-tier finance roles.

But let’s cut through the noise:

How much does a CFA earn in India?

What real career impact can you expect at every stage?

And does it truly pay off compared to other credentials, such as ACCA, CPA, or even FRM?

Here’s your complete roadmap – backed by expert data, industry interviews, and fresh real-world comparisons.

CFA charterholders globally earn nearly 54% more than their non-certified peers. In India, that difference is becoming impossible to ignore. A fresher might start around ₹6-10 LPA, but within a few solid years, the same professional can cross ₹25-30 LPA and, with the right exposure, even ₹1 crore isn’t out of reach. – CFA Institute

What is CFA?

Let’s begin by understanding what is CFA. The Chartered Financial Analyst is often considered the gold standard of investment management. It is offered by the CFA Institute (USA). This globally recognised certification covers three levels focused on investment analysis, portfolio management, ethics, and financial modelling.

Unlike academic degrees, the CFA program is deeply applied – it trains you to interpret markets, understand businesses, and make data-driven investment decisions. In short, it turns finance enthusiasts into strategy leaders capable of managing money, not just accounts.

“The CFA doesn’t just teach about valuations. It teaches how investors think.”

If you are confused about how to clear the CFA Level 1, this video is a guide to clear it on the first attempt.

https://youtu.be/sOmQezdI0Z8?rel=0

Why Choose CFA for a Finance Career?

The CFA Charter is one of the world’s most respected credentials in finance. Developed and awarded by the CFA Institute in the US, it unlocks prestigious jobs in investment analysis, portfolio management, research, corporate finance, and beyond. Whether you want to be an investment banker, equity analyst, asset manager, or risk consultant, the CFA is an all-access pass to India’s and the world’s best opportunities.

There’s a reason why global firms actively seek CFA talent. These professionals don’t just analyse numbers, they understand what those numbers mean for investors, funds, and companies.

Here’s what gives the CFA its edge:

- Global Recognition: The CFA Charter is valid in over 165 countries, making it a passport for international careers in finance. The CFA course opens doors in investment banks, hedge funds, asset management firms, and consulting giants worldwide.

- Strategic Thinking: CFAs are trained to ask “what’s next?”, turning data into direction with strategic thinking skills.

- Ethical Leadership: The CFA exam emphasises integrity, something every serious employer in finance prioritises.

- Cross-Industry Demand: From fintech startups to multinational banks, CFAs fit across diverse roles with career opportunities in today’s data-driven finance world.

- Multiple Career Paths: CFA holders are in demand not only in banks but also in career paths like investment firms, fintechs, consultancies, corporations, and regulatory bodies.

The CFA Edge in India

India’s financial ecosystem is undergoing seismic growth. With new asset management firms, a surging fintech sector, and ever-more global investment flowing in, CFAs are more sought after than ever before, especially for jobs that require market acumen, rigorous ethics, and advanced analytical skills.

This video provides a comprehensive overview of why CFA is the best career move in finance.

Let’s look at salary data across each CFA stage, how work experience builds your paycheck, regional variations, and how roles compare.

CFA Salaries in India: An Exhaustive Breakdown

Money talks – so let’s talk numbers. So, what does all this translate to in real paycheques? The salary for CFAs in India depends on three things: experience, industry, and function. But here’s a realistic breakdown across stages.

| Experience Level | Typical Salary (Annual) | Common Roles |

| 0-2 years | ₹6-12 LPA | Junior Analyst, Research Associate |

| 3-7 years | ₹15-30 LPA | Equity Analyst, Portfolio Associate |

| 8+ years | ₹30-70 LPA+ | Fund Manager, VP – Investments, Head of Research |

Entry-Level CFA Salary in India

Completing CFA Level 1 or CFA Level 2 won’t always guarantee a job, but even at this entry stage, candidates are landing strong packages, often outpacing business school graduates or basic finance degree holders.

| Role | Salary (Annual) | Typical Qualification |

| Analyst – Entry Level | ₹6-12 LPA | CFA ≥ Level 1, grad degree |

| Junior Research Associate | ₹7-13 LPA | CFA Level 2, 0-2 yrs exp |

| Investment Banking Analyst | ₹10-20 LPA | CFA Level 2 or CFA Level 3 |

Note: These figures vary based on city, company, and undergraduate background. Mumbai, Gurugram, and Bengaluru offer the biggest starting packages for CFA candidates.

Mid-Career CFA Salary in India (CFA Level III Passed, CFA Charterholder)

Once you’ve passed CFA Level III or earned your Charter (with four years’ experience), salaries accelerate sharply, reflecting both technical expertise and leadership potential.

| Role | Avg Salary (Annual) | Typical Experience |

| Equity Research Analyst | ₹15-25 LPA | CFA Charterholder + 3-6 yrs |

| Portfolio Manager | ₹20-40 LPA | CFA Charterholder + 5-10 yrs |

| Senior Risk Analyst | ₹17-28 LPA | CFA Charterholder + 5+ yrs |

For high performers at MNCs, investment banks, or asset management firms, bonuses can lift total compensation by another 30-40% especially in bull markets or top investment teams.

Senior CFA Salary in India

Moving into senior or leadership positions, charterholders can command compensation rivalling top corporate executives, especially in Mumbai and Delhi.

| Role | Avg Salary (Annual) | Experience |

| VP – Investments | ₹40-70 LPA | CFA Charterholder + 10-15 yrs |

| Fund Manager | ₹30 LPA – 1 Crore | CFA Charterholder + 12+ yrs |

| Head – Research/Products | ₹50 LPA – 2 Crore | CFA Charterholder + 15+ yrs |

Bonuses, profit sharing, and ESOPs can make up a significant chunk of total compensation at this level – sometimes doubling the base pay.

CFA Salary in India: By Industry and Sector

The CFA Charter isn’t just for banks. Salaries are influenced dramatically by your chosen industry, type of company, and scope of role. Here are some key verticals hiring CFAs:

- Investment Banking: Highest salaries, especially for dealmakers and analysts.

- Portfolio & Asset Management: Attractive base pay, with incentive-based bonus structures.

- Equity and Market Research: Growing demand, premium pay for niche expertise.

- Private Equity/Venture Capital: Lucrative for those moving into fund-level investment roles.

- Fintech and Startups: Rapidly growing, but packages are variable – often with equity upside.

- Consulting: Risk consulting, investment advisory, and valuation roles offer diverse opportunities.

- Corporate Finance: Increasing demand for CFAs in FP&A, M&A, and treasury teams.

- Regulatory/Government: Lower base pay, but strong job security and benefits.

| Industry | Average CFA Salary Range |

| Investment Banking | ₹15-50 LPA |

| Portfolio / Asset Management | ₹20-60 LPA |

| Equity Research | ₹12-35 LPA |

| Consulting & Advisory | ₹10-25 LPA |

| Fintech & Startups | ₹8-30 LPA (often with ESOPs) |

| Corporate Finance | ₹10-22 LPA |

| Risk Management / Treasury | ₹15-40 LPA |

Regional Salary Differences: Mumbai vs. Other Cities

Location matters. Mumbai, the financial epicentre, pays 20-40% above national averages for CFA professionals. Bengaluru’s fintech sector, Gurugram’s corporate hubs, and even Hyderabad and Pune offer attractive opportunities – but smaller cities or Tier 2 locations may pay significantly less.

- Mumbai: ₹10-20 LPA (entry), ₹25-50 LPA (mid), ₹50 LPA -1 Crore (senior)

- Bengaluru: ₹8-15 LPA (entry), ₹20-35 LPA (mid), ₹35-75 LPA (senior)

- Delhi NCR, Gurugram: Similar to Mumbai/Bengaluru in a finance job cluster in select MNCs.

- Kolkata, Ahmedabad: Lower salary bands, but rising as financial services expand.

CFA Salary in India: By Roles or Functions

The role you play matters just as much as your experience. Here’s how compensation typically maps across common CFA positions:

| Role | Average Salary Range | Typical Responsibilities |

| Equity Research Analyst | ₹15-25 LPA | Market and company valuation, investment analysis |

| Investment Banking Analyst | ₹10-20 LPA | Deal valuation, M&A research, pitchbooks |

| Portfolio Manager | ₹20-40 LPA | Asset allocation, performance management |

| Risk Analyst | ₹12-25 LPA | Risk modelling, compliance, strategy |

| Fund Manager / VP Finance | ₹40 LPA – ₹1 Cr+ | Investment leadership, governance, and client advisory |

The closer your role is to strategy and fund performance, the higher your compensation tends to be.

Let’s unpack what those numbers actually mean, what drives them, and how the CFA can reshape your financial career from the ground up.

Comparing CFA Salaries With Other Certifications

How does CFA stack up against ACCA, CPA, or FRM? Here’s a transparent comparison based on actual pay data and career prospects.

| Certification | Entry Level | Mid Career | Senior Role | Typical Sectors |

| CFA | ₹6-12 LPA | ₹15-40 LPA | ₹40 LPA-2 Crore | Investments, Banking, Research |

| ACCA | ₹5-8 LPA | ₹12-20 LPA | ₹40 LPA+ | Audit, Accounting, Corporate Finance |

| CPA (US) | ₹8-15 LPA | ₹20-30 LPA | ₹35-60 LPA | Audit, Consulting |

| FRM | ₹4-8 LPA | ₹10-25 LPA | ₹30-80 LPA | Risk, Treasury, Corporate Risk |

Key Takeaway: CFA delivers higher salaries in investment, research, and portfolio roles. ACCA and CPA dominate accounting/audit roles; FRM pays a premium in risk management, especially at banks and large corporates.

Bonus and Variable Compensation

One of the least understood aspects of CFA pay is variable compensation – bonuses, performance incentives, ESOPs, and profit sharing. Here’s what you need to know:

- Bonuses: Top-tier analysts and associates earn bonuses from 20% to 50% of their base salary, linked to fund performance and deal outcomes.

- Profit Sharing: Common in investment management and private equity, can add 20-100% to annual pay for senior roles.

- ESOPs & Equity: Fintechs and startups incentivise CFA talent with equity. While risky, these can be highly lucrative over time.

- International Packages: Working for global investment banks or MNCs can mean dollar – or pound-linked bonuses, making net take-home far higher.

This video shows a mock interview to crack an interview for CFA roles.

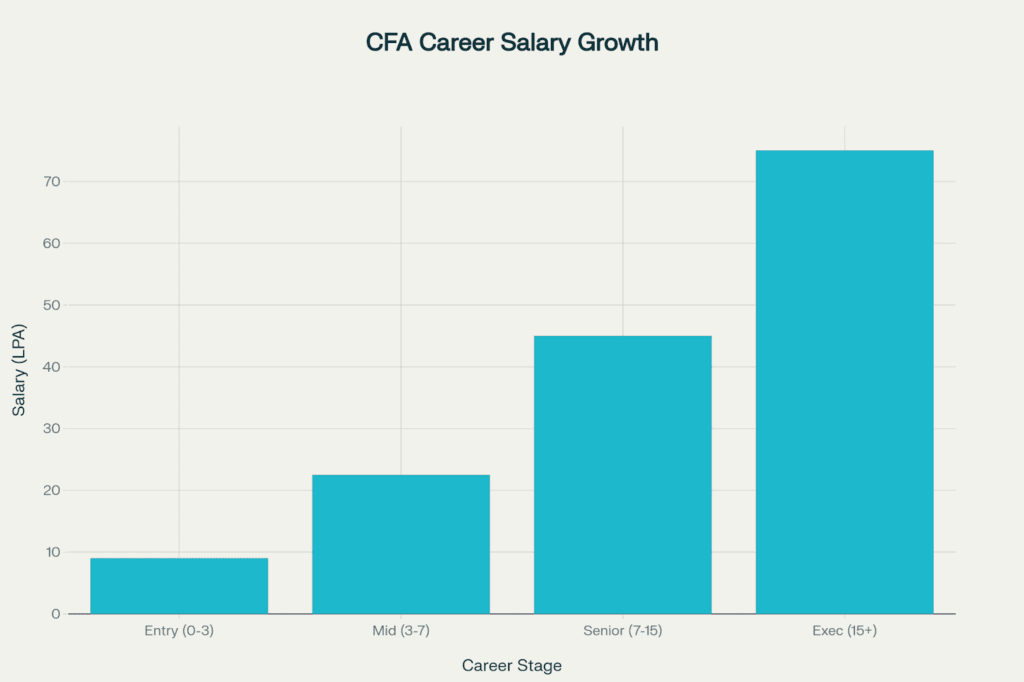

CFA Salary Growth Trajectory: How Fast Can You Hit Six Figures?

Hitting a six-figure (₹1 Crore+) salary isn’t easy, but achievable for high-performing CFA charterholders in India. On average, it takes:

- 5-7 Years to reach ₹30-40 LPA as a mid/senior analyst, with solid experience and performance.

- 8-12 Years to break the ₹1 Crore bracket, typically moving into fund management, senior product head, or director roles.

- Faster Trajectory possible with brand (IIM/IIT), global bank roles, or exceptional networking/accomplishments.

| Career Stage | Approx Salary Range | Work Focus |

| Entry-Level | ₹6-10 LPA | Research, analytics, and financial modelling |

| Mid-Level | ₹5-30 LPA | Investment planning, portfolio support |

| Senior | ₹30-50 LPA | Market strategy, fund oversight |

| Leadership | ₹50 LPA – ₹1.5 Cr+ | Fund management, executive advisory |

Factors Influencing CFA Salary in India

What pushes CFA salaries higher or holds them back? Here are five essential factors:

1. Work Experience

Experience is king. Freshers get a premium over standard finance grads, but seasoned CFA charterholders can double or triple base pay by moving up the value chain. The more markets, instruments, or sectors you handle, the more valuable you become.

2. Location

Metro cities, especially Mumbai, yield higher packages. Living costs are greater, but so is exposure and networking.

3. Industry Sector

Investment management, private equity, and international banks pay more than domestic corporates or smaller consultancies.

4. Company Size and Brand

Global MNCs, top asset management firms, and bulge-bracket banks reward CFA credentials with higher CTC, better perks, and long-term career paths.

5. Performance and Personal Branding

High performers – those who drive business, win deals, or build standout research are fast-tracked for bonuses and promotion. Earnings explode when you can show measurable returns or business impact.

CFA Salary: India vs Global Comparison

So how do Indian salaries compare globally? The CFA Institute Global Salary Survey 2024 gives us perspective:

| Region | Base Salary (Mean) | Total Compensation (Mean) |

| Americas | $130,000 | $155,000 |

| Europe | $100,000 | $120,000 |

| Asia-Pacific | $37,000 | $45,000 |

| India (within MEAI region) | $30,000–$35,000 | $38,000–$42,000 |

The dollar figures abroad look higher, but when adjusted for living costs, CFA salaries in India offer exceptional purchasing power, especially within Tier 1 finance hubs like Mumbai, Gurugram, and Bengaluru.

CFA Recruitment and Top Employers in India

Curious who hires CFA talent and what roles they offer? Here’s a snapshot of the top employers and the positions they seek:

Top Recruiters

- Investment Banks: JP Morgan, Goldman Sachs, Morgan Stanley, Citi, Deutsche Bank

- Asset Management Firms: ICICI Prudential, SBI Mutual, HDFC Asset Management, Kotak AMC, Franklin Templeton

- Consultancies: EY, KPMG, Deloitte, PwC (for risk/investment advisory)

- Fintech Startups: Zerodha, Groww, Paytm Money, Upstox, Pine Labs

- Corporations/MNCs: Tata Group, Aditya Birla, Reliance Industries, Wipro

- Rating Agencies: CRISIL, ICRA, CARE Ratings

Most in-demand Roles

- Equity Analyst – ₹17 LPA average salary.

- Investment Banking Analyst – ₹15.1 LPA average salary.

- Portfolio Manager/Assistant Manager – ₹24.5 LPA average salary.

- Risk Analyst – ₹17 LPA average salary.

- Corporate Finance Manager – ₹22.6 LPA average salary.

- Research Associate – ₹10.9 LPA average salary.

- Treasury Analyst – ₹15.3 LPA average salary.

CFA Salary in India: Gender and Diversity Trends

While finance has historically favoured men, recent years have seen more women CFA charterholders breaking salary and promotion records. Leading firms offer equal access, but individual negotiation and networking remain critical for maximising pay equity.

Emerging Roles

CFAs who combine financial strategy with data analytics and AI insights will redefine investment research and risk modelling. These professionals won’t just interpret reports, they’ll build intelligent systems that optimise portfolios and predict market behaviour.

- Fintech Product Advisor – ₹16.8 LPA average salary.

- ESG Research Analyst – ₹26.4 LPA average salary.

- Sustainable Investment Advisor – ₹21.8 LPA average salary.

- Impact Fund Manager – ₹19.1 LPA average salary.

- Fintech Valuation Specialists – ₹30.8 LPA average salary.

- Blockchain Investment Analysts – ₹10.7 LPA average salary.

- Risk Advisors for Digital Assets – ₹ 23.1 LPA average salary.

- Venture Capital Analyst – ₹14 LPA average salary.

- Private Equity Associate – ₹24.5 LPA average salary.

- Alternative Investments Strategist – ₹29.7 LPA average salary.

The finance industry is no longer limited to banks; it’s expanding into platforms, apps, and ecosystems that thrive on automation and predictive modelling. CFAs who adapt to that shift will lead the game.

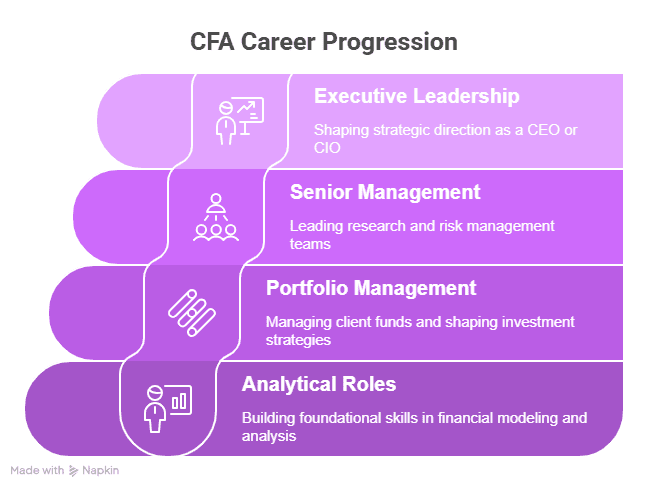

What Roles to Expect in the Next 5 years?

When someone says the finance industry is evolving faster than ever, they’re not exaggerating. Between AI, climate-conscious investing, and digital assets, the rulebook of modern finance is being rewritten. The exciting part? CFA Charterholders are at the centre of it all.

The CFA credential has always been about mastering analysis, ethics, and investment judgment. But in the next five years, its value will go beyond traditional roles like equity research or portfolio management; it’s expanding into new, high-growth frontiers.

Here’s what the future looks like for CFAs stepping into the new decade.

- Quantitative Finance Analyst – ₹28.3 LPA average salary.

- AI Investment Strategist – ₹26 LPA average salary.

- Data Analytics Manager for Funds – ₹26.3 LPA average salary.

- Financial Risk Intelligence Lead – ₹24.5 LPA average salary.

- Compliance and Regulation Consultant – ₹18.47 LPA average salary.

- Cyber Risk Finance Manager – ₹30 LPA average salary.

International Opportunities for Indian CFA Charterholders

The CFA Charter’s acceptance across 165 countries. This global recognition means Indian professionals are landing roles in London, New York, Hong Kong, Singapore, and Dubai – often earning 2x-5x domestic salaries.

CFA charterholders from India can earn 2x to 5x their domestic salary by working in these global financial centres.

- Salaries vary with experience, role, and local cost of living; high nominal pay in places like NYC or London may be balanced by living costs.

- The CFA charter is highly portable, recognised in 165+ countries, enabling easier mobility between financial hubs.

- Beyond salary, international roles offer exposure to global markets, diverse financial products, and accelerated career paths.

This offers a clear snapshot of where global CFA jobs pay the most and the breadth of international opportunities available to Indian charterholders.

Potential ROI: Costs vs Rewards

Ask any CFA charterholder, and they’ll tell you – the biggest return isn’t just the salary. It’s the transformation. You start thinking like an investor, not an accountant. You become fluent in the language of risk, return, and long-term strategy.

The cost of earning a CFA charter is approximately ₹2 LPA, typically spread over several years, covering exam fees, study materials, and registration. Completing all levels requires a serious time commitment – candidates usually spend 4 to 5 years passing exams and fulfilling the mandatory 4,000 hours of professional experience.

Each exam is challenging, with pass rates ranging from 40% to 50%, emphasising the CFA’s rigour and the exclusivity of the qualification. But that challenge is precisely what makes the charter so highly regarded and well compensated worldwide.

In short, the cost is meaningful, both in time and money, but the reward is far greater. You’re not just investing in a certification, you’re investing in a profound shift in how you see and influence finance.

And that’s exactly why companies pay a premium – because you don’t just work in finance; you shape it.

FAQs on CFA Salary in India

If you’re thinking about pursuing the CFA or curious about salaries after pursuing CFA, these FAQs will give you a clear picture of what to expect from the course, program fees, salaries and recognition, to real-world challenges and opportunities.

What is the entry requirement for the CFA program?

You can begin your CFA journey if you’ve already earned a bachelor’s degree or are in your final year of college. Even working professionals with relevant experience can apply. So, if graduation is around the corner, you’re good to go for Level I. Undergraduates in their final year can enrol and sit for the Level I exam.

How much does the CFA program cost?

On average, the total cost of CFA comes to about ₹2 lakhs spread across the three levels – including registration, exams, and materials. The cost is relatively lower if you clear all levels on the first attempt.

How much do fresh CFA candidates (Level I or II) get paid in India?

CFA Level I and II candidates usually start with salaries at ₹6-12 LPA, depending on their academic background and city. With each level cleared, those numbers climb steadily, especially in metro markets like Mumbai and Bangalore.

Which is better for investment banking: CFA or ACCA?

CFA is tailored for investment banking, research, and asset management; ACCA focuses more on accounting and audit functions. If your dream job is in investment banking, portfolio management, or asset management, CFA is your clear winner. ACCA, on the other hand, fits better if you’re drawn to accounting, tax, or audit roles.

Do CFA charterholders have international mobility?

Yes, Indian CFA charterholders can land finance jobs in over 165 countries, including the US, UK, Singapore, and Dubai, with lucrative packages. That global credibility is one of the reasons it’s so respected.

How challenging is the CFA exam?

All three levels are intense and require deep study; it’s rigorous but fair, with pass rates hovering around 40-50% per attempt, signalling a tough but rewarding journey.

Key Prospects for CFA Charterholders: The Takeaway

- Industry Recognition: The CFA is increasingly required or preferred for senior roles in banking, investments, asset management, and fintech.

- Salary Upside: India is seeing premium compensation packages for CFA holders, especially in Tier 1 cities and global firms.

- Career Mobility: From equity research to corporate finance, risk, and consulting, CFA opens diversified paths for fast-track growth.

- Longevity and Growth: The CFA Charter is an asset for life. Even in tough markets, charterholders retain employability and edge.

Unlocking Your Financial Future: CFA Career in India

The CFA Charter is much more than a line on your resume; it’s a catalyst for remarkable careers, a mindset shift, higher salaries, and international growth. It transforms how you see business, money, and decision-making. Whether you’re eyeing Wall Street, Dalal Street, or the fintech frontier, the CFA certification is your passport to global finance.

If you aspire to world-class finance roles, thrive on analytics and investment decisions, and want salary packages that stand out in a crowded job market, the CFA is unparalleled. For those passionate about accounting, auditing, and tax, consider ACCA or CPA. For risk management, FRM offers niche rewards. But for investment, financial analysis, and asset management, CFA remains king.

Enrol today to step onto a global stage and position yourself for the top jobs across India and the world.

In India’s dynamic and expanding financial sector, CFA professionals are at the centre of transformation, commanding premium compensation and opening doors to diverse, high-value roles. If you’re serious about success in finance, the path starts here. Imarticus offers CFA in association with KPMG in India, which gives you an added advantage of industry collaboration with internship opportunities. The markets don’t wait. Why should you?