Dreaming bean-counting as a career? Hold on, there’s more to the Certified Public Accountant job description than tax forms and calculators. These financial geniuses are most often the behind-the-scenes heroes supporting businesses and navigating people through money minefields. Let’s see if this is your cup of coffee.

What Does a Certified Public Accountant Do?

Right, let’s put that stereotype of CPAs as stodgy bean-counting nerds to rest immediately

The CPA working functions are actually quite varied, as it turns out:

- Sorting out tax horrors that’d make most people’s head spin

- Keeping company books from cooking the books

- Identifying sneaky money-saving ploys that business owners haven’t yet caught up with

- Giving plain-English guidance that cuts through financial jargon

We were discussing this with a CPA buddy the other day and chuckling at how much his work has changed. He spends more time consulting clients and planning than curating numbers into spreadsheets. The AICPA doesn’t mind – about 40% of CPAs now do more advisory work than straight accounting. Not so boring after all, huh?

CPA Responsibilities: Much More Than Spreadsheets

The Certified Public Accountant duties have grown up. The calculator and receipt segregation days are behind us.

The Day-to-Day Bread and Butter

CPAs reconcile huge pieces such as:

- Battling Byzantine tax codes (so you don’t lose your mind)

- Being the financial detective in case there’s an audit

- Taking confusing financial data and making it readable by mere mortals

- Putting accounting systems in place that won’t drive people to pull their hair out

The Really Interesting Strategic Stuff

But more and more, CPAs do too:

- Work their way across the books to find out where money’s being wasted

- Suggest technology that gets the job done (not new and glitzy just for the hell of it)

- Spot financial disasters in the making before they blow

- Help companies grow without leaving financial landmines behind

Becoming a CPA: A Good Slog, But Worth It?

Achieving those three letters after your name? It ain’t exactly a stroll in the park. Certification weans out the part-timers pretty darn fast.

The Study Bit

In order to even sit for the CPA exam, you’ll need:

An accounting or equivalent degree

- 150 semester hours (yes, more than an average degree – no penny-pinchers here)

- Specialised classes in accounting, business law, and taxation

Each state has regulations, but each demands more education than an average bachelor’s degree. It’s a marathon, not a sprint, and that’s why many of my university classmates started down the CPA track but didn’t finish them all.

The Certification Obstacle Course

The whole process is like

1. Filling all those boxes of education

2. Sitting and passing the four-part CPA exam (which loses around half who sit for it)

3. Picking up 1-2 years worth of experience under a actual CPA

4. Practising lifelong learning (as tax law alters more often than British weather)

Where Do CPAs Actually Work

The best thing about the CPA qualification? It’s stone dead adaptable. CPA job opportunities come literally wherever there is money changing hands.

The CPAs’ Natural Homes

| Industry | What You’d Really Be Doing |

| Public Accounting | From easy tax returns to sneaky advisory work |

| Corporate Finance | Keeping the books in balance and looking for ways to make more money |

| Government | Not flushing taxpayer money down a rat hole |

| Non-profit | Stretching pennies and satisfying grant sponsors |

| Education | Teaching the future (while war-storrying about tax time) |

Fancy Something a Bit Different?

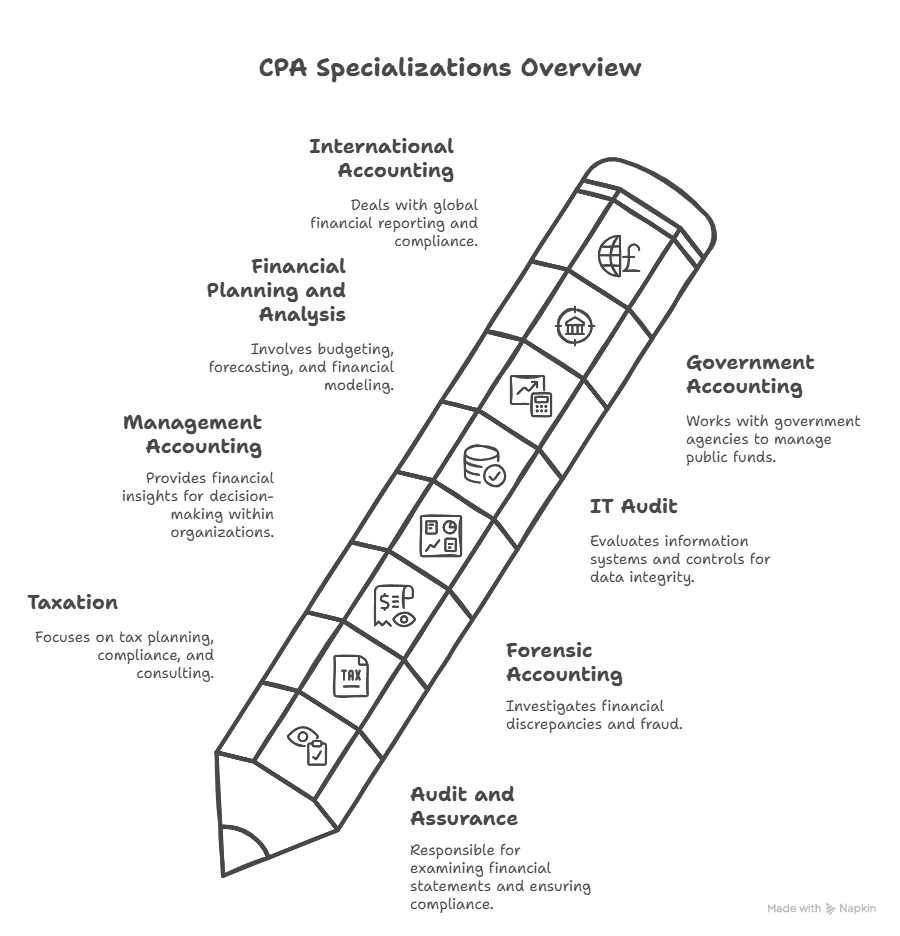

Some CPAs pursue specialty careers like:

* Forensic accounting (breaking financial crimes)

* Environmental accounting (making green profitable)

* International taxation (for those who enjoy nice, challenging puzzles)

* Information systems (where money and technology intersect in interesting ways)

Show Me the Money: CPA Salary and Growth

Now you might be willing to know how much CPAs earn, don’t you? The career prospects and CPA pay are not to be sneezed at, which is why people overcome the qualification hurdle.

Robert Half’s latest figures show CPAs earn 10-15% more than their un-certified counterparts. Over a lifetime, that’s a holiday home or private school fees.

The Pay Journey

* New graduates (0-2 years): £45,000 – £55,000

* Getting-the-hang-of-it (3-7 years): £60,000 – £85,000

* Old pros (8-12 years): £90,000 – £120,000

* Top performers (13+ years): £125,000+ (partners in large firms earn an awful lot more)

They vary based on where you work, what industry you specialise in, and where your specialty is. A London City financial district CPA might be neck-deep in it, while a country practitioner might make less but be out on weekends from email.

Is CPA a Good Career?

Let’s get the good, bad, and sometimes ugly into perspective before you head straight into the certified public accountant job description.

The Absolute Positives

Recession-proof : Even when the economy’s in the dumpster, folks still need financial gurus

Options aplenty: Work for yourself, a massive company, or somewhere in between

Respect factor: Even that CPA qualification still commands a great deal of respect

Fair pay: Not startup riches, but good, steady cash

The Less Clever Bits

Getting qualified might be tough: The actual exam does have a 50% failure rate

Madness on tax return season: February-April can mean 60+ hour weeks and takeaway breakfasts, lunches and dinners

Continuous swotting: The regulations change all the time, so you’re constantly learning

Early career drudge work: Junior positions are actually soul-destroying

Remarkably, a survey by Accounting Today found 85% of CPAs actually enjoy their profession choice despite the highs and lows. They particularly enjoyed job security and that each day is different.

Would You Fit In?

The CPA career path actually appeals to people who:

* Get an odd kick out of figuring out tough problems

* Don’t mind being the voice of fiscal reason (even when nobody else will be)

* Pick up on little things that other people never even see at all

* Can take financial geek-speak and make it plain English

* Have a strong sense of right and wrong when money is involved

CPAs and Tech: Not Foes Anymore

The modern certified public accountant job description is filled with lots of technology. But rather than AI performing all the accounting, technology is transforming the way CPAs conduct business – for the most part, for the better.

Today’s CPAs employ the following on a daily basis:

* Cloud accounting software that makes older desktop software look ancient enough

* Data analysis software that identifies patterns humans wouldn’t catch

* AI for mind-numbing repetitive tasks (the work no one enjoyed doing in the first place)

* Blockchain for tamper-proof transactions

This tech revolution means less mind-numbing data entry and more interesting analysis. My CPA friend jokes that technology has saved him from getting permanent spreadsheet-induced eye damage.

Here’s a closer look at how technology is revolutionizing accounting:

Hot CPA Specialisations That Are Actually Interesting

Some of the CPA work is particularly in demand these days, with faster career growth and greater pay.

Financial Forensics

Financial sleuths find financial crime by:

* Uncovering fraud schemes (which grow more complex each year)

* Estimating damages in lawsuits and insurance claims

* Finding hidden assets in dirty divorces and bankruptcies

* Translating complex financial evidence to judges and jurors who didn’t study accounting

ESG Accounting

As sustainability moves from nice-to-have to business-critical, CPAs with Environmental, Social, and Governance accounting skills assist in:

* Imposing sustainability reporting that actually says something

* Performing ESG audits that don’t fall into greenwash

* Unraveling the increasing complexity of green rules without losing the plot

PwC reports ESG accounting professionals have experienced an 82% boost in demand since 2020.

FAQs: What People Really Want to Know About CPA Careers

Q1: How long does it take to become a CPA?

A US CPA certification requires 12-18 months of preparation

Q2: Does the CPA qualification transfer well overseas?

The US CPA is highly regarded nearly wherever you travel, although you will probably need to acclimatize to local regulation if you are keen to work overseas.

Q3: Can I work part-time as a CPA?

A3: Absolutely! There are loads of CPAs working flexible hours, especially once they’ve had some experience. Perfect if you have family or other responsibilities to take care of.

Q4: What’s the actual distinction between an accountant and a CPA?

Becoming a CPA takes further schooling, taking a rightfully tough test, supervised work experience, and continuing professional education. It’s similar to being someone who likes to cook versus being a professional chef.

Q5: How much does the CPA certification actually advance?

Robert Half found CPA-certified professionals are 15% more apt to progress to senior financial roles than those without a certificate. It’s often the differentiator between two otherwise equally skilled applicants.

Q6: Do CPAs merely sit and stare at figures all day?

CPAs nowadays require people skills because they’re playing the role of business consultants more frequently.

Q7: With all this automation, will CPAs still have jobs in 10 years?

Indeed, they do. Automation handles mundane details so CPAs can focus on more valuable advisory engagements. The BLS forecasts steady 6% growth to 2028, which is not so bad.

Q8: What about industry specialties for CPAs?

A8: Of course – some CPAs specialise in healthcare, technology, real estate, or entertainment. Industry specialisation can demand top dollar because you know the special issues.

For a no-BS guide on how to crack the CPA exam, attempt this

Conclusion: Is the CPA Path Worth the Hassle?

Role definition of certified public accountant verifies a career that is never static. It integrates technical capabilities with business skill, offering numerous career possibilities to the candidate ready to invest in the front-end sweat equity.

Key Takeaways:

1. Job Security and Flexibility – The CPA designation opens doors to employment in an unlimited array of industries and never goes out of style when the economy heads down the tubes.

2. Less Math, More Strategy – The CPA’s role in today’s day and age is more conceptual and advisory, and less compliance and math-intensive.

3. Worth the Slog – Sure, obtaining a CPA does take humongous amounts of effort to begin with, but the payoff in the long run is most definitely worth it for the majority who persevere.

Believe the certified public accountant career path is for you? Take the first step. Download our brochure or talk to one of our programme advisors about how our specialist accounting courses could be the beginning of your journey.