Introduction

So, you wish to have a career that is high-flying, intellectually stimulating, and financially rewarding in investment banking? You’re not the only one. It may be the excitement of financial markets, the thrill of executing multi-crore deals, or the pride of working for global companies, but investment banking draws the best brains. But before you get that coveted job, you must know just what it will take to achieve it.

Let’s dissect the vital qualifications, degrees, and skills that pave the way for an electrifying investment banking career.

Table of Contents

- Investment Banking Qualifications You Need

- Best Degrees for Finance Careers

- Educational Requirements for Bankers

- Finance Certifications for Investment Banking

- MBA for Investment Banking: Is It Worth It?

- Top Finance Courses for Banking Jobs

- Skills Needed for Investment Banking Roles

- Comparing Qualifications: A Table

- FAQs

- Key Takeaways

- Conclusion

Investment Banking Qualifications You Need

To break into investment banking, especially in the competitive market, you’ll need:

- A strong academic background (preferably in commerce, economics, or finance)

- A bachelor’s or master’s degree in finance-related fields

- Recognised certifications that signal technical expertise

- Soft skills like communication, negotiation, and problem-solving

Minimum qualification required for bankers in this space is a- bachelor’s degree, while they prefer higher-level certifications and post-graduate degrees. Professionals also get exposure to internships, workshops, and live projects, which increase exposure to real-world realities and networking.

Best Degrees for Finance Careers

Wondering which degrees best support a career in investment banking? Here’s a rundown:

| Degree | Why It’s Useful |

| B.Com/BBA | Builds strong finance and accounting foundation |

| BA in Economics | Enhances understanding of markets and policy |

| Chartered Accountancy | Deepens financial reporting and analysis skills |

| MBA (Finance) | Broadens strategic thinking and leadership skills |

| CFA | Globally recognised and highly valued |

Selecting the top degrees for finance jobs can pave the way for your career. Additionally, such careers also usually entail access to solid networking from alumni, finance clubs, and on-campus placements, which may be determinant in securing leading positions.

Educational Requirements for Bankers

The basic educational requirements for bankers interested in investment banking include:

- Completion of Class 12 with Commerce or Science (Maths preferred)

- Undergraduate degree in Finance, Economics, or related fields

- Optional but beneficial: Postgraduate degree or diploma in Finance

- Relevant internships with finance firms or startups

Early planning and consistent academic performance are key. Students who participate in business case competitions, finance internships, and summer analyst programs significantly improve their chances of entering top-tier investment banks.

Finance Certifications for Investment Banking

Certifications can give you a real edge in a crowded talent pool. Here are the most respected finance certifications for investment banking:

- CFA (Chartered Financial Analyst)

- FRM (Financial Risk Manager)

- CIMA (Chartered Institute of Management Accountants)

- NISM & NCFM Modules for Indian regulatory knowledge

- CPA (Certified Public Accountant) for global mobility

These demonstrate expertise and dedication to recruiters worldwide. Completing these certifications also proves your commitment to continuous learning & can significantly boost your salary potential and career trajectory.

MBA for Investment Banking: Is It Worth It?

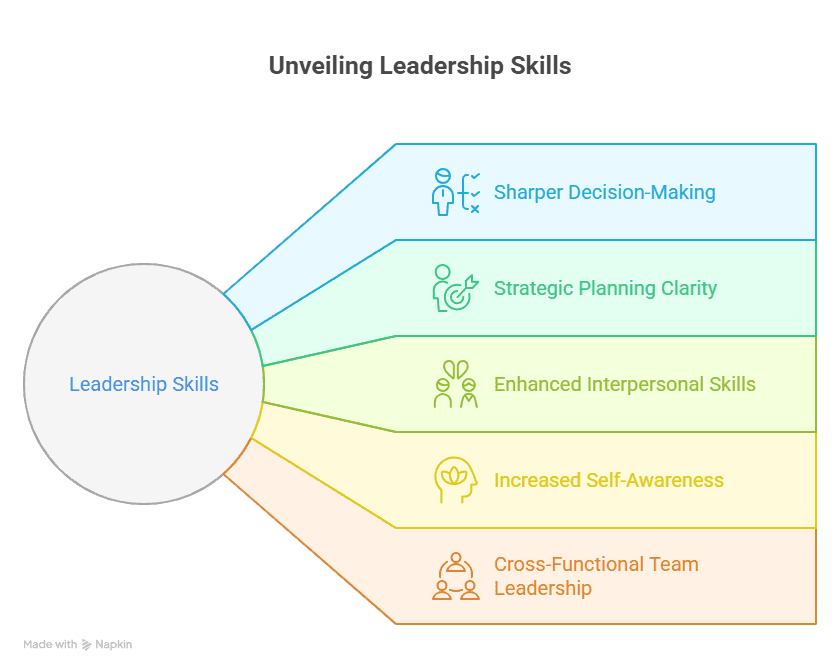

Absolutely. An MBA for investment banking acts like a career catalyst. Here’s why:

- It helps transition from mid-level roles to leadership

- Many top recruiters visit B-schools for campus hiring

- It offers networking opportunities with alumni and industry experts

Focus on Tier-1 institutes like IIMs, ISB, XLRI, or global names like INSEAD and London Business School. Apart from the degree, the peer learning and case-study approach of MBA programs sharpen decision-making and leadership skills essential for investment bankers.

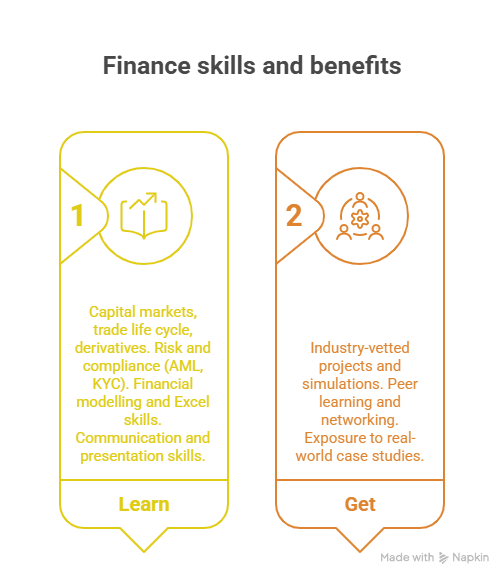

Top Finance Courses for Banking Jobs

Apart from traditional degrees, consider these top finance courses for banking jobs:

- Certified programs in Investment Banking (like those from Imarticus Learning)

- Online courses on platforms like Coursera or edX

- Executive programs from NSE, BSE Institute, or IIMs

These equip you with both theoretical understanding and hands-on training. Some programs also include placement support, industry mentorship, and access to real-time trading simulations, making them extremely valuable for beginners and professionals alike.

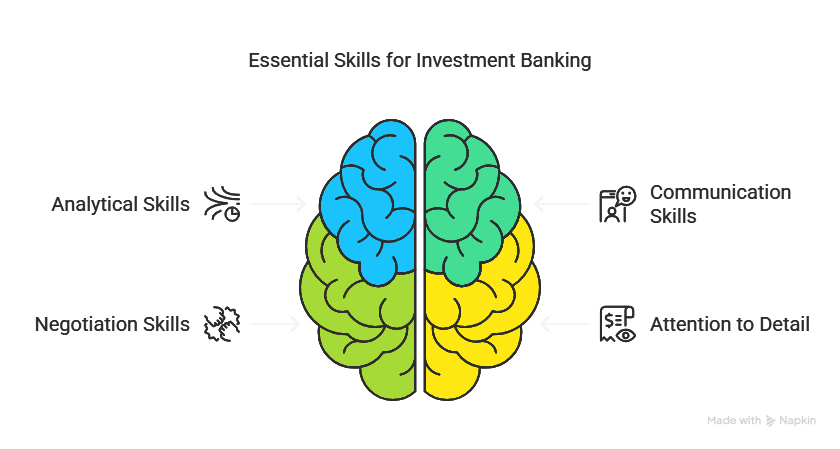

Skills Needed for Investment Banking Roles

While qualifications matter, your skills determine your success.

- Top Skills Needed for Investment Banking:

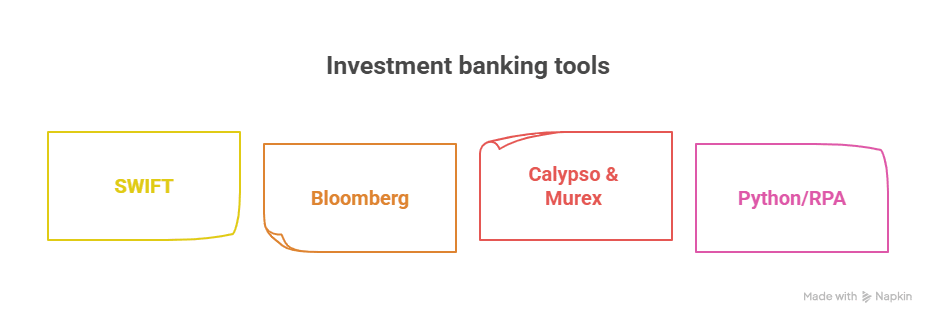

- Financial modeling and valuation

- Excel, PowerPoint, and data tools proficiency

- Analytical and problem-solving ability

- Communication and interpersonal skills

- Ability to work long hours under pressure

- Presentation and storytelling skills

A well-rounded profile is what truly builds a standout career in investment banking. Employers value candidates who show leadership potential, adaptability, and commercial awareness in high-stakes financial environments.

Comparing Qualifications

| Qualification | Entry-Level Role | Avg. Package | Global Recognition |

| B.Com/BBA | Analyst | ₹4-6 LPA | Medium |

| CA | Analyst/Associate | ₹8-12 LPA | High |

| CFA | Associate | ₹8-15 LPA | Very High |

| MBA (Tier-1) | Associate/Manager | ₹12-25 LPA | Very High |

| PGP Investment Banking | Analyst/Associate | ₹7-10 LPA | Medium to High |

Frequently Asked Questions (FAQs)

1. What is the minimum qualification for a career in investment banking?

A bachelor’s degree in finance, economics, or business is typically the minimum, but most firms prefer candidates with additional certifications or post-graduate degrees.

2. Is CA better than MBA for investment banking?

Both have their strengths. CAs bring deep financial expertise, while MBAs offer strategic and managerial exposure, especially from Tier-1 schools.

3. Can engineers become investment bankers?

Yes, especially if they pursue an MBA or CFA to gain finance knowledge. Many top IB professionals are engineers with finance specialisations.

4. How important is CFA for investment banking?

CFA is highly regarded. While it doesn’t guarantee a job, it significantly boosts credibility and global employability.

5. What GPA or academic record is needed?

A consistently strong academic record (above 75%) is often a requirement, especially when applying to top banks or MBA programs.

6. Are online certifications valid for investment banking?

Yes, if they are from reputed platforms and cover core skills like valuation, M&A, and financial modelling.

7. Is an MBA mandatory for mid-career shifts to investment banking?

Not mandatory, but highly recommended. It enhances career switch opportunities and access to IB networks.

8. What are the top institutes for finance courses?

IIM Ahmedabad, ISB, XLRI, and institutions like Imarticus, BSE Institute, and NSE Academy are popular choices.

9. How long does it take to build a career in investment banking?

It usually takes 2-5 years post-graduation to land a strong role, depending on qualifications and networking.

10. Do investment banks hire freshers?

Yes, especially from top colleges or through certification-based programs that offer placement support.

Key Takeaways

- A career in investment banking requires a mix of education, certifications, and skills.

- Start with a finance-based degree and build up with CFA, MBA, or specialised PG courses.

- Hands-on skills and real-world application matter just as much as theoretical knowledge.

- Aspirants have multiple pathways, from CA and CFA to B-school and online certifications.

Conclusion

Investment banking is more than a job; it is a career racked with high stakes and high rewards. Entry for a fresh graduate or a mid-career changer – the right combination of qualifications, skills, and strategy will divert good fate onto a prosperous road. Start with goal setting, map possible educational courses, earn certifications, and – most importantly – build a personality that radiates competence and confidence in every direction. Once the candidate invests in the adequate preparation, the effulgent financial market awaits.

External Links: