Python is now the undisputed data science king—and, not surprisingly, so. Its simplicity, malleability, and size of library ecosystem are some of the reasons that it remains the perfect tool for data manipulation, visualization, and analysis. For either the new entrant newcomer entering the picture or the experienced analyst scaling up high-end models, mastery of the leading Python libraries for data science is the thing.

If you’re studying data science, or at least considering it, then you’ve probably already heard the names Pandas, NumPy, Matplotlib, etc. This tutorial is all about the Python packages for data analysis that will bring you up to the next level. They’re not just a timesaver— they’re a must to anyone serious about getting this done.

In this article, we will talk about the most popular Python libraries utilized in data analysis, best Python tools for data analysis, and how they are used in production pipelines, and their usage.

What Makes Python Ideal for Data Science?

Let us take a look at why Python is the favored language for data science.

Readability and Simplicity

Python has clean and readable syntax. It is easy for new developers to learn, and it removes the complexity that most programming languages contain.

Community and Support

There are wildly enormous numbers of developers who support and take care of data analysis with Python libraries with day and night support and very descriptive documentation.

Compatibility with Tools

Python is highly compatible with tools like SQL, Hadoop, Spark, Tableau, and Power BI.

Pandas: The Backbone of Data Analysis

Query any data scientist his workhorse tool for his day-to-day operations and Pandas will more than likely be the answer. Pandas offers smooth data analysis with clean data and offers high-level data manipulation capabilities.

Key Features:

- Tabular data in DataFrames

- Smooth CSV, Excel, SQL imports

- Grouping, filtering, joining, reshaping data

Use Case: Cleaning and preparing ginormous data sets to feed machine learning algorithms.

NumPy: Powerful Numerical Computing

NumPy (Numerical Python) forms the foundation of all Python data pipelines. NumPy offers n-dimensional array and high-level numerical functions.

Key Features:

- Support for large datasets

- Fourier transform, linear algebra, and random numbers

- Construction blocks for libraries such as TensorFlow and SciPy

Usage: Math calculation between ginormous matrices in a data science training course.

Matplotlib: Data Visualization Made Easy

Matplotlib is the old grandfather of Python graphics libraries. It is capable of taking raw data and converting it into meaningful visualizations with small amounts of code.

Key Features:

- Has support for bar chart, line chart, scatter plot, histogram

- Very configurable and horrifyingly flexible

- It is capable of embedding itself in applications

Use case: Plotting customer trends in exploratory data analysis.

Seaborn: Statistical Graphics on Steroids

Along with Matplotlib, Seaborn is equally good as an info-visualiser and as a prettifier. Also works exceedingly well with Pandas DataFrames.

Key Features:

- Themes and in-built color palettes

- Violin plots, regression plots, box plots, etc.

- Statistical libraries integration

Use Case: Plotting heatmaps of correlation in your data science course capstone project.

SciPy: Advanced Scientific Computing

SciPy is built on top of NumPy and is a library to facilitate scientific and technical computing. It is generally used to calculate optimisation, statistics, and linear algebra issues.

Key Features:

- Interpolation and integration

- Signal and image handling

- Multidimensional image operations

Use Case: Executing high-level simulations in research work data.

Scikit-learn: Machine Learning Simplifiedg

Due to being one of the most effective Python modules for machine learning and data processing, Scikit-learn facilitates clustering, regression, classification, etc.

Key Features:

- Preprocessing techniques like MinMaxScaler, OneHotEncoder

- Classification, regression models like SVM, Logistic Regression, etc.

- Tools for model performance

Use Case: Loan approval prediction in a banking case study for data science training.

Statsmodels: Statistical Modelling the Right Way

Statistical modelling at heart, and hypothesis testing too, if that’s what you want, then Statsmodels is the place for you. It provides you with an insight which can’t be obtained using machine learning models.

Key Features:

- Linear regression, logistic regression

- Time-series analysis

- ANOVA, chi-square tests

Use Case: Time-series forecasting model designing to predict stock prices.

TensorFlow and PyTorch: Deep Learning Giants

Even though both such libraries are technically used to perform deep learning, both these libraries get proper utilization in Python data manipulation and data analysis at the abstraction level through the use of Python.

Key Features:

- Building neural networks and training them

- GPU acceleration

- Scaling on CPUs and clusters

Use Case: Building image classification models in sophisticated AI modules.

Plotly and Bokeh: Interactive Visualisation

Matplotlib and Seaborn are awesome, yes, but Plotly and Bokeh offer something more—interactivity.

Key Features:

- Hover tools and click events in dashboards

- Integration with web apps

- Zoomable, pannable plots

Use Case: Real-time dashboard generation for a business analytics project.

Jupyter Notebook: The Ultimate Playground

Originally a standard library, Jupyter Notebook is now just a bare necessity of every data analysis practitioner. It has code, images, and documentation all under one roof.

Use case: Interactive presentation and report generation for portfolio creation.

Real-World Application: From Learning to Earning

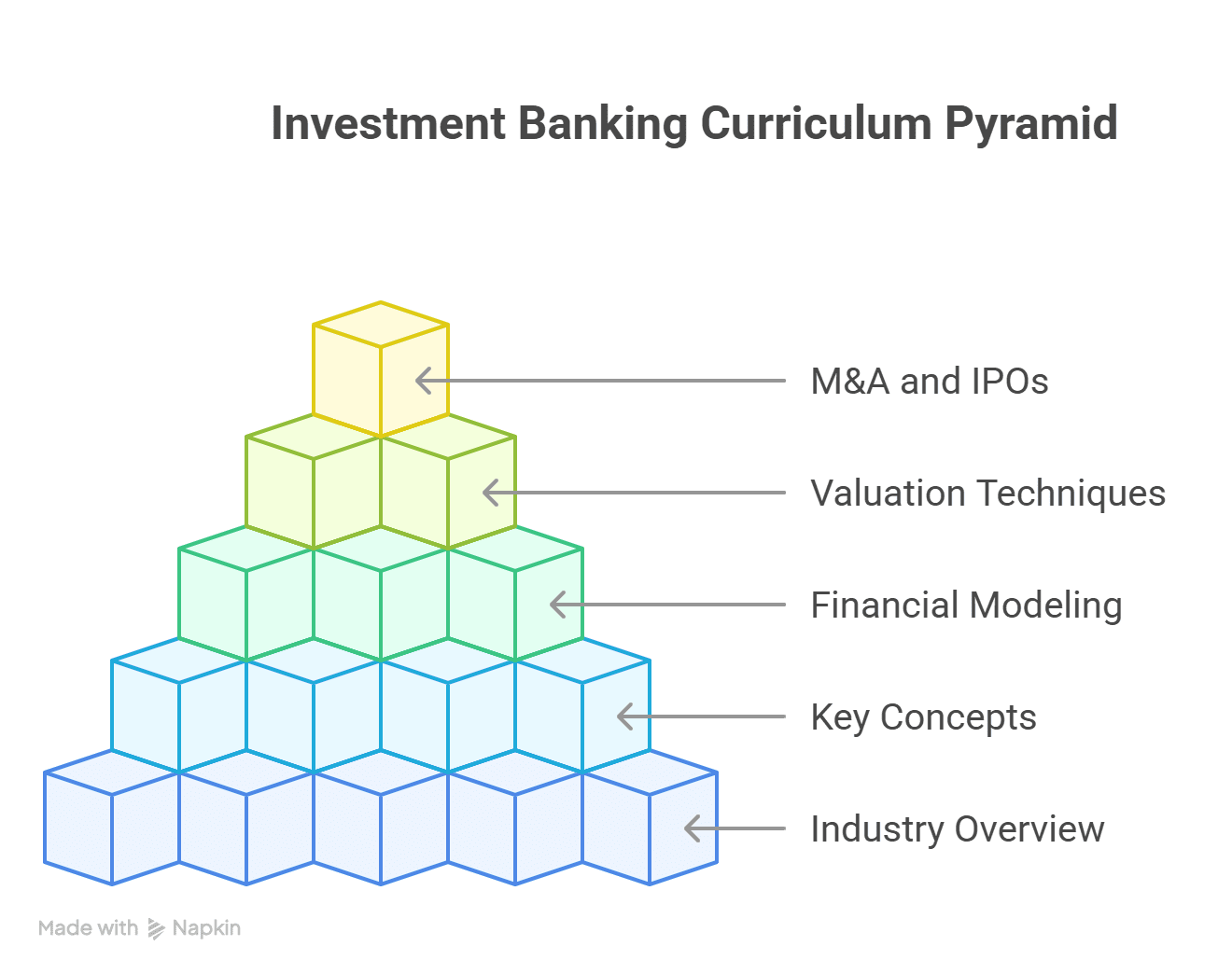

Imarticus Learning 6-month job-assured Postgraduate Programme in Data Science and Analytics covers all these best Python libraries as a part of the course. Students are guided from Pandas to TensorFlow via 25+ real-time live projects.

Online and classroom course advantages:

- 100% Job Guarantee

- 10 Sure Shot Interviews

- 52% Average salary increase

- Access to 2000+ Hiring Partners

Course curriculum allows you to collaborate with Python data manipulation libraries, such as Power BI, SQL, and live hackathon case studies.

Benefits of Mastering Top Python Libraries

Career Edge

Knowledge of top Python libraries makes you employment-ready to implement in any industry—fintech or healthcare, for example.

Practical Exposure

Imarticus’ courses don’t just make you “learn” but develop your skills through Python coding for data analysis.

Portfolio Building

You may upload all of your actual projects that you are working on at present to your GitHub, and you are competent enough to be recruited by the recruitment managers.

FAQs

1. What are the top Python libraries for data analysis?

The most important ones are Pandas, NumPy, Matplotlib, Seaborn, Scikit-learn, Statsmodels, and TensorFlow.

2. Do I need to know all libraries to start a data science career?

No, start with Pandas and NumPy for data science. Once you’re familiar with those, you’ll need to learn the others like Scikit-learn and Matplotlib.

3. Are these Python libraries used in actual companies?

Yes. Start-ups and Fortune 500s alike, these libraries make up the foundation of data teams globally.

4. Is it better to learn Python or Excel for data analysis?

Excel can be okay for small businesses but Python can be scaled up and automated and therefore is used by professionals.

5. Can I master these libraries through an online course?

Yes. Imarticus’s Postgraduate Program in Data Science and Analytics imparts comprehensive training in all the large scale Python libraries.

6. How long will it take to learn these libraries?

If you invest the time, 3–4 months will be sufficient to learn basics with projects and training from experts.

7. Are these libraries free to use?

Yes. All the aforementioned large Python libraries are open-source and free.

Conclusion

The data science world is big and breathtaking—but gated by the incorrect tools, inaccessible to you. Beginner or upgrade, discovering the best Python libraries is your path to smarter data.

If you are looking for a structured method to know about all these tools, then Imarticus Learning’s Postgraduate Program in Data Science and Analytics is your doorway to an exciting high-salary and future-proof career.