Graduation is a strange phase. On paper, it feels like a finish line. In reality, it feels more like standing at a crossroads. I’ve spoken to hundreds of students who describe the same emotion: relief mixed with confusion. You’re proud of finishing your degree, but somewhere in the back of your mind, a question keeps repeating – “What next?” That’s where ACCA, after graduation, actually steps in

For many graduates, this moment feels like stepping out into a much bigger world. College gave structure. Exams had deadlines. Results showed progress. At this stage, suddenly the structure disappears. Now, choices matter more. Decisions feel heavier because they shape the direction of your career.

This is where ACCA, after graduation, begins to make sense for a lot of students. Not because it is booming. Not because everyone is doing it. But because it offers something graduates deeply need at this stage: clarity, direction, and professional identity.

I often compare graduation to finishing basic driving lessons. You know how the car works. You understand the rules. But you’re not yet confident on highways, unfamiliar roads, or international routes. ACCA Certification is what teaches you how to drive professionally. It builds confidence, decision-making ability, and technical depth.

I’ll walk you through everything you must know before you can pursue your ACCA after graduation, so that you can choose your career path confidently.

Did you know?

Students who pursue ACCA after graduation often feel more confident in interviews because they can speak both the language of academics and the language of business.

What Does ACCA After Graduation Really Mean?

When people hear “ACCA after graduation,” they ask me what is ACCA and sometimes think it’s just another certification. But once you understand, you realise it’s much more than that. It’s a professional qualification designed to shape the way you think, work, and grow in the finance world.

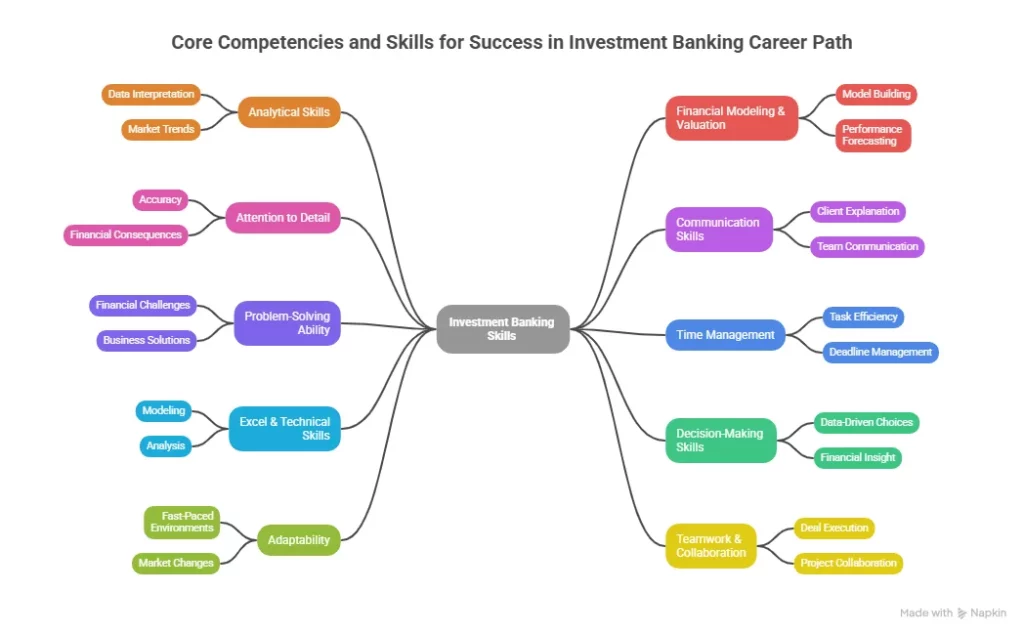

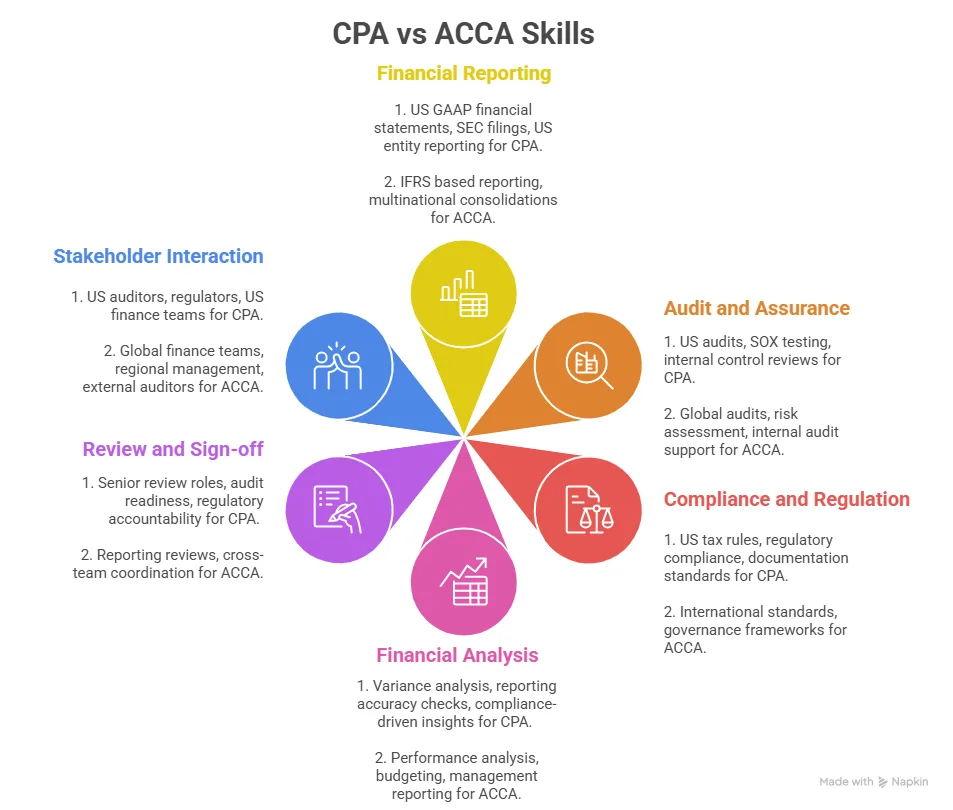

ACCA turns you into a professional who understands:

- How businesses work

- How money flows

- How financial decisions are made

- How risk is managed

- How strategy is shaped

Graduation gives you knowledge. The ACCA qualification gives you accountability.

Think of it like joining a gym after doing a nutrition and fitness course – You may know what calories, proteins, and workouts are. But none of that really changes anything until you actually walk into the gym and start moving. Once you enter the gym, discipline starts. Routine starts. Results start becoming visible. That’s when theory turns into reality. That’s when learning becomes experience.

That’s what ACCA after graduation is. It moves you from understanding finance to being responsible for finance. And that shift is powerful.

If you’re confused between CA and ACCA, this video will give you real clarity. It shows you how each path affects your career in the long run.

Why ACCA After Graduation Makes Sense Today

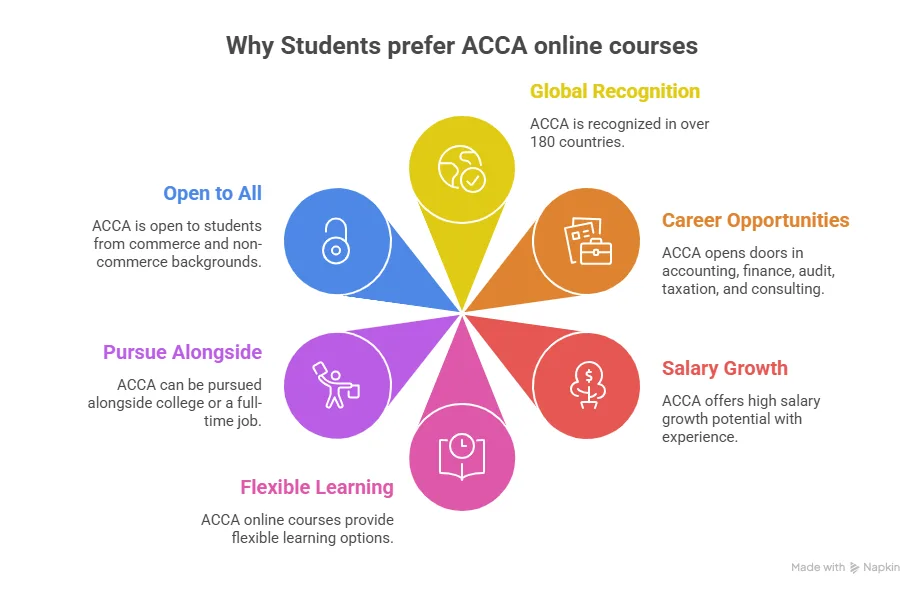

In today’s competitive job market, pursuing ACCA after graduation is a smart way to turn your academic knowledge into real, career-ready professional skills.

Holding a degree is still important, but it doesn’t make you stand out anymore. It has become the starting point, not the finish line. What employers really look for now is how ready you are for the real world.

Employers now look for professional qualifications, industry-ready skills, practical exposure, and global standards. That is why the ACCA course has gained so much relevance.

It fits perfectly into this reality because:

- It is globally recognised.

- It is structured.

- It is practical.

- It builds long-term career credibility.

Having a degree was like having a passport. Today, everyone has a passport, but ACCA becomes your visa. It determines where you can actually go. ACCA after graduation is not about starting over. It’s about upgrading your profile and taking your existing education to a global level.

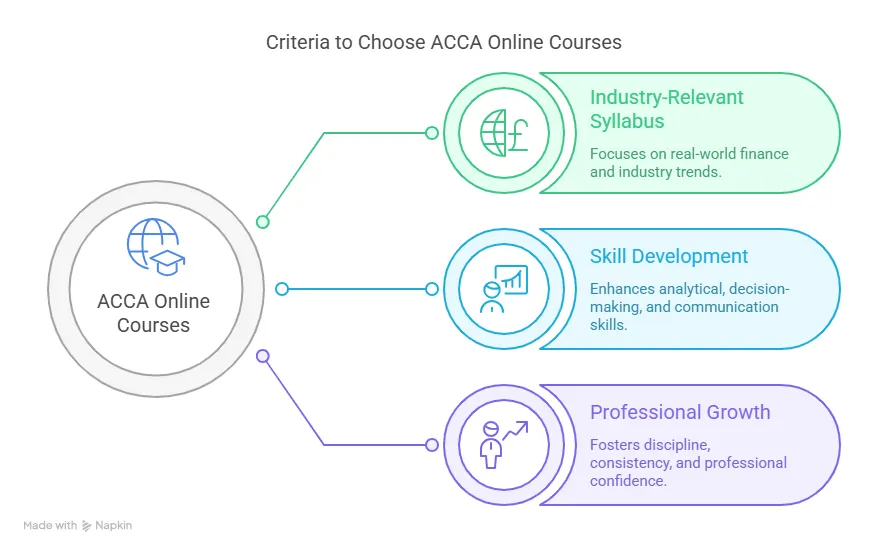

Choosing an ACCA course after graduation is a mindset shift. You stop being a student preparing for exams. You start becoming a professional, preparing for responsibility.

Your learning changes:

From memorisation → application

From theory → decision-making

From “What is the answer?” → “What is the right business choice?”

This is where the ACCA exam stands apart. It trains you to think.

I’ve seen students who were average during graduation become outstanding professionals after ACCA, not because their intelligence changed, but because their mindset matured.

Did you know?

ACCA after BCom is a very natural progression. Since BCom students already study accounting, taxation, and finance, they often get exemptions and complete ACCA faster. It is especially popular among students who want careers in audit, taxation, and corporate finance with multinational companies.

ACCA Eligibility After Graduation

One of the most comforting things about ACCA is that it doesn’t try to put everyone into one rigid box. It understands that students come from diverse academic backgrounds. That’s why the ACCA course eligibility structure is flexible and welcoming.

If you’ve completed your graduation, you are already in a strong position to start ACCA. Whether your degree is in commerce, finance, management, economics, or even a non-commerce field, ACCA has an entry route for you.

I often explain eligibility using a gym analogy. Some people walk into the gym already fit. Some are beginners. The gym doesn’t reject either. It simply assigns different starting points. ACCA works in the same way.

Here’s how it usually looks:

| Background | Exemptions (Level / Papers) | Time Reduced |

| Commerce Graduates (BCom, BAF, BBA Finance) | Exemptions in Applied Knowledge level (BT, MA, FA) and sometimes 1-2 papers in Applied Skills. | 6 to 12 months |

| CA / Partly Qualified CA | Exemptions in Applied Knowledge and most of the Applied Skills level papers. | 1 to 2 years |

| MBA (Finance) | Exemptions in Applied Knowledge and selected Applied Skills papers. | 6 to 9 months |

| Non-Commerce Graduates | Usually, no exemptions; start from Applied Knowledge or via the FIA route. | No reduction (full duration) |

ACCA eligibility is not about whether you are smart enough. It’s about choosing the right starting point.

Planning ACCA after graduation also means staying aware of upcoming changes. ACCA keeps updating its exam pattern to match what the industry needs. This video on the ACCA pattern change 2027 explains what’s changing and how it may impact your preparation, so you can plan your journey with clarity and confidence.

The Most Natural Progression of ACCA After BCom

For many students, choosing ACCA after BCom feels like a natural next step. BCom already introduces you to accounting, finance, taxation, economics, and business law. You understand the language of commerce. You are familiar with balance sheets, profit and loss statements, and basic financial analysis. ACCA builds on all of that and takes it to a professional level.

I often tell BCom students that their degree is like learning the grammar of a language. ACCA teaches you how to speak that language confidently in the real world.

In BCom, you study concepts. In ACCA, you use them.

This shift becomes clear very quickly. Instead of just preparing answers for exams, you start thinking like someone responsible for financial decisions. You analyse scenarios, interpret data, and understand how your choices affect businesses. That is when education starts to feel meaningful.

One of the biggest advantages of pursuing ACCA after BCom is the ACCA exemptions. Depending on your university and subjects, you may be exempted from some ACCA papers. This means:

- Fewer exams

- Shorter completion time

- Faster entry into the professional world

But I always remind students: exemptions are helpful, but understanding concepts is still essential. ACCA papers build on each other. Skipping an exam does not mean skipping the knowledge.

In many ways, ACCA transforms BCom from an academic qualification into a professional identity. It’s like joining a gym after years of casual walking. You were active before. Now you train with purpose.

If you’re curious about how ACCA compares with CA when it comes to earnings, this video walks you through how salaries differ in India and how the picture changes once you look at international opportunities.

ACCA After CA: Adding Global Power to a Strong Base

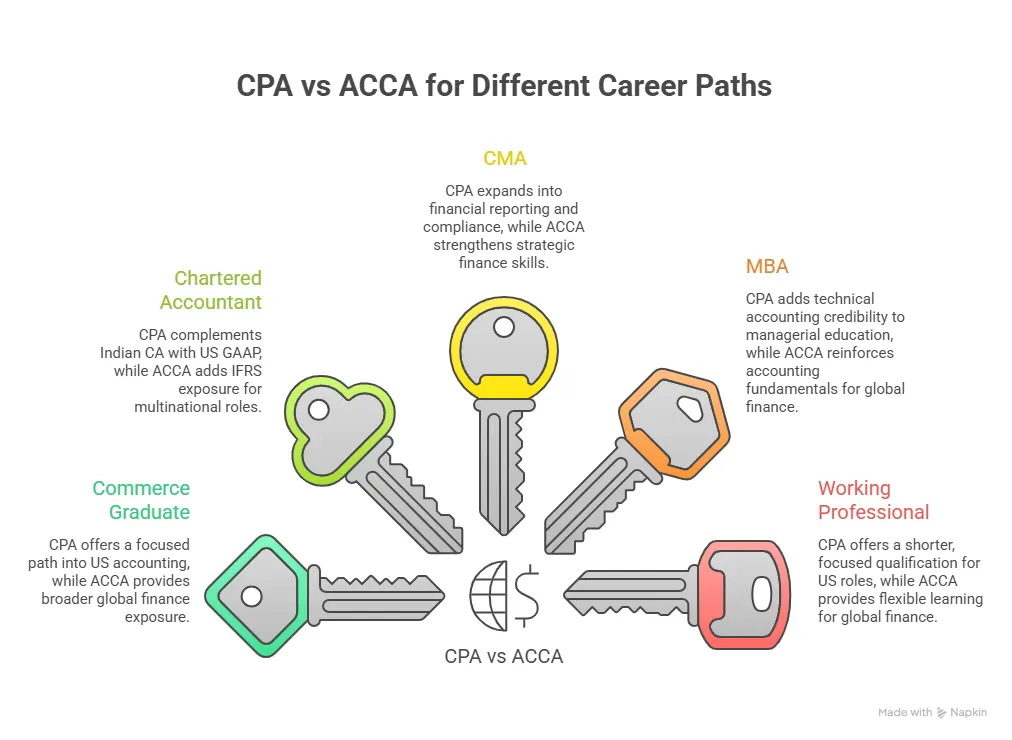

Choosing ACCA after CA is not about replacing CA. It’s about expanding its reach. CA gives deep technical expertise and a strong understanding of Indian regulatory knowledge. ACCA adds international standards, global mobility, and broader business exposure.

For many CAs, ACCA becomes a bridge between national expertise and international opportunity. It’s like upgrading from driving within one country to being confident driving internationally. Choosing the ACCA course after CA is not common because CA is weak. It is chosen because CA is strong.

| CA Gives You | ACCA Adds |

| Deep technical accounting knowledge | Global standards like IFRS |

| Strong exposure to Indian laws and regulations | International business exposure |

| High credibility in audit and taxation | Career mobility across borders |

For many CAs, ACCA feels like unlocking international doors. I often compare CA and ACCA to two powerful tools. CA is a sharp, precise instrument tailored for Indian accounting systems. ACCA is a versatile tool that works across global markets. When you have both, your professional toolkit becomes much stronger.

Professionals who choose ACCA after CA often do so because they want overseas opportunities, aim to work with multinational companies, and want exposure to global financial practices.

This combination is especially valued in countries like the UK, UAE, Singapore, and Australia. Choosing ACCA after CA is like upgrading your career passport. It doesn’t change who you are. It simply increases where you can go.

ACCA After MBA: Strategy + Technical Authority

ACCA after MBA is a powerful combination. MBA builds leadership, strategy, and decision-making. ACCA builds financial discipline, risk assessment, and professional accounting strength.

Together, they make you highly valuable for consulting, corporate finance, strategic roles, and leadership positions in finance-heavy organisations.

I often say that an MBA is like learning how to lead a team. ACCA is like learning how to manage the money that the team controls. When both come together, your leadership becomes complete. It allows MBA graduates to speak with confidence in boardroom-level financial discussions.

This short video breaks down the differences in cost, career outcomes, global recognition, and time investment between ACCA and MBA pathways, helping you see which option might fit your goals better.

How ACCA After Graduation Changes Your Professional Identity

What I love about ACCA after graduation is that it does not force everyone into the same mould. Whether you come from a BCom, CA, MBA, or any other graduation background. ACCA adapts to you. It strengthens what you already know and fills the gaps where needed.

It’s like travelling with a personalised map. Everyone starts from a different location, but ACCA helps everyone reach a higher destination.

Some students use ACCA:

- To build a finance career from scratch

- Shift from general business roles to finance-specific roles

- Add global credibility

- Improve earning potential.

That flexibility is rare and powerful. One thing students don’t always expect is how ACCA changes the way they see themselves.

Before ACCA: “I am a graduate looking for a job.”

After ACCA: “I am a finance professional building a career.”

That shift is subtle but powerful. Employers sense it in interviews.

- Your answers become more structured.

- Your thinking becomes more analytical.

- You stop talking only about marks and start talking about impact, decisions, and responsibility.

ACCA doesn’t just teach you accounting. It trains you to think like someone who is trusted with financial decisions. And trust is what companies value the most.

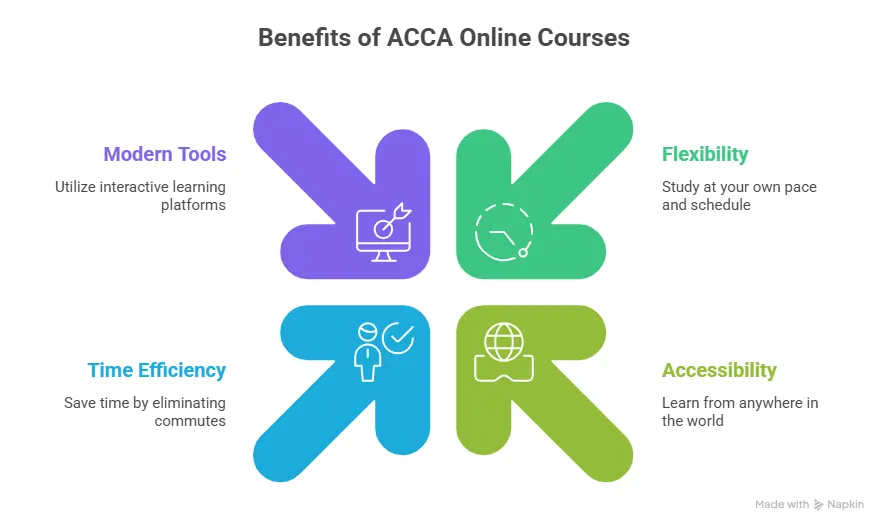

Why Graduates Choose ACCA

The ACCA syllabus is progressive as each level builds on the previous one, much like training programs at a gym. Most students do not choose ACCA impulsively. They reach it after:

- Feeling unsure about job roles

- Wanting something more structured

- Looking for global relevance

- Wanting professional respect

ACCA becomes attractive because it answers all of these.

It provides:

- Direction

- Recognition

- Identity

- Career growth

- And most importantly, confidence.

Graduation tells you that you can learn. ACCA tells the world that you can lead in finance.

ACCA after graduation works best when combined with internships or work experience, as it helps you apply concepts in real professional environments.

ACCA Course Duration After Graduation

There is no single timeline that fits everyone. That’s actually one of ACCA’s biggest strengths.

On average, most graduates finish ACCA in 2 to 3 years. Those with more exemptions may finish sooner. Working professionals may take slightly longer. And opting for online learning makes this ACCA course duration even more flexible.

| Qualification Background | Typical Exemptions Level | Average ACCA Duration After Graduation |

| CA (Qualified / Partly Qualified) | Applied Knowledge + several Applied Skills | 12 to 18 months |

| CMA (India / US) | Applied Knowledge + several Applied Skills papers | 15 to 24 months |

| MBA (Finance) | Applied Knowledge + a few Applied Skills | 18 to 24 months |

| BCom / BAF / BBA Finance | Mainly Applied Knowledge, sometimes 1-2 Applied Skills. | 2 to 2.5 years |

| Non-Commerce Graduates | Usually, no exemptions (start from basics or FIA) | 2.5 to 3+ years |

| Working Professionals (any background) | Depends on prior qualification | 2.5 to 3.5 years |

I compare this to travelling: Some people take flights. Some take trains. Some enjoy road trips. All reach the destination. The journey just looks different.

Your speed depends on:

How many papers do you attempt per session?

How many exemptions do you have?

How much time can you dedicate?

ACCA never rewards rushing. It rewards consistency.

Did you know?

ACCA after graduation is not just about better salaries. It’s about better roles, global mobility, and long-term career flexibility.

ACCA Exemptions After Graduation

ACCA exemptions are one of the biggest advantages of choosing ACCA after graduation. But they are often misunderstood. An exemption means you don’t need to write specific ACCA papers because your previous qualification already covered that subject.

It does not mean you already know everything, or that you can skip learning the topic. Think of exemptions like transferring credits when changing colleges. You save time, but the responsibility of understanding remains.

For example:

A BCom graduate may get exemptions in Accounting or Business Law.

A CA student may get exemptions in multiple Applied Skills papers.

An MBA Finance student may get exemptions in management-related subjects.

Exemptions help you:

- Reduce total exam count.

- Shorten your ACCA timeline.

- Save exam fees

But concept clarity remains your responsibility. ACCA papers are connected. Weak basics can affect future performance.

| Educational Background | Number of Exemptions (Approx) |

| ACCA exemptions after CA | 6 to 9 papers |

| ACCA exemption after MBA (Finance) | 1 to 4 papers |

| ACCA exemptions after BCom / BAF / BBA Finance | 3 to 5 papers |

| ACCA exemptions after CMA (India / US) | 5 to 8 papers |

| ACCA exemptions after CS | 1 to 3 papers |

| ACCA for Non-Commerce Graduates | 0 to 1 paper (usually none) |

| ACCA after MCom | 4 to 6 papers |

(Source: ACCA Exemptions Calculator – ACCA Global)

Did you know?

An ACCA course after graduation is often more time-efficient than starting a new degree because exemptions can reduce the number of papers you need to write.

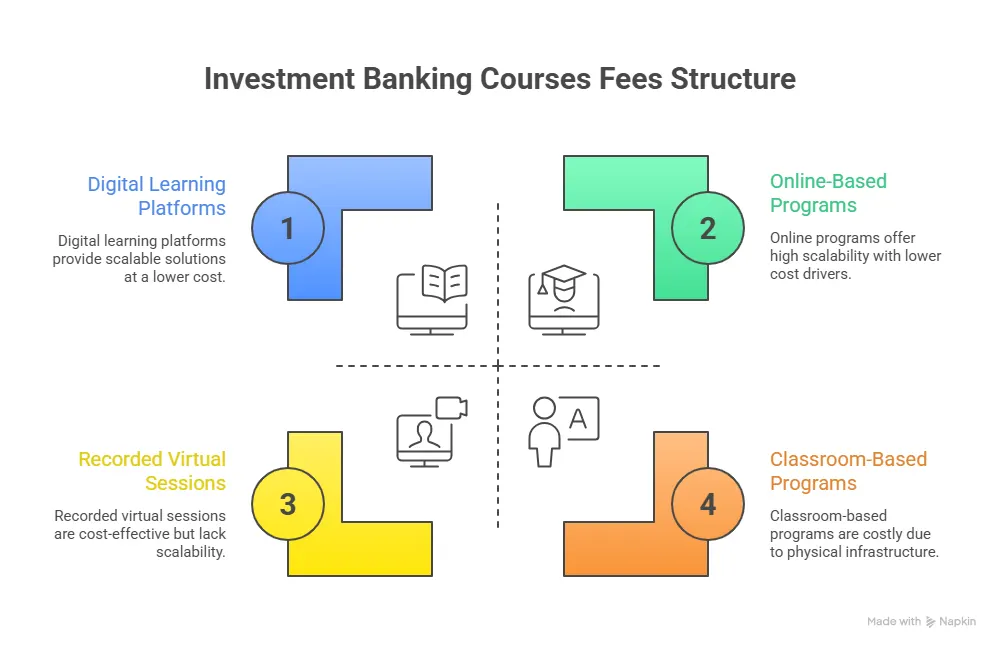

ACCA Fees After Graduation

ACCA fees are usually where anxiety peaks. And that’s normal. ACCA is an investment. In India, the total cost often ranges between ₹2.8 to ₹5.5 lakhs, depending on:

- Number of papers

- Coaching provider

- Exemptions

- Study pace

But I always ask students to think differently.

Don’t ask: “How much does it cost?”

Ask: “What does it give me back over 10 to 15 years?”

ACCA gives you a globally recognised credential, career mobility, better salary potential, and professional stability. It’s like buying gym equipment for long-term health rather than paying for a one-time fitness program.

Here’s a concise overview of how much ACCA course fees you might have to pay:

| Fee Type | Approximate Cost |

| ACCA Registration Fee (One-time) | ₹9,000 – 12,000 |

| Annual Subscription Fee (Per Year) | ₹10,000 – 15,000 |

| Applied Knowledge Level (3 papers) | ₹35,000 – 45,000 |

| Applied Skills Level (6 papers) | ₹90,000 – 1,20,000 |

| Strategic Professional Level (4 papers) | ₹1,10,000 – 1,40,000 |

| Exemption Fee (Per Paper) | ₹9,000 – 12,500 |

| Total ACCA Exam Fees (Without Coaching) | ₹2.3 – 3.2 Lakhs |

| Coaching Fees (All Levels – Average) | ₹1.5 – 3 Lakhs |

| Overall ACCA Cost in India | ₹2.8 – 5.5 Lakhs |

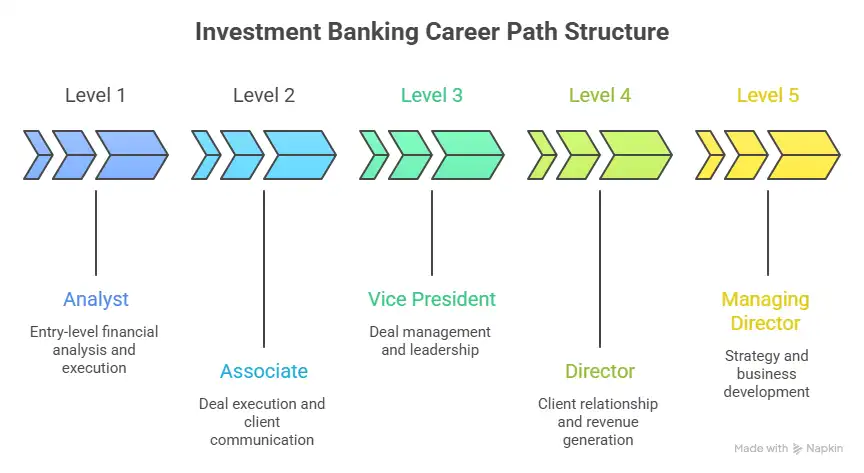

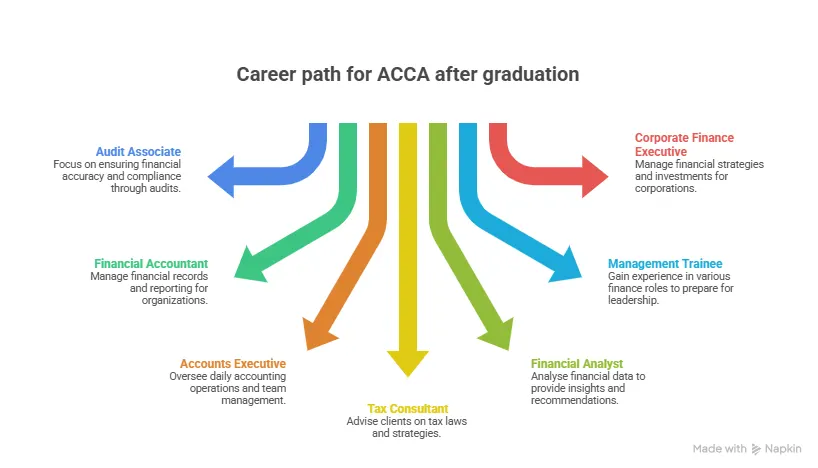

Career Scope After ACCA After Graduation

This is usually the part where everything becomes real. Until now, ACCA has been about preparation, discipline, eligibility, and structure. Here is where students finally ask, “What does my life look like after all this effort?”

And honestly, that’s a fair question.

From what I have seen, ACCA after graduation gives you something that many degrees alone don’t: career flexibility with credibility. You are not stuck in one narrow role or one type of company. You are trained to understand finance from multiple angles, which allows you to move across functions and industries.

Think of ACCA like learning how to navigate confidently. Once you know how maps work, you are not afraid of new cities. Similarly, once you understand financial systems, reporting, compliance, and strategy, you are not afraid of new job roles.

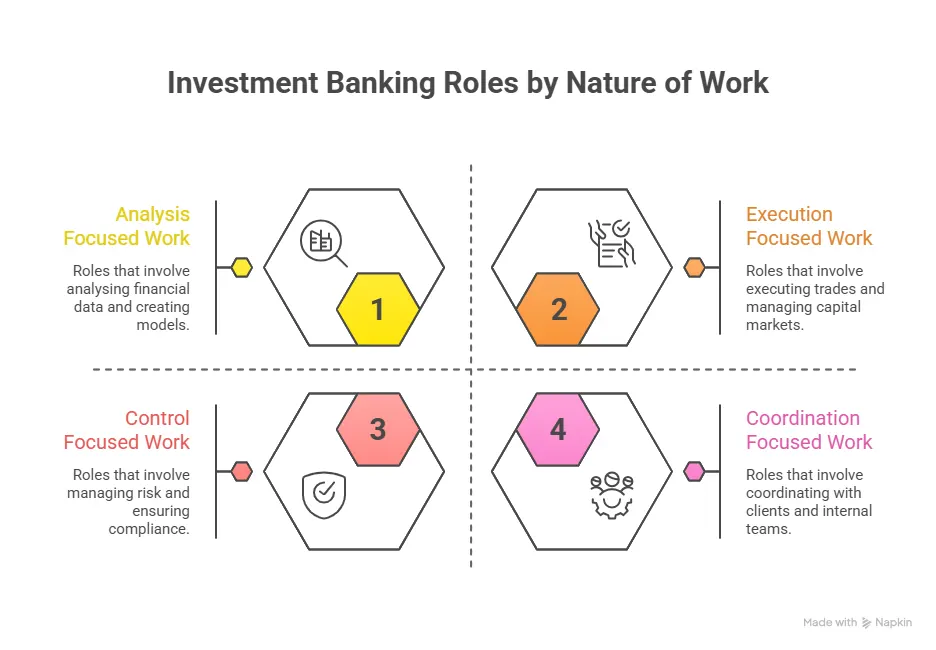

Sometimes, students imagine that an ACCA career only leads to audit firms. That’s not true anymore. ACCA professionals today work in:

| Job Roles After ACCA | Where You Work |

| Accountant / Management Accountant | MNCs, Shared services and global capability centres |

| Audit / Tax Associate | Big 4, Consulting Firms |

| Financial / Business Analyst | Strategy and planning teams in Banks, Corporations, fintech and analytics firms |

| Risk & Compliance Analyst | Risk management divisions in Banks, Financial Institutions |

| Corporate Finance / Treasury | Large Corporations, Global finance teams of MNCs |

The scope has expanded because finance today is not just bookkeeping. It is decision-making. Companies want professionals who understand compliance, reporting, strategy, risk, and business performance. ACCA prepares you for exactly that mix.

Did you know?

ACCA after graduation is one of the smartest ways to add global value to your degree. It turns your academic knowledge into a professional qualification recognised in more than 180 countries.

Salary Prospects With ACCA After Graduation

I prefer to talk about ACCA salary in India in terms of growth, not just starting numbers. Because ACCA is not a quick-win qualification. It is a compounding investment.

Here’s what salary progression usually looks like in India:

| Experience Level in ACCA Careers | ACCA Salary in India (Approx) | Avg. ACCA Salary Abroad (in INR) | Career Stage & Role Type |

| Fresher (0-2 years) | ₹4 – 8 LPA | ₹29 – 46 LPA | Entry roles like Audit Associate, Accounts Executive, Junior Financial Analyst |

| Mid-Level (2-5 years) | ₹8 – 15 LPA | ₹46 – 75 LPA | Specialised roles with client handling and domain expertise |

| Experienced (5+ years) | ₹15 – 25 LPA+ | ₹75 LPA – 1.15 Cr+ | Managerial, leadership, and strategic finance roles |

These numbers change with city, company size, industry, your internships and work exposure, communication and problem-solving skills.

But here’s something I always emphasise: ACCA does not guarantee a salary. It enables growth. Just like joining a gym doesn’t guarantee fitness. Your consistency does. One of the strongest advantages of ACCA after graduation is global mobility.

ACCA salary insights show that these professionals earn significantly higher in countries like the UK, UAE, Singapore, Australia, and Canada, especially once they gain experience.

This is why ACCA is often chosen by students who want international exposure without repeating their education from scratch in another country. It’s like holding an internationally valid driving license. You still need to learn the roads, but the permission to drive is already there.

This video breaks down the kinds of jobs ACCA professionals take up in India, how the salary grows over time, and what companies are looking for.

Myths About ACCA After Graduation

There are many misconceptions around ACCA jobs. Let’s clear a few of the most common ones, honestly.

| Myth | Reality |

| ACCA is only for toppers | ACCA is for consistent learners, not just academic stars |

| ACCA is easy if done online | The syllabus and exams are equally challenging. |

| ACCA guarantees a high salary | It enables growth; your effort decides results. |

| ACCA is only for accounting jobs | It opens doors to finance, consulting, strategy, and analytics. |

| ACCA takes too long | 2-3 years is reasonable for a global qualification |

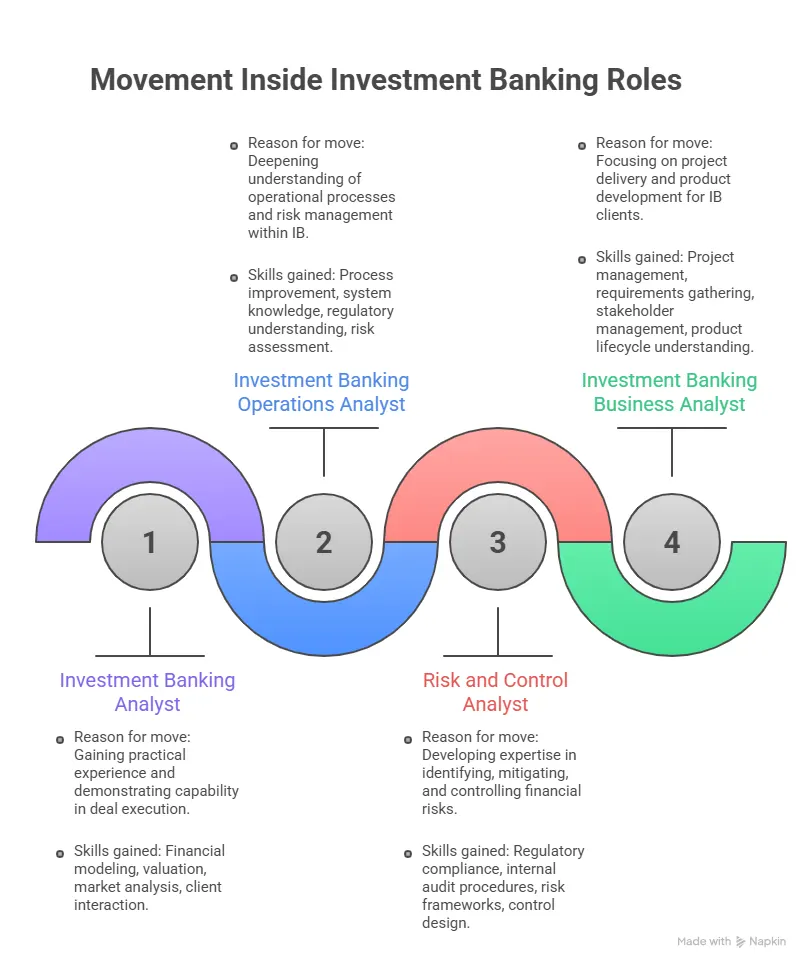

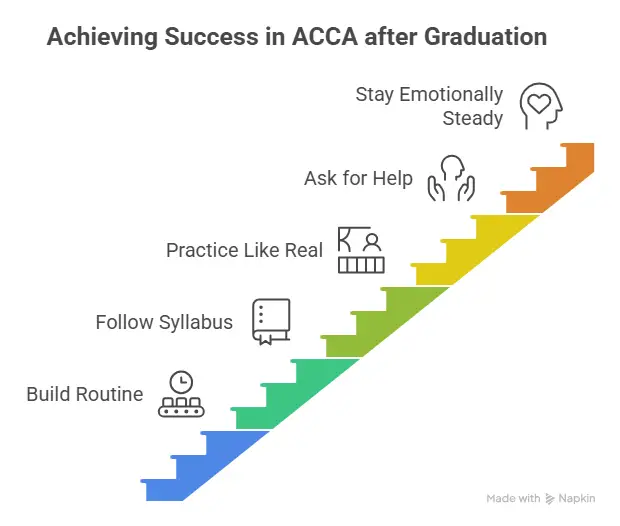

ACCA is not about being extraordinary. It is about being committed. The image below shows you a strategic path to succeed in ACCA:

Also Read: ACCA salary in the UK, insights on earning potential, career growth, and global comparison.

Why Imarticus Learning Feels Right for ACCA After Graduation

When you decide to start ACCA after graduation, you’re not just choosing a generic course. You’re choosing a professional pathway to shape your career. And for getting that, you would want something that feels structured, supportive, and realistic. That’s why the learning partner you choose matters so much.

Imarticus Learning designs its ACCA program with one clear goal: helping you move from being a graduate to becoming a confident finance professional. Some programs focus only on helping you pass papers. Others help you grow into a finance professional who understands how the real world works. Imarticus belongs to the second category. With Imarticus Learning, you get:

- Career-Focused Learning

- Flexible Learning

- Practical, Job-Oriented Preparation

- Strong Academic and Mentorship Support

- Global Career Readiness

- Internship and Placement Opportunities

- Structure with Flexibility

Choosing Imarticus for ACCA after graduation feels like choosing a system that keeps you organised, supported, and moving forward, even on the days when motivation is low.

FAQs About ACCA after Graduation

If you are thinking about how to become acca after graduation, you want to be sure you’re choosing something that truly fits your goals, your background, and your plans. These frequently asked questions are meant to clear the most common doubts students have to clear all the confusion.

Can I pursue ACCA after graduation while working or doing an internship?

Yes. Many students pursue ACCA while working full-time or with an internship. ACCA is designed to be flexible, especially when combined with online learning. It fits well alongside jobs and internships. You can enrol in institutes like Imarticus Learning, where you can manage your work and studies better.

Can non-commerce graduates pursue ACCA after graduation?

Yes. Non-commerce graduates can start ACCA through the Applied Knowledge level or the FIA route. It may take a little longer as you need to start from the basics, but success is absolutely possible.

Is ACCA after graduation worth it?

What makes ACCA after graduation powerful is that it doesn’t force you into one “default” path. You can start in audit, move into reporting, then shift to business finance or consulting. The qualification evolves with you. That adaptability is exactly what modern careers need.

Can I do ACCA after an MBA?

ACCA after MBA is perfect for those who want to combine strategic thinking with strong financial expertise, making them valuable for leadership roles. Institutes like Imarticus Learning help you analyse what exemptions you are eligible for and apply only for the papers that you need to take. This makes your duration and fees quite low.

Is ACCA better than CA or MBA?

It’s not about better. It’s about fit. CA is strong for Indian accounting and taxation. An MBA is strong for management and leadership. ACCA is strong for global finance and accounting careers. Your goals decide what’s right.

How long will ACCA take after graduation?

It depends on your background and exemptions. ACCA course duration after CA is 12-18 months, while others take 2-3 years. Both are normal. ACCA is about steady progress, not rushing.

When is the right time to start ACCA after graduation?

The right time is when you feel ready to take your career seriously. Many students choose ACCA after graduation because it gives them a clear professional identity, not just another academic qualification.

Can I do ACCA after CA?

ACCA after CA is ideal for professionals who want international exposure. It adds global recognition to your strong Indian accounting foundation and opens overseas career opportunities. It can significantly boost international employability, especially in countries like the UK, UAE, Singapore, and Australia.

Upgrade Your Career with ACCA After Graduation

Choosing ACCA after graduation is not about collecting another certificate. It is about choosing who you want to become professionally. Graduation shows that you can learn. ACCA shows that you can lead. It teaches discipline, builds professional confidence, gives global credibility, and creates long-term career stability.

If you are even considering ACCA after graduation, it means you are ready to think bigger. And that, in itself, is the first sign of a professional mindset. ACCA isn’t about rushing ahead but choosing growth over comfort, step by step.

You don’t need a perfect plan; you just need one small action. Explore the ACCA course, understand your exemptions, and see what your journey could look like.