Last updated on November 24th, 2025 at 02:04 pm

While planning your ACCA journey, one of the first things you’ll want absolute clarity on is ACCA Course Fees. And that makes sense – unlike many global accounting qualifications, ACCA doesn’t follow a single fixed fee. Your location, number of papers, learning mode, and even the time of the year you register can change the overall ACCA total fees.

While speaking to ACCA aspirants from different countries, I noticed something interesting: Everyone pays the same ACCA exam fees in GBP – but the final amount is completely different depending on where you live.

Why? Although ACCA sets a global fee structure in pounds, your bank converts it into your local currency. When you pay your exam fees or your annual subscription fee from India, it’s automatically converted to INR, and this fluctuates depending on the day’s exchange rate.

Considering ACCA?

Get personalized guidance on your ACCA journey—eligibility, exam roadmap, and career outcomes in a 15-minute call with our expert counsellor.

No commitment required • 200+ students counselled this month

That’s why, when one student says their total ACCA cost was ₹2.8 lakhs,

While another may say it was ₹3 lakhs, they both are correct.

Their fees differ even if both wrote the same number of papers.

And this isn’t just an India-specific story; it affects students everywhere.

But here’s the real twist:

Even though the exam fees are globally the same, the total cost of completing ACCA differs drastically from country to country – not because of ACCA course fees, but because of the cost of living, training costs, and local economics.

So whether you’re a student, a working professional, or switching careers, in this guide, I’ll help you plan your ACCA journey smartly, confidently, and cost-effectively.

What Makes ACCA Worth the Cost?

Before we talk about numbers and have a look at ACCA course fees, let’s take a step back and understand what is ACCA and why lakhs of students across the world choose it every year.

What Is ACCA?

ACCA is a globally recognised professional accounting qualification. It opens opportunities to international careers in:

- Finance

- Audit

- Accounts

- Tax

- Business analytics

- Advisory

- Investment & corporate finance

And unlike many qualifications, the ACCA Course:

- Has 13 papers only.

- Can be completed in 2-3 years.

- Offers flexible exam scheduling.

- And the best part? It is recognised in 180+ countries.

With ACCA, you’re not just learning how to handle accounts – you’re learning how business works, how decisions are made, and how organisations grow responsibly.

Understanding your ACCA course duration and ACCA course fees clearly helps you plan your time and money efficiently.

ACCA Fee Structure: What Costs Should You Expect?

The ACCA fee structure has four primary components, which will help you find the complete breakdown of each of these, so you can estimate your ACCA total fees accurately.

What is the ACCA Registration Fee in India?

The very first payment you’ll make is the ACCA Registration Fee.

₹9,500 – ₹12,000 (approximately, depending on exchange rates)

This fee is paid once when you first register as an ACCA student.

Many institutes run promotions where this entire fee is waived, reducing your total cost for ACCA significantly.

What is the ACCA Annual Subscription Fee or ACCA Membership Fees?

After registering, you’ll be required to pay a yearly membership charge called the ACCA Annual Subscription Fee of ₹10,000 – ₹12,500 per year. This is compulsory until you complete all exams.

What is the ACCA Exam Fee Structure Per Paper?

This is where most students want clear numbers. ACCA has three levels, and the ACCA exam fees vary according to the level and the time you register. Most students ask me whether ACCA fees are the same for all level papers? To answer this question, no. ACCA exam fees are different at each level.

Below is the overall breakdown of ACCA per paper fee:

ACCA Applied Knowledge Level Exam Fee

ACCA Applied Knowledge Level has 3 papers with an approximate fee between ₹9,000 – ₹12,000 per paper.

ACCA Skills Level Exam Fee

ACCA Skills Level has 6 papers with an approximate fee between ₹14,000 – ₹18,000 per paper.

ACCA Professional Level Exam Fees (P-Level)

ACCA Strategic Professional Level has 4 papers with an approximate fee between ₹18,000 – ₹27,000 per paper.

These prices vary based on:

Early, standard, or late exam registration, Exchange rate fluctuations, and exam centre vs remote exam.

What are the ACCA Online Course Fees in India?

This is the cost you pay to a training provider for the course, study materials, placement support and doubt sessions.

₹1,50,000 – ₹3,00,000 (for all 13 papers)

Your cost depends on:

- Mode of lectures – whether classes are held online or offline.

- City – location plays an important role in the fee structure as pricing differs for tier 1, 2 and 3 cities.

- Type of package – whether training includes exemption handling, mentoring, and revision kits.

ACCA Total Fees in India

By combining all costs, the estimate of your ACCA total fees comes to ₹2,80,000 – ₹5,50,000. This includes:

- ACCA registration fee

- ACCA subscription fee

- ACCA exam fees (all levels)

- Training / ACCA online course fees

If you apply during a registration fee waiver period, you can save ₹10,000-₹12,000.

ACCA Syllabus Summary

Now that you know how the exam fees differ across Knowledge, Skills and Strategic Professional levels, it’s useful to understand what the ACCA syllabus is and the topics each level actually covers before you calculate costs.

- Applied Knowledge Level (3 papers) – Fundamentals of accounting & business.

- Applied Skills Level (6 papers) – Core finance, audit, tax, and reporting.

- Strategic Professional Level (4 papers) – Advanced corporate reporting, strategy, and auditing.

Because the syllabus is structured level-wise, the cost increases as you progress. This explains why Knowledge-level fees are lower than Professional-level fees.

ACCA Cost Summary Table

Before we go deeper into the ACCA course fees, here’s a simple snapshot of the entire ACCA cost structure in India for 2025:

| Cost Component | Approx. Fees (₹) |

| Registration Fee (One-Time) | ₹9,500 – ₹12,000 |

| Annual Subscription (Per Year) | ₹10,000 – ₹12,500 |

| Exam Fees (13 Papers) | ₹1,80,000 – ₹2,20,000 |

| Online Course Fees | ₹1,50,000 – ₹3,00,000 |

| Total ACCA Cost (2025) | ₹2,80,000 – ₹5,50,000 |

Note: Students should also account for optional expenses such as exemption fees, reactivation fees, and study materials, which are not included in the summary above.

Mini Calculator Formula for ACCA total cost = Registration Fee + (Subscription Fee × Years) + (Exam Fees × Papers) + Coaching Fees

ACCA Fee Payment Timeline

One common concern among students is: “Do I need to pay everything together?” Thankfully, no. You are not required to pay the entire ACCA course fees in advance.

You don’t need to pay for all papers at once. ACCA allows students to pay only per paper and pay annually for subscriptions. This pay-as-you-go model keeps ACCA accessible even for students who are working part-time or self-funding the course.

ACCA follows a three-tier exam fee structure-early, standard, and late. Choosing early registration can lower your exam cost by 20-30%, while late fees increase the price considerably.

Here’s a simple timeline of when each ACCA fee is actually paid:

- At the time of registration, the Registration fee + the first year subscription fee

- Before each exam attempt – Exam fees for the specific papers you choose to attempt

- Every January – Annual subscription fee (until you finish all exams)

- When you join a coaching, Training, or ACCA online course, fees (often available on EMI)

- Optional costs – Retake fees (only if needed), late registration fees, and exemption fees (if applicable)

This timeline helps you plan your finances smoothly, rather than paying everything up front.

Smart Tips To Reduce ACCA Course Fees

The best part about ACCA course fees is that you can significantly reduce your total cost with smart planning.

Here’s how:

1. Register Early – Exam fees are lower during early registration windows.

2. Avoid Late Exam Registration – Late fees can increase your exam cost by 30-40%.

3. Clear Papers on First Attempt – Every retake increases your expense.

4. Choose Online Classes Over Offline – Online fees are usually 20-40% lower.

5. Leverage Exemptions – If you have a BCom, BBA, MCom, CA Inter, or CA Final background, you can skip multiple papers – saving both time and money.

6. Watch for Registration Fee Waivers – Look for limited-time ACCA fee waivers – ACCA and many learning partners often run promotions where the registration fee or exemption processing fee is waived completely. These periods can reduce your total cost significantly.

7. Create a personal ACCA budget – Before starting ACCA, map out expected costs for registration, annual subscription, per-paper fees, and coaching. Break this into monthly saving targets so you’re financially prepared before each exam window.

8. Plan your exam attempts smartly – Attempting too many papers at once increases stress and can lead to retakes. But spacing them too far apart increases subscription fees. A balanced 2–3 papers per exam session helps optimise cost and performance.

9. Use EMI or instalment plans if needed – Most training institutes allow students to split coaching fees into monthly instalments, making it easier to manage ACCA costs without financial pressure.

Tiny decisions can save you ₹20,000-₹60,000 in your ACCA course fees over your entire ACCA journey.

ACCA Cost in India vs Other Countries

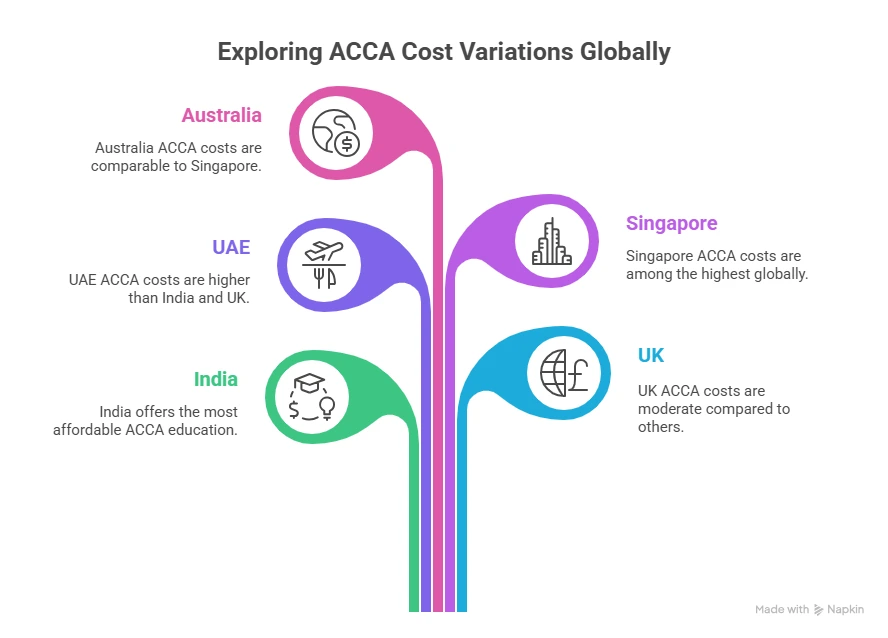

Because ACCA exams fees are charged in GBP, your ACCA cost in India is converted to INR on the payment date. This is why fee estimates vary slightly by month. At the same time, India remains one of the most affordable countries to complete ACCA compared to the UK, UAE, Singapore, and Australia.

How Do ACCA Fees Differ by Country?

Even though ACCA is a single global qualification, the experience and the cost can look very different depending on where you study.

If you’re in India, you get:

- Lower training fees.

- Affordable living costs.

- International-quality training through online programs.

- The same global exam papers.

- This makes India one of the best value-for-money destinations to complete ACCA.

If you’re abroad (UK, UAE, Singapore, Australia), you get:

- Stronger local job markets

- Access to corporate networks

- Higher training/living expenses

Many students actually start ACCA in India, complete most papers affordably, and then move abroad for jobs.

And that’s the beauty of ACCA – ACCA is one of the few qualifications where you can begin in India, continue in Dubai, and finish in London – without losing a single exam attempt. In simple words, ACCA is like a passport.

The ACCA course fees may change based on where you live, but the qualification opens doors everywhere. Your investment stretches further in India – but your opportunities remain global.

How Geographical Locations Affect Total Cost for ACCA?

The ACCA course fees don’t just depend on exam fees – where you live plays a major role too. Training fees, cost of living, availability of coaching, and even access to exemptions can dramatically change your overall investment.

To give you a clearer picture, here’s how the ACCA journey looks for students in different parts of India and across the world. Each story highlights how location quietly shapes the total cost of becoming an ACCA professional.

1. India – The Most Affordable ACCA Destination

India remains one of the most budget-friendly destinations for ACCA because:

- Training fees are lower.

- Multiple online coaching options are available.

- Living costs are manageable.

- Students can study while continuing college or a job.

Here’s what the ACCA course fees look like across various cities in India:

- Mumbai: Offline classes preferred due to networking and strong finance industry presence.

- Kerala & Tier-2 Cities: Students often choose online coaching due to fewer local centres, saving up to ₹60,000.

- Delhi NCR: Career-switchers prefer offline batches for structure and consistency.

- Chennai: Online learning is popular among working professionals with rotating shifts.

- Bangalore: College students balance ACCA with degree programs via online classes.

Typical ACCA Cost in India: ₹2.8 to 5.5 lakhs for the complete ACCA course.

This makes India one of the smartest and most economical locations to complete ACCA – without relocating or pausing your education.

2. United Kingdom – Studying Where ACCA Was Born

In the UK, the fee structure for exams remains the same globally, but everything around it becomes more expensive:

- Coaching institutes charge premium fees.

- Rent, food, and transport are significantly costlier.

- Central London almost doubles overall expenses.

Typical ACCA Cost in the UK: £3,500 – £6,000+ (₹3.5 to 6 lakhs+). Higher for students living in central London.

Many UK learners choose online ACCA coaching from India to reduce costs.

3. UAE – A Popular Destination for ACCA + Work

In Dubai and Abu Dhabi:

- Training fees are higher.

- Living costs are premium.

- But many employers reimburse or sponsor ACCA.

- Tax-free income makes self-funding easier.

Typical ACCA Cost in the UAE: AED 15,000 – AED 25,000 (₹3.5 to 6 lakhs).

Corporate sponsorship reduces expenses for many learners.

4. Singapore – High Quality, High Cost

Singapore offers excellent coaching quality, but it comes with:

- Premium tuition fees.

- One of the highest living costs globally.

- Access to university-affiliated training centres.

Typical ACCA Cost in Singapore: SGD 6,000 – SGD 10,000 (₹3.7 to 6.2 lakhs).

The higher cost is offset by strong demand for ACCA-qualified professionals in the Singapore financial district.

5. Australia – A Global Career Hub With Higher Training Costs

In Australia:

- Professional training fees are comparatively high.

- Living costs add a major chunk.

- Many students start ACCA in India and finish it after relocating.

Typical ACCA Cost in Australia: AUD 5,500 – AUD 10,000 (₹3 to 5.5 lakhs). Excluding living expenses

The investment pays off, as ACCA professionals are eligible for high-paying roles in audit, advisory, and corporate finance across Australian cities.

If you are planning to take the ACCA exams, this video will guide you through the preparation and strategies to clear the exam on your first attempt:

City-Wise ACCA Course Fees in India

ACCA course fees can vary quite a bit depending on where you live. Different cities have distinct teaching ecosystems, varying infrastructure costs, and differing faculty availability – all of which impact the overall fee structure.

Here’s a quick look at what ACCA coaching typically costs across major Indian cities:

| City | Approx. Total Coaching Fees (₹) |

| Bangalore | ₹2,50,000 – ₹3,50,000 |

| Delhi / NCR | ₹2,50,000 – ₹3,30,000 |

| Mumbai | ₹2,40,000 – ₹3,20,000 |

| Hyderabad | ₹2,30,000 – ₹3,10,000 |

| Chennai | ₹2,20,000 – ₹3,00,000 |

| Kerala (Cochin / Trivandrum) | ₹2,00,000 – ₹3,00,000 |

Online vs Offline ACCA Course: Which One Should You Choose?

One of the biggest decisions ACCA students face is choosing between online and offline coaching.

Both options have their advantages, but the right choice depends on your learning style, schedule, budget, and the ACCA syllabus difficulty level.

ACCA Online Course Fees

Here’s the good news – online ACCA coaching is usually more affordable and more consistent across all states. You don’t have to worry about city-based price differences, and you get access to the same quality of faculty, study materials, doubt-solving sessions and mock tests, no matter where you are.

This is why many students from tier-2 and tier-3 cities choose online programs: They get metro-city quality training without metro-city pricing.

Best suited for: college students, working professionals, and individuals who prefer flexibility.

Why students choose it:

- More affordable than offline coaching.

- Access to recorded & live lectures.

- Doubt-solving sessions from anywhere.

- No travel time or living expenses.

- Consistent quality across India.

If you’re from a city where ACCA classes are limited or expensive, online coaching gives you access to top faculty at a much lower cost.

ACCA Offline Course Fees

Here’s the other side of the story – an offline ACCA course offers a classroom experience that many students still prefer.

With in-person lectures, direct interaction with faculty, and a structured study routine, offline classes create a learning environment that some students find more engaging and motivating.

You also get the added benefit of peer learning, immediate doubt clarification, and a focused study atmosphere – especially helpful if you struggle with self-discipline or prefer face-to-face teaching.

However, offline coaching does come with city-based price differences, and the overall cost may be higher due to factors such as infrastructure, faculty availability, and travel or living expenses, depending on your location.

Best for: Students who prefer classroom interaction.

Why some prefer it:

- Face-to-face support.

- Peer environment.

- Structured daily routine.

- Immediate doubt resolution.

But the downside is higher costs, especially in metro cities where infrastructure and rent are expensive.

ACCA Course Duration and Fees

The faster you clear ACCA, the lower you end up paying ACCA course fees. Here’s why:

- You pay the annual subscription fee for fewer years.

- You avoid retake fees.

- You spend less on additional coaching.

- You enter the job market earlier, earning sooner.

Example:

If you complete the course in 2 years, your total subscription cost is around ₹20,000.

If you take 4 years, it becomes ₹40,000+.

Time saved = money saved.

ACCA Exemptions Explained

Knowing the ACCA course eligibility helps you in planning to take the exams. Your academic background may enable you to skip certain ACCA papers, which can significantly reduce your total cost.

| Qualification | Possible Exemptions | Why are these exemptions given |

| BCom | Up to 3-4 papers | BCom covers core accounting, business, and finance fundamentals that match the Applied Knowledge level. |

| BBA | Up to 2-3 papers | BBA includes introductory business and management subjects aligned with early ACCA papers. |

| MCom | Up to 4-6 papers | Postgraduate-level commerce expands on accounting, reporting, and finance, overlapping with Skills-level knowledge. |

| CA Inter | Up to 6-9 papers | CA Inter has advanced accounting, audit, and taxation content equivalent to multiple ACCA Skills-level papers. |

| CA Final | Up to 9 papers | CA Final covers professional-level competencies in auditing, strategy, and reporting – giving exemptions up to the Strategic level. |

| MBA Finance | Up to 4-5 papers | MBA Finance includes corporate finance, financial management, and business strategy subjects that align with ACCA’s mid-level papers. |

Exemptions = fewer papers → lower exam fees → faster completion → lower total cost.

Did You Know? The ACCA Exemption Calculator helps you calculate the papers that you can skip.

Factors That Can Increase Your ACCA Course Fees

While planning to pay your ACCA course fees, remember:

- If you fail a paper, you must repay the ACCA per-paper fee.

- If you miss the annual subscription, you must pay a reactivation fee.

- Late exam registration increases cost by 30-40%.

- Always aim for “early registration” to reduce your expenses.

How ACCA Course Duration and Fees Affect the Total Cost

Once you know what ACCA really offers, it becomes easier to understand and plan the cost involved.

Your ACCA course fees depend on:

- Your location

- The number of papers you take

- Exchange rates

- Coaching or online course fees

- Duration of your ACCA journey

Planning ensures you manage both time and budget efficiently – without surprises along the way.

It is essential to explore how the syllabus is structured across all levels and to have a clear understanding of the ACCA subjects.

In this video, you will learn how to leverage your BCom with ACCA:

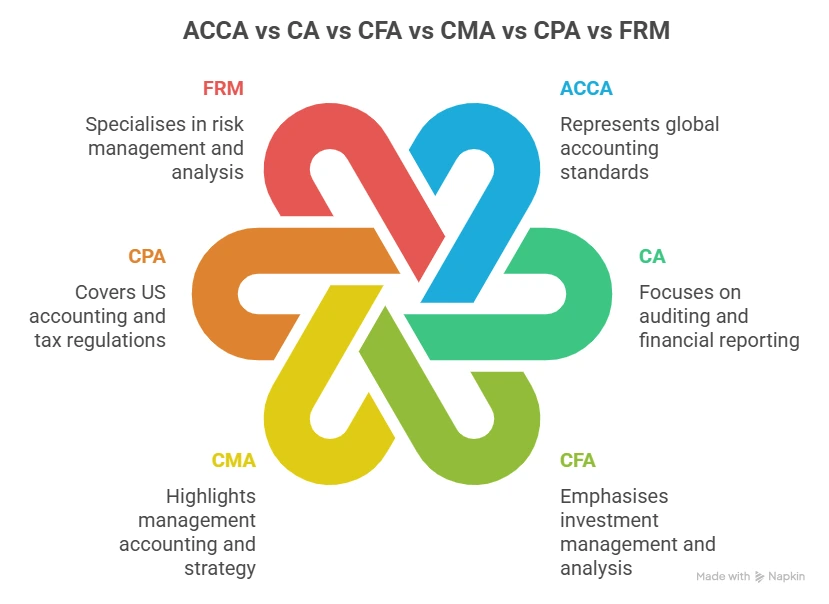

Is ACCA Expensive Compared to Other Accounting Certifications?

ACCA delivers a rare combination: global portability at a lower cost. Compared to CPA and CFA, which are expensive and region-focused. ACCA gives Indian students access to roles across the UK, EU, Middle East, Australia, and Singapore at a fraction of their cost.

When students begin comparing finance and accounting certifications, one of the first questions they ask is: Is ACCA expensive?

The truth is, ACCA sits right in the sweet spot – it offers global recognition, high salary potential, and flexible learning options at a much lower cost than most international qualifications. Compared to CA, CPA, CMA, or CIMA:

- ACCA offers the best global mobility.

- ACCA course fees are significantly less than CPA/CIMA.

- Has a more flexible exam structure.

- Provides better international salary potential.

Another advantage is ACCA’s flexible exam pattern and strong exemptions. Students from commerce, finance, and CA backgrounds progress faster than in CA or CPA, where exemptions are extremely limited.

In fact, ACCA offers one of the most affordable pathways to an international finance career.

It strikes the perfect balance between:

- reasonable cost

- global recognition

- flexibility

- strong career growth

- fast ROI

Students who complete ACCA typically recover their investment within 1-2 years of working in audit, finance, or accounting roles. This is why students continue to choose ACCA as their long-term global qualification.

ACCA Course Fees vs. Other Accounting Certifications

Now that you are clear with the ACCA course details, you might want to understand where ACCA stands compared to other major finance and accounting qualifications. Here’s a quick side-by-side comparison across key factors like fees, exemptions and overall affordability.

| Feature / Course | ACCA | CA (India) | CFA | CMA (USA) | CPA (USA) | FRM |

| Affordable / Reasonable Fees | ✔ | ✔ | ✘ | ✔ | ✘ | ✔ |

| Scholarships / Discounts | ✔ | ✔ | ✘ | ✔ | ✘ | ✘ |

| Exemptions Available | ✔ (Strong) | ✔ (Limited) | ✘ | ✔ | ✘ | ✘ |

| Affordability | ✔ | ✔ | ✘ | ✔ | ✘ | ✔ |

ACCA vs. Other Accounting Certifications Detailed Fee Comparison

Here’s a cost comparison using actual estimated fee ranges in INR:

| Course | Total Estimated Cost (₹) |

| ACCA | ₹2,80,000 – ₹5,50,000 |

| CA (India) | ₹1,00,000 – ₹3,00,000 |

| CFA | ₹3,00,000 – ₹6,00,000 |

| CMA (USA) | ₹2,50,000 – ₹3,50,000 |

| CPA (USA) | ₹4,00,000 – ₹7,00,000 (for Indian candidates) |

| FRM | ₹1,80,000 – ₹3,00,000 |

Unlike CPA or CFA, whose fees change based on exam centres, testing partners, and international surcharges, ACCA maintains a simple and predictable fee system based on GBP pricing. Despite being a global organisation, the ACCA qualification remains one of the most affordable international qualifications.

Why Students Feel ACCA Is Worth the Investment

Unlike many qualifications that take years of preparation and strict batch schedules, ACCA is designed for modern learners:

Only 13 Papers – You study structured concepts without unnecessary repetition – making the journey efficient and practical.

Flexible Exam Windows – You choose when to appear for exams. No fixed annual timetable. This is why students easily balance ACCA with college or work.

Future-Ready Curriculum – ACCA continuously updates its syllabus to match skills in demand: ESG, data analytics, automation, financial modelling, risk management, and more.

2-3 Year Completion Time – Most students complete ACCA in 2-3 years, depending on exemptions and their study pace

Global Job Opportunities – From Big 4 firms to multinational companies, ACCA is recognised across the UK, Europe, the Middle East, India, Singapore, Canada, and Australia.

ACCA ROI – How Fast You Recover Your Investment

ACCA is a rare finance qualification where the cost-to-opportunity ratio is extremely favourable. ACCA graduates typically earn:

- ₹3-7 LPA(freshers in India)

- ₹7-12 LPA(with experience)

- ₹30-60 LPA+ abroad

Most students recover their entire ACCA investment in 1-2 years, especially when placed in:

- Big 4 firms

- MNCs

- Banks

- Financial consultancies

- Audit and advisory roles

This is where ACCA truly shines – high ROI + global opportunities + affordable cost.

How Imarticus Learning Helps You Reduce Your ACCA Course Fees

At Imarticus Learning, we’ve helped thousands of students complete ACCA faster, more affordably, and with higher pass rates, thanks to a structured, student-friendly approach.

Here’s how we help you reduce your overall ACCA cost:

- Fee Waivers & Discounts

We frequently offer 100% ACCA registration fee waivers, early-bird discounts, and bundled offers – reducing your upfront cost significantly.

- EMI & Instalment Options

Instead of paying ₹1.5 to 3 lakhs at once, Imarticus allows you to split your training fees into low-interest monthly EMIs, making ACCA accessible to everyone.

- Exemption Support

If you’re from BCom, BBA, CA Inter, CA Final, or MBA Finance, we help you identify & claim all valid exemptions – saving you both money and time.

- Guaranteed Quality Across India

For online learners, you don’t pay “city-based pricing” – you get consistent training quality with expert faculty, mock tests, revision bootcamps, and personalised doubt-clearing.

- Proven Career Support

From resume building to mock interview training to Big 4 placements, our dedicated Career Services team helps students recover their ACCA investment within 12 years of starting their career.

If you’re planning to reduce your ACCA course fees and fast-track your global accounting career, Imarticus Learning offers a structured, affordable, and proven learning pathway.

FAQs About CFA Course Fees

These frequently asked questions about ACCA course fees help you understand the complete cost structure, value, and long-term career benefits of pursuing the ACCA qualification in India and globally.

What are the total ACCA course fees?

The total ACCA fees in India range from ₹2,80,000 to ₹5,50,000. This includes the ACCA registration fee, annual subscription fee, ACCA exam fees for all 13 papers, and online/offline coaching fees. The final amount varies based on exemptions, exchange rates, and your mode of training.

Is ACCA more costly than CA?

No. ACCA is not costlier than CA in India. CA usually costs ₹1-3 lakhs, while ACCA costs ₹2.8-5.5 lakhs, but CA takes longer, has a lower pass rate, and has limited global recognition. ACCA offers higher global mobility, flexible exams, faster completion, and better international opportunities. For the value it provides, ACCA is considered more cost-efficient globally.

Is ACCA worth the cost?

Yes, ACCA is absolutely worth the cost. With global recognition in 180+ countries, only 13 papers, flexible exam scheduling, and strong demand from Big 4 firms and MNCs, ACCA provides an excellent return on investment. Most students recover their ACCA fees within 1-2 years of starting their career.

Does ACCA have hidden charges?

No, ACCA does not have any hidden charges. However, possible additional costs in ACCA include late exam registration fees, retake fees, exemption fees, reactivation fees (if you miss the subscription deadline), and study materials (if purchased separately).

Does ACCA offer scholarships?

Yes. Students can avail: ACCA scholarships, Early exam registration discounts, and Fee waivers through approved learning partners. Imarticus Learning often offers ACCA registration fee waivers.

Planning Your ACCA Journey the Smart Way

The ACCA qualification is one of the most globally recognised accounting credentials in the world, and when planned smartly, it’s also one of the most affordable international qualifications.

With the right planning, exemptions, fee waivers, and smart exam scheduling, you can reduce your ACCA course fees by ₹20,000 to ₹60,000 – and recover your entire investment in just 12–24 months after you begin working.

Whether you’re starting ACCA in India or planning to pursue global opportunities in the UK, UAE, Singapore, or Australia, the qualification stays the same – only your strategy changes.

And if you need structured guidance, exemptions support, fee planning help, or end-to-end ACCA coaching, Imarticus Learning is here to make your journey smoother, more affordable, and career-ready.

Your ACCA journey is not just an expense, it’s an investment in a global career.

The ACCA Course is one of the most flexible and globally recognised finance qualifications in the world – and understanding your ACCA Course Fees upfront helps you start your journey with confidence.