ACCA Results are one of the most anticipated milestones in an ACCA journey. When an exam session ends, you start planning for the results. Understanding the results date and ACCA result time helps you manage expectations, plan your next study phase, and make important decisions about your career. For the September 2025 session, the results were scheduled for publication on October 13, 2025.

Your ACCA Results are not just a pass or fail label. They include performance metrics that help you understand how you did in each paper. These results show your achievement against the pass percentage of the ACCA standards. To pass any ACCA exam, a score of 50 or above is required. This threshold is consistent across all papers, whether you are taking foundational exams or professional-level exams.

When you log into myACCA, you can view your ACCA Exam Results under the exam status report section. That is how results are communicated officially. Results are usually made available in the morning (UK time), so students in different time zones may see them later in the day. The actual ACCA result time in India may vary slightly depending on daylight saving changes or server rollouts.

It helps to know what time results are released so you are ready when they go live. Generally, results go live around the UK morning hours. For students in India, this often translates to mid-afternoon or early evening. Logging into myACCA and checking your registered email are the most reliable ways to see your result quickly.

Understanding ACCA Before You Explore Your ACCA Results

Before going deeper into ACCA Results, it helps to understand the qualification itself. Many students search for what is ACCA when they first begin exploring the pathway. The Association of Chartered Certified Accountants is a global accounting qualification recognised in more than 180 countries. It prepares you for roles in finance, audit, taxation, analytics, business advisory, and corporate reporting.

Knowing how the qualification is built makes your results easier to interpret. Each paper connects to a specific professional skill, and the way you progress through the modules affects how you plan upcoming exams. The structure is straightforward and designed to help you progress from basic concepts to advanced judgment.

ACCA Qualification Overview

The table below shows a quick view of the ACCA course framework so you can relate your ACCA Results to the exam structure.

ACCA Structure Summary

| Component | Details |

| Total Papers | 13 papers (3 Applied Knowledge, 6 Applied Skills, 4 Strategic Professional) |

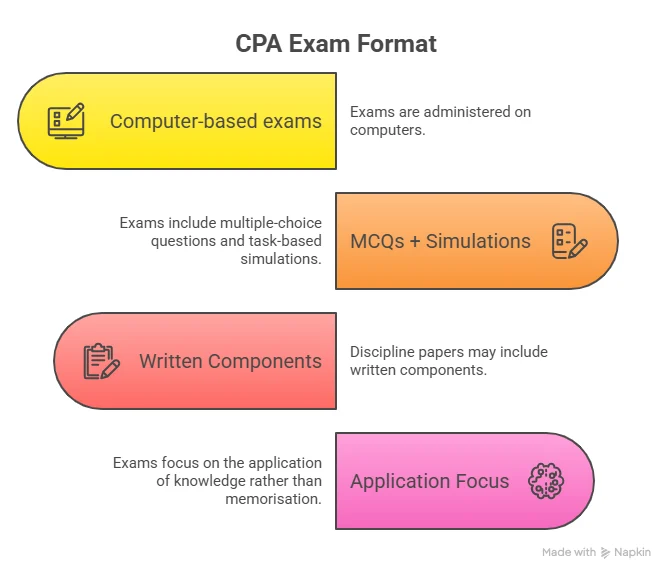

| Exam Format | Computer-based exams for most papers |

| Difficulty Progression | Conceptual (Knowledge), Application (Skills), Judgment (Professional) |

| Assessment Style | Objective questions, case scenarios, and constructed response tasks |

| Global Recognition | Accepted in 180+ countries, strong employer demand |

Subjects in ACCA

The ACCA Course Details below show how you move through the qualification.

1. Applied Knowledge

- Business and Technology

- Management Accounting

- Financial Accounting

2. Applied Skills

- Corporate and Business Law

- Performance Management

- Taxation

- Financial Reporting

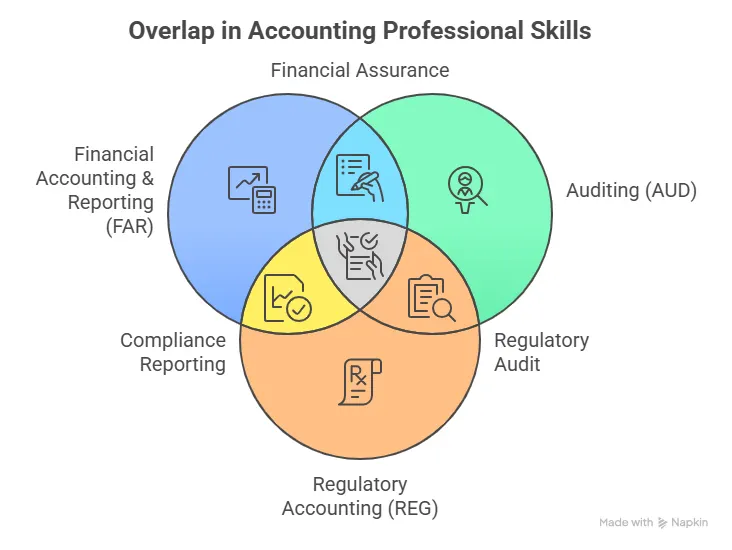

- Audit and Assurance

- Financial Management

3. Strategic Professional

- Strategic Business Leader

- Strategic Business Reporting

- Two optional papers (AFM, APM, ATX, AAA)

Every ACCA Exam Result reflects how well you understand concepts at these levels.

ACCA Duration Overview

Students often ask how long the ACCA Course Duration is. The time depends on how many papers you attempt each cycle.

| Progress Speed | Typical Duration |

| Fast Track | 2 to 2.5 years |

| Balanced Pace | 3 years |

| Flexible Pace | 4 to 5 years |

Efficient planning becomes easier when you follow your ACCA Results cycle by cycle.

ACCA Fees Snapshot

The ACCA course fees include registration charges, annual subscriptions, and individual exam fees across the Applied Knowledge, Applied Skills, and Strategic Professional levels. Having a clear view of these costs allows you to prepare your budget in advance and stay focused on your study plan while tracking your ACCA Results along the way.

These numbers help you plan the financial side of your ACCA journey while you monitor your ACCA Exam Results.

This explainer video breaks down key aspects of the ACCA qualification in a concise format, helping you grasp the structure, core stages of exams, eligibility, and global relevance in a few minutes. It highlights how the qualification is organised, the subjects covered, and what makes ACCA recognised worldwide as a professional accountancy pathway

Why ACCA Result Schedules Matter and How They Are Set

Each ACCA cycle has defined sessions. The ACCA exam runs four main exam cycles each year, typically in March, June, September, and December. The results date of ACCA for each cycle is announced well in advance, so you can plan your study calendar, revision schedule, and work commitments around it.

In the official ACCA calendar, for example, exam results for the December session are set to be released about 40 to 45 days after exams conclude. This gap allows ACCA to mark, moderate, review, and quality-assure exam responses before making ACCA Exam Results available.

Table of Typical Result Release Schedule

Below is a simple reference chart that reflects standard timelines for results across key sessions. These are based on official ACCA results releases and typical patterns:

| Exam Session | Exam Dates | ACCA Results Date | Notes |

| March 2025 | Early March | Mid April | Results around 40 days post exams |

| June 2025 | Early June | Mid July | Officially confirmed release |

| September 2025 | Early Sep | 13 Oct 2025 | Listed on the ACCA portal |

| December 2025 | Early Dec | Mid Jan 2026 | Scheduled in the ACCA calendar |

Even though the exact ACCA result time is not always shared publicly, this table gives a clear picture of when you should be ready to check myACCA results.

Because ACCA maintains consistent patterns, this also creates predictability for your study planning, especially when you are preparing for ACCA with online resources. You can mark your calendar once the exam timetable is announced for the year. Knowing your ACCA results date helps reduce stress and gives you time to prepare mentally for different outcomes.

How to Check ACCA Result

Once the results are released, how to check ACCA results becomes one of the first questions everyone asks. There are two main ways to access your ACCA results:

1. Through Your myACCA Account

Log in with your credentials. Navigate to the Exam Status and Results section. This page shows all the exams you have attempted, your results, and any next steps. It will list whether you passed or did not pass each paper.

2. Email Notification

ACCA often sends an email when your results go live. This email contains a link to your result status. Your contact information must be up-to-date for this to work smoothly.

Some regions also offer text message notifications, but these require an opt-in before results day. If you choose this option early, your result arrives via SMS without logging in.

When you view your results, the report shows not only a pass or fail status but also your performance in each paper. This information is useful when planning your next ACCA session and helps you simplify your ACCA qualification. For example, if you did not pass a paper, the report helps identify which topics might need revision.

Understanding ACCA Pass Rates

ACCA pass rates give important insight into ACCA exam results. These percentages show how many candidates passed specific exams compared to how many sat for them. They provide a picture of how tough or accessible certain papers are in a given session.

Did you know? For the March 2025 ACCA exam sitting, over 90,000 students entered and completed 102,000 exam attempts. This sitting saw thousands completing their final exams and becoming ACCA affiliates.

Broad View of ACCA Pass Percentages

Pass rates differ by paper. Applied Knowledge papers like Business and Technology often have higher pass percentages, sometimes over 80% in some sessions. Meanwhile, Strategic Professional papers like Advanced Audit and Assurance often have lower pass percentages in the 40s. These patterns reflect the varying cognitive demands of each paper and help you understand how to pass your ACCA exams.

Here is a simple breakdown of pass rates from the June 2025 results:

| Paper Level | Exam Pass Rate | Observations |

| Applied Knowledge | BT: 88% | Conceptual and introductory nature |

| Applied Skills | FR: 50% | Balanced reporting and application |

| Strategic Professional | SBL: 51% | Complex judgment based |

| Strategic Professional | AAA: 40% | Advanced analytical demand |

Higher pass rates in foundational exams show a strong conceptual grasp, while lower pass rates in advanced exams like AAA reflect deeper analytical requirements.

Another snapshot from the September 2025 exam results showed similar trends:

| Paper Category | Pass Rate |

| Taxation (TX) | 55% |

| Financial Reporting (FR) | 48% |

| Performance Management (PM) | 43% |

| Strategic Business Leader (SBL) | 51% |

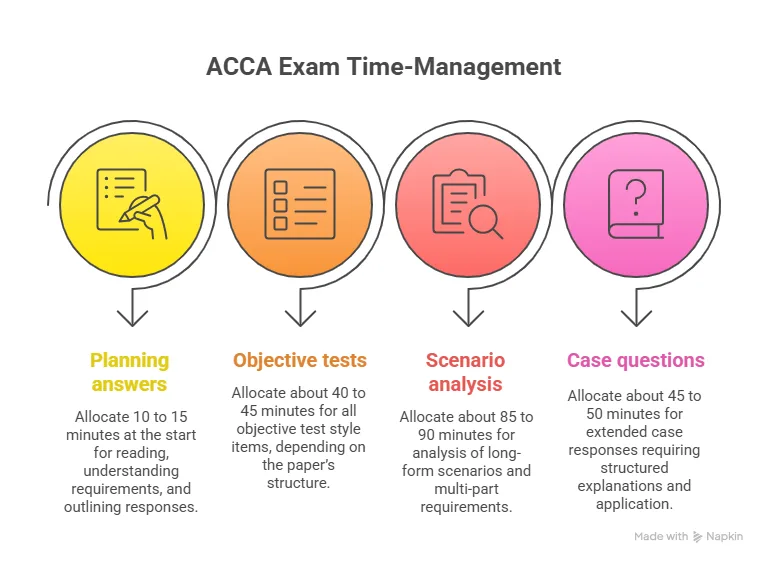

This table again highlights how the ACCA pass percentage tends to shift with academic complexity and exam session structure. With a structured plan and learning support, you can move through the exam journey with effective time management and here’s an overview of how you can do it.

How ACCA Pass Rates Show the Learning Curve Across Levels

Understanding the ACCA course benefits, along with the ACCA pass rate, gives clarity to your long-term study plan. Pass rates often differ by paper family because each level introduces new types of judgment and application.

Below is a description of how student performance usually shifts across the qualification. These insights come from ACCA’s published result summaries.

Applied Knowledge

These exams focus on understanding concepts. Papers like BT often show pass rates around 80% in some sessions.

Applied Skills

This level tests your ability to apply ideas to scenarios. Pass rates in papers like FR and PM can range between 43 to 55% in many sessions.

Strategic Professional

These papers expect higher judgment. Pass rates here often sit around 40 to 51%. This is common for exams like SBL and AAA.

These numbers help explain how the ACCA exam results breakdown changes as you advance. Each level builds on earlier knowledge and requires more integration of ideas, so you may see more variation in your own ACCA Results as you progress.

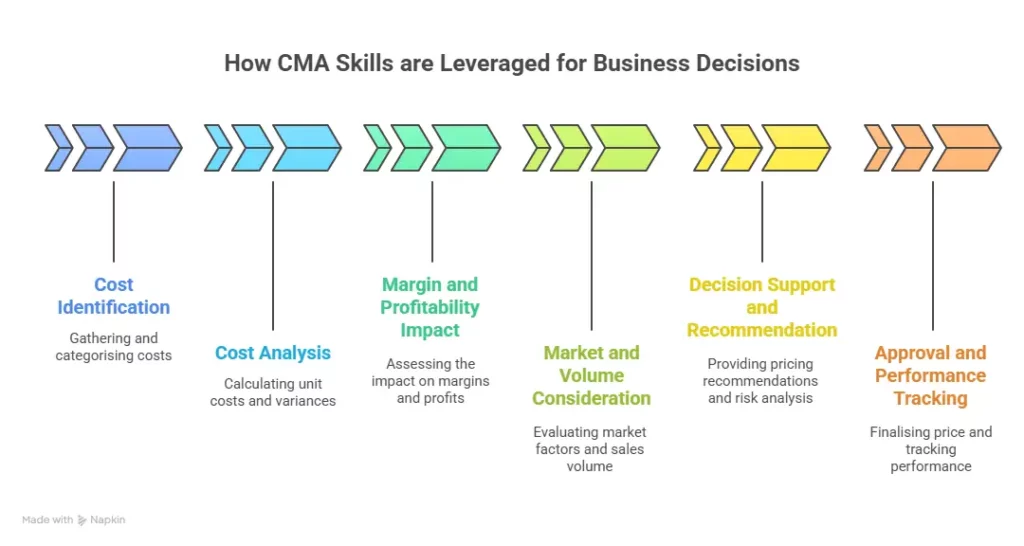

Here is a structured approach to planning for ACCA exams, showing how study time, revision cycles, and topic prioritisation typically map against the demands of the syllabus. It explains common strategies for balancing full-time work or study with exam preparation.

ACCA Pass Percentage in India and How It Compares

Many learners want to understand the ACCA pass percentage in India. ACCA Results are not published country-wise pass rates. However, training institutions in India share insights based on their internal student performance. The general trend shows that Indian students usually track close to global averages. In many exam cycles, Indian learners meet or exceed the pass percentage of ACCA benchmarks for Applied Knowledge and Applied Skills papers.

When you review your ACCA Exam Results, it helps to remember that students across India prepare in many different ways. Some use coaching programs. Some prefer self-study. Some blend both. A balanced study plan often aligns closer to global pass patterns and helps enhance your ACCA employability. This gives you a clearer idea of how tough or accessible any paper feels during a particular cycle.

How the ACCA Result Time Affects Planning for Indian Students

The ACCA result time in India plays a role in your preparation cycle. ACCA releases results early morning in the UK, which usually means results appear in India in the afternoon or evening. This pattern has been consistent for many years.

Knowing this helps you schedule your day. Some students prefer checking myACCA results in a quiet part of the evening. Others want to see updates as soon as they appear. Planning this ahead reduces stress.

If you want to know what time ACCA results are released, ACCA usually publishes this information in the student admin updates on their website. Time zone differences can shift your viewing window slightly, but the release is usually predictable.

Why Understanding Your ACCA Result Percentage Helps You Plan Better

Your ACCA result percentage gives you a reference point. If a paper has a 55% pass rate, and you scored above that, you know your understanding meets the typical performance standard for that session. If you are below that, you can identify how to refine your strategy.

This metric becomes helpful when planning subject pairings. For example, many students choose to pair FR with AA or SBR with SBL. When pass rates differ, the combination tells you how much time each subject may require.

Common Patterns I See When Students Review Their ACCA Exam Results

When you examine ACCA Results over multiple cycles, a few patterns stand out:

Many learners perform better in concept-heavy papers: Papers like BT or FA often show stronger global performance.

Application-based papers challenge test takers: FR, PM, and TX often reflect more variation in student results.

Judgment-based papers draw the widest range of scores: Strategic Professional exams show this pattern year after year.

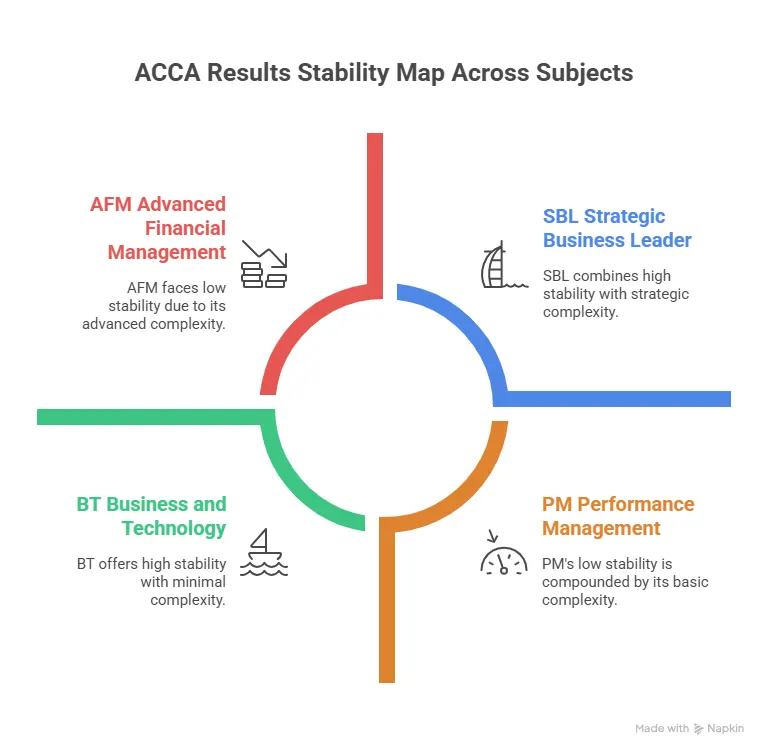

These trends can help you select your next papers wisely. The ACCA results stability map across subjects gives a clear view of how consistently each paper performs across multiple exam cycles. By seeing which papers maintain steady pass rates and which show sharper fluctuations, you get a better sense of how predictable each exam tends to be.

How Your ACCA Results Guide Your Next Study Phase

Once you receive your results, the next step is planning. Some students move ahead with new papers. Others take a moment to reassess their schedule.

Here is a layout you can use:

→ If you passed all papers: Plan your next exam session early. Apply before the standard entry deadline.

→ If you passed some papers: List the papers that remain. Review each paper’s pass rate and difficulty level. Align them with your strengths.

→ If you passed none of the papers: Look at your ACCA Exam Results breakdown. This will show the areas that need deeper focus.

→ If you almost passed: Scores between 45 and 49 deserve careful reflection. One extra revision cycle often changes the outcome.

This simple structure helps you use your ACCA Results as a planning tool rather than a milestone alone.

How ACCA Results Shape Career Paths and Industry Opportunities

ACCA results do more than indicate whether you passed an exam. They show how close you are to reaching a global finance qualification that employers trust. Each set of ACCA Exam Results reflects progress toward a profile that many firms value for roles in audit, finance, business analysis, taxation, investment reporting, sustainability reporting, internal control, and other career opportunities with ACCA.

Across industries, companies appreciate the discipline needed to track exam cycles, prepare for exams, manage ACCA results date schedules, and build knowledge independently. These habits translate well into roles where deadlines, regulatory compliance, and structured thinking are essential.

| Career Aspect | How ACCA Results Play a Role |

| Progress Toward Qualification | Shows how close you are to completing a globally recognised finance credential valued by employers. |

| Technical Readiness | Strong scores in papers like FR, AA, SBR, or APM reflect competence in reporting, audit, and analytical judgment. |

| Hiring Advantage | Many job descriptions prefer candidates who have completed or are close to completing ACCA, and ACCA Exam Results help signal that readiness. |

| Industry Fit | Clear performance across papers aligns you with roles in audit, finance, taxation, business analysis, sustainability reporting, and investment reporting. |

| Work Habits & Discipline | Managing exam cycles, preparing consistently, and working around ACCA results date schedules demonstrate reliability and professional commitment. |

| Role Suitability | Employers use ACCA Results to judge whether your strengths match the expectations of internal control, consulting, or reporting roles. |

| Growth Potential | Continual improvement across exam cycles shows adaptability, which supports long-term career prospects in competitive finance fields. |

1. Where Your ACCA Results Hold Extra Weight

Some fields draw a direct line between technical competence and exam performance. Your ACCA Results carry extra weight in sectors where analytical judgment matters. A few examples include:

- Statutory Audit: Firms look closely at your performance in Audit and Assurance and Strategic Professional papers.

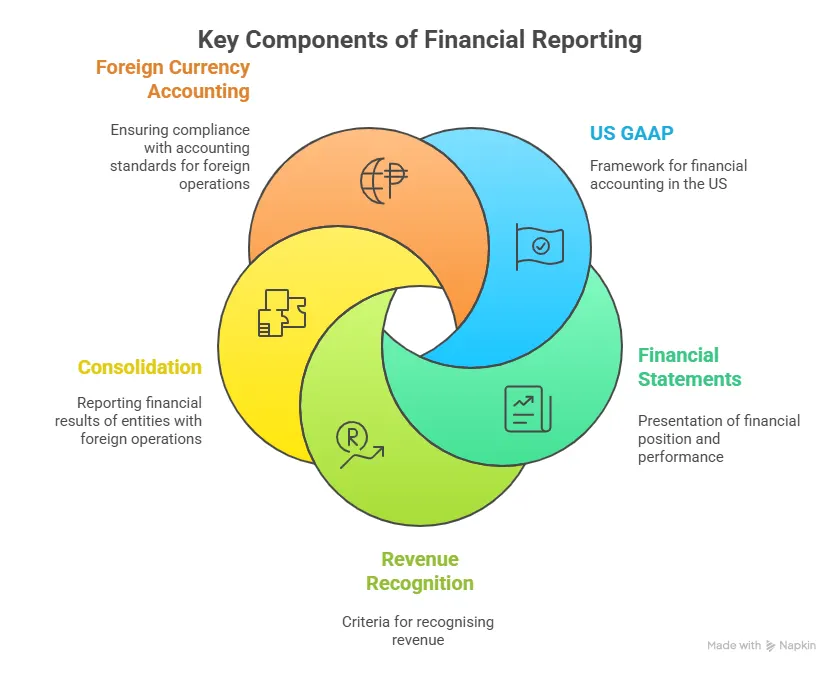

- Financial Reporting: Results in FR and SBR show how well you can interpret accounting standards.

- Performance Analysis: Results in PM and APM highlight business planning and decision-making among other ACCA skills.

- Tax: TX and ATX signal familiarity with tax frameworks and compliance rules.

These links help recruiters judge how prepared you are for specific tasks within these roles.

2. When ACCA Results Open Global Mobility

Because with ACCA, you can work in 180+ countries, your results connect you to opportunities across regions. The qualification is accepted by many regulators and employers in the UK, UAE, Singapore, Canada (pathway through provincial bodies), and multiple Asian and African markets.

Your performance in the ACCA Exam Results also helps you enter postgraduate pathways. Many universities accept ACCA papers toward master’s degree credits. Sometimes, clearing Strategic Professional papers counts toward academic credit under formal agreements. Programs in the UK, Australia, and Europe often list these arrangements.

When you complete all required papers and meet experience requirements, you become an ACCA member. Membership signals to employers that you met the global standard for competency in accounting and finance.

3. Using Your ACCA Results to Build a Strong CV

Your ACCA Results can support your CV if you present them well. Many candidates list completed papers, pass indicators, and progress levels. You can also highlight strengths based on the papers you cleared. For example:

- Cleared SBR and SBL reflect analytical judgment.

- Strong performance in PM or APM indicates comfort with quantitative work.

- Passing TX shows readiness for tax operations.

You can note the result percentage if you achieved a significantly high score. This adds substance to your professional profile, especially when applying for roles that involve financial reporting or analysis, because ACCA unlocks global career opportunities.

Why Many Students Choose Imarticus Learning for ACCA Preparation

Choosing the right support system can make a significant difference in how effectively you interpret your qualification for the ACCA course and progress through each exam cycle. Imarticus Learning stands out as a structured ACCA preparation partner with specific strengths that align with the demands of this global qualification.

- Gold Approved Learning Partner of ACCA (UK), ensuring globally recognised and ACCA-standard training.

- Official Kaplan study resources, including books, question banks, and practice tools approved for ACCA preparation.

- Live instructor-led classes supported by structured doubt-clearing sessions for every paper.

- Industry-aligned learning exposure, offering practical perspectives alongside exam preparation.

- Flexible learning formats suitable for full-time students and working professionals.

- Comprehensive coverage across all exam levels, supporting learners from Applied Knowledge to Strategic Professional.

FAQs About ACCA Results

This section answers the most frequently asked questions students have about ACCA Results, including release timings, pass percentages, exam expectations, and global recognition. Each answer helps you understand how the results shape your progress and what they mean for your next steps in the qualification.

What time are ACCA results released?

The results are released in the morning according to UK time, and this timing usually places the announcement in the afternoon or evening for students in India. ACCA follows a predictable pattern for results, which helps you plan ahead for each exam cycle. The official release process happens through the myACCA portal and through registered email notifications. Imarticus Learning offers guided training that helps you build clarity, discipline, and exam-focused skills for your upcoming papers.

Is it common to fail ACCA exams?

It is not unusual to fail some ACCA papers because each exam carries a high standard of competency. ACCA Results reflect the difficulty level of the qualification, and global pass rates often show that some papers have pass percentages in the range of 40% to 55%. This means many students do not pass certain exams on their first attempt. Failing a paper does not limit your future because the ACCA framework allows retakes. Imarticus Learning help many students understand concepts better after reviewing their results.

Are ACCA jobless in India?

ACCA students and members are employed across many sectors in India, including audit, consulting, shared services, taxation, investment research, and corporate finance. Organisations in India hire ACCA candidates for roles that involve IFRS reporting, internal controls, statutory audit, and business analysis. Many students also pursue support through Imarticus Learning to strengthen their job readiness. So ACCA candidates are not jobless as a group; instead, their opportunities expand as they progress through the qualification.

Do Google hire ACCA?

Google hires for finance roles that involve reporting, controllership, internal audit, and compliance. While the company does not restrict hiring to only one qualification, having the ACCA credential can help you demonstrate your technical skills. Whether Google hires a candidate depends on the job requirements, experience, and skill match, but ACCA candidates have competitive profiles for such roles.

Which MNC hires ACCA?

Many multinational companies hire ACCA students and members across business sectors. These include Deloitte, EY, PwC, KPMG, BDO, Grant Thornton, Accenture, JP Morgan, Wells Fargo, Vodafone, and several global capability centres. Students who combine their ACCA credentials with practical skills from Imarticus Learning often find opportunities in audit, financial reporting, and advisory roles within these companies.

Does JPMorgan hire ACCA?

JP Morgan hires ACCA candidates, and many ACCA members work in their finance, risk, and reporting teams. Positions in controllership, financial analysis, regulatory reporting, and risk operations often welcome applicants with accounting qualifications. Strong ACCA Results give you an advantage because they show the technical depth needed for these functions.

Does America recognise ACCA?

The United States of America does not have a direct equivalency arrangement for ACCA membership, but the qualification is recognised by employers for many finance roles. Many global companies operating in the US hire ACCA candidates for internal audit, financial reporting, tax operations, and analytics roles. Some states also offer pathways where certain ACCA papers may support credential evaluations for further studies. ACCA Results help you demonstrate your capability to employers who value international accounting knowledge.

Shaping Your ACCA Journey Ahead

ACCA Results are more than a score; they are a clear view of where you stand today and the direction you can take next. When you understand how pass rates shift across levels, how exam structures influence performance, and how your own strengths show up in each paper, the entire ACCA journey becomes easier to navigate. Every result gives you information you can use to refine your preparation, choose your next papers with intention, and build confidence one cycle at a time.

If you are beginning your preparation or looking to strengthen your approach for the coming sessions, learning with a structured support system can make a meaningful difference. Many students choose guided programs when they want clarity on concepts, exam technique, and time-management strategies that align with ACCA expectations. Imarticus Learning offers ACCA course prep in this kind of direction in a focused, practical way that helps you stay consistent and prepared for the papers ahead.