Last updated on December 3rd, 2025 at 03:54 pm

Every student looks at the ACCA pathway and wonders how to shorten the long road ahead. This is where ACCA Exemptions quietly become one of the most valuable advantages available to commerce, finance and accounting graduates.

Most candidates hear about them in passing, but very few understand the deeper impact these exemptions have on learning load, scheduling, exam strategy and final career outcomes.

The official guidance on exemptions is outlined on the ACCA’s official page, but what often goes unspoken is how exemptions reshape your entire preparation journey. Learning load reduces, timelines shrink, but the expectations on foundational knowledge remain the same.

Considering ACCA?

Get personalized guidance on your ACCA journey—eligibility, exam roadmap, and career outcomes in a 15-minute call with our expert counsellor.

No commitment required • 200+ students counselled this month

This guide is designed to be the missing link between what the ACCA outlines and what students experience on the ground.

Understanding ACCA Exemptions In Real Terms

If you are trying to understand how ACCA Exemptions actually help, it makes sense to start with a clear idea of what is ACCA. It is a professional qualification in accounting and finance that is recognised globally, but at its core, it is simply a structured way to learn the skills needed in real-world finance roles. It teaches you how to read financial statements properly, how to analyse decisions using numbers, how to audit with accuracy, and how to think financially in a way that companies genuinely value.

The full ACCA course has thirteen exams, and that number can feel intimidating when you first hear it. This is where ACCA Exemptions become very practical. If your previous degree already covered certain subjects, ACCA lets you skip the equivalent exams. Nothing complicated.

This helps in three straightforward ways.

→ First, it removes repetition. A BCom or MBA Finance student has already done subjects like financial accounting, management accounting or business law.

→ Second, it changes your starting point. Instead of beginning from the very first paper, you start from the level that actually matches your knowledge.

→ Third, it cuts down the overall time you spend preparing.

ACCA Levels and Papers Eligible for Exemptions

The following table summarises the structure of ACCA’s early levels and helps you understand how exemptions map to the exam tiers. This is especially useful for students who are unclear about which level their degree corresponds to.

| ACCA Level | Papers | Eligible for Exemptions | Notes |

| Applied Knowledge | BT, MA, FA | Yes | Maximum exemptions at this level |

| Applied Skills | LW, PM, TX, FR, AA, FM | Yes | Exemptions depend on degree relevance |

| Strategic Professional | SBL, SBR, AFM, APM, ATX, AAA | No | Exemptions not permitted |

Many students think exemptions at the Applied Skills level are automatic. They are not. The matching is based on syllabus strength, depth of coverage, credit hours and institutional approval history.

Now, imagine climbing a thirteen-story building one floor at a time. Some floors are easy, some have tricky corners, and some feel like they have been designed to test your patience. This is how the ACCA journey feels for most students. It is long, demanding and requires the kind of discipline that most university degrees do not prepare you for.

This is exactly where ACCA Exemptions come in.

ACCA looks at the academic and professional work you have already done. If your past studies covered a subject in a way that matches ACCA’s standards, you are not asked to climb that floor again. You simply take the express lift past it and continue your journey from a higher level.

It sounds simple, but the impact is enormous.

The best part is that exemptions do not dilute the qualification. ACCA maintains the same global recognised standard whether you take all thirteen papers or begin midway. What changes is your starting point. It is like entering a marathon with the advantage of already having built stamina through past training.

💡Key Insight!

Students who receive four to six ACCA Exemptions often finish the qualification nearly 40% faster than those who start from scratch. This does not just save time. It accelerates when you begin Strategic Professional papers, when you start earning, and when you qualify for roles that require higher financial judgment.

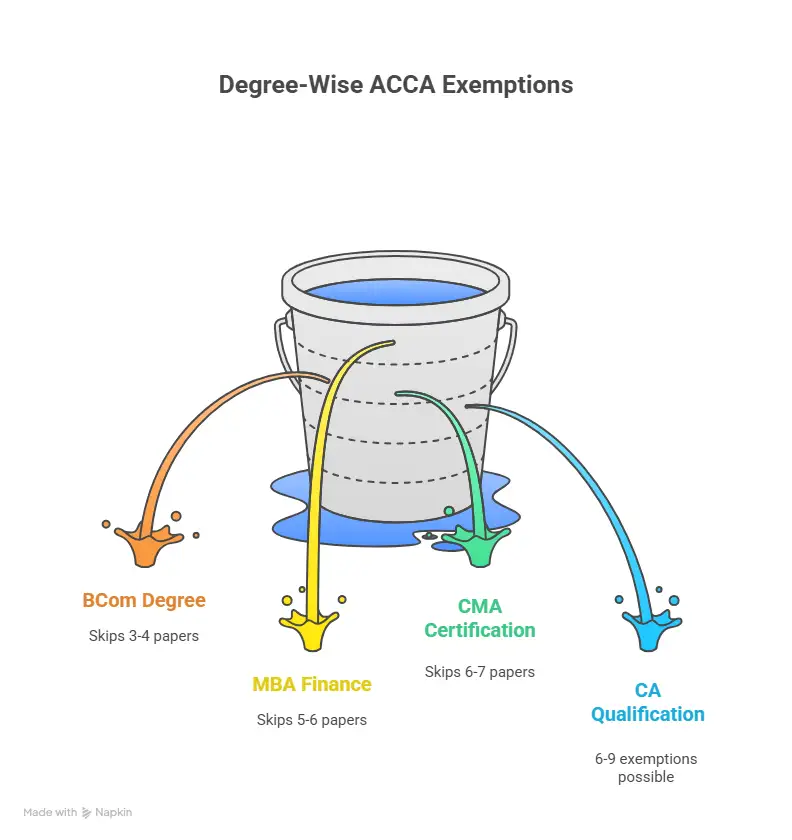

Understanding ACCA Exemptions for CA, MBA Finance, BCom, and CMA

This section gives you a quick, practical look at how different academic and professional backgrounds translate into ACCA Exemptions. By highlighting CA, MBA Finance, BCom and CMA pathways, it helps you understand why some students start ACCA at higher levels, which ACCA subjects their previous qualifications already cover, and how these exemptions shape their overall ACCA journey.

CA

Chartered Accountants receive some of the strongest recognition within the ACCA framework because the CA syllabus already covers advanced accounting, taxation, law, auditing and financial management with considerable depth. This alignment allows qualified CAs to secure the maximum block of ACCA Exemptions across both the Applied Knowledge and Applied Skills levels.

MBA Finance

Many MBA Finance students cover advanced modules like corporate finance, financial modelling and managerial economics. Syllabus depth tends to align well with FM, PM and sometimes MA. This is why ACCA Exemptions for MBA Finance often come out stronger.

BCom

ACCA exemptions for BCom usually include FA, MA, BT and sometimes FR, depending on the institution. Indian BCom degrees vary widely in curriculum quality.

CMA

For ACCA exemptions for CMA, exemptions tend to be higher because CMA training is structured around cost accounting, management accounting and financial principles.

The following visual captures this and gives an overview of the exemptions.

ACCA Exemptions for CA

If you are a Chartered Accountant, your CA qualification carries one of the strongest alignments with ACCA’s early levels. This means you can skip a large part of the foundational structure and begin directly with the advanced papers.

To make this easy to understand, the section below breaks down:

- What exemptions does a Qualified CA receive

- What exemptions a CA Inter student may receive

- What stays non-exempt at all levels

Why CAs Receive High ACCA Exemptions

A full CA qualification includes deep training in:

- Financial Reporting

- Cost and Management Accounting

- Taxation

- Corporate Laws

- Audit and Assurance

- Strategic Financial Management

Because of this coverage, ACCA recognises a large portion of the Applied Knowledge and Applied Skills syllabi.

- Exact ACCA Exemptions for Qualified CA

This table shows the typical exemption mapping followed for Qualified Indian CAs, excluding any university-level variations.

| ACCA Level | ACCA Paper | Exemption Status for CA | Notes |

| Applied Knowledge | Business & Technology (BT) | Exempt | Covered in CA foundation and intermediate law and business modules |

| Applied Knowledge | Management Accounting (MA) | Exempt | Covered through CA costing and management accounting |

| Applied Knowledge | Financial Accounting (FA) | Exempt | Covered comprehensively in CA accounting papers |

| Applied Skills | Corporate & Business Law (LW) | Exempt | Indian corporate law coverage is strong enough for exemption |

| Applied Skills | Performance Management (PM) | Exempt | Managerial accounting and costing in CA match the PM content |

| Applied Skills | Taxation (TX) | Exempt | Indian direct and indirect tax coverage satisfies the exemption |

| Applied Skills | Financial Reporting (FR) | Exempt | CA FR coverage aligns with ACCA’s FR outcomes |

| Applied Skills | Audit & Assurance (AA) | Exempt | CA audit training fulfils the audit syllabus |

| Applied Skills | Financial Management (FM) | Exempt | Strategic financial management in CA covers FM modules |

Total Exemptions for Qualified CA: 9 (Maximum allowed)

A qualified CA typically receives full exemptions across both Applied Knowledge and Applied Skills.

This means they start ACCA directly at the Strategic Professional level.

- ACCA Exemptions for CA Inter

CA Inter students do not receive the full exemption block, but they are still eligible for several important skips.

ACCA Exemptions for CA Inter (Typical)

This table outlines the common exemptions CA Inter students receive, based on partial completion of the CA syllabus.

| ACCA Paper | Exemption Status | Reason |

| BT | Exempt | Business and law modules covered |

| MA | Exempt | Costing and management accounting completed |

| FA | Exempt | Financial accounting is covered in depth |

| LW | Conditional | Depends on the law papers cleared |

| PM | Partial | Some content overlaps, varies by transcript |

| TX | Not Exempt | ACCA tax aligns with the international tax base |

| FR | Not Exempt | IFRS-heavy paper, CA Inter does not fully satisfy |

| AA | Not Exempt | CA Inter audit coverage is insufficient for a full exemption |

| FM | Partially Exempt or Not Exempt | Depends on the depth of SFM completed |

Typical CA Inter Exemptions: 3 to 5 papers

They usually begin at the Applied Skills level.

What CA Students Cannot Be Exempted From

Regardless of qualification:

- No exemptions are given at the Strategic Professional level

- Mandatory papers include SBR, SBL and the optional advanced paper you select

- Case-based professional judgment must be demonstrated directly through exams

This ensures all ACCA members meet the same global standard at senior levels.

Both CA and ACCA are considered among the most sought-after qualifications in Finance. Understanding which one best suits your career goals, hence becomes very important. Below is a video that draws comparisons between the key aspects of both the qualifications and reflects on the salary prospects in-depth:

ACCA Exemptions for MBA Finance

MBA Finance students often carry a diverse academic background. Some completed a BCom or BBA before the MBA, while others transitioned from engineering or economics into finance at the postgraduate level. The MBA curriculum usually includes modules like corporate finance, financial modelling, financial markets, management accounting, and strategic cost management. These align well with several ACCA Applied Skills papers.

Most MBA Finance students using the official ACCA Exemption Calculator on the ACCA site find that at least four to six exemptions are possible. This includes MA, PM, FM and sometimes BT, depending on the university’s accreditation. If the MBA programme includes substantial coursework in accounting theory, FR may also appear on the calculator summary.

The scenarios here are drawn from mentorship examples to help students relate to how MBA exemptions typically look in real situations.

Exact ACCA exemptions for an MBA in Finance

This table outlines the common ACCA exemptions information awarded to students with an MBA in Finance degree. Actual exemptions may vary slightly depending on the university’s curriculum, accreditation status and the strength of subjects like accounting, finance and analytics.

| ACCA Level | ACCA Paper | Exempt for MBA Finance | Reason for Exemption |

| Applied Knowledge | Business & Technology (BT) | Yes | Covered through business management and organisational behaviour modules |

| Applied Knowledge | Management Accounting (MA) | Yes (Most MBAs) | Managerial accounting, cost analysis and budgeting are taught in MBA core subjects |

| Applied Knowledge | Financial Accounting (FA) | Yes (Many MBAs) | Financial accounting fundamentals are present in most MBA Finance programmes |

| Applied Skills | Corporate & Business Law (LW) | Sometimes | Depends on the law coverage in the curriculum |

| Applied Skills | Performance Management (PM) | Yes | Strong alignment with managerial economics, analytics and performance evaluation subjects |

| Applied Skills | Taxation (TX) | Rarely | MBA Finance typically does not include detailed tax training |

| Applied Skills | Financial Reporting (FR) | Sometimes | Exemption depends on IFRS or advanced accounting exposure |

| Applied Skills | Audit & Assurance (AA) | No | MBA Finance does not offer audit-specific learning |

| Applied Skills | Financial Management (FM) | Yes | Strong match with corporate finance, investment analysis and capital budgeting modules |

Common scenarios for MBA Finance exemptions

- Students with a strong finance-heavy MBA receive exemptions in 5 to 6 papers

- Students whose MBA was general management-focused receive fewer exemptions

- MBAs from AICTE-approved institutes often qualify for predictable exemption patterns

- International MBA programmes with IFRS coverage may secure FR exemptions

- Students with a dual degree, such as MBA plus BCom, see outcomes influenced mainly by the MBA

One important detail that students often overlook is that the ACCA calculator prefers postgraduate courses where the accounting content is well-documented in transcripts. If your transcript generalises subjects under terms like “Financial Studies”, the calculator may not recognise the syllabus match.

ACCA Exemptions for BCom

BCom students form the largest segment of ACCA aspirants in India. Many universities teach financial accounting, but vary widely in coverage of IFRS, audit practice and strategic subjects like performance management. Because ACCA follows a globally consistent standard, BCom exemptions depend heavily on the intensity and structure of the programme.

Typical Exemption Outcomes for BCom Graduates

This table summarises typical exemption outcomes observed among BCom students across a variety of Indian universities. It reflects mentoring trends, not official ACCA numbers.

| BCom Category | Typical Exemptions | Influencing Factors |

| BCom (General) | 3 to 4 papers | Accounting coverage, auditing depth, and IFRS exposure |

| BCom (Hons) | 4 to 5 papers | Higher credit hours, structured finance modules |

| BCom with International Accounting Electives | 5 to 6 papers | IFRS, international reporting, audit modules |

Watch this video to explore how you can get started on your ACCA journey after you have done a BCom:

Key Insight: Many students assume that BCom is a guaranteed path to a high number of exemptions. The quality of the university plays a significant role. Autonomous colleges that follow global accounting standards often see higher alignment with ACCA.

ACCA Exemptions for CMA

Students who have completed CMA tend to receive more exemptions than typical degree holders. This is because CMA training includes structured modules in costing, performance management, finance theory and strategic analysis. These subjects map directly to ACCA’s Applied Skills level.

When CMA students run their qualification through the ACCA exemption calculator tool, they often find exemptions in PM, FM, MA and sometimes additional papers depending on international accreditation.

ACCA Exemptions for CMA Graduates

This table explains the ACCA exemptions usually awarded to CMA students. Since the CMA curriculum focuses heavily on cost accounting, performance management, corporate finance and strategic decision making, it aligns closely with several ACCA Applied Skills papers. Actual exemptions may vary slightly based on whether the candidate holds CMA India or CMA USA, the year of completion and transcript match.

| ACCA Level | ACCA Paper | Exempt for CMA | Reason for Exemption |

| Applied Knowledge | Business & Technology (BT) | Yes (Most CMA students) | CMA covers the business environment, management concepts and organisational performance |

| Applied Knowledge | Management Accounting (MA) | Yes | CMA core syllabus includes extensive cost and management accounting |

| Applied Knowledge | Financial Accounting (FA) | Sometimes | Some CMA programmes include accounting fundamentals; varies by transcript |

| Applied Skills | Corporate & Business Law (LW) | No | CMA does not provide detailed corporate law coverage |

| Applied Skills | Performance Management (PM) | Yes | Strong match due to CMA’s focus on decision making, variance analysis and costing systems |

| Applied Skills | Taxation (TX) | No | CMA curricula do not typically include taxation to the ACCA depth |

| Applied Skills | Financial Reporting (FR) | Sometimes | Depends on exposure to financial statements and IFRS concepts |

| Applied Skills | Audit & Assurance (AA) | No | Audit is not part of the CMA core syllabus |

| Applied Skills | Financial Management (FM) | Yes | CMA covers capital structure, investment analysis, working capital, and financial strategy |

Common patterns in CMA-based exemptions

This list captures common outcomes and patterns seen among CMA students pursuing ACCA.

- CMA often leads to 6 or more exemptions, depending on the region

- Students with CMA and prior commerce degrees may start ACCA at the Strategic Professional stage

- CMA improves performance in SBL because of strong strategic modules

- CMA candidates entering ACCA find financial management papers easier if they skip exemptions and choose to revise

- CMA qualification improves job readiness while progressing through the Strategic Professional papers

One thing CMA students appreciate is that ACCA recognises rigorous professional qualifications. The exemptions granted to CMA students reflect confidence in professional learning outcomes.

The Impact of Exemptions on Your ACCA Timeline

Students often underestimate how exemptions reshape their preparation calendar. Those starting with 6 or more exemptions finish the qualification much earlier, but must adapt to the pace of Strategic Professional.

Estimated ACCA Completion Timelines With Exemptions

This table illustrates how exemptions affect the total timeline for different student types and provides a broad estimate for planning.

| Starting Point | Estimated Duration | Notes |

| 0 Exemptions | 2.5 to 3 years | Full journey through 13 papers |

| 3 to 4 Exemptions | 2 to 2.5 years | Common for BCom students |

| 5 to 6 Exemptions | 1.5 to 2 years | Typical for MBA Finance students |

| 6 to 7 Exemptions | 1.3 to 1.8 years | Many CMA students fall here |

| 8 to 9 Exemptions | 1 to 1.3 years | Rare but possible for accredited degrees |

Choosing Whether to Claim or Skip Exemptions

Many students assume that claiming every eligible exemption is always beneficial. This assumption becomes problematic for students with weak foundations. For example, if a BCom graduate claims exemption in Financial Reporting but has little exposure to IFRS, they will struggle heavily in Strategic Business Reporting later.

- Claiming exemptions requires a careful balance. Consider these factors:

- Strength of your academic foundation

- Gap between graduation and the ACCA start date

- Comfort with international reporting standards

- Goal of becoming a statutory auditor

- Long-term plans with Big 4 firms

Mentors often ask students to consider how exemptions affect future exam performance rather than how they save time.

How To Use ACCA Exemptions To Strengthen Your Preparation

Some students claim all exemptions and then realise they are underprepared for strategic-level exams. Others spend months avoiding exemptions because they fear missing foundational knowledge. Both extremes cause unnecessary delays.

The key is to evaluate your exemptions not as shortcuts but as academic evidence of what you already know. If you have genuinely mastered performance management or managerial accounting, claiming the PM or MA exemption makes perfect sense. If your exposure to IFRS is weak, it may be useful to skip claiming the FR exemption and sit for the paper.

Strategies for using ACCA exemptions in a thoughtful manner

This list presents strategies that help students use exemptions intelligently rather than mechanically.

- Claim exemptions only for subjects you feel fully confident about

- Take one or two foundational papers manually if your basics need strengthening

- Use mentor feedback to identify weak conceptual areas

- Plan Strategic Professional exams only after reviewing missed concepts

- Use revision modules offered by academies like Imarticus Learning to fill conceptual gaps

- Treat exemptions as time savers, not knowledge substitutes

This approach refines your ACCA career journey and improves your confidence in higher-level exams.

Exemptions Are Not Awarded Based On Multiple Degrees Combined

This is a fact that surprises many students. If you have a BCom, an MBA in Finance, a CA, and a CMA, ACCA does not combine exemptions from all three. Instead, ACCA evaluates the single qualification that provides the highest number of exemptions.

For example:

- BCom might provide 4

- MBA Finance might provide 5

- CMA might provide 7

ACCA will grant the highest eligible number, which in this case aligns with CMA.

Students sometimes misinterpret this as ACCA ignoring their other degrees. In reality, ACCA ensures that exemptions are academically justified rather than accumulated.

Using the ACCA Exemption Calculator Correctly

Many students have used the calculator casually. The ACCA Exemption Calculator available on the ACCA’s official website is highly precise, but students often interpret the results incorrectly. The calculator does not evaluate the quality of your transcripts. This guide to applying for exemptions simply reflects what ACCA already recognises globally. The final approval always happens after registration and document upload.

Checklist for interpreting exemption calculator results

Students often misinterpret what the calculator shows for ACCA exemptions. This checklist helps confirm whether you are reading the results in the right context, especially when evaluating exemption eligibility before joining ACCA.

- Ensure the correct country and university are selected

- Match your exact degree title, not a close alternative

- Understand that exemptions for BCom, MBA, CMA or BBA differ

- Expect minor variations when ACCA updates its syllabus

- Treat results as provisional until ACCA verifies documents

Why Not All Degrees Receive Equal Exemptions

Higher exemptions are awarded only when the degree content matches ACCA standards. Many Indian universities follow theory-heavy accounting curricula without integrated practical components. ACCA looks for practical, standards-based learning. If your degree had minimal IFRS training, exemptions in FR or SBR will not be granted.

This is why some MBA Finance degrees get more exemptions than BCom degrees, even though BCom is technically more accounting-focused. The key differentiator is curriculum depth.

Your Roadmap After ACCA Exemptions

Once exemption outcomes are visible in the student portal, most candidates are unsure how to build a structured preparation plan. Many students rush into Strategic Professional exams without revisiting concepts from exempted papers. This creates conceptual gaps that surface unexpectedly during case-based or scenario-based questions.

A successful plan begins by evaluating how many papers you must complete, how many papers you skipped, and how strong your base knowledge is for the advanced exams you intend to take.

Strategic planning framework for post-exemption ACCA students

The framework outlines a stepwise process for planning your ACCA journey after exemptions are confirmed. It is suitable for students with 0 to 9 exemptions.

- Review all topics from your exempted papers to identify areas needing revision

- Map each Strategic Professional paper to the foundational papers underneath it

- Build a study timeline that includes a short revision cycle for exempted concepts

- Practice integrated case studies to check conceptual depth

- Take at least one mock exam per subject with mentor feedback

- Use revision lectures from training academies like Imarticus Learning to rebuild weaker areas

- Plan Strategic Professional attempts in pairs, especially SBR with SBL

- Leave enough time to revisit corporate reporting and audit techniques

This structured approach avoids rushed attempts and improves exam confidence.

How ACCA Evaluates Your Qualification

ACCA never discloses internal scoring criteria, but over time, mentors observe patterns. ACCA typically assesses:

- Curriculum matches with ACCA modules

- Credit hours of accounting and finance subjects

- Whether the institution is accredited

- Whether the qualification is relatively recent

- Depth of subjects such as financial reporting and audit

- Whether quantitative subjects carry academic weight

This evaluation is the reason why sometimes two students with the same degree from different universities receive different exemption outcomes.

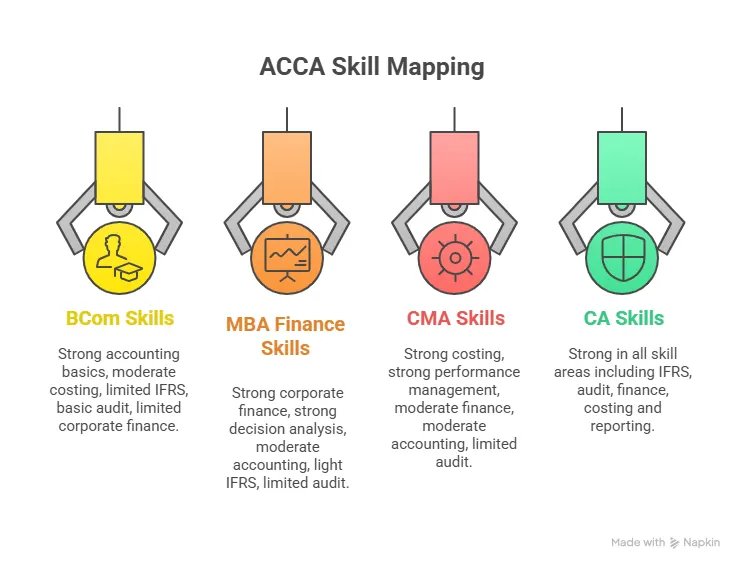

Here is a visual that maps the various ACCA skills that you will be evaluated as per the degree you hold. This allows you to apply for exemptions:

Why Choose Imarticus Learning for Your ACCA Journey

Choosing the right learning partner matters more than most students realise. ACCA is a long, layered qualification, and the quality of your preparation shapes how confidently you move through each level. Imarticus Learning stands out because its ACCA course prep is designed with a clear structure, industry alignment and transparent outcomes. Nothing is vague. Nothing is overstated. Every feature ties back to what an ACCA student actually needs.

- Joint certification in collaboration with KPMG in India: the programme is co-designed with KPMG in India.

- Gold status ACCA Learning Partner: Imarticus is a gold-status approved partner of the ACCA, signalling high quality in content and delivery.

- Study materials powered by Kaplan: Course content uses Kaplan-approved resources: books, question banks, practice papers and on-demand sessions.

- Money-back guarantee: If you do not clear all your ACCA Professional level exams, Imarticus offers a 50% fee refund guarantee.

- 100% placement/intership support: For students completing the initial levels, Imarticus promises internship or placement opportunities with leading firms.

- Real-world case-study focus: The ACCA programme is built with 23 business case studies aligned to market requirements and evaluated by KPMG practitioners.

- Flexible learning modes: Offers both offline and online classes, making the ACCA path accessible regardless of your location.

FAQs About ACCA Exemptions

This section answers the most frequently asked questions students ask about ACCA exemptions, from eligibility and rules to fees and degree-wise exemption limits. It is designed to clarify doubts quickly and help you understand how exemptions work, how many you can receive and how they affect your overall ACCA journey.

How to get 9 exemptions in ACCA?

Students can receive up to nine ACCA Exemptions if their qualification matches ACCA’s Applied Knowledge and Applied Skills syllabi completely. This is usually possible when a degree is formally accredited by ACCA and covers accounting, finance, audit and taxation in depth. Students should verify their eligibility using the official calculator on the ACCA site and then submit transcripts for review. Training institutes such as Imarticus Learning can guide students through document preparation

How many exemptions are there for ACCA?

There is a maximum of nine ACCA Exemptions available across the Applied Knowledge and Applied Skills levels. These include BT, MA, FA and LW, PM, TX, FR, AA and FM, depending on academic background. Strategic Professional papers do not carry exemptions. Students often assume these exemptions are automatic, but each exemption reflects a syllabus match that ACCA must validate through transcripts.

What is the 7-year rule for ACCA?

The seven-year rule applies once a student enters the Strategic Professional exams. From the first attempt of a Strategic Professional paper, students have seven years to complete the remaining exams. This ensures that ACCA members demonstrate updated, consistent knowledge. Many students enrol in coaching support through Imarticus Learning to maintain exam consistency.

How to claim per the exemption ACCA?

Claiming exemptions is done through the official ACCA portal after registration. Students must upload academic transcripts, degree certificates and any supporting documentation. ACCA then verifies the syllabus match and confirms the exemptions along with applicable exemption fees. Students should check their qualifications through the calculator first, then finalise documents before submitting the exemption request.

Is ACCA closing in 2026?

There is no announcement from ACCA indicating closure in 2026. Rumours usually arise from changes in global regulatory environments or updates to international accounting standards. ACCA has existed for more than a century and remains one of the most widely recognised global accounting qualifications.

Is it better to claim ACCA exemptions?

Claiming exemptions can save significant time and effort when the student’s academic foundation is strong. However, exemptions must be claimed thoughtfully. Students who feel uncertain about IFRS, taxation or audit may benefit from sitting for certain papers even if exemptions are available. Institutes like Imarticus Learning help students evaluate whether claiming or skipping certain exemptions will enhance readiness for Strategic Professional exams.

What is the cost of ACCA exemptions in India?

The cost of exemptions in India varies depending on the paper and is updated regularly by ACCA. Students must pay an exemption fee for each paper they skip. These fees tend to increase gradually over time because they reflect administrative processing and recognition of prior learning. Students should check the current fee structure on the official ACCA site or consult with academies like Imarticus Learning for the latest updates and planning advice.

Is ACCA losing its worth in India?

ACCA remains a respected global qualification in India. Demand for ACCA professionals is rising because of global business processes, international accounting standards and multinational corporations operating in India. Big 4 firms and global capability centres are actively hiring ACCA students..

Which degree gives the maximum ACCA exemptions?

Degrees that provide the highest number of exemptions are usually ACCA-accredited accounting and finance degrees offered by recognised universities. Professional qualifications like CMA also offer strong exemption pathways. MBA Finance degrees with intensive accounting modules can offer multiple exemptions as well. Institutes such as Imarticus Learning can help students interpret calculator results correctly.

Which university gives the most ACCA exemptions in India?

Several Indian universities offer strong pathways for exemptions, particularly those that embed international accounting, IFRS-based teaching and practical financial reporting modules. Universities that partner with ACCA or global accounting academies often align their syllabus closely with ACCA expectations. Students should verify the exact exemption count through the ACCA calculator and then consult training partners like Imarticus Learning for mentorship support.

Which degree is equal to ACCA?

No degree is considered equal to ACCA, although some qualifications align closely enough to provide several exemptions. ACCA is a professional qualification with global recognition, practical assessment methods and international regulatory alignment. Degree programs, even if comprehensive, do not fully replicate the strategic case-based structure of ACCA’s advanced papers.

Can I apply for ACCA exemptions after registration?

Yes, students can apply for exemptions after registration by uploading the required documents in the ACCA portal. Students often start with registration first, then gather transcripts and degree certificates to claim exemptions. The process is straightforward but must be completed accurately to avoid approval delays.

Conclusion

ACCA exemptions allow you to begin ACCA from the level that genuinely reflects your prior learning. They reduce repetition, shorten timelines and help you focus your effort on the papers that have the most impact on your global finance career. Whether you come from BCom, MBA Finance, CA or CMA, using your exemptions thoughtfully ensures you build momentum instead of feeling weighed down by subjects you have already mastered.

Pairing these exemptions with structured preparation strengthens the advantage even further. Imarticus Learning’s ACCA course prep offers a balanced mix of guided training, industry-aligned resources and steady mentor support, making the progression to Strategic Professional levels far smoother. If you are ready to begin your ACCA journey, choosing the right academic partner can make your exempted pathway faster, clearer and far more rewarding.