Table of Contents

Investment banking subjects are not meant to make you sound smart. They’re meant to make you useful. In the real world, nobody cares how many chapters you’ve completed. What matters is whether you understand how money moves, how risk is managed, and how real financial decisions are made.

When you study for the investment banking certificate in the right way, something shifts. Your thinking changes from a student preparing for exams and starts to transition to someone who belongs in the industry. Investment banking concepts quietly shape how you analyse problems, how careful you are with numbers, and how confidently you handle responsibility.

Investment banking isn’t just about big job titles or impressive salaries. It’s about solving real business problems, making decisions under pressure, and working in environments where accuracy matters. And most people don’t realise this, but the subjects you study are built exactly for that purpose.

At first, topics like financial modelling, valuation, M&A, and capital markets can feel heavy and technical. But on the job, these become your everyday tools. They help you understand companies, evaluate deals, and support decisions that move real money and real businesses.

In this blog, I’ll try to bridge that gap between classroom learning and real work. I’ll show how what you study as your investment banking subjects isn’t just theory on a slide, but actual skills that you’ll actually use in meetings, projects, and day-to-day banking roles.

Did you know?

Every major subject you study in investment banking, from markets, operations, risk, compliance, derivatives, and settlements, directly matches an actual team inside a bank. That means your syllabus is not theoretical – it is literally a map of how an investment bank is structured in real life.

Why Investment Banking Subjects Matter

Most people think investment banking is only about big deals and high salaries. But behind every deal is a massive system that needs to work perfectly.

So what is investment banking, really? If I have to explain it in simple terms, investment banking is about helping companies and governments raise capital, make significant financial decisions, and manage complex transactions. It’s the space where finance meets strategy. Banks advise companies on mergers and acquisitions, help them go public, raise funds through bonds or shares, and make sure large financial deals are executed smoothly.

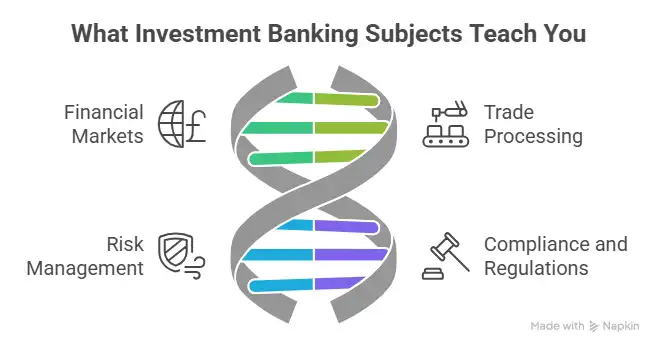

Investment banking subjects are what introduce you to that world; they teach you:

- They show you what really happens after a deal is signed, after a trade is placed, and after money starts moving. You begin to see that banking isn’t just about making money, it’s about handling responsibility.

- They help you understand how financial markets actually work in real life. Who is trading, why they are trading, and what happens the moment a trade is executed.

- They teach you the full journey of a trade, step by step – from execution to confirmation to settlement. You realise how even small mistakes can turn into big problems if systems are not handled carefully.

- They show you how banks protect themselves from different types of risk, including market risk, operational risk, credit risk, and compliance risk. Risk management stops being a theory and starts feeling like the backbone of banking.

- They explain why compliance and regulations matter so much. You understand how rules shape daily operations, protect customers, and keep the financial system safe and stable.

When you understand this foundation, you also gain clarity on how your skills translate into real earning potential, making it easier to evaluate the true investment banking salary in India and the value professionals bring to the industry.

Together, these investment banking topics build the foundation of every real banking role. They don’t just teach you finance. They teach you how banks stay safe, stable, and trustworthy.

If you’re still trying to visualise what investment banking actually involves beyond text and definitions, here’s a short video that breaks down the role of an investment banker – what they do, how they think, and how deals come together in real life:

Investment Banking Subjects & Topics Breakdown

Investment banking isn’t just about fancy job titles or big numbers. It’s about understanding how money really moves, how trades actually get completed, and how global financial institutions function every single day. A good investment banking curriculum doesn’t make you feel like a student. It slowly trains you to think like a professional who belongs inside a bank.

That’s exactly how the Certified Investment Banking Operations program is structured. It’s not built for just investment banking exams. It’s built for real work. You don’t just learn concepts. You learn how banks operate.

Financial Markets & System Overview

This is where everything starts. You first understand how financial markets are connected and how money flows through equities, bonds, derivatives, and forex, and how all of this is reflected in financial statements that show the real impact of market activity on a company’s performance.

Instead of memorising definitions, you begin to see the market as a system.

Who trades?

Why do they trade?

What happens after a trade is placed?

It changes your mindset from “learning finance” to “working in finance.”

Introduction to Investment Banking Operations

This is where you see what actually happens inside an investment bank.

You learn about the trade lifecycle – from the moment a trade is executed to when it is settled. You understand why operations teams exist and why they are critical to the bank’s survival.

Without operations, even the biggest trades mean nothing.

No settlement = no money.

This is the point where you stop seeing banks as abstract institutions and start seeing them as real working systems.

Cash Equities & Fixed Income Securities

Here you get into the heart of financial products. You learn how shares and bonds are traded, processed, and managed. More importantly, you understand what can go wrong if things aren’t handled properly.

It’s not just “what is a bond?”

It becomes: How is it settled? How is it recorded? What happens if prices move suddenly? That’s real-world thinking.

Foreign Exchange & Money Markets

This is where you understand how global money actually flows. You learn how currencies are traded, how banks manage liquidity, and how short-term funding keeps the financial system alive.

This subject quietly teaches you something powerful: Banks don’t run on profits alone. They run on liquidity.

Derivatives Markets

Derivatives sound complex, and honestly, they are. But here you practically learn them. You understand futures, options, and swaps not just as instruments, but as contracts that need to be tracked, valued, and settled accurately.

This subject builds your respect for precision. Small errors in derivatives can become big problems.

Trade Lifecycle & Reference Data

This is one of the most important areas used by investment bankers. You follow a trade from start to finish:

- Execution

- Confirmation

- Settlement

- Reconciliation

You also learn about reference data – the backbone of every system. If this data is wrong, everything breaks. This is where you truly understand how detail-oriented investment banking is.

Corporate Actions & Reconciliation

This is about handling real-life events like valuation, dividends, stock splits, and bonus issues. You learn how banks adjust positions, update records, and resolve mismatches between systems.

It teaches patience, accuracy, and accountability. Three qualities every investment bank looks for.

Asset Management, Risk & Compliance

Here, your role expands beyond just trades. You learn how portfolios are managed, how risks are monitored, and how banks stay compliant with regulations.

KYC, AML, and compliance stop feeling like boring rules. You start seeing them as protection systems for the entire financial world.

Collateral & Credit Support

This is about safety. You learn how banks protect themselves from counterparty risk using collateral and margin systems. This is how trust is maintained in global markets.

No collateral = no confidence.

Interview Readiness & Professional Skills

Building the skills required in investment banking is where everything becomes real. You’re not just learning finance anymore. You’re preparing to walk into an interview and speak like someone who understands banking from the inside.

Confidence comes from clarity. And clarity comes from practice.

At this stage, many students start wondering about investment banking eligibility. The good news is that you don’t need to be a finance genius to begin. Most investment banking courses are designed for graduates from commerce, management, engineering, or even non-finance backgrounds who are willing to learn, stay consistent, and build strong fundamentals.

Also Read: How investment banking compensation compares with other finance careers.

What Makes Investment Banking Subjects Different

What makes investment banking subjects different is that they don’t treat finance like an academic topic. They treat it like a working system that has real consequences. You’re not just learning concepts to pass an exam; you’re learning how real banks function every single day. If you are wondering how to become an investment banker, you should be able to:

- Process millions of trades.

- Prevent financial and operational disasters.

- Manage global money flows.

- Stay compliant with regulations.

- Protect themselves from risk.

This is professional training, not academic learning.

Most courses teach you what something is. Investment banking subjects teach you how things actually happen. How a trade moves through systems. How money gets settled. How errors are caught. How risk is controlled. How compliance protects the bank and its clients.

These subjects force you to think practically. Accuracy matters. Timelines matter. Responsibility matters. One small mistake in banking can have a big financial and legal impact, and these subjects train you to respect that from the start.

They also connect everything. Markets, operations, risk, compliance, settlements, and technology are not taught as separate topics. You begin to see how they depend on each other. If one part fails, the entire system feels it.

Another big difference is mindset. While most subjects focus on understanding, investment banking concepts focus on trust. Banks don’t just hire people who know finance; there are plenty of them available in the market. They hire professionals they can trust with their money, data, and investment decisions. These subjects for investment banking quietly train you to become that person.

And finally, investment banking subjects prepare you for responsibility. They move you away from being a student and closer to being a professional. You evolve from asking, “Will this be in the exam?” and start thinking, “What happens if this goes wrong in real life?”

That shift is what truly makes them different.

Here’s a short video that breaks down the real day-to-day responsibilities of investment bankers – from pitching deals and analysing companies, to working with financial models and collaborating with clients:

How to Study Investment Banking Subjects Effectively

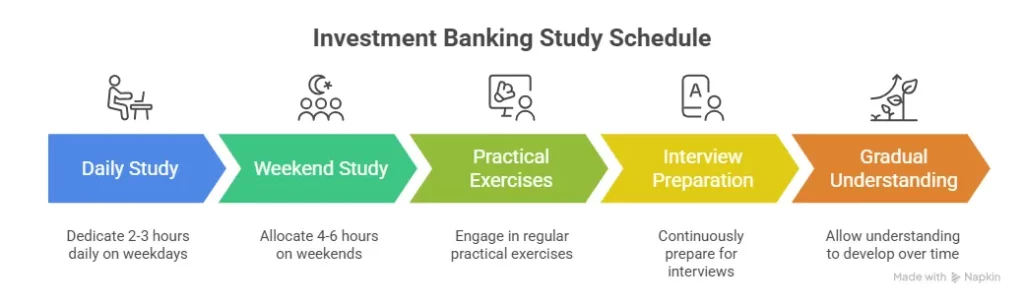

Studying investment banking subjects is less about how smart you are and more about how steady you are. These subjects reward consistency, patience, and real understanding. You’re not preparing to pass an exam; you’re preparing to handle responsibility in a real banking role. So the way you study for an investment banking degree matters.

The goal is to understand how things work, not just remember them, and practice regularly, not occasionally. Consistency beats intensity. A simple, realistic routine works best:

| What to Do | How to Do It | Why It Helps |

| Study daily | 2-3 hours on weekdays | Builds consistency and keeps concepts fresh |

| Weekend revision | 4-6 hours for practice and recap | Strengthens memory and fills gaps |

| Focus on concepts first | Understand before memorising | Makes learning logical and long-lasting |

| Practice real scenarios | Use case studies & trade flows | Trains job-ready thinking |

| Revise weak areas weekly | Note mistakes and correct them | Prevents repeated errors |

| Do mock interviews | Practice explaining concepts aloud | Builds confidence and clarity |

| Connect subjects | See how markets, operations & risk link | Helps you think like a professional |

| Track progress | Weekly self-check | Keeps you motivated and organised |

Investment banking subjects teach you about becoming someone the financial industry can trust. When you study them calmly and seriously, you’re not just preparing for a job. You’re preparing for a responsibility.

How Investment Banking Subjects Train You for Real Banking Roles

You can think of an investment banking course in India as the engine that keeps large-scale finance moving. Deals may be the headline, but the real work is in making sure money flows safely, systems stay stable, and trust in the financial world is maintained.

Investment banking subjects don’t just teach you finance. They train you to think, act, and take responsibility like someone who already works in a bank. That’s the real difference.

When you study these subjects properly, you start paying attention to accuracy. You become more careful with numbers. You understand why processes exist and why shortcuts can be dangerous. You stop asking “Will this come in an exam?” and start asking “What happens if this goes wrong in real life?”

They also build your confidence. When you know how trades move, how risks are controlled, and how systems connect, you don’t feel lost in interviews or on the job. You feel prepared. You know what banks expect and why.

Most importantly, these subjects teach you responsibility. In investment banks, you deal with real money, real clients, and real consequences. These topics slowly train your mindset to handle that pressure calmly and professionally. That’s how students turn into banking professionals.

This table shows how investment banking subjects connect to real banking roles:

| Investment Banking Subject | What You Learn | Job Roles That Use It |

| Financial Markets & Systems | How markets function, and money flows | Market Analyst, Trade Support Analyst |

| Investment Banking Operations | Trade lifecycle, settlement process | Operations Analyst, Settlements Officer |

| Cash Equities & Fixed Income | Trading and processing stocks and bonds | Equity Operations, Fixed Income Analyst |

| Foreign Exchange & Money Markets | Currency trading and liquidity management | FX Operations, Treasury Analyst |

| Derivatives Markets | Futures, options, swaps and their risk | Derivatives Analyst, Risk Analyst |

| Trade Lifecycle & Reference Data | Execution to settlement accuracy | Middle Office Analyst, Reconciliation Analyst |

| Corporate Actions & Reconciliation | Handling dividends, splits, mismatches | Corporate Actions Analyst, Control Analyst |

| Risk Management | Identifying and controlling financial risks | Risk Analyst, Credit Risk Officer |

| Compliance & Regulations | KYC, AML, regulatory standards | Compliance Officer, Regulatory Analyst |

| Collateral & Credit Support | Margin, collateral management | Collateral Analyst, Credit Support Analyst |

| Asset Management Basics | Portfolio handling and reporting | Portfolio Analyst, Fund Operations |

| Interview & Professional Skills | Communication and confidence | All entry-level banking roles |

When you look at it this way, investment banking subjects stop feeling theoretical. You can clearly see where each topic fits inside a real bank.

You’re training for accuracy, responsibility, trust, and professional thinking. And that is exactly what banks look for when they hire.

If you’re serious about turning your study into a real career, this video breaks down actionable steps and mindset shifts that can help you actually land a job in investment banking.

Career Impact of Learning Investment Banking Subjects

In real banks, a single settlement error can delay millions of dollars. So the investment banking career impact is largely dependent on the understanding of investment banking subjects.

Learning investment banking subjects changes the perception of you in the hiring industry – from being seen as just a graduate or a fresher, to being seen as someone who understands how banking actually works. That shift is powerful.

When you know how trades move, how risks are managed, and how systems connect, you become useful from day one. Companies don’t have to spend months teaching you the basics. You already speak their language. That alone makes you stand out.

These subjects also open up more career options. Instead of being limited to one narrow role, you become suitable for multiple teams:

- Operations

- Trade support

- Risk and compliance

- Asset management

- Treasury

- Reconciliation and control

- Middle office and settlements

You gain flexibility in your career. If one role doesn’t suit you, you can shift to another because your foundation is strong.

Another big impact is confidence. When you understand how banking works from the inside, interviews feel different. You’re not memorising answers. You’re explaining processes. You sound natural. That confidence is something recruiters immediately notice. It also builds trust.

Investment banks always look for people who are careful, structured, and reliable as they deal with sensitive data, large transactions, and strict regulations. Investment banking subjects train you to think that way. You become someone they feel safe trusting with the responsibility of investment banking jobs.

And over time, this knowledge helps you grow faster. Promotions in banking often come to people who understand systems, prevent errors, and handle risk well. These subjects prepare you for that long-term growth, not just your first job.

Most importantly, learning investment banking subjects changes your mindset. You stop thinking like a student and start thinking like a professional. That’s the real career impact.

Did you know?

Most costly banking errors don’t happen because of bad financial knowledge, but because of process mistakes in settlement, reconciliation, or compliance, which is why these subjects focus so much on accuracy and control.

Why Imarticus Learning for Investment Banking Subjects

Choosing where you learn matters just as much as what you learn – especially for something as detailed and practical as an investment banking program. Imarticus Learning doesn’t treat investment banking subjects like textbook theory. They teach them as real skills you’ll actually use in a job.

Here’s what makes Imarticus stand out:

- Work-Ready Curriculum – Imarticus doesn’t just cover concepts; it teaches you how banks actually operate.

- Industry-Aligned Structure – The subjects are organised in a way that mirrors how real financial institutions work. You learn the foundational pieces first, then build up to more advanced topics – just like you would on the job. This makes your learning feel logical and connected, not disjointed or academic.

- Practical Learning – Several modules are built around practical exercises, case studies, and scenario-based learning.

- Expert Faculty with Industry Experience – The trainers at Imarticus aren’t just educators, they’re professionals who’ve worked in finance. They explain concepts with examples drawn from real market situations, making everything easier to understand and more relevant.

- Career-Focused Support – Imarticus goes beyond teaching investment banking subjects and helps with interview preparation, resume building, and understanding how your subject knowledge translates into roles like operations analyst, risk analyst, trade support, or treasury associate.

- Flexible Learning Options – Whether you prefer online classes, live sessions, or recorded lectures to revisit later, Imarticus fits into your schedule. This makes it easier to balance preparation with work or studies.

- Regular Practice – With mock tests, performance feedback, and doubt-clearing support, you always know where you stand. You don’t just finish a topic, but you master it.

- Exposure to Broader Finance Ecosystem – Apart from investment banking subjects, Imarticus connects you with industry webinars, finance frameworks, and guest sessions that help you see the bigger picture beyond just one course.

What makes Imarticus Learning even more valuable is its focus on investment banking placement, where your subject knowledge is directly connected to interview preparation, job roles, and real hiring expectations of banks and financial firms.

In short, Imarticus Learning doesn’t just prepare you for a test. It prepares you for a job. It teaches you not just what investment banking subjects are, but how they’re used in daily work, and that’s what really makes the difference.

FAQs About Investment Banking Subjects

These frequently asked questions about investment banking subjects can help you understand how investment banking subjects fit into your long-term career plans.

Are investment banking subjects only useful for front-office roles?

Not at all. These subjects are useful across the entire bank. Whether you work in operations, risk, compliance, middle office, or trade support, the same core understanding applies. They help you know how money moves and how systems stay safe.

Can investment banking subjects really make me job-ready?

Yes. They teach you how banks function in real life. You don’t just learn definitions, you learn workflows, systems, risks, and controls. That’s exactly what companies expect from entry-level professionals. If you enrol for a course in institutes like Imarticus Learning, you get access to career support, internship opportunities and placement.

How are investment banking subjects different from regular finance courses?

Most finance courses focus on theory. Investment banking subjects focus on execution. They teach you how trades are processed, how mistakes are fixed, and how responsibility is handled inside banks.

Will studying investment banking subjects help in interviews?

Definitely, by studying these subjects, you won’t sound like someone who memorised answers. You’ll sound like someone who understands investment banking from the inside. That confidence is what interviewers notice.

Can I study investment banking subjects while working full-time?

Yes. Many learners do study investment banking while balancing their jobs. You just need a steady routine and consistency. These subjects reward regular effort more than long study hours.

Do investment banking subjects help only for my first job?

Not just in the first job, but they help throughout your career. Promotions in banking come to people who understand systems, reduce errors, and handle risk well. These subjects prepare you for long-term growth, not just entry-level roles.

Do I need to be good at maths to learn investment banking subjects?

You don’t need to be a maths genius to handle investment banking subjects. A basic comfort with numbers is enough. In most investment banking courses, the real focus is on logic, accuracy, and understanding how systems work. The subjects in investment banking involve processes, managing risk, and making careful decisions rather than solving complex equations. If you can think clearly and pay attention to detail, you’re already on the right track.

Are investment banking subjects too difficult for beginners?

At first, some investment banking topics may look heavy or technical, especially if you’re new to finance. But they are designed to be taught step by step. Once you start seeing how different topics in investment banking connect, everything begins to make sense. In fact, beginners who enrol in institutes like Imarticus Learning often benefit the most because they build strong fundamentals from day one. These subjects for investment banking slowly shape your thinking and prepare you properly for real-world roles.

How Investment Banking Subjects Shape Your Career

Investment banking subjects shape you in quiet but powerful ways as they teach you to be careful with details, confident with decisions, and calm under pressure. As you progress, you stop feeling like a student and start feeling like someone who is a pro who actually understands how the industry works.

Investment banking course subjects give you clarity. You walk into interviews knowing what you’re talking about. You step into roles feeling prepared, not confused. That confidence comes from real understanding, not memorised answers.

If this is the career you want, take investment banking subjects seriously. They are your foundation.

Take your first step by choosing the right investment banking course that doesn’t just teach theory, but prepares you for how the industry actually works. Because the right certification, backed by real skills, is what turns your ambition into a real investment banking career.