Last updated on October 31st, 2025 at 04:05 pm

Last Updated on 4 months ago by Imarticus Learning

Introduction

Arriving on the scene into the volatile and technologically driven landscape, demanding growth through innovation and adaptability, CFO activities do not concern themselves with book balancing and compliance. In short, if you seek to enter the CFO role, one thing is certain–you can no longer rely on a CFO toolbox of yesterday.

The contemporary CFO should be a strategic thinker, a technologically savvy decision-maker, and a powerful leader, all combined into one. From AI-driven analytics skills to financial agility, the competencies have changed significantly. That’s where Chief financial officer training comes in—not only for survival, but for superior performance.

Financial Leadership Skills for CFOs

Those days are gone when CFOs were limited to control and accounting functions. They now head large multifunctional teams, impact boardroom discussions, and shape long-term strategies. It is no longer a choice, but integral—developing financial leadership skills.

A strong CFO today needs grit, emotional smarts, and the ability to genuinely connect with people—especially when things get rocky. It’s not just about the numbers anymore. Effective people management, clear communication across teams & leading change with real presence have all become essential to driving results. If a CFO can’t step up & inspire confidence, especially during tough times, they’re missing the mark.

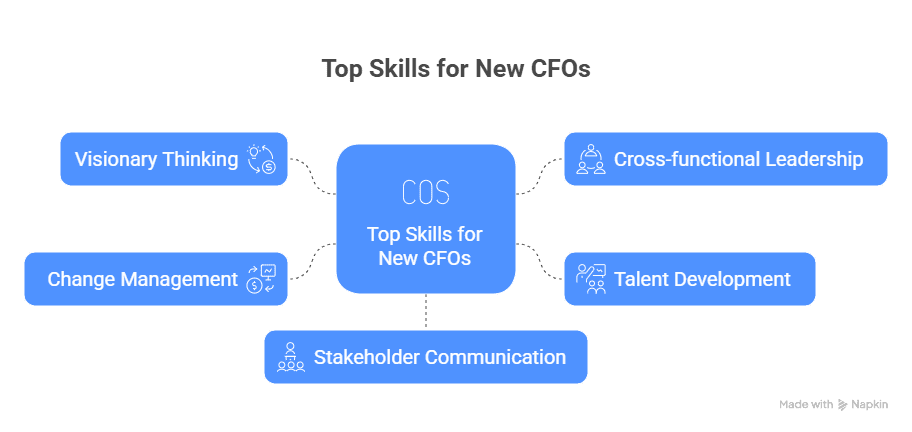

Top Leadership Skills for CFOs Today:

| Skill | Description |

| Visionary Thinking | Setting financial direction aligned with business goals |

| Cross-functional Leadership | Collaborating with Marketing, IT, HR, and Operations |

| Talent Development | Mentoring finance teams for future leadership |

| Change Management | Driving and managing financial transformation |

| Stakeholder Communication | Presenting to boards, investors, regulators |

Investment in Chief financial officer training enables leaders to sharpen these soft and strategic skills—particularly those transitioning from operational finance.

Strategic Thinking for CFOs

Strategic foresight is what truly sets a standout CFO apart in today’s business landscape. It’s not enough anymore to just deliver the numbers every quarter.. companies expect their CFOs to provide sharp insights that actually shape the organization’s direction. A CFO with strategic vision doesn’t just focus on financial statements -they’re evaluating capital investments, analyzing long-term risks, exploring opportunities in new markets, and ensuring the company is ahead of the curve with sustainability initiatives. That’s the difference between simply managing finances and actually driving the business forward. The CFO now has to co-own corporate strategy and work hand in hand with CEOs and COOs.

The most crucial aspects of strategic thinking are:

- Long-term scenario planning

- M&A evaluation and due diligence

- Return on capital analytics

- Sustainability and ESG reporting

- Market intelligence and benchmarking

According to McKinsey, 41% of CFOs now dedicate most of their time to strategic leadership roles, compared to only 25% a decade ago. Clearly, the bar has been raised.

Mastering Financial Risk Management

Risk is now more multidimensional than ever—cybersecurity, global supply chains, currency fluctuations, regulatory changes—the list keeps growing. That’s why financial risk management sits at the core of a modern CFO’s responsibilities.

New-generation CFOs must move from reactive to proactive risk approaches. They must not only comprehend risk exposure but also develop frameworks that enhance resilience and business continuity.

Major risk management areas for CFOs:

- Operational risk and fraud detection

- Cybersecurity and data privacy governance

- Treasury risk such as currency and interest rates

- Climate and sustainability-linked financial disclosures

- Regulatory compliance geographically

Most of these dangers are handled by the application of predictive analytics, AI-based models, and scenario planning—capabilities that may be learned through Chief financial officer training packages for the future.

A good read here is by Deloitte detailing how CFOs are becoming the focal point of enterprise risk strategy.

Digital Finance Skills for Modern CFOs

Finance is going digital, and fast. From robotic process automation (RPA) to cloud ERP to predictive modeling, technology is redefining the role of finance. CFOs today must build strong digital finance skills to stay relevant and future-ready.

You don’t need to be a coder to thrive in digital finance, but understanding the tools and how to apply them for insights and efficiency is vital.

Major Digital Tools CFOs Need to Know:

| Tool/Tech | Purpose |

| Power BI / Tableau | Data visualisation and insights |

| SAP S/4HANA / Oracle | Cloud-based financial planning and control |

| AI/ML Models | Predictive forecasting, anomaly detection |

| RPA Tools | Automating routine finance tasks |

| Blockchain | Secure, real-time ledger tracking |

An HBR study mentions that organisations with technologically savvy CFOs realize 1.5x greater profitability and customer satisfaction growth.

If you’re a finance professional aspiring to lead, explore the Postgraduate Certificate Postgraduate Certificate Programme for Emerging CFOs by IIM Indore. It blends leadership, finance strategy, and digital innovation to future-proof your journey.

Pathways for CFO Career Growth

The CFO career path has changed. Today’s CFOs often function as strategists, technologist, compliance officers, and advisors to the board. To ensure future growth and that you to acquire, to learn and invest in opportunities to grow and that will set you up for future growth as a CFO, is essential to map your journey.

Regardless if you are coming up from a controller position or pivoting from investment banking, what capabilities you need at each path can create momentum to moving forward. Mentorship, upskilling and certification will have a huge impact.

CFO Career Development Roadmap:

Level 1: Senior Manager/Analyst

Develop core technical competencies, budgeting, and financial modeling.

Level 2: Director/Financial Controller

Take ownership of audit, reporting, and budgeting.

Level 3: Strategy Head/VP Finance

Exposure to leadership, M&A, and investor relations.

Level 4: CFO

Oversee enterprise-wide initiatives, board communication, and strategy execution.

To remain competitive, you need to focus on professional growth with formal Chief financial officer training aligned with business directions and individual goals.

Key Takeaways

- The changing role of CFO broadens from finance leader to strategic and digital executive.

- Great leadership in financial management is required, whilst managing people, unpleasant change, and value delivery.

- Business-oriented thinking enables CFOs with long-term influence in business and credibility at board level.

- Being a CFO entails risk management in finance-centric making of decisions, which is crucial in a globalised, technology-driven, and complex economy.

- Endowing future-proof digital finance skills makes CFOs transformation enablers rather than scorekeepers.

- Career growth for CFOs necessitates attitude upgrading, proactive thinking, and forward thinking.

- Pursuing future-centric courses such as Imarticus Learning’s Chief financial officer training will help unleash your full leadership potential.

Frequently Asked Questions (FAQs)

1. Why is chief financial officer training essential for modern finance leaders?

Chief financial officer training equips aspiring CFOs with the advanced leadership, strategic thinking, and digital finance skills needed to navigate complex business environments and lead enterprise transformation.

2. What are the most critical financial leadership skills for today’s CFOs?

Modern CFOs are expected to collaborate across departments, communicate persuasively with stakeholders, cultivate talent, and maintain composure during chaos—because, let’s face it, disruption is the norm now. Anyone hoping to thrive needs to be more than a numbers person; they need the toolkit to lead transformation from the front.

3. How does strategic thinking help CFOs drive business growth?

Strategic thinking enables CFOs to go beyond financial reporting and contribute to corporate strategy through capital planning, M&A insights, market analysis, and ESG initiatives.

4. What role does digital finance play in a CFO’s responsibilities today?

Digital finance skills help CFOs leverage tools like AI, RPA, and data analytics for real-time insights, efficiency gains, and predictive forecasting—crucial for staying competitive.

5. How do CFOs remain ahead in financial risk management?

CFOs need to use proactive risk models on cybersecurity, treasury, compliance, and sustainability. Contemporary training enhances capability in AI-enabled risk analytics and scenario planning.

6. What’s the best path for CFO career growth?

The typical path includes roles like senior analyst, controller, finance director, and VP of finance—each requiring targeted upskilling. Structured training and mentorship are key to advancing to the CFO level.

7. Are there soft skills CFOs need today?

Yes. Emotional intelligence, communication, toughness, and people leadership are now equally essential as technical skills for successful CFO performance.

8. Do I require a technology background to acquire digital finance skills?

No. Although some basic understanding is beneficial, CFO-centric programs break down intricate tools and focus on applied usage over intensive technical coding.

9. What are the benefits of enrolling in the IIM Indore CFO program?

The program offers a comprehensive mix of strategic finance, leadership, and digital innovation training—designed to accelerate CFO readiness and career growth in a global context.

10. How can I assess if I’m ready for CFO training?

If you’re currently in mid-to-senior finance roles, eager to lead transformation, and want to expand your strategic and digital capabilities, CFO training is the next logical step in your journey.

Conclusion

Today’s CFO is not merely a number-cruncher; they define the story. In an age of continued transformation—whether from AI disruption, or ESG imperatives—today’s CFO must be a strategist, technologist, and a coach. It requires a different skillset—combining technical aptitude, business sensibility, digital experience and emotional intelligence.

If you are willing to ascend to the next generation of financial leadership, now is the right time to do so. Through customized programs such as the Postgraduate Certificate Programme for Emerging CFOs by IIM Indore and Imarticus Learning, you can move on from being a capable finance manager to being an impactful CFO.