Last updated on March 26th, 2024 at 10:52 am

Now in the information age, data and information are getting a more important role everywhere, especially for decision-making tasks, classification, and recommender systems. With the use of technologies driven by artificial intelligence, machine learning, big data, and others, we have the duty to understand how we can use these technologies and the vast amount of information for the study and management of credit risk.

As a specialist, you must understand the trends and the different models used by large financial companies and know how to use the different tools available to minimize risks.

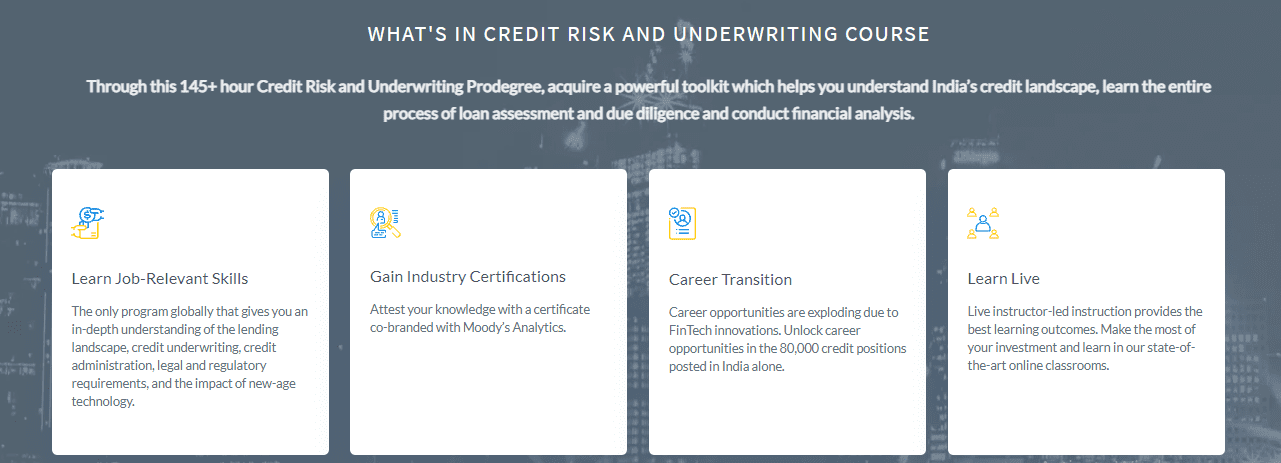

If all this sounds interesting to you, then read on, because at Imarticus we offer the CRU-PRO degree program where you can learn more about these topics and get certified so you can take your career to the next level.

How to Use Data?

Thanks to the information and analysis of the millions of data that is collected every day, it is possible to detect trends and patterns that can be used to predict or make decisions. Data analysis is widely used today due to the rapid advancement of artificial intelligence and can be used in any field such as medicine, finance, meteorology, and content creation.

For financial and credit risk analysis, it can be used to detect patterns of risky behavior given the known history of some businesses. At Imarticus, we know the importance of technological advances and the experience of other financial institutions, which is why in our CRU-PRO degree, we offer you the possibility to learn together with Moody’s Analytics, one of our industrial partners. Moody’s Analytics is a subsidiary of Moody’s Corporation that specializes in the area of financial risk.

How Will You Learn?

The CRU-PRO degree we offer enables you to acquire the theoretical and technical knowledge to enable you to perform as a specialist in any scenario. When you enroll, you will have to take a series of courses such as credit risk management courses, credit analyst courses, credit risk modeling courses, and more with the most qualified teachers during 14 weeks. You will also have to complete 5 case studies to check that you have acquired all the knowledge and skills you have learned during the program.

What Else do I Get When I Take a CRU-PRO Degree?

What Else do I Get When I Take a CRU-PRO Degree?

With our CRU-PRO degree, you also have access to our career service, which will accompany you all the time to improve all kinds of skills so that you have a complete education at the end of the program. This service will help you build a professional profile that corresponds to what is sought in any job offer. As well, we will also help you prepare for the different types of job interviews. We can assure you that by the end of the program, you will have the knowledge and confidence to become a financial risk specialist.

What Can You Become?

Some of the different positions you can aspire to after completing the program are Operational Risk Manager or Credit Risk Manager. You may also have the experience to become an Investor or start in a Credit Financing Manager position.

Conclusion

With this program, you can add great value to your professional profile as you will have theoretical and technical knowledge about risk management.

In addition, you will be aware of all the current most efficient methods using the latest technology to detect credit risks. Upon completion of the credit risk management course, you will have an industry-approved certification that will allow you to showcase the knowledge you have acquired and will open many doors to all kinds of job offers.