Investment Banking Operations Professional (CIBOP™)

The Best Investment Banking Course In India

Why CIBOP Is The Best Course In Investment Banking

CIBOP is a job-oriented investment banking course with placement, aligned to global banks. It is one of the best certification courses for investment banking in India, focused on real-world banking operations.

Graduates of this investment banking training program are prepared for entry-level and mid-office roles, with long-term growth opportunities across the broader investment banking career ecosystem.

7

Interviews Guaranteed

60%

Salary Hike

1200+

Batches Completed

50,000+

Learners

4 LPA

Average Salary

1000+

Hiring Partners

Why CIBOP Is The Best Course In Investment Banking

CIBOP is a job-oriented investment banking course with placement, aligned to global banks. It is one of the best certification courses for investment banking in India, focused on real-world banking operations.

Graduates of this investment banking training program are prepared for entry-level and mid-office roles, with long-term growth opportunities across the broader investment banking career ecosystem.

7

Interviews Guaranteed

60%

Salary Hike

1200+

Batches Completed

50,000+

Learners

4 LPA

Average Salary

1000+

Hiring Partners

Career In Investment Banking

As our commitment to excellence, CIBOP is a complete investment banking course with placement. Our alumni work at some of the top investment banking companies, building a glorious career in investment banking.

About the Investment Banking Course

Our Certified Investment Banking Operations Professional (CIBOP™) course has been guiding finance professionals for over a decade, shaping careers and turning dreams into reality.

Focused on real-world scenarios and insights from industry experts, the refined curriculum of our investment banking course addresses intricacies in securities operations, wealth and asset management, financial market, risk management, and AML. Imarticus offers more than just a certification, it delivers a transformative experience, propelling you toward greatness in the investment banking operations realm.

Why Choose Imarticus For Investment Banking Course

Imarticus Learning is widely recognised as one of the best institutes for investment banking in India, offering industry-aligned investment banking training programs with proven placement outcomes.

Investment Banking Course Reviews

The preferred choice of investment banking professionals, BCom graduates, Finance graduates and more, CIBOP is trusted by millions of learners around the world.

Legacy of 12 Years

Mumbai

Homeground- Birthplace of CIBOP, redefining finance education!

The CIBOP program was launched, laying the foundation for excellence in investment banking education.

The CIBOP program secured trademark recognition, reinforcing its identity as a trusted brand in investment banking operations worldwide.

We secured our first international placement, expanding the global footprint of CIBOP graduates.

With 16 CIBOP centers in India, we’re proud to have impacted 50,000 lives with empowerment and inspiration nationwide.

To know more about our Legacy, (Click here)

Investment Banking Syllabus & Course Curriculum

Core Module

Topics

- Financial System – Structure & Design

- Equities

- Fixed Income Securities

- Derivatives

Beyond Classroom

Learning Outcomes

Assesments

Specialization

Track 1- KYC & Transaction Monitoring

Track 2- Wealth & Asset Management Operations

Topics

- Introduction to KYC in Investment Banking

- Introduction to Anti- Money Laundering

- KYC Remediation

Beyond Classroom

Learning Outcomes

Assesments

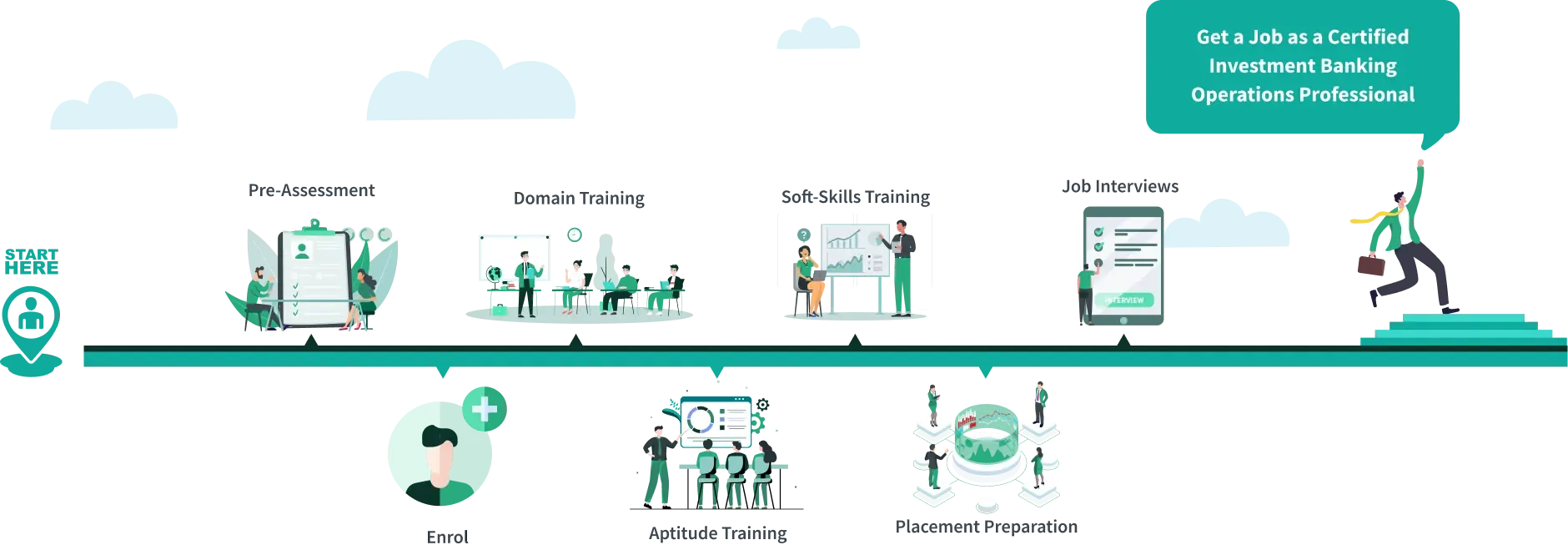

The Investment Banking Career Roadmap

Imarticus delivers one of the best investment banking courses in India, guiding learners through structured training, real-world projects, and placement readiness. From understanding what is investment banking is to becoming a certified investment banking professional, the journey is designed to build a successful career in investment banking.

What Can I Become?

Completing this certified investment banking course opens doors to high-growth roles in investment banking across global banks, asset management firms, and financial services companies. Build a career in Certified Investment Banking Operations Professional and work in different roles

What Can I Become?

Completing this certified investment banking course opens doors to high-growth roles in investment banking across global banks, asset management firms, and financial services companies. Build a career in Certified Investment Banking Operations Professional and work in different roles

Investment Banking Associate

Wealth Management Associate

Settlement Associate

Risk Management Consultant

Collateral Management Analyst

Hedge Fund Associate

Regulatory Reporting Analyst

Client Onboarding Associate

Trade Surveillance Analyst

KYC Analyst

Clearing & Settlements Analyst

Process Associate

Investment Banking Associate

5.7k+

Job Openings

4.5 Lacs

Average Salary

An Investment Banking Associate supports front-office and middle-office operations in investment banking courses, including M&A, capital markets, and deal execution. Learn investment banking operations, client management, and portfolio analysis, building a career in investment banking. This role is ideal for graduates exploring BCom in investment banking or those seeking certification courses in investment banking.

Grow with Imarticus learning

Aptitude Training

We provide aptitude training that will help you excel in the aptitude tests taken by employers to assess your problem-solving abilities.

Profile Enhancement

Interview Prep

Placement

Investment Banking Course Faculty

Investment Banking Certification

On successful completion of the Certified Investment Banking Operations Professional (CIBOP) Program, you earn a recognised investment banking certificate that validates your expertise in investment banking operations, financial markets, and post-trade processes - accelerating your career transition into investment banking.

Earn Your Certificate

Share your Achievement

Investment Banking Career Transitions

Our Success Stories

The overall learning experience at Imarticus was great. When it comes to the investment banking course curriculum, it is very precise and aligned with industry requirements, making it one of the best investment banking courses in India. The trainers are highly professional in terms of teaching and providing domain knowledge and support. I would like to thank the domain and soft skill trainers for their continuous efforts. Right after the completion of this investment banking certification course, the placement team guided me very well, which helped me get placed in such a reputed organisation. This course gave me a strong kickstart to my investment banking career, and it is truly one of the best courses for investment banking.

We Have An 85% Placement Success Rate

Learn more about how we’ve been impacting thousands of careers.

How to join the Investment Banking Course?

Need Help? Our admission team is happy to assist you.

Investment Banking Course Fees

Flexible payment options available for this investment banking certification course, including instalments and EMI plans - making it accessible for learners pursuing a career in investment banking operations.

Program Fee

Instalments

EMI Options

Moments of Honour

In our EdTech journey of more than a decade, we have received numerous awards.

Some of the recent notable awards we have received in analytics are:

The Successprenuer Award 2023 for being the best analytics edtech business

Most Promising Digital Learning Platform 2023 for being one of the most promising digital learning platforms

FAQs

About Program

About Placements

Admission and Eligibility

Program Fee

Investment banking is a branch of the banking sector which focuses on building capital for organisations via complex financial instruments. These organisations can be government or private setups. Investment banks guide clients in the placement and issue of stocks, thus saving time while playing a pivotal role in organisations preparing for their Initial Public Offering (IPO).

Investment banking operations take care of processing, clearing, and settling the financial transactions made at an investment bank. The operations department ensures that the business is administered in an efficient, controlled, risk-free, and timely manner.

The investment banking program is a 180+ hour classroom or online training program that provides aspirants with an in-depth understanding of products, processes, and operations, preparing them to take on roles in investment banking operations.

The CIBOP program is 180+ hours of program and is available in the below formats:

1) Classroom(Weekdays & Weekends)

2) Online(Weekdays & Weekends)

The CIBOP program has the following features:

1) Buy-side and Sell-side specialization based on industry demand

2) Aptitude and Soft-skills training to crack placement interviews

3) Job assurance with 7 guaranteed interviews

The Certified Investment Banking Operations Professional (CIBOP) Program is a 3-month full-time investment banking program conducted on weekdays and 6-months part-time program conducted on weekends. For further information, please get in touch with our nearest centre.

Our professional courses in finance and accredited certification courses in finance teach you how to be an investment banker in India, help you build your professional network and learn the nuances of investment banking.

The Certified Investment Banking Operations Professional (CIBOP) Program is designed as a comprehensive investment banking course with a strong focus on real-world banking operations, compliance, and asset management. In addition to core operations, the curriculum introduces learners to investment banking fundamentals, market instruments, and end-to-end transaction lifecycles, ensuring a holistic understanding of how global investment banks function.

The course introduces learners to financial concepts, capital markets, and investment products that form the foundation of valuation and modelling in investment banking. While advanced financial modelling is typically covered in specialised front-office programs, this course builds the conceptual and operational groundwork required to understand how valuation models are used in real investment banking environments.

Yes, learners gain exposure to the investment banking deal lifecycle, including an overview of IPO processes, capital raising, and transaction workflows. The focus is on understanding how these deals are supported and executed within investment banks from an operations and compliance standpoint

This program is primarily aligned with investment banking operations and middle-office roles, which form the backbone of global banking institutions. However, learners are also introduced to front-office concepts, roles, and workflows, helping them understand how investment bankers, analysts, and associates interact across teams.

Yes, the concepts covered in this investment banking course complement globally recognised certifications such as CFA, FRM, and CISI by strengthening your understanding of investment products, financial markets, and banking operations. Many learners pursue these certifications alongside or after completing this investment banking course.

Yes, our investment banking course includes a plethora of features - like project-based learning, real-world case studies, and scenario-driven exercises that simulate investment banking environments. These practical elements help learners apply concepts and gain hands-on exposure similar to what is expected in investment banking internships.

The duration of this investment banking course is structured to balance theoretical learning with hands-on project work. The course is of 2.5 Months (Weekdays) or if you prefer the weekend only, it is 5 Months (Weekends).

This investment banking course includes practical Excel-based training relevant to investment banking operations, reporting, reconciliation, and data analysis. These skills are essential for working in global investment banks and provide a strong foundation for learners who wish to advance into more analytical or finance-focused roles.

This investment banking course has 3 modules - Domain, Soft-skills, Aptitude and Excel. Candidates should hold a minimum of 60% in each of the above modules with a requirement of at least 75% attendance throughout the course, to be eligible for placements in investment banking.