Last updated on July 23rd, 2025 at 12:16 pm

In the fast globalising world today, the US CPA course is an extremely sought-after and well-known accounting certification. Provided by the AICPA (American Institute of Certified Public Accountants), the internationally renowned credential is an entry ticket to high-income professional roles in finance, audit, taxation, and consultancy in India and overseas. For hardworking Indian students and working professionals seeking to pursue their global accounting profession, the US CPA course is more relevant than ever in 2025.

This blog serves as the complete 2025 guide to the US CPA course—explaining everything from eligibility and fees to syllabus, training options, and how it compares to Indian CA. If you’re serious about making a global mark in finance, this guide is for you.

What is the US CPA Course?

Certified Public Accountant (CPA) is professional certification awarded by AICPA, which is world standard in accountancy. The course involves creating accounting procedures, financial reporting, taxation, business law, and ethics. It is designed for those professionals who desire to take control of strategic positions in corporations, accounting groups, and financial institutions.

With the duration of the CPA course in India falling between 12 to 18 months, this course offers a fast-tracked route to attaining global finance leadership. Indian candidates can also learn CPA training in India now through live online classes and high-quality content of Imarticus Learning, an approved prep provider.

US CPA Eligibility in India

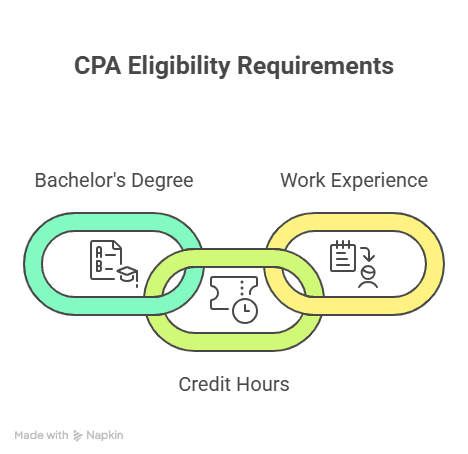

One of the most frequently asked questions among the aspirants is: “What is US CPA eligibility in India?” The requirements are marginally different state-wise in the U.S., but standards are:

- A bachelor’s degree in accounting, finance, or commerce (preferably 120 credits)

- Most states now mandate 150 credit hours (about a master’s or a B.Com + MBA/CA)

- Some states accept CA or MBA degrees from India as credit transfer

- Relevant work experience is sometimes required for licensing (not exam)

- Imarticus Learning has detailed information on credit evaluation and choosing the best state board.

CPA Course Fees in India

Being aware of the CPA course fees in India would assist in strategizing your way. Here is a general guideline:

- Evaluation fees: ₹12,000 to ₹18,000

- Exam application charges (per section): ₹15,000 to ₹18,000

- International test fees: ₹75,000 to ₹80,000

- AICPA regn. and admin fees: ₹40,000 to ₹50,000

- Study & training material (Imarticus): ₹1.5 to ₹2.25 lakhs based on package

The overall cost of US CPA in India typically varies between ₹3.25 lakhs and ₹4.25 lakhs. Put the investment aside, the ROI is phenomenally high with CPAs in India drawing an average salary of ₹12.5 to ₹20.5 LPA.

CPA Course Duration in India

One of the most significant advantages of the US CPA course is that it is time shorter in comparison to Indian CA. Indian students can achieve the goal with hard work and right direction within 12 to 18 months.

This is how the average timeline stands:

- 3–6 months: Preparation for first section

- 3–4 months each: All the remaining sections

- Total Time: Around 12–18 months taking into account the process of exam enrollment, practice, and licensing processes

Students studying through Imarticus have a defined timeline and regular mentorship to remain on track.

CPA Exam Syllabus 2025: What Has Changed??

The CPA syllabus 2025 is so designed that it matches contemporary accounting norms. The four central modules are:

1. Auditing and Attestation (AUD)

Deals with audits, reviews, ethics, and attestation engagements.

2. Business Environment and Concepts (BEC)

Includes corporate governance, IT, financial management, and business strategy.

3. Financial Accounting and Reporting (FAR)

Puts U.S. GAAP, IFRS, and financial reporting systems to the test.

4. Regulation (REG)

Covers U.S. taxation, business regulations, and ethics.

The 2025 exam is more focused on data analytics, technology tools, and real-world simulations, and thus there is a need for hands-on learning. Imarticus Learning uses simulations and technology training to respond to these changes.

How to Become a CPA in India?

Here’s your step-by-step guide to becoming a CPA in India in 2025:

Step 1: Eligibility Evaluation

Provide academic transcripts for credit evaluation and determine eligible U.S. states.

Step 2: Enrol with a Training Provider

Select a trusted institute such as Imarticus Learning to make the most of top-quality CPA study material and live classes.

Step 3: Apply for the Exam

Enroll for the CPA exam sections from NASBA.

Step 4: Prepare & Take the Exam

Use study aids, attend classes, and take practice exams. Schedule exam slots at accredited test centers.

Step 5: License Application

Fulfil work experience requirements (if any) and apply for your CPA license.

CPA Training in India: What to Look For?

If you’re preparing in India, opt for an institute that offers:

- Live online training

- Comprehensive study material (Kaplan or Becker preferred)

- One-on-one mentoring

- Simulated mock tests

- Placement and licensing support

Imarticus Learning provides all the above, that is money-back guarantees, career guidance, and a sure success rate of enabling thousands of Indian students to pass the US CPA exam.

US CPA vs Indian CA: Which One is Right for You?

The US CPA vs Indian CA question is relevant to the majority of commerce students. Here’s a quick comparison:

| Feature | US CPA | Indian CA |

| Duration | 12–18 months | 4–5 years |

| Global Recognition | 170+ countries | Primarily India |

| Pass Percentage | 50–55% | 5–10% |

| Syllabus Focus | U.S. GAAP, IFRS, Tax | Indian Laws, Auditing, Accounting |

| Salary Range | ₹12.5–20.5 LPA | ₹8–12 LPA (average) |

| Flexibility | 4 exam parts anytime | Fixed exam schedules |

US CPA is ideal for students with plans for international careers or MNCs, Big 4s, international finance, etc.

Career Opportunities After US CPA

Upon successful completion of your US CPA course, you can become:

- Financial Controller

- Audit Manager

- Tax Consultant

- Business Analyst

- Finance Manager

- Internal Auditor

The majority of CPAs in India are placed in top firms like EY, Deloitte, PwC, KPMG, Amazon, Accenture, and JP Morgan. Not only does CPA certification enhance your employability but also accelerates your promotion chances.

Why Choose Imarticus Learning for CPA?

Here’s why Imarticus Learning is the ideal CPA prep partner in India:

- Official authorised prep provider

- Live online classes led by industry experts

- Money-back guarantee on non-clearance

- One-to-one CPA mentors with CPA/CA/ACCA credentials

- Career guidance and placement assistance

- High-quality Kaplan study guides

- Live simulation exams

Backed by a proven track record and awarded the title of Best Education Provider in Finance for the 30th Elets Summit, Imarticus is the go-to name for CPA aspirants all over India.

FAQs

Q1: Is CPA valid in India?

Yes, several Indian companies and MNCs accept CPA qualifications, particularly for strategic finance and audit positions.

Q2: What is the total cost of the CPA course in India?

CPA course charges in India typically range from ₹3.25 to ₹4.25 lakhs based on training, exam, and material.

Q3: Can I take the CPA exam in India?

Indian candidates can now write the CPA exam at authorized Prometric test centers in India.

Q4: What is the US CPA course duration in India?

The US CPA course typically takes 12–18 months to complete if pursued sincerely.

Q5: Is CPA better than CA?

Both are worthwhile, but CPA is better for international jobs and faster professional growth, while CA is best for Indian audit and tax.

Q6: What’s the average salary after CPA in India?

Indian CPA holders can command ₹12.5 to ₹20.5 LPA depending on experience and company.

Conclusion

The US CPA program has been a professional-building certificate for Indian professionals to design global finance careers. With flexible length, high Return on Investment, and global acceptance, the CPA program can reverse your career direction.

No matter if you are an early riser or a professional already working in finance, 2025 is your ideal year to take the leap and study for your CPA. If you have the right guidance, mentoring, and support from a top provider such as Imarticus Learning, you can make this vision a possible reality for yourself.

Start your CPA journey today—because your international finance career won’t wait.