In 2025, the business world isn’t just about making money—it’s about understanding it. Whether you’re a fresh graduate, a mid-career switcher… or a finance enthusiast looking to level up, enrolling in a financial analysis course can be one of the smartest decisions you make.

But let’s be honest—what do you actually learn in these courses? Is it all Excel sheets & theory… or do you come out ready to make real-world impact?

Let’s break it down, human to human.

What Does a Financial Analyst Really Do?

Before diving into what you’ll learn, here’s a quick refresher. A financial analyst isn’t just someone who works with spreadsheets—they interpret data, assess risks, build forecasts & guide business decisions.

To do that well in 2025, you’ll need more than just formulas. You’ll need to build a solid foundation in financial logic, tools… & real business thinking.

This is where a well-structured financial analysis course comes in handy.

Core Skills You’ll Learn (with Examples)

| Skill Area | What You’ll Learn | Why It Matters |

| Financial Statements | Read, interpret & analyse balance sheets, P&L, cash flows | You can’t assess a business if you don’t speak its language |

| Budgeting & Forecasting | Project future income, expenses, profits using assumptions | Planning is key for growth… & survival |

| Ratio & Variance Analysis | Assess business performance with numbers like ROI, debt-equity, variance reports | You’ll know what’s going well… & what’s not |

| Business Valuation | Use techniques like DCF, comparables, etc. to determine value | Helps in M&A, fundraising, investor communication |

These foundational areas shape your confidence in finance… not just your competence.

And yes, if you’re interested in M&A roles, you’ll enjoy this blog on Mergers and Acquisitions Careers for CA Graduates.

💻 You’ll Learn Financial Modeling (Properly!)

Now, let’s talk about one of the most important skills in modern finance—financial modeling.

Most people think it’s just a glorified Excel sheet. But when you truly learn financial modeling, you learn to build models that answer real questions:

- What happens if revenue drops 20%?

- Will this new investment pay off?

- Can we afford this acquisition?

What Good Modeling Teaches You:

| Component | You’ll Learn To… |

| Income Statement Modeling | Forecast future profits |

| Balance Sheet Projections | Align assets, liabilities & equity with strategy |

| Cash Flow Forecasting | Plan for liquidity… not just profits |

| Scenario & Sensitivity | Test “what-if” questions with logic & flexibility |

A robust financial analyst course helps you learn financial modeling hands-on—no fluff, just work-ready skills.

What Makes a Certification Worth It?

In 2025, recruiters aren’t just hiring degrees—they’re hiring proof of real skills.

That’s why a financial analysis certification matters. But not all certifications are created equal.

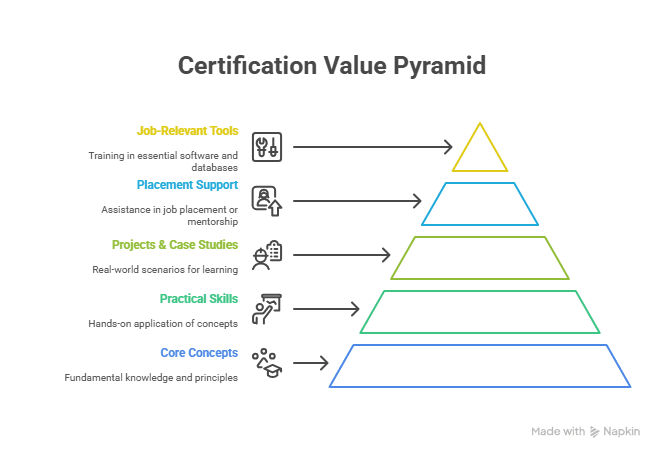

The right certification:

- Covers both core concepts & practical skills

- Includes projects or case studies

- Offers placement support or industry mentorship

- Teaches job-relevant tools (Excel, PowerPoint, financial databases, etc.)

One such program that checks these boxes is the Postgraduate Financial Analysis Program by Imarticus Learning. It blends deep curriculum with real-world projects, placement support & expert-led sessions.

And if you’re still curious about the larger scope of financial analysis roles, this blog explains it beautifully.

Skills Required for Financial Analysts in 2025

Sure, you need to be good with numbers… but that’s just the start.

| Category | Skill | Why It Matters in 2025 |

| Technical | Excel, data tools, accounting standards | For hands-on analysis & reporting |

| Analytical | Critical thinking, problem-solving | To find trends, gaps… & strategic recommendations |

| Communication | Reports, presentations, storytelling | To influence decisions, not just state facts |

| Domain Knowledge | Industry trends, regulatory landscape | Adds strategic edge to your analysis |

When you focus on developing the skills required for financial analysts, you set yourself up for roles across FP&A, investment banking, corporate finance & equity research.

Is an Investment Analysis Course Different?

Short answer: Yes… & no.

An investment analysis course is often a sub-specialisation within broader finance programs. It focuses more on:

- Portfolio strategy

- Risk-return balance

- Security valuation

- Investor psychology

If you’re keen on asset management, private equity, or equity research—picking a course that offers both financial analysis certification and modules in investment evaluation is ideal.

Look out for curriculums that combine investment analysis course components with core finance… so you stay versatile.

Are Online Financial Analysis Programs Effective?

Absolutely—if they’re interactive, well-structured & career-focused.

The best online financial analysis programs today:

- Offer live sessions with industry experts

- Provide downloadable resources & templates

- Include doubt-solving & peer networking

- Offer career support or job assurance

In fact, online programs are perfect for working professionals or students in Tier-2/3 cities aiming for global roles.

Imarticus Learning’s Postgraduate Financial Analysis Program is a great example. It blends online delivery with job assurance & practical training.

For a quick visual overview, check out this short video guide.

Career Scope After a Financial Analyst Course

Wondering where all this leads?

Here are typical roles you can pursue post-certification:

| Job Role | What You’ll Do |

| Financial Analyst | Evaluate financial data… build models… support strategy |

| FP&A Analyst | Help companies plan budgets… forecast future earnings |

| Equity Research Analyst | Research stocks… provide investment recommendations |

| Corporate Development Associate | Work on M&A, partnerships & strategic initiatives |

| Treasury Analyst | Manage liquidity, cash flows & funding decisions |

Still unsure about the bigger finance career picture? Read this helpful blog on career opportunities in finance.

Final Thoughts: Is It Worth It?

In 2025, employers want finance talent who don’t just understand numbers… but can use them to drive action.

A well-rounded financial analyst course teaches you exactly that—from interpreting statements, to building models… to guiding decisions.

When paired with a recognised financial analysis certification, experience-based learning & practical tools—you’ll walk into your next role job-ready.

And remember, whether you want to learn financial modeling, build investment strategies, or master the skills required for financial analysts—the right course will put you ahead of the curve.

FAQs

1. What does a financial analysis certification teach you?

It covers statements, forecasting… & valuation basics.

2. Why should I learn financial modeling?

It helps you test business outcomes before they happen.

3. Is an investment analysis course good for beginners?

Yes, especially if you’re curious about markets & returns.

4. What are the top skills required for financial analysts today?

Excel, logic, reporting… & clear communication.

5. Are online financial analysis programs flexible?

Totally—they fit into work schedules & save commute time.

6. How long does a financial analysis certification usually take?

Most are 3–6 months with live projects.

7. Can I learn financial modeling without a finance background?

Yes—start with templates, then build your own.

8. Does an investment analysis course include risk assessment?

Absolutely—it covers risk, returns… & diversification too.

📌 So, are online financial analysis programs your next step?

If you’re serious about building a future-proof career in finance… the Postgraduate Financial Analysis Program might be the perfect starting point.

Let the numbers guide your future—but more importantly, learn to guide the numbers.