You would like to know about what is investment banking and why so in-demand finance career. Investment banking is where capital, strategy, and innovation meet. It is a team that propels corporate development, powers mergers and acquisitions, manages fundraising, and oils financial markets. From the giants of multinationals to governments and start-ups, investment banks bring entities together, provide an advisory function, and intermediate opportunities and capital.

Here in this blog, we will demystify investment banking, walk you through different investment banking careers, categorise types of investment banks, and provide some career opportunities—how a course like the CIBOP certification course can be your passport to this lucrative industry.

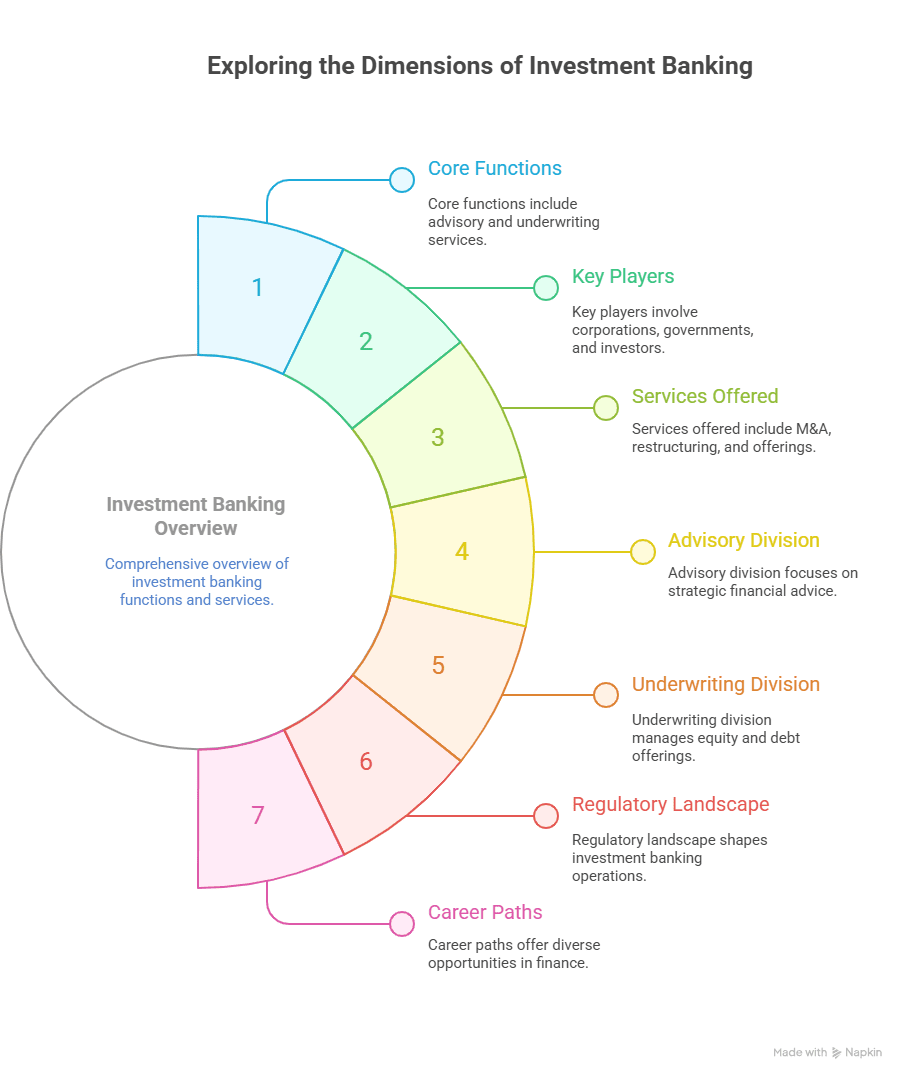

Understanding Investment Banking

Investment banking is actually specialised banking activity undertaken to assist organisations, institutions, and governments in raising capital and participating in big and complicated financial deals. It is not retail banking in terms of consumer loans, savings, and credit cards.

Some of the key activities are:

- Assisting companies in issuing shares and bonds.

- Merger, acquisition, and company restructuring.

- Assisting governments and institutions in raising debt and equity capital.

- Providing research, dealing, and asset management services.

Investment banking corporate is the center of investment banking, where experts analyze industries, risk management, and financial instrument structuring for customers.

Functions of Investment Banking

1. Capital Raising

Among the most vital roles being performed by investment banks is ensuring that the companies can raise their capital. It can either be through issuance of bonds, private placements, or IPOs. Investment banks play the role of middlemen agents between investors and firms and ensure that the two’s financial goals are achieved.

2. Mergers and Acquisitions (M&A)

M&A is the most publicity-intensive segment of investment banking. Advisory, structuring, and valuation analysis are matters of concern of the investor in maximising shareholder value whenever a corporation is acquiring or merging with another corporation.

3. Underwriting Securities

Investment banks sell securities on their own account and are therefore obligated to carry the securities to the customers. It exempts the companies from financing without regard to business cycles in the market.

4. Trading and Market Making

Investment banks trade in the bank’s own account and clients’ accounts. They play the role of market makers by providing liquidity to financial markets.

5. Research and Analysis

Offering market insights, future projections, and guidance is also among the primary duties. They guide clients in investment and serve as a central figure for strategic advisory clients.

Types of Investment Banks

Investment banks are not all the same. They differ in size, scope, and type of services provided. There are three altogether:

Bulge Bracket Banks – International scale players such as Goldman Sachs, JPMorgan, and Morgan Stanley offering end-to-end solutions to all markets.

Middle-Market Banks – Mid-cap transaction specialists, usually regionally based players with industry knowledge in one particular industry.

Boutique Banks – Specialization of specialist advisory business, most often in a specialist field such as restructuring or mergers and acquisitions.

They offer career opportunity in interest and capability at the professional level.

Roles in Investment Banking

Investment banking firm is well structured and defined. Some of the best careers in investment banking are given below:

- Analyst: At the incumbent grade level work with financial modeling, research, and contribution to pitch books.

- Associate: Mid-professional working with handling analysts, client interaction, and deal execution.

- Vice President (VP): Manages groups, maintains client relationship and executes transactions at a professional level.

- Director/Executive Director: Executes high-end transactions and strategic transactions.

- Managing Director (MD): Most senior in position, with the responsibility of attracting the business and negotiating humongous deals.

All these require technical competence along with networking, ruthlessness, and stress working.

Corporate Investment Banking

If we look at corporate investment banking, then we are looking at such services that are tailor-made for corporations. They are:

- Debt finance structures.

- Equity advice on Initial Public Offers and private placements.

- Strategic counsel on mergers, acquisitions, or divestitures.

- Risk products using derivatives and hedging products.

Corporate investment banking is the means for corporations to reach global capital markets, facilitating the growth of corporations.

SEBI and NSE Regulations

Investment banking in India is governed strictly to advance equity and transparency. The strongest regulating authorities amongst them are:

- SEBI (Securities and Exchange Board of India): Governs the securities market so that the investment banks are regulated under disclosure, underwriting, and investor protection standards.

- NSE (National Stock Exchange): Offers the facility of debt and equity securities and governs trading and market conduct compliance.

SEBI and NSE regulations are something one must be aware of if one wishes to become a player in the Indian investment banking landscape, because that is where all the drama happens.

Career Paths in Investment Banking

Presumably highest salary choice, both in salary and advancement. It will also be most demanding. Transplants usually start at the analyst level, putting in extra hours to gain experience. They will then progress to associate, VP, and finally director or managing director level later in life.

Professional training also places the experts on the same level of private equity, hedge funds, corporate finance, or wealth management. Such experts utilise the investment banking expertise and exposure to different work-life balance and niches.

Why Choose the CIBOP Certification Course?

Purchasing an in-door investment banking is a matter of passion but proper credentials and aptitudes. That is where Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP) course steps in.

- 100% Job Guarantee: 7 interview guarantees, the program leads you to place your foot in the corporate door confidently in the industry.

- Successful Placement: 85% offer with up to 9 LPA placement.

- Flexible Duration: You can choose the duration between 2.5 months (weekdays) or 5 months (weekends).

- Industry Recognition: Best Education Provider in Finance at 30th Elets World Education Summit 2024.

- Professional Growth: Over 1200 batches successfully completed, 50,000+ trainees trained, and 1000+ recruitment partners.

The CIBOP certification program not only trains—but industry-reads learners with live case studies, hands-on training, and instructions by industry experts.

Know rare insights about the investment banking here- Learn Financial Markets A to Z in 2024 | Investment Banking Masterclass | CIBOP

Skills Required for Investment Banking

In order to become effective investment bankers, the candidates must be well-equipped on technical as well as inter-personal skills:

- Technical model preparation and valuation tools.

- SEBI and NSE regulation know-how.

- Analytical and problem-solving skill.

- Communication and presentation ability.

- Pressure management and client expectation management.

These are the cornerstones of a successful career in corporate investment banking.

Challenges in Investment Banking

As profitable as it is, investment banking is not for the faint-hearted:

- Long working hours: 80-100 working hours a week by analysts and associates.

- Envy-spurred competition: Unwavering determination is needed to access the business.

- Conformity to regulations: SECI and NSE rules and regulations that are in constant flux daily need to be approached with accuracy.

- Work-life balance: Work-dominated to a great extent due to the fact that deadlines hang over one’s head.

- Despite all these negatives, the payoff in terms of pay and career growth makes investment banking a career one can dream of.

FAQs

Q1. What is investment banking in simple terms?

It is a specialised branch of banking which helps corporates and governments raise capital, structure mergers and acquisitions, and distribution of securities.

Q2. What are the types of investment banks?

They are bulge bracket banks (global leaders), middle-market banks (regional players), and boutique banks (specialised advisory firms).

Q3. What are common roles in investment banking?

Typical jobs are Analyst, Associate, Vice President, Director, and Managing Director.

Q4. What does corporate investment banking cover?

They are risk management services, strategic advisory, equity issuance, and debt financing.

Q5. Why are SEBI and NSE important in investment banking?

They are leading the market to a level that it becomes transparent, compliant, and fair while transacting.

Q6. Is investment banking a good career choice?

Yes, it is providing good compensation, career, and access to international finance but with very high expectations.

Q7. How does the CIBOP certification course help?

It provides profession-specific training, interview assurances for placement, and full-profession consultancy.

Q8. Can freshers join investment banking?

Yes, mature finance graduates who have 0–3 years of experience with the above-mentioned certification such as CIBOP can be recruited.

Q9. What is the average salary in investment banking in India?

They are ₹6–9 LPA with fat pay cheques being handed over to deserving hands.

Q10. What skills are needed for success in investment banking?

Financial modeling, regulatory, analytical skills, communication, and grit are the requirements.

Conclusion

So what does investment banking entail? It is a highly demanding and profitable occupation where financial intelligence dismantles businesses, industries, and economies into pieces. From capital raising to mergers and acquisitions, and regulation, investment banking is a brain-driven and passion-filled profession.

Career aspirants would never be able to enter this profession without guidance. That is where similar to Imarticus Learning CIBOP certification course comes into play. With experiential learning, guaranteed placement, and proper exposure to the field, CIBOP provides finance graduates with the platform they need. Your initiative towards an investment banking career is a lot more than just a stable future. If you are ready to step into this world, the path starts with the right skills, knowledge and a recognised credential. Enrol in Imarticus Learning’s CIBOP course today!