Introduction

If you’re a CFO or headed in that direction, you already understand—budgeting is more than a series of numbers on a spreadsheet. It’s where vision and execution come together. The Chief Financial Officer of today do not just manage funds—they control the strategic engine of the business. The role of budgeting is no longer simply about cutting costs; it is now about growing, building resilience, and an organization’s ability to be agile in a world that is constantly shifting.

In this blog, we break down everything that CFOs must know about budgeting, by combining traditional principles with the newest developments. Whether you’re fresh to the C-suite or reviewing your methodology, this CFO training manual provides a strategic dive into financial planning, budgeting best practices, and revolutionary tools to lead the way.

Table of Contents

- The Importance of Financial Planning for CFOs

- Top Budgeting Strategies for CFOs

- Corporate Budgeting Best Practices

- Strategic Budgeting Techniques Every CFO Must Know

- CFO Financial Management: Aligning Budget with Business Objectives

- Key Takeaways

- FAQs

- Conclusion

The Importance of Financial Planning to CFOs

A well-formulated financial plan is the backbone of any winning budgeting exercise. Financial planning by CFOs goes beyond the financial year—it is all about creating a long-term master plan that addresses risk, investment, and expansion. Contemporary CFO training places high emphasis on the importance of foresight, scenario modeling, and macroeconomic analysis in financial planning.

CFOs have transitioned from number crunchers to strategic advisors. Financial Planning now requires communication with other functions in the organization, understanding of pressures in the industry, and flexibility to shift gears, without worry to modify the plan along the way. In this backdrop, financial planning for CFOs becomes the guide that provides direction to every budgeting decision.

Key Elements of Financial Planning:

- Multi-year revenue forecasts

- Capital allocation models

- Debt versus equity analysis

- Departmental budget consolidation

- Sensitivity analysis for external risk

Latest Read: Harvard Business Review – The Evolving Role of CFOs

Best Budgeting Techniques for CFOs

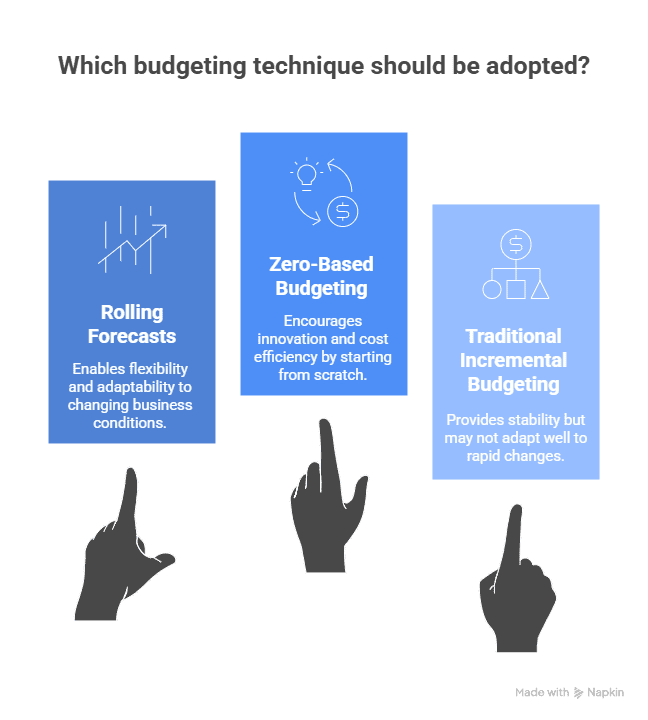

Budgeting techniques for CFOs need to transcend traditional incremental budgets. In today’s world, adaptive structures like rolling forecasts and zero-based budgeting are becoming the standard. These techniques enable CFOs to manage uncertainty, drive innovation, and refocus on shifting business realities.

CFOs must combine past data with predictive analysis, along with setting budgets that enable both fixed and variable cost control. Budgeting is not a static report; it’s a living document that adjusts in harmony with your business.

CFO Budgeting Responsibilities

| Responsibility | Purpose |

| Strategic Planning | Align budgets with long-term business goals |

| Forecasting & Analysis | Prepare for market shifts and financial risks |

| Cost Optimisation | Improve efficiency and reduce unnecessary spend |

| Team Collaboration | Ensure cross-departmental alignment and accountability |

| Performance Monitoring | Track KPIs and adjust strategies as needed |

| Technology Adoption | Enhance accuracy with budgeting tools and automation |

| Stakeholder Communication | Present financial plans clearly to leadership and boards |

Top Budgeting Strategies:

- Zero-Based Budgeting (ZBB)

- Rolling Forecasts

- Activity-Based Budgeting (ABB)

- Hybrid Models (ZBB + traditional)

- Driver-Based Budgeting (DBB)

Recommended Resource: McKinsey’s Guide to Agile Budgeting

Corporate Budgeting Best Practices

Best corporate budgeting practices are meant to instill discipline, transparency, and strategic alignment in every business unit. CFOs that embrace such practices are able to promote more accountability and performance-driven culture.

A best practice is more than process; it’s about attitude. Cross-departmental collaboration, stakeholder alignment, and technology alignment are important. Current CFO training approaches value data-driven decisions and cloud-based budgeting software to drive accuracy and reduce turnaround.

Best Practices Checklist:

- Engage department heads from the beginning

- Use cloud-based budgeting software (such as Adaptive Insights, Anaplan)

- Incorporate contingencies and buffers

- Prioritize KPIs, not line items

- Embed budgeting with performance dashboards

Visit: Deloitte’s 2024 CFO Insights on Budget Transformation

Strategic Budgeting Techniques That Every CFO Must Know

Budgeting without strategy is like being lost with no map. Practical strategic budgeting techniques enable CFOs to make decisions around strategic investments, allocate resources more impactfully, and shape financial plans with a view to long-term goals.

Strategic budgeting has two dimensions—short-term agility and long-term sustainability/feasibility. Whether your budgeting os for digital transformation, M&A activity, or international expansion, these strategies help financial leaders ensure they are building value with every dollar.

Key Strategic Methods:

- Portfolio-based budgeting (resource allocation based on ROI)

- Risk-weighted capital planning

- Integrated scenario planning

- CapEx vs OpEx balancing

- Goal-focused budgeting

A fundamental aspect of strategic CFO training is how to say no to projects that are not aligned with the vision of the company—no matter how profitable they might appear in the short term.

CFO Financial Management: Budgeting in Alignment with Business Objectives

Good CFO financial management implies budgets as facilitators of strategic results rather than as constraints on cost. This is the crossroads of vision, execution, and value.

To do this, CFOs need to take high-level strategy and convert it into tangible financial results, and vice versa. Budgeting is then the link between what the organisation desires to accomplish and how it will accomplish it. CFOs need to lead from the front—align departments, rationalise spend, and embed a performance-first culture.

How CFOs Align Budgets to Strategy:

- Establish top-down strategic goals

- Link KPIs to every budget line

- Make quarterly reviews and reforecasts

- Connect financial results to departmental bonuses

- Use dashboards to track real-time progress

Ready to learn all these budgeting techniques in detail?

Discover the Chief Financial Officer Programme by ISB and Imarticus Learning—designed to empower finance leaders like you with capabilities to drive enterprise transformation, budgeting, and strategy at scale.

Key Takeaways

- Budgeting is no longer an operational but a strategic responsibility for CFOs.

- CFO training should encompass planning, forecasting, and scenario analysis capabilities.

- Methods such as rolling forecasts, ZBB, and risk-weighted planning enhance agility.

- Best practices include technology embrace, cross-functional alignment, and frequent reforecasting.

- Each CFO should reconcile budgeting with overall corporate strategy and measurable objectives.

FAQs

1. What’s the best budgeting approach for contemporary CFOs?

Although it depends on the organisation’s requirements, rolling forecasts and zero-based budgeting are becoming highly effective because they are highly adaptable and rationalise costs.

2. How do CFOs enhance the accuracy of financial planning?

Through the combination of cross-functional inputs, the use of AI-driven analytics, and repeated scenario simulations, CFOs can enhance the accuracy and timeliness of financial plans.

3. Why is budgeting so important in CFO training programmes?

Budgeting underlies financial control, resource allocation, and the execution of strategy. CFO training incorporates it to develop foresight, responsiveness, and alignment with stakeholders.

4. What strategic budgeting tools do CFOs use?

Well known tools are -Anaplan, Oracle Hyperion, Adaptive Insights & Workday. These systems enable real time collaboration, sophisticated forecasting & tracking of performance.

5. How frequently should CFOs revise the budget?

Budgets should ideally be reviewed every quarter.. but high-growth or volatile businesses can take advantage of monthly or rolling revisions in order to maintain alignment with changing realities.

6. How does a CFO resolve budget conflicts between departments?

Good communication, priority transparency, and objective models like ROI analysis or goal alignment resolve conflicts between departments over budgets.

7. Do traditional budgeting practices remain relevant?

They remain relevant in settled industries but most CFOs are embracing hybrid or agile models to lead the way in volatile environments.

8. What is the role of technology in CFO financial management?

Technology speeds up the preparation of the budget, makes it more accurate with automation, and more visible with dashboards and real-time metrics.

9. How do CFOs best prepare for budget presentations to the board?

CFOs must convert financial information into stories—with emphasis on impact, ROI, and strategic fit. Visualization and peer benchmarking are also effective.

10. Can budgeting be used to manage risks?

Definitely. Strategic budgeting involves planning for contingencies, reserving funds, and prioritizing low-risk, high-impact programs.

Conclusion

Budgeting has changed—and so must the CFO of today. As the organisation’s financial stewards, CFOs are required to connect capital with capability, risk with resilience, and strategy with execution. From learning about cutting-edge CFO training methods to excelling in agile budgeting models, financial executives must be ahead of the curve.

Budgeting mastery comes with influence mastery, foresight mastery, and transformation mastery.

And if you’re ready to sharpen your skills, lead from the front, and drive business impact, consider enrolling in the Chief Financial Officer Programme by ISB and Imarticus Learning. Your next level of leadership starts with the right training.