CFA certification is the world’s most sought-after finance degree, most universally respected by all employers. CFA charter not only increases your power, but also triggers very profitable CFA career paths in investment banking, asset management, private equity, hedge funds, risk management, and corporate finance.

As the world financial markets undergo brisk transformation, organizations seek CFA-qualified leaders with finance genius, problem-solving abilities, and ethics to take them through navigating investment-related problem-solving challenges. You are equipped to navigate your next professional advancement in the direction of the gold standard for finances as a chartered financial analyst or an aspired candidate towards CFA Level 1 knowing about the career prospects and requirements of becoming CFA professionals.

Why CFA is the Gold Standard in Finance?

CFA charter is the gold standard in portfolio analysis and management of investment. Through teaching its coursework on portfolio management, corporate finance, risk measurement, and equity analysis, it prepares finance professionals to work at the top of the line in the profession.

Key Benefits of CFA Certification:

✔ Global Acceptance – CFA is acknowledged by 160+ countries of the world and therefore is an extremely coveted possession for international job seekers.

✔ Chances for Increased Salary – CFA charter members enjoy a 192% higher salary hike than non-chartered professionals.

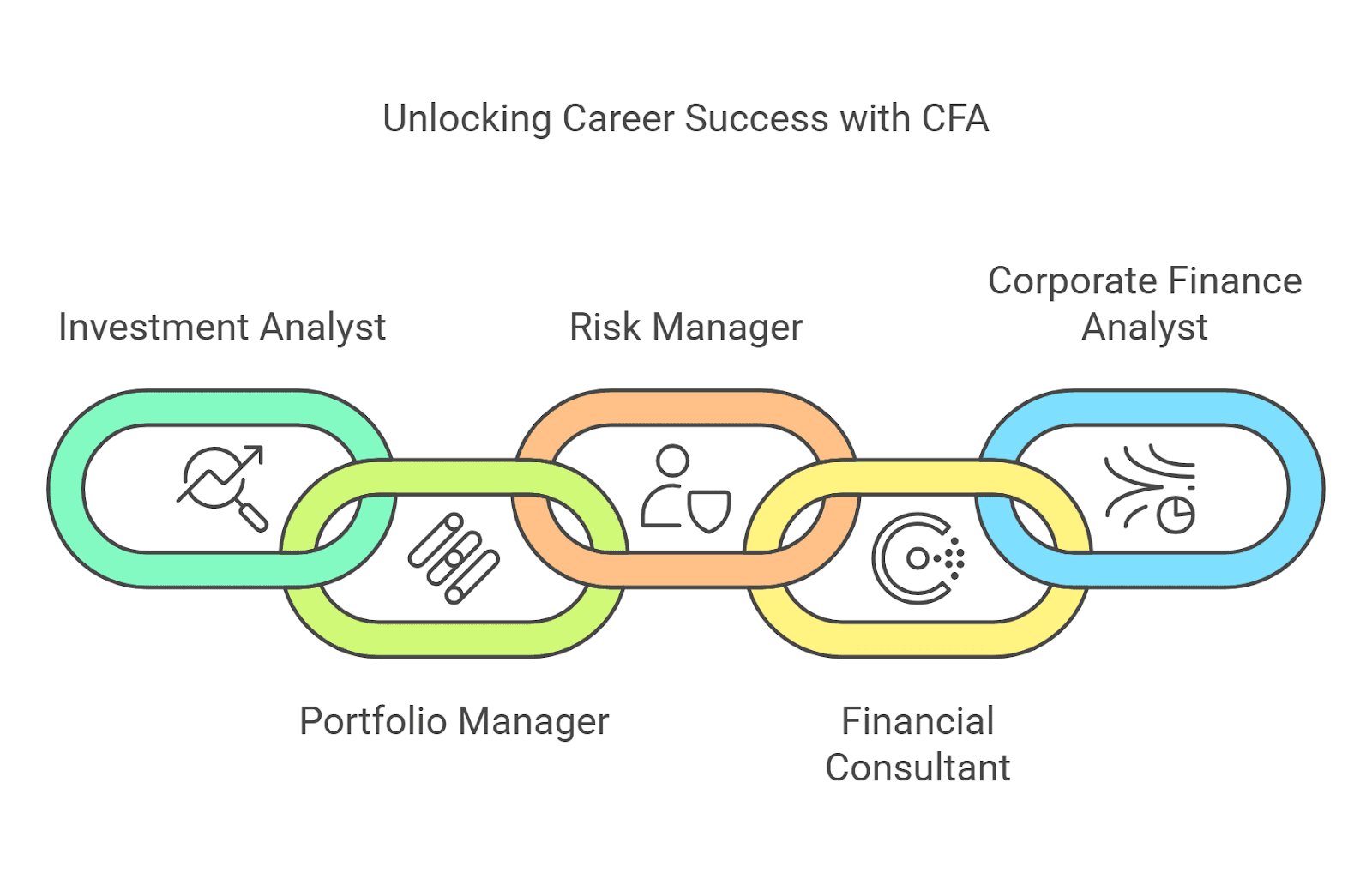

✔ Multiple Career Paths – CFA experts get jobs in investment banking, asset management, risk analysis, private equity, and corporate finance.

✔ Respect from Professional Life – CFA designation reflects superior-level analytical capabilities, ethical decision-making, and dedication to finance.

✔ High Employer Demand – Top companies like Goldman Sachs, J.P. Morgan, BlackRock, and McKinsey recruit CFA-certified professionals.

With all these advantages, the CFA charterholder is set to be a finance leader.

Top CFA Job Roles in the Industry

1. Investment Banking Analyst

Job: Investment bankers manage mergers, acquisitions (M&A), IPOs, and company valuations.

Salary: ₹10–₹25 LPA in India; $100,000+ overseas.

Employer Preferences: CFA Level 2+, financial modeling and valuation expertise.

2. Portfolio Manager

Job: Manages pension fund, mutual fund, and high-net-worth client portfolios.

Salary: ₹15–₹30 LPA in India; $120,000+ worldwide.

Employer Preferences: CFA Level 3, asset allocation and risk management ability.

3. Equity Research Analyst

Job: Offers stock suggestions, fundamental and technical analysis.

Salary: ₹8–₹20 LPA in India; $85,000+ worldwide.

Employer Preferences: CFA Level 2+, financial modeling and valuation expertise.

4. Risk Analyst

Job: Manages market, credit, and operation risks.

Salary: ₹9–₹22 LPA in India; $90,000+ overseas.

Employer Preferences: Wanted to be certified by CFA and FRM (Financial Risk Manager).

5. Financial Analyst

Job: Analyzes financial information, investment concepts, and financial forecasts.

Compensation: ₹7–₹15 LPA in India; $70,000+ abroad.

Employer Preferences: Preferred with CFA Level 1 qualification, strong analytical skills with numbers.

6. Corporate Finance Manager

Job: Manages budgeting, capital structure, financial planning, and strategy.

Compensation: ₹12–₹25 LPA in India; $100,000+ abroad.

Employer Preferences: CFA Level 2+, strategic finance management skills.

7. Hedge Fund Manager

Job: Investment planning, risk analysis, and portfolio performance.

Salary: ₹20–₹50 LPA in India; $200,000+ abroad.

Employer Preferences: CFA charter, quantitative finance background.

8. Credit Research Analyst

Job: Examines the creditworthiness of companies and fixed-income instruments.

Salary: ₹8–₹18 LPA in India; $80,000+ abroad.

Employer Preferences: CFA Level 2+, financial statement analysis background.

9. Private Equity Analyst

Job: Invests in opportunity assessment, fundraising, and exit strategy.

Salary: ₹15–₹35 LPA in India; $120,000+ abroad.

Employer Preferences: Investment banking experience, CFA charter.

10. Chief Financial Officer (CFO)

Role: Corporate finance, investment planning, management of financial strategy.

Salary: ₹50+ LPA in India; $250,000+ internationally.

Employer Preferences: Finance leadership, CFA charter.

Employer Expectations for CFA Professionals

The CFA designation is highly valued by employers in asset management, corporate finance, investment banking, and risk management. Hiring managers actively search for CFA-certified job applicants with technical skills, ethical judgment, and leadership skills.

Key Employer Expectations from CFA Professionals:

1. Financial Modeling & Valuation Skills

The employers require the CFA professionals with the skills in financial modeling, DCF analysis, and valuation. All the above skills are typical for the career of equity research analyst, investment banker, and portfolio manager.

2. Ethical Decision-Making & Compliance

Ethics is highly stressed by the CFA Institute. Firms need the CFA professionals with ethical financial reporting, corporate governance, and risk compliance.

3. Risk Management & Asset Allocation

Risk management is the largest problem in the investment houses, corporate treasury, and banks. The CFA professionals have to examine the risk exposure, optimize asset allocation, and manage volatility in the markets.

4. Leadership & Communication Skills

The CFA professionals will walk to the CFO or Portfolio Manager position in the C-suite, where they are going to converse technical finance with the stakeholders. Leadership and interpersonal skills are enormity important to individual development.

5. Proficiency in Financial Technology (Fintech)

With AI, robo-advisory services, and blockchain ruling the market, finance professionals must possess technology-driven financial product experience. CFA professionals with hands-on experience with financial software, data analysis, and fintech innovations are becoming the need of the hour for employers.

6. Global Investment Insights

Global investment topic matter, cross-border investment, and foreign exchange in CFA curriculum make charterholders highly desirable candidates for global finance careers.

7. Portfolio & Wealth Management Expertise

CFA professionals working in wealth management companies, family offices, and hedge funds are well capable of generating investment ideas, preventing losses, and delivering clients’ goals.

8. Adaptability & Problem-Solving

In this fast-evolving business and financial era, CFA professionals need to be mind quick with money complexity solving capability based on hard facts.

CFA Job Market Trends

There is a greater demand for CFA professionals across all sectors of business as a result of changes in the marketplace, directions in technology, and financial directions of the world. Some of the most significant employment market trends of CFAs include:

1. Growing Demand for CFA Holders in Developing Nations

India, the Middle East, and China experienced 30% growth in CFA charterholder positions with growing development in fintech, capital markets, and investment banking.

2. Embracing AI & Machine Learning

Banks are moving towards AI-driven investment decisions. This has spawned the boom in data analysis and quant finance expertise in demand among CFA professionals.

3. ESG Investing & Green Finance Boom

ESG investing would increase to more than $50 trillion in assets by 2025. Corporates are recruiting CFA professionals with ESG skills on a frenetic level.

4. CFO & Corporate Finance Roles with CFA or CFA roles in finance

Increasing number of corporates are approaching CFA charterholders to recruit them for finance roles with CFA as the finance decision-making is getting increasingly data-driven and strategic.

5. Growth in Private Equity & Venture Capital

Private equity (PE) and venture capital (VC) funds are experiencing record levels of inflows, offering fresh opportunities for CFA professionals to get involved in financial due diligence, mergers and acquisitions, and deal structuring.

6. Alternative Investment Fund (AIF) Growth

Alternative investment funds (AIFs) and hedge funds are growing at a phenomenally rapid rate, and the CFA professional with education in alternative asset management is in greater demand.

7. Banking & Wealth Management Fintech Revolution

Fintech transforms banking, payments, and wealth management, and CFA professionals need to be trained in blockchain, digital lending, and AI portfolio management.

8. Greater Pay for CFA Charterholders

CFA charterholders are still being paid more in terms of salary bumps, and companies are paying 20%-40% higher than the pay received by non-chartered professionals holding similar titles.

FAQs on CFA Job Roles

Following are some of the most frequently asked FAQs regarding CFA career paths and opportunities and positions:

1. What are the highest-paying CFA job positions?

The highest-paying CFA positions are Hedge Fund Manager, Portfolio Manager, Private Equity Analyst, and CFO (Chief Financial Officer). The salary rates for these positions are over ₹50 LPA ($200,000+) per year worldwide.

2. Is employment assurance through CFA Level 1?

Yes, CFA Level 1 can command entry-level jobs such as Financial Analyst, Risk Analyst, or Research Associate with investment companies, consulting companies, and banks.

3. Is CFA sufficient to be a CFO?

CFA is a fine certificate to be a CFO, but leadership abilities and corporate finance training are also necessary to be a CFO.

4. In which sectors do CFA professionals most often work?

Investment banking, asset management, corporate finance, hedge funds, fintech, and risk management are the most prevalent fields that employ CFA professionals.

5. Do CFA charterholders earn higher salaries than MBAs?

This depends on the field. CFA charterholders earn higher salaries than MBAs in investment management, but MBA graduates will likely dominate corporate management and consulting.

6. CFA or CPA or FRM?

CFA is best for investment management, asset pricing, and portfolio analysis.

CPA is best suited for accounting, audit, and tax.

FRM is best suited for risk management and quantitative finance professionals.

7. What are the career opportunities for CFA professionals in India?

India needs more CFA professionals with career opportunities in corporate finance, investment banking, fintech, and private equity.

8. Is CFA suitable for fintech careers?

Yes! Fintech firms hire CFA professionals with expertise in blockchain, AI trading, robo-advisory platform, and alternative investments.

Conclusion

CFA certification is a highly powerful investment banking, portfolio management, private equity, and corporate finance career candidate tool. With international acceptability, comprehensive syllabus, and high employer demand, the CFA charter has leadership roles and high-paying opportunities available.

With the financial markets still changing, CFA professionals need to be up to date on what is going on in the markets, new technology, and ESG investing so that they can stay in the game. Whether candidate for the CFA Level 1 or charterholder, utilizing your CFA credential to its best will advance your career in finance and land you the best jobs in the industry.

If you are ready to take a step towards high-paying CFA job market trends, begin your career in CFA today!