Enrolling in the US CPA Course can be the game-changer your finance or accounting career needs.

Whether you’re a recent graduate or a seasoned professional, this qualification offers global recognition, practical expertise, and a pathway to leadership roles.

In today’s competitive job market, accountants with a US CPA credential stand out for their credibility and expertise, making them highly sought after across industries. Read this detailed blog to understand the US CPA course benefits and why to choose CPA certification.

What Is a US CPA Course?

A US CPA Course is a detailed program aimed at preparing candidates for the Uniform Certified Public Accountant Examination, which is conducted by the American Institute of Certified Public Accountants (AICPA).

It includes four major sections—Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Taxation and Regulation (REG), and an electing discipline section—providing students with thorough technical expertise and real-world skills.

1. Global Recognition and Credibility

US CPA for Career Growth

One of the primary reasons for opting for a US CPA Course is the unrivalled global recognition it offers.

The certification is recognised in more than 130 nations, indicating to employers that you are equipped with world-class skills and high standards of ethics.

- AICPA Prestige: The AICPA has more than 400,000 members worldwide and is the gold standard in accounting professionalism.

- International Mobility: With this certification, you will be able to practice in the USA, Canada, India, and other countries without requiring re-qualification.

- Trusted by Top Employers: Global companies, Big Four accounting firms, and major corporations respect the rigour of a US CPA qualification, frequently making it an essential qualification for senior positions.

2. Lucrative Salary Prospects

Career Opportunities with US CPA

One of the significant advantages of the US CPA Course is increased remuneration.

Industry surveys indicate that US CPAs have salaries that are 20%–30% higher compared to their non-CPA counterparts, with senior positions in finance and audit comfortably exceeding six-figure salaries (USD).

Global Demand: India surpassed Japan in 2023 to claim the second-largest market for CPA candidates (5,286 test takers, an increase of 60% over 2022), and this increasing trend is indicative of the rising demand and competitive pay offered for qualified US CPAs. (Source)

Diverse Career Roles: CPAs can find themselves employed as Financial Controllers, Internal Auditors, Tax Consultants, and even CFOs, each with handsome pay.

3. Comprehensive Exam Preparation

CPA Exam Preparation Course

CPA Exam preparation is intimidating, but an organised CPA exam prep course makes it easy. Imarticus Learning’s US CPA Course, for example, provides:

- Live Online Classes: Live sessions by subject matter experts, so you can raise doubts in real time.

- Premium Study Materials: Powered by Surgent, including comprehensive textbooks, sample questions, and mock exams that replicate the actual exam setting.

- Hands-On Simulations: CAPSIm-based simulations incorporate hands-on applications, such as Advanced Excel, Financial Modelling, and real-world case studies, to develop decision-making skills.

- Money-Back Guarantee: Outcome confidence is supported by a 50% refund if you fail to pass all exams, reflecting our belief in your success.

CPA – What is CPA? Should you do CPA or ACCA OR CA?

4. Eligibility and Benefits

US CPA Eligibility and Benefits

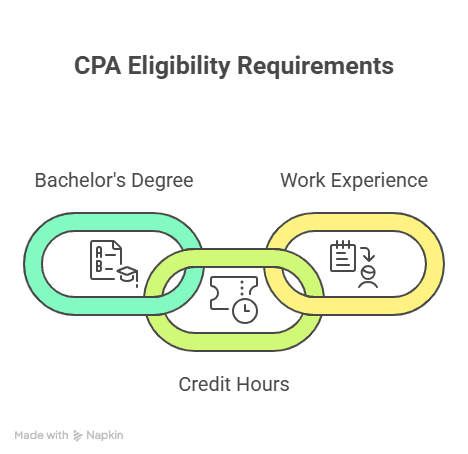

A query that arises is why go for the CPA certification when there are other credentials. The eligibility standards as well as the benefits involved present persuasive arguments:

- Educational Qualifications: A typical 120–150 credit-hour bachelor’s degree in accounting or a business-related field is required. Some jurisdictions can require extra credits, but most institutes (like Imarticus Learning) provide a Bridge Course for those without credits.

- Flexible Exam Attempts: Four sections may be attempted within one window, or they can be attempted across several windows to accommodate individualised study plans.

- National and International Licensing: Clearing the exam and meeting work experience requirements (varies across states) results in a license to practice anywhere in the United States. It is common for Indian CPAs to be employed in US-based companies while living in India.

- Continuing Benefits: In addition to the exam, renewing CPA certification entails Continuing Professional Education (CPE), so your skills remain up to date—an opportunity recognised by leading employers.

5. Career Growth and Opportunities

CPA Course Benefits

Investing in a US CPA course unlocks senior leadership positions and specialised niches:

- Audit and Assurance: Become an Auditing and Attestation specialist, guiding teams to guarantee financial statement integrity.

- Taxation Advisory: Specialise in Tax Compliance and Planning (TCP) or Federal Taxation of Entities (REG), guiding high-net-worth clients.

- Forensic Accounting: With expertise from Financial Analysis and Business Regulations modules, you can probe fraud and financial misstatements.

- Corporate Finance: Use Financial Accounting and Reporting (FAR) knowledge to work in corporate strategy, valuations, and mergers & acquisitions.

- Consulting and Advisory: Offer strategic guidance on regulatory compliance and risk management at premium fee levels.

Table: Program Features Comparison

| Feature | Details |

| Duration | 12–18 Months Study Period (Live Online) |

| Course Materials | Surgent-powered CPA books, video lectures, mock tests, and practice questions |

| Practical Simulations | CAPSIm case studies: Advanced Excel, Financial Modelling, Audit scenarios |

| Money-Back Guarantee | 50% refund if unable to clear all CPA exams |

| Eligibility Bridge Course | For those without required credits, additional modules offered |

| Career Support | Free Placement Bootcamp, Resume Workshops, Mock Interviews |

| CTC Range (India) | INR 12.50 – 20.50 Lakhs |

| Accreditation | Authorised Prep Provider by AICPA |

FAQs

Q1: How long does a standard US CPA Course last?

A 12–18 months study duration is provided by most providers, including Imarticus Learning, in live online delivery. This includes exam preparation and revision times.

Q2: How many attempts are given for the CPA Exam?

Candidates can attempt up to four sections in a testing window. You can attempt all four in one window or split them over two windows, depending on your study schedule.

Q3: What is the pass percentage of the CPA Exam?

A: Pass rates by section differ. For 2024, they were:

- AUD: 45.79%

- FAR: 39.59%

- REG: 62.61%

- ISC: 58.00%

- BAR: 38.08%

- TCP: 73.91% en.wikipedia.org.

Q4: Who is eligible to register for a US CPA Course?

A: Generally, you need a bachelor’s degree with 120–150 accounting or related credits. If you have no credits, then institutions such as Imarticus have a Bridge Course to complete the extra credit requirements.

Q5: Can I prepare for the US CPA exam while living in India?

A: Yes. You can study in India and take the test at authorised testing facilities with live online classes. Many Indian CPAs work for international companies either from home or abroad after qualification.

Q6: What is taught in a US CPA Course?

A: Major areas are:

- Financial Accounting and Reporting (FAR)

- Auditing and Attestation (AUD)

- Taxation and Regulation (REG)

- One discipline area (Information Systems & Controls, Business Analysis & Reporting, or Tax Compliance & Planning) en.wikipedia.org.

Q7: What is a money-back guarantee?

Imarticus Learning provides 50% reimbursement of course fees if you fail to clear all four CPA exam sections, subject to completion of preparation and taking all sections within the given timeframe.

Q8: In what way does the US CPA assist in career prospects?

A: The certification makes candidates eligible for Senior Auditor, Tax Consultant, Financial Controller, and CFO positions. Companies like Deloitte, KPMG, EY, and PwC recruit US CPAs as they undergo stringent training and an ethical foundation.

Q9: Bridge program for candidates who are not eligible?

A: Yes. If you fail to satisfy the minimum credit criteria, most institutes offer a Bridge Course to assist you in earning extra credits and being eligible to appear for the exam.

Q10: What study materials are made available?

A: Good-quality materials are:

- Surgent-powered textbooks and practice questions

- Mock tests replicating the exam conditions

- Video lectures and case simulations through CAPSIm.

Conclusion

Selecting a US CPA Course today is a strategic decision for any finance professional.

Not only does it bring about international recognition and give you access to higher salary brackets, but it also equips you with functional skills through intense exam preparation.

As India keeps on becoming the leading market for CPAs—surpassing Japan in 2023 by more than 5,286 test takers and growth to over 11,000 by 2025—now is the ideal time to make this investment.

Key Takeaways

- Global Prestige: A US CPA credential is widely recognised across 130+ countries, signalling top-tier expertise and credibility.

- Career Advancement: The course offers lucrative roles in audit, taxation, corporate finance, and advisory, with salaries significantly higher than non-CPA peers.

- Structured Preparation: Live classes, premium materials, hands-on simulations, and placement support make exam readiness effective and efficient.

Call to Action

Ready to transform your accounting career and join the ranks of globally recognised finance professionals?

Enrol in the US CPA Course with Imarticus Learning today and begin your journey to unmatched career growth.