Are You Still Struggling to Get Your Trial Balance Right?

Let’s be honest: balancing accounts is one of the most dreaded parts of accounting. You’ve followed every rule and entered every transaction, but somehow… the trial balance just doesn’t match.

They affect everything: ledgers, financial statements, and even your confidence.

The good news? Once you understand the process and learn how to spot common mistakes, creating a trial balance becomes routine.

This blog takes you through everything from understanding the trial balance format to resolving trial balance questions most people overlook. Whether you’re preparing for your ACCA course or trying to clean up your books, you’ll find practical answers here.

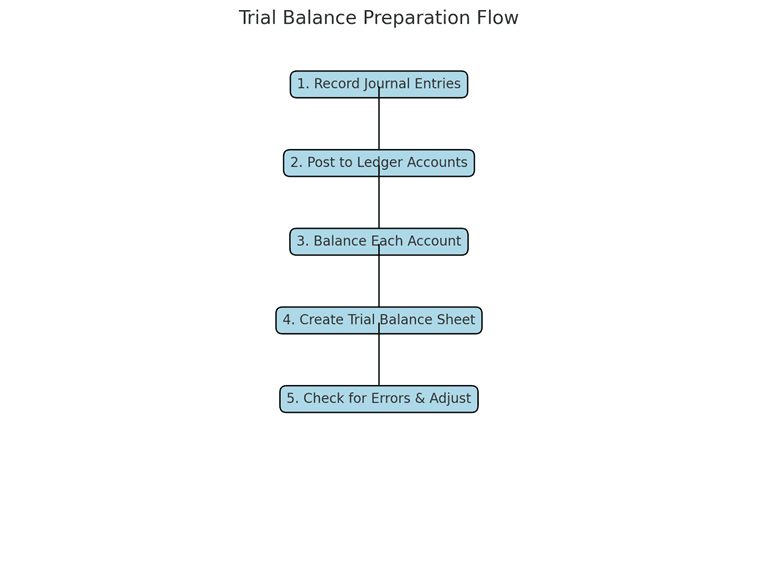

Understanding the Basics of a Trial Balance

Before anything else, let’s break it down. What is trial balance?

A trial balance lists the adjusted closing balances of all general ledger accounts, both revenue and capital, on a specific date. It serves as an internal financial statement for the business.

Why it matters:

A correct trial balance helps ensure accurate financial statements. Without it, the foundation of your accounting is shaky. These are the unadjusted trial balance, the adjusted trial balance, and the post-closing trial balance.

Ø An unadjusted trial balance provides a quick check to ensure that all recorded transactions are in balance. Accountants often use this version as a starting point to review entries and identify areas.

Ø Adjusted trial balance version includes final balances across all accounts and serves as the foundation for preparing the official financial statements. It reflects the most accurate picture of a business’s financial position at the close of an accounting period.

Ø Following the preparation of financial statements, a post-closing trial balance includes only the permanent accounts, such as assets, liabilities, and equity, after temporary accounts. This version becomes the starting point for the next accounting year.

However, while a trial balance helps verify that debit and credit totals match, it doesn’t catch all types of errors. It has its limitations.

Data entry errors, such as recording amounts in the wrong account or entering the wrong figures, also won’t always show up through the trial balance alone.

Trial Balance Format: Know It Inside Out

A standard trial balance includes:

| Account Name | Debit (₹) | Credit (₹) |

| Cash | 50,000 | |

| Sales | 1,20,000 | |

| Purchases | 70,000 | |

| Rent | 15,000 | |

| Capital | 1,15,000 | |

| Totals | 1,35,000 | 1,35,000 |

Most Common Errors in Trial Balance

A study by Indiana University found that around 60% of accounting errors result from basic bookkeeping mistakes.

Mistakes happen. But recognising patterns makes solving them faster.

These are often covered with examples in ACCA course material.

Here are the most frequent mistakes and what causes them:

| Type of Error | What It Means | Example |

| Transposition Errors | Digits reversed while recording | ₹4356 instead of ₹4536 |

| Omission Errors | A transaction is completely left out | Rent of ₹5,000 not recorded |

| Reversal of Entries | Debit and credit swapped | Crediting salary instead of debiting |

| Single Entry Errors | Only one part of a transaction is recorded | Only the debit is entered |

| Duplication | The same entry is posted more than once | Two identical sales entries |

How to Quickly Spot Errors in Your Trial Balance

Want a faster way to fix mistakes?

Try this checklist:

- Does debit = credit?

- Are all account names correct?

- Do ledger balances match?

- Did you forget any entries?

- Re-add all totals.

Every accounting student should follow this routine. It saves time.

Trial Balance Questions That Confuse Students

Here are some trial balance questions you may encounter in exams:

- What is trial balance, and why is it prepared?

- Which accounts don’t appear in a trial balance?

- Can you prepare a trial balance without a journal?

Questions like these are well explained during Imarticus Learning’s ACCA course, especially in the Skill and Knowledge levels.

Imagine you’re working late. Your boss wants a report tomorrow. You complete the accounts, but your trial balance won’t match. Panic? Not any more. These are the situations ACCA-trained professionals handle well.

Training with practical problems prepares you for the real world. That’s why the ACCA course focuses on scenarios like this.

Explore ACCA Course with Imarticus Learning

The ACCA course isn’t just theory. It builds your foundation in trial balance, journal entries, ledgers, and more.

The ACCA Course at Imarticus Learning opens doors in over 180 countries, making it one of the most respected certifications in the accounting world. Spread across three levels: knowledge, skill, and professionalism.

It equips you with practical and global-ready skills in audit, taxation, management, and corporate finance. Imarticus Learning delivers this course with Kaplan-powered study material and experienced faculty who also offer exam-specific mentoring.

Because it doesn’t stop at theory, it includes placement boot camps, a 100% placement guarantee after Level 2, and even a money-back guarantee if you don’t pass all papers. Every learner gets access to real-time simulations, advanced Excel training, and internship opportunities with top firms.

Imarticus Learning ACCA course is your launchpad. From foundational support to guaranteed internships and even a refund policy, this isn’t just a course; it’s a commitment to your career growth.

Start Your ACCA Journey With Imarticus Learning!

FAQs

1. What does the trial balance format include?

It includes columns for account names, debit values, and credit values. Totals on both sides should be equal.

2. What happens if the trial balance doesn’t match?

It means there’s an error in journal entries or ledgers. Recheck all entries, figures, and calculations.

3. Can errors still exist if the trial balance matches?

Yes. Compensating or complete omission errors won’t affect totals, but they still exist.

4. Why is trial balance preparation important for ACCA exams?

It helps you practise accuracy in core concepts, which you test across all levels of the ACCA course.

5. Are trial balance questions asked in ACCA exams?

Yes. Many questions revolve around trial balance format, errors, and corrections.

6. How does Imarticus Learning support students with trial balance problems?

Live sessions, doubt-clearing, simulations, and Kaplan-approved study content help learners understand this deeply.

7. Is there a guarantee with the ACCA course at Imarticus?

Yes, there’s a placement or internship guarantee after Level 2. If you don’t pass, you may receive a partial fee refund.

Conclusion

Preparing a trial balance is about more than just matching numbers. It’s a habit. A mindset. And once you get the hang of it, your entire accounting process becomes cleaner and faster.

Whether you’re solving trial balance questions in your ACCA course or working on company accounts, the solution is always in the steps. Follow them right, and errors won’t have space to hide.