Stock investing is a highly competitive and risky business. The risk of losing your money in the stock market can be mitigated by learning about treasury management, trade finance, and other related areas. If you are a beginner stock investor, there is no time like the present to learn as much as you can about this exciting field.

There are many mistakes that beginners often make, and those mistakes could cost you dearly in the long term. In this post, we’ll discuss four common mistakes made by beginner traders and offer advice on how to avoid them.

Common mistakes made by beginner traders and how to avoid these mistakes are:

Purchasing without doing the research: One of the most important parts of trading is understanding what you are buying. This requires some background knowledge and information on your part to make an informed investment decision. You should have all this before making any investments to avoid mistakes like jumping into something just because someone else said it was good or looking at a graph that makes something look more promising than it really is.

Not considering risk management: When people hear about successful traders, they often think that these traders were simply lucky; however, there’s much more behind their success than luck alone. These professional investors know how to manage risks properly, which has helped them navigate through rough patches while maintaining portfolios over time. Risk management also helps know what to sell when things go south and how much of a loss is too big.

Not having an exit strategy: Another common mistake investors make is not having an exit strategy. They often get caught up in the moment when something starts to go well and don’t sell it even though they know that it might come back down. Having a solid plan for exiting trades should include some type of profit-taking or using stop-losses, which are set according to your preferences as they can limit potential losses while still allowing you to take advantage of gains.

Getting caught up on emotions: Investing requires patience more than anything else as it takes time for good investments to pay off—but this doesn’t mean you should be patient all of the time. When new traders make a lot of money, they tend to hold onto those stocks thinking that their luck will continue, which isn’t always true; hence why risk management is so important because if things go south (i.e., there was an unanticipated event like bad news from another company), then these beginner traders may end up losing a lot more than they bargained for.

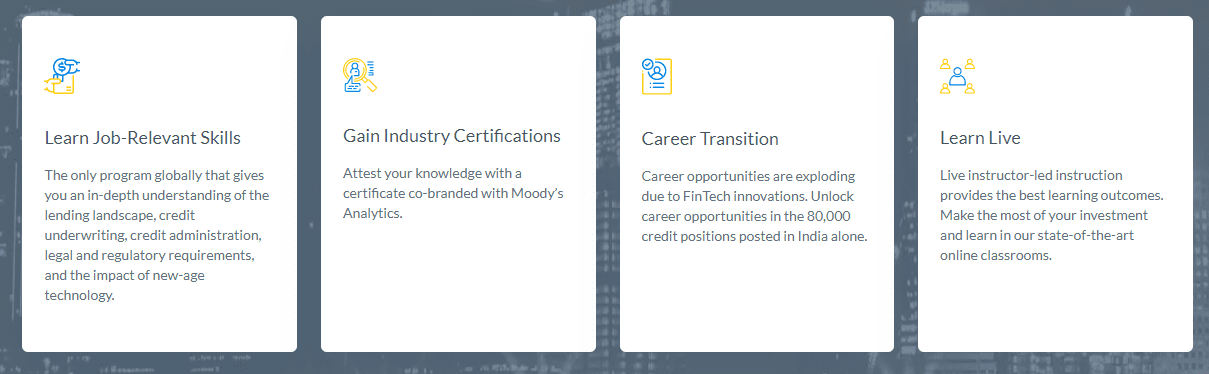

Learn treasury management by joining MBA course at Imarticus Learning Institute

Avoiding these mistakes is the primary step towards becoming a successful trader. The second and equally important part of learning to trade profitably is good risk management skills as well as understanding various compliances in the market. Learn risk and treasury management in banking & finance with Imarticus Learning.

Imarticus Learning offers MBA courses in finance in collaboration with Jain University. This course will enable you to gain in-depth knowledge & understanding of the various treasury operations and also help you understand risk management.

For more information, connect with us through the Live Chat Support system or visit any of our training centers based in – Chennai, Mumbai, Thane, Pune, Bengaluru, Hyderabad, Delhi, and Gurgaon.

A credit analyst course or PG diploma in banking and finance may help you to achieve that.

A credit analyst course or PG diploma in banking and finance may help you to achieve that.