Tired of just running reports? Ready to be the one guiding decisions when markets shift and uncertainty hits? That’s exactly where the Financial Risk Manager (FRM) course steps in.

Offered by the GARP and recognised worldwide, the FRM program equips you to analyse, manage, and mitigate complex financial risks. Its curriculum spans quantitative methods, market and credit risk, liquidity and operational challenges, and emerging industry practices – preparing you to build risk frameworks that support real business strategy.

For professionals aiming to move beyond routine finance tasks and step into impactful, leadership-oriented roles in banks, consulting firms, and multinational organisations, FRM acts as a true career accelerator.

In this guide, we’ll break down everything you need to know about the FRM course – from eligibility and fees to career benefits and job opportunities – so you can decide if it’s the right next step for your finance career.

What is the FRM Course?

The FRM course is offered by the Global Association of Risk Professionals (GARP). It’s globally recognised. That means whether you’re in Mumbai, New York, or Singapore, your credential signals expertise in financial risk management – a language that every top-tier firm understands.

In today’s unpredictable financial landscape, FRM gives you the expertise to make smarter, more confident decisions, the kind that help organisations stay steady even when markets get volatile.

If you might be wondering what is FRM, think of the FRM Course as your toolkit for risk leadership. While traditional finance roles focus on reporting or compliance, FRM trains you to identify, assess, and mitigate risks before they turn into problems.

🎥 Before we dive in, here’s a video that breaks down everything you need to know about the FRM course – from fees and eligibility to duration and career scope.

The FRM Course Structure

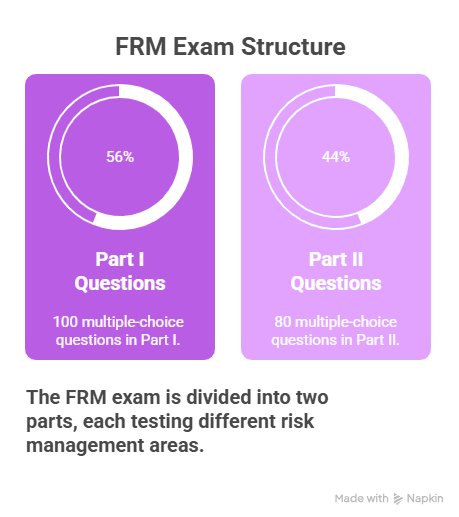

The FRM isn’t just a credential; it’s a signal to employers that you’re prepared for strategic leadership. The FRM program is broken down into two parts, designed to build your knowledge from the ground up.

Part I builds foundations in quantitative methods and financial market instruments, while Part II delves into market, credit, operational and liquidity risks, as well as contemporary risk management challenges.

Part I: The Core Foundations

This is where you lay the groundwork. Imagine trying to explore a new city without a map – you’d get lost. Part I gives you the map. It focuses on quantitative methods, financial instruments, and the core concepts of risk.

| Topic | Focus |

| Foundations | Ethics, Corporate Governance, and Core Risk Concepts |

| Quantitative Analysis | Statistical methods and modelling for risk |

| Financial Markets & Products | Understanding Derivatives, Fixed Income, and more |

| Valuation & Risk Models | Measuring risk with tools like VaR and stress testing |

If you were equipped with Part I knowledge back during the 2008 financial crisis, you could have quantified subprime mortgage risk, understood derivatives exposure, and anticipated the ripple effects across global banks. That’s the kind of foresight FRM equips you with.

Part II: Strategic Application

Part II is where you move from theory to strategy. It’s like being fresh out of an architecture degree; the first project hits hard. It isn’t just designing – suddenly, you are juggling market swings, credit, operations, cash flow, and new challenges like ESG and cyber risks. Real-world projects are way more complex than any classroom could prepare you for.

| Topic | Focus |

| Market Risk | Managing fluctuations in market prices |

| Credit Risk | Dealing with potential borrower defaults |

| Operational Risk | Mitigating losses from internal failures (people, processes, systems) |

| Liquidity & Investment Risk | Managing cash flow and investment portfolio risks |

| Current Industry Issues | Emerging topics like ESG, climate risk, and cyber risk |

Passing the exams and documenting two years of relevant professional experience signals your readiness to lead risk initiatives rather than simply react to them. To understand how the FRM program builds your knowledge step-by-step, explore our detailed FRM Course Structure section.

Pro Tip: Specialising in emerging areas like ESG risk, climate modelling, regulatory technology, and sustainable finance further enhances your market edge. As firms prioritise these domains, FRM holders find themselves at the forefront of transformational finance roles.

Important Note: To officially get your FRM Charter, you must document two years of relevant work experience after passing both exams and within a 10-year window.

FRM Exam Details & Preparation

You can’t ace this by just skimming. The FRM exams are rigorous, but the structure is straightforward. With disciplined preparation, you can confidently clear them.

| Aspect | Part I | Part II |

| Format | 100 multiple-choice questions | 80 multiple-choice questions |

| Duration | 4 hours | 4 hours |

| Study Time | 275-300 hours recommended | 275-300 hours recommended |

Smart Tip: If you schedule 2 hours daily for quantitative practice and another hour for reading GARP core texts. By four months, complex probability models that initially seemed daunting become intuitive.

FRM Course Cost Breakdown

Here’s a quick overview of the FRM course fees to help you understand how the total cost is distributed across different components.

| Component | Cost (USD) | Notes |

| Enrolment Fee | $400 | One-time fee |

| Part I Exam Fee | $600-$800 | Based on early vs. standard registration |

| Part II Exam Fee | $600-$800 | Based on early vs. standard registration |

| Estimated Total | $1,600-$2,000 | A small investment for a big return! |

Think about it – spending $2,000 to unlock global career opportunities and leadership roles is a small price for financial freedom and professional growth.

FRM Course Pass Rates

The FRM Certification remains one of the most demanding credentials in financial risk management – official data from GARP shows that exam pass rates for Part I typically range between 40% and 50%, while for Part II they trend higher, at about 50% to 60%.

These moderate pass rates reflect the rigorous nature of the exams and why holding the FRM credential is viewed as a mark of serious competence in risk management skills.

How to Prepare for the FRM Course?

Using the right techniques can make a huge difference when it comes to acing your exams. Here are a few practical tips to help you prepare effectively for the FRM exams:

- Structured Study Plan: Break the syllabus into weekly milestones with a reputable provider. Consistency beats cramming.

- Mock Exams: Build stamina and timing. FRM isn’t just about knowledge – it’s about applying it under pressure.

- GARP Core Readings: Don’t skip them. They’re the backbone of exam success. Supplement with trusted third-party question banks.

- Real-World Application: Whenever possible, link theory to your current work. For example, use Part II frameworks to evaluate your company’s operational risks.

Why is the FRM a game-changer?

Let’s be real – the FRM isn’t just another finance certification you add to your résumé. It’s a powerful launchpad that can completely change the direction of your career. Let’s break it down:

- Massive Paycheck: According to the U.S. Bureau of Labour Statistics, risk management roles and FRM holders enjoy median salaries soaring around USD 156,100 globally. For Indian finance professionals, this translates to career paths that not only elevate your earning potential but position you as a coveted expert in a field that’s gaining unprecedented strategic importance.

- Job Security & Growth: Roles in financial management are expected to grow by a strong 16% through 2032. Plus, 40% of risk-management jobs require or prefer the FRM credential.

- Global Elite: Join a network of 90,000+ FRM professionals operating in over 190 countries. Talk about a serious networking edge!

- In-Depth Expertise: You won’t just learn buzzwords. You’ll master cutting-edge quantitative models, stress testing, and frameworks for complex risks like climate and cybersecurity.

- Future is Bright: A staggering 73% of professionals expect risk management roles to increase over the next 18 months, and 85% would recommend a risk career to a peer. Optimism is high. And you need to be ready to step up!

Why Choose the FRM Course?

Let me be honest: the FRM is not for everyone. This certification is purpose-built for finance professionals who are ready to seize the leadership seat. If you’re in a finance role and feel limited by repetitive tasks, FRM can change your trajectory.

You should pursue the FRM if you are a:

- Risk Analyst ready to lead projects and transition into management.

- Credit & Market Risk Manager seeking the deepest, most authoritative insights.

- Operational Risk Specialist looking to streamline firm-wide processes and influence enterprise strategy.

- Consultant advising clients on macro-level risk and corporate resilience.

- Finance Leader committed to steering a firm through market volatility and regulatory change.

Stop settling for a career of calculations. The FRM course is the definitive step to becoming an indispensable, high-earning financial strategist.

💡 Did You Know?

According to the 2025 FRM Global Practice Analysis Report,

40% of financial risk managers have responsibilities related to climate risk.

42% of financial risk managers view AI/machine learning as a key area for continuing education.

55% of financial risk managers spend at least half of their time performing risk management tasks.

Insights from the 2024 GARP Risk Careers Survey

- GARP‑certified professionals are in high demand. More than 40% of survey respondents said the FRM Certification is listed as preferred or required in job postings.

- Nearly 79% of survey respondents globally reported a high degree of satisfaction in their work. 73% anticipate opportunities in risk management will increase slightly or significantly over the next 18 months. 54% plan to hire more risk professionals, and 85% would recommend a risk management career to peers.

This underscores why FRM holders are in demand worldwide.

FRM Course Benefits

Imagine being the person in the room who can spot a financial storm before it hits – a professional everyone turns to for guidance when markets shift unexpectedly. That’s the kind of edge the FRM certification gives you.

Earning your FRM isn’t just about learning risk – it’s about becoming the go-to expert in a fast-moving financial world.

Top banks, investment firms, consultancies, and regulators look for professionals who can spot, analyse, and manage complex risks that others might miss.

It also opens doors to better pay – FRMs often earn 15-30% more than their peers and career paths that can take you from risk analyst all the way to chief risk officer.

With a global network of over 90,000 risk professionals across 190 countries, your opportunities aren’t limited by geography.

And with emerging areas like ESG, climate, and cyber risks shaping the future of finance, FRM helps you stay ahead, think strategically, influence decisions, and turn your expertise into real impact, reputation, and career growth.

FRM Career Path

When I first looked into the FRM course, what really grabbed my attention was how practical and career-focused it is. Unlike generic finance certifications, FRM is built to give you skills you can actually use in high-impact roles.

Here’s what you stand to gain from pursuing the FRM:

Strategic Risk Expertise: You’ll learn how to spot, measure, and manage financial risks before they become big problems. Think of it as having a financial radar for every decision your company makes.

Global Recognition: FRM is recognised in over 190 countries. Your skills aren’t just for local roles—they make you a global asset.

Leadership Readiness: FRM doesn’t just teach technical stuff. It trains you to make smarter decisions under uncertainty – a skill that sets you apart for managerial and executive roles.

Future-Proof Skills: From ESG and climate risk to AI in finance, FRM ensures your knowledge stays relevant as the industry evolves.

Networking Opportunities: You join a community of over 90,000 professionals worldwide, opening doors to mentorship, collaboration, and career growth.

Real-World Impact: Imagine being a Risk Analyst, and your bank is eyeing a new investment portfolio. FRM equips you to quantify market and credit risks, spot operational weak spots, and make recommendations that protect the firm’s bottom line – turning you into a trusted decision-maker.

But the opportunities don’t stop there. The rise of fintech and digital banking has created new roles in model risk, compliance analytics, and stress testing, where FRM knowledge gives you a powerful edge. Even consulting and tech-driven financial companies now rely on FRM-certified professionals to design robust, data-backed risk frameworks.

Whether your goal is to work with global banks or lead risk strategy for an emerging fintech, the FRM badge signals that you’re equipped to guide decisions – not just report on them.

Emerging Specialisations: ESG, AI, and Sustainable Finance

Risk management isn’t just about markets anymore.

With global shifts in ESG (Environmental, Social & Governance) standards, climate risk, and AI-driven analytics, FRMs are at the forefront of defining what financial sustainability looks like.

These evolving domains are opening new, high-impact roles in green finance, climate risk assessment, and digital risk strategy – all areas where FRM knowledge gives you a clear edge.

FRM Salary in India

More than just a pay bump, the certification opens doors to leadership. Many professionals transition from routine finance roles to strategic positions like Risk Manager or even Head of Risk within a few years of completing their FRM journey.

Let’s talk numbers. One of the biggest motivators for taking any certification is the career upside – and FRM salary delivers.

| Experience Level | Common Job Roles | Average Salary Range |

| Entry-Level (0-2 years) | Risk Analyst, Credit Risk Associate, Junior Risk Manager | ₹10-15 LPA |

| Mid-Level (3-5 years) | Risk Manager, Market Risk Analyst, Treasury Specialist | ₹18-25 LPA |

| Senior-Level (7+ years) | Senior Risk Manager, Head of Risk, Chief Risk Officer (CRO) | ₹30-50 LPA+ |

- Fresh FRM-certified professionals start in analytical or junior management roles across banks, NBFCs, and consulting firms.

- With experience, FRMs move into risk management and treasury functions, handling complex portfolios and regulatory reporting.

- At senior positions, FRMs lead enterprise-wide risk frameworks, policy compliance, and strategic decision-making across financial institutions.

You can transition from an Analyst role at a mid-sized bank to a Senior Risk Manager position at a multinational after completing FRM. Within three years, your salary can nearly double, and you can lead a team that directly advises on strategic investments.

Globally, salaries are even more attractive than the FRM salary in India: FRM holders in the US, Singapore, and the Middle East often earn USD 100,000-180,000+, depending on experience and industry.

Why Choose Imarticus for the FRM Course?

The FRM is the smartest move for ambitious finance pros who want to lead, not just calculate. It’s in high demand, offers great pay, and equips you with future-proof expertise in a rapidly evolving financial world.

Thinking of studying FRM on your own? That’s possible – but here’s why Imarticus Learning makes it easier and more effective:

Why Choose Imarticus FRM:

- Learn from Experts: Mentorship from industry pros who’ve managed risk at global banks.

- Complete FRM Coverage: Structured, GARP-aligned guidance for Part I & II.

- Interactive Classes: Real-time problem-solving, case studies, and doubt-clearing sessions.

- Smart Progress Tracking: AI tools highlight your strengths and areas to improve.

- Trusted Study Material: Kaplan resources and mock exams included.

- Flexible Learning: Full-time, part-time, or hybrid options for working professionals.

- Career Support: Assistance with placements at top banks and firms.

- Pass & Career Guarantee: Structured coaching to get you exam-ready and job-ready.

- Real-World Learning: Cases drawn from actual boardrooms, trading floors, and advisory work.

Success in FRM isn’t about cramming formulas; it’s about connecting those numbers to real situations – like understanding how a shift in interest rates ripples through bond portfolios or liquidity positions. With a clear plan, discipline, and the right training support like Imarticus’ GARP-aligned modules, most committed candidates manage to clear both parts confidently.

🎥Curious about how the FRM stacks up against other big finance certifications like ACCA, CMA, CFA, or CPA? Check out this video:

FRM Course vs CA vs CPA vs CFA vs CMA vs ACCA: Which Finance Qualification Wins?

The FRM is specialised in risk management, whereas general finance certifications like CFA or CPA focus on investments, accounting, or auditing. For professionals aiming to lead strategic decision-making in uncertain markets, FRM offers unmatched expertise and credibility.

| Credential | Focus | Global Reach | Senior Salary (India) | Top Role Target |

| FRM | Risk Management (ESG, Credit) | Global | ₹30 LPA+ | Chief Risk Officer |

| CFA | Investment Analysis | Global | ₹28 LPA+ | Fund Manager |

| CPA | Accounting (US GAAP) | Global | ₹25 LPA+ | CFO |

| CA (India) | Accounting & Tax | India | ₹20 LPA+ | Domestic CFO |

| CMA (USA) | Management Accounting | Global | ₹22 LPA+ | Corporate CFO |

| ACCA | Global Accounting | Global | ₹22 LPA+ | Audit Specialist |

Why FRM is the Preferred Choice?

- Directly prepares you for leadership roles in risk management.

- Global recognition in 190+ countries ensures career mobility.

- Hands-on skills in quantitative modelling, ESG risk, climate, and AI.

- High earning potential with strategic career growth.

- Networking edge with 90,000+ FRM professionals worldwide.

For finance professionals looking to step into roles where decisions shape business outcomes, FRM is not just another certification – it’s a career accelerator.

FAQs About the FRM Course

If you’re considering the FRM course, you probably have a few questions. Here are a few frequently asked questions covering topics such as eligibility, exam difficulty, salaries and career opportunities related to the FRM course.

What is the FRM Course?

The FRM course, offered by the Global Association of Risk Professionals (GARP), is one of the most respected and in-demand qualifications in the finance world. It’s designed to help you truly understand how risks affect businesses and how to manage them effectively. Whether it’s market, credit, operational, or liquidity risk, FRM gives you the real-world tools to handle them confidently. In simple terms, it trains you to think like a risk expert – the kind of professional companies rely on when the markets get unpredictable.

Is FRM better than CFA?

Honestly, it depends on what you want to do in your career. The CFA is great if you’re drawn to investment analysis, portfolio management, or research. On the other hand, the FRM is all about understanding and managing financial risks – perfect if you’re interested in banking, treasury, or enterprise risk roles. They’re both valuable in their own ways. In fact, many professionals choose to pursue both, as the combination provides them a strong balance of investment knowledge and risk expertise – a real advantage in today’s financial world.

Who is eligible for the FRM course?

Anyone interested in finance or risk can register for FRM Part I. There aren’t strict eligibility rules. To actually earn the FRM Charter, though, you need to pass both Part I and II and have at least two years of relevant work experience in finance, investments, or risk management.

What are the FRM course fees?

The total cost of the FRM course typically ranges between ₹1,41,800 and 1,80,000. This covers a one-time enrollment fee plus the exam fees for both Part I and Part II. The exact cost depends on when you register – those who sign up early usually pay less. So, if you plan and register during the early window, you can save quite a bit compared to the standard registration fee set by GARP.

Is FRM tougher than an MBA?

They’re different. An MBA gives you a broad understanding of business, while FRM is highly specialised and technical. Many people find FRM more quantitative, especially in areas such as probability, statistics, and valuation models. That said, pairing an MBA with an FRM can give you an edge in strategic and technical skills.

Is the FRM Course Very Difficult?

Let’s be honest – yes, it’s challenging. GARP designed the exam to test real-world understanding, not just theory or rote learning. You’ll be diving deep into quantitative methods, risk models, and decision frameworks that push you to think like a strategist. Pass rates usually range between 40% and 60%, which tells you it’s rigorous but absolutely doable with the right approach.

Can I complete the FRM course in 1 year?

Yes! With the right plan, it’s doable. Many candidates take Part I in May and Part II in November. With consistent study and guidance from institutes like Imarticus Learning, you can complete both parts in just one year.

What is the FRM Salary?

FRM-certified professionals generally start around ₹12-15 LPA in entry-level roles, often as Risk Analysts or Associates. Once you gain a few years of experience, the numbers rise quickly – mid-level professionals earn between ₹18-25 LPA, while senior roles, especially in risk leadership or treasury, cross ₹30 LPA and beyond.

Who Hires FRMs in India?

FRM professionals in India land roles at some of the biggest names in finance – HDFC, ICICI, SBI, and the Big Four consulting giants like Deloitte and KPMG. You’ll also find them steering risk at global banks like Morgan Stanley, Citi, and HSBC. But it’s not just the traditional players – fintech startups, asset managers, rating agencies, and even regulatory bodies are now actively hunting for FRM-certified talent. If you want to be the go-to person who helps firms navigate risks and make smarter decisions, getting your FRM opens doors everywhere.

Take Charge of Tomorrow’s Financial Challenges with FRM

The FRM course is your ticket to stepping out of routine finance tasks and into strategic risk leadership. The FRM isn’t just about clearing exams – it’s about truly mastering the skills to navigate real-world challenges like market volatility, credit risks, operational hiccups, and even newer threats such as ESG and cybersecurity.

It’s a globally recognised credential that earns you respect and opens doors to top banks, consulting firms, fintechs, and regulatory bodies. More than anything, it gives you the confidence and credibility to make an impact where it matters most – in key financial decisions.

Ready to lead, not just calculate? Start your FRM Course journey with Imarticus Learning, where expert mentors, GARP-aligned curriculum, smart progress tracking, and real-world case studies come together to make your success achievable. Take that decisive step towards becoming the financial strategist tomorrow’s market needs.