Have you ever felt like your finance degree just isn’t enough?

You’ve got the basics, but when it’s time to actually analyse a company’s value or make investment calls, there’s hesitation.

Why?

Because textbooks won’t teach you how to think like a CFO. What’s missing is real-world skill, the knowledge you get from a Financial Modelling and Valuation Course. If you’re serious about CFO career development, it’s time to level up.

What’s Holding You Back From Becoming a Future CFO?

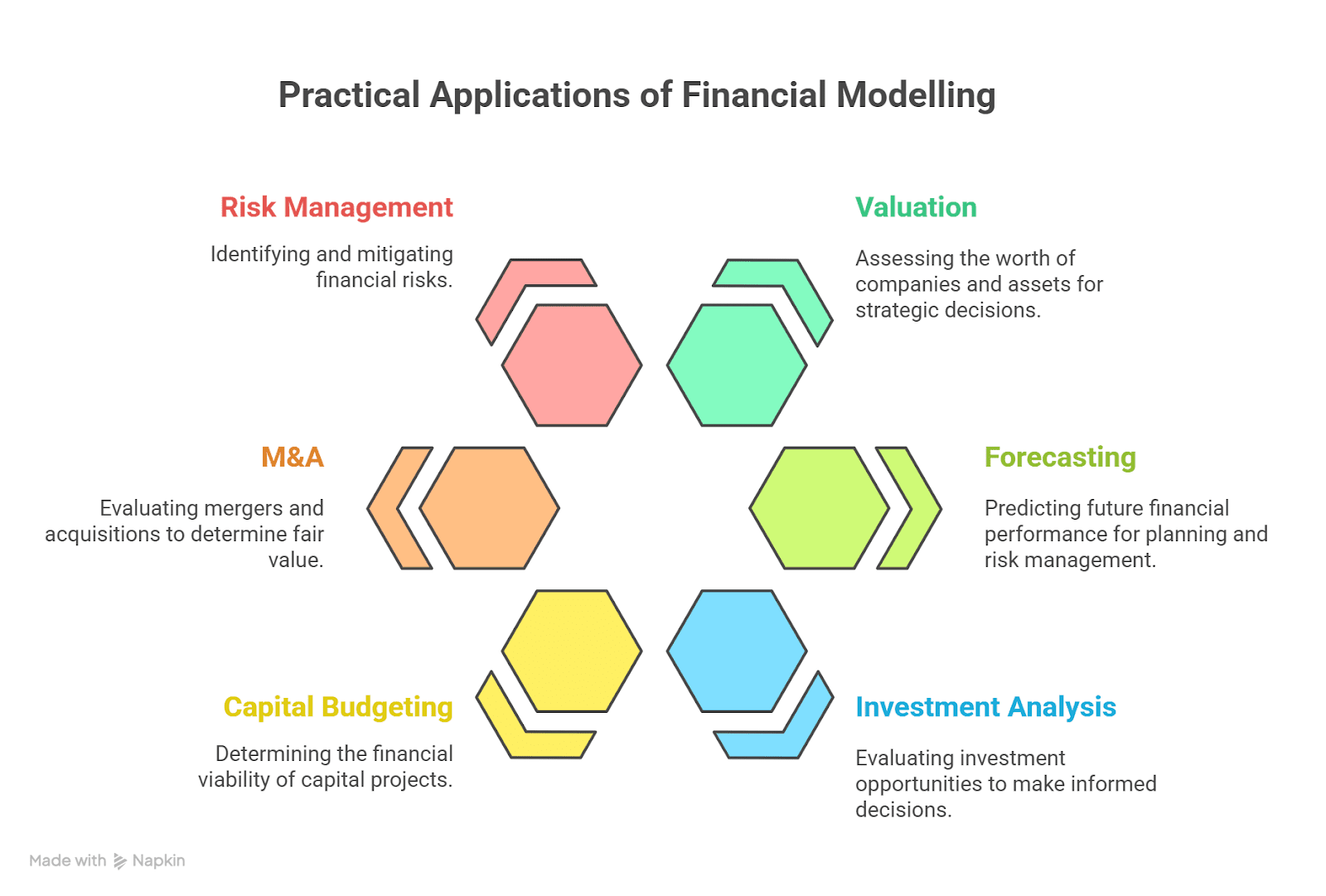

Financial modelling means creating a simplified version (a model) of a real-life financial situation. Financial models are basically used by businesses to work out budgets, value the businesses, and assess risks. Such models assist the leader in making decisions on the areas to utilise the money, how to expand, or even reduce the need.

Strong models consist of real historical numbers, assumptions, and correct financial statements, such as profit & loss, balance sheet, and cash flow. These are essential, without which the numbers become useless.

The model should be simple, clear, and changeable. Ensure that others will be able to understand it. Do not make mistakes; recheck your formulas. Design it in a good way so that it does not collapse when inputs vary.

Case Examples in the Big Companies

Ø Activision Blizzard is a company purchased by Microsoft.

They have adopted a DCF (Discounted Cash Flow) that would help determine whether the $68.7 billion deal made business sense.

Ø Airbnb in the time of COVID-19

In order to make ends meet during the pandemic, Airbnb constructed models that demonstrated worst-case scenarios in terms of cash flows. This was to keep them prepared for anything.

Ø Production Planning of Tesla

Tesla also employed models in terms of cash expenditure and supply chain risks. These assisted the company in planning its expansion without a lack of funds.

Ø Apple Share Buybacks

Apple used financial modelling to determine the amount of money to pass to the shareholders. It assisted the company in striking a balance between reward and risk.

Why Finance Graduates Struggle Without Practical Skills

The academic world often misses what the industry expects, such as practical finance execution. Think about it. When you’re asked to assess a company’s worth or present forecasts to stakeholders, are you just guessing based on formulas?

Or are you relying on solid investment analysis skills backed by business valuation techniques?

This gap isn’t small. Most finance graduates enter the workforce without hands-on skills like Excel financial modelling, market risk evaluation, or cash flow structuring. They know theory, not execution.

Financial Modelling and Valuation Course: Why It’s More Than Just Numbers

According to its World Economic Outlook report, the International Monetary Fund (IMF) thinks that global growth will remain low at 3.2 percent in 2024 and 2025.

You may think it’s just Excel. But financial modelling and valuation courses go beyond spreadsheets.

They train you to:

- Forecast revenues and costs

- Build three-statement models (Income Statement, Balance Sheet, Cash Flow)

- Conduct scenario analysis

- Do comparative company valuations

- Understand DCF (Discounted Cash Flow) and LBO (Leveraged Buyout)

If you’re chasing a CFO career development, knowing how to use Excel like a CFO does isn’t optional; it’s essential. You need to break down performance metrics, evaluate risk, and create investor-ready reports.

Corporate Finance Training: Your First Step to the CFO Career

Being a CFO isn’t just about knowing finance. It’s about applying it at a strategic level.

That’s where corporate finance training changes everything. You’ll learn to look beyond balance sheets to judge company performance, make capital structure decisions, and manage profitability. This training sharpens your ability to make financial decisions that impact the business directly.

CFOs don’t just track money. They tell stories with it. For instance, if you’re handed a proposal to acquire a smaller company, can you assess whether the target firm is undervalued or overpriced? That’s where your business valuation techniques come in.

Business Valuation Techniques: How CFOs Make Smart Calls

Valuation isn’t opinion. It’s structured logic.

If you can’t value a business, you can’t lead its financial strategy. With strong business valuation techniques, you’ll be able to:

- Value public companies using market comparables

- Evaluate startups using revenue multiples

- Forecast discounted cash flows under various scenarios

Imagine you’re in a board meeting, and someone asks if the company should expand into a new geography. You can’t rely on instinct. You’ll need numbers. That’s what this training equips you for: data-backed, analytical thinking. CFO career development doesn’t happen overnight. But with the right skills and roadmap, you can fast-track your growth.

Start as a financial analyst. Get hands-on with real-world deals. Master modelling, valuation, and risk. Gain exposure to internal controls, compliance, and budgeting.

From there, you move up to associate, manager, finance lead, and eventually, CFO. Every level requires smarter financial judgment and deeper accountability.

Why Indian Finance Professionals Need This Now

India’s financial services sector is growing fast. But there’s a shortage of finance talent that’s job-ready.

Employers today don’t want just degrees. They want professionals who can:

- Evaluate investments confidently

- Forecast accurately

- Navigate financial operations smoothly

Whether you’re in Mumbai, Bangalore, Delhi, or Hyderabad, a Financial Modelling and Valuation Course bridges the classroom-to-boardroom gap. And if you’re serious about corporate finance training, investment analysis skills, and CFO career development, then this is your next logical step.

How the CIBOP™ Programme from Imarticus Learning Transforms Your Career

Let’s break down how Imarticus Learning’s CIBOP™ course stands out:

| Feature | Why It Matters |

| 100% Job Assurance | You don’t just study, you get placed. A real job. Guaranteed. |

| 85% Placement Success | Strong industry connections mean real results. |

| 3- or 6-Month Format | Choose based on your schedule both are intensive and industry-ready. |

| Focused on Real Scenarios | Learn what actually happens in investment banks, not textbook fluff. |

| Recognition in Industry | Named Best Education Provider in Finance at the 30th Elets World Education Summit 2024. |

More than just a certificate, this course is your launchpad to high-growth finance roles. Whether you aim to enter an investment bank, a fintech firm, or a consulting company, this programme builds your credibility.

No one becomes a CFO without mastering Excel. Why? Because it’s the language of modern finance.

With Excel financial modelling, you’ll:

- Build structured forecasting models

- Automate budget tracking

- Perform real-time risk calculations

- Create dashboards for C-level decision making

The Imarticus Learning programme doesn’t just skim Excel. It deep-dives. You’ll model P&Ls, run sensitivity tests, and even simulate equity research reports. These models speak louder than words when you’re sitting across a boardroom pitching your vision. Imarticus Learning supports this journey with dedicated career services, mock interviews, resume building, LinkedIn branding, and access to top recruiters in finance.

FAQ

1. What does a financial modelling and valuation course consist of?

A financial model and valuation course teaches the use of Excel to create models to analyse companies, plan budgets, and undertake business valuation based on real data.

2. What is the benefit of taking a financial modelling and financial valuation course?

It assists in the development of fundamental finance skills such as Excel financial modelling, investment analysis, and business valuation methodologies, all of which are essential in the development of a CFO career.

3. Who may attend the financial modelling and valuation course?

Anyone interested in training in corporate finance can become a member, and so can graduates of finance or those young professionals who are new to the professional world. It suits workers between 0 and 3 years.

4. What role does this course play in developing CFO careers?

This course will make you learn real-life skillsets of a finance professional, such as investment analysis, prediction, and decision-making, which are also necessary to become a CFO.

5. What do you learn in a course in financial modelling and valuation?

You will study Excel financial modelling, the financial statements, the DCF analysis, forecasting, sensitivity analysis, and business valuation skills.

6. Is Excel financial modelling challenging?

No. Excel financial modelling is something that, with an organised corporate finance training, can be easily mastered by any person. Courses begin with the elementary tools and then get advanced.

7. What is the contribution of this course towards investment analysis?

You will train in analysing company performance, determining risk, and constructing models to make investment decisions, as some of the skills employed by leading finance experts.

8. What are the possible careers people can practice after the course?

You have a possibility of working as a financial analyst, investment banking associate, risk analyst, or even advance to be a CFO.

The Final Words

You don’t need another generic finance course. You need a financial modelling and Valuation Course that turns ambition into action. If you want to rise through the ranks and eventually take the CFO seat, then this is your moment.

Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP™) programme isn’t just a course. It’s a career accelerator that combines corporate finance training, investment analysis skills, business valuation techniques, and Excel financial modelling; all the basics you need for CFO career development.

Enrol now in the CIBOP™ course and turn your finance knowledge into job-ready action, with 100% placement assurance and a future you’ve earned.

After completing the

After completing the