Who can qualify for Credit Risk Management courses?

To answer that question, one must first ask, ‘What is the role of a Credit Risk Analyst?’

The role of a credit risk analyst is to judge the credit worthiness of an obligor effectively. To have the capability and knowledge to understand the various risk-generating factors of the lending market and come to an effective conclusion about the entity’s financial status that the company will be acquainted. It is the job of a credit risk analyst to assess the possibility of returns when they take exposure to or send money to clients—in simpler terms, answering the question of whether individuals will be willing and able to make their payments as agreed upon, down the road and will their company get their money back?

Why choose to become a Credit Risk Analyst?

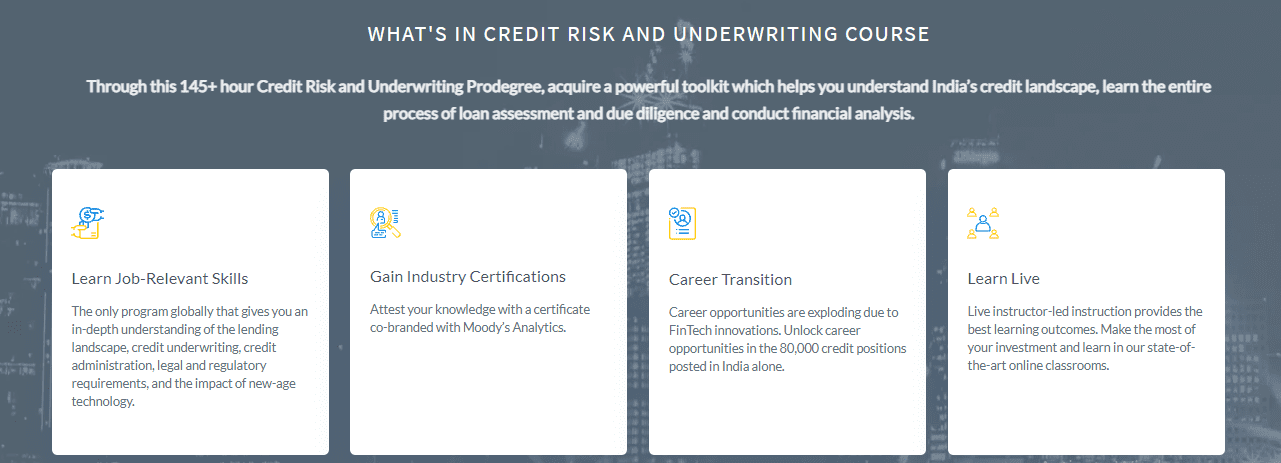

Considering the times that we live in, the financial sector is one of the most rapidly booming sectors in the global market involving big risks and big turnovers, which makes the job of a credit risk analyst all the more important and attractive. With Imarticus Learning’s ‘Credit Risk and Underwriting Prodegree Course’, you can have these required skills and knowledge at your disposal and an impressive Credit Risk Analyst Certification.

Click here to learn more about what this course offers: Credit Risk and Underwriting Course, Credit Risk Analyst Course – Imarticus Learning.

Who is eligible for Credit Risk Management Courses?

We live in a highly competitive world, and even more so in the job market. Hence, it is advisable and necessary to constantly upskill oneself to gain an edge over one’s competitors. With Imarticus Learning’s ‘Credit Risk and Underwriting Prodegree Course’, experienced professionals with 2+ years of work experience in banking and financial services or individuals exposed to working in a lending space can conveniently upskill, all the while unlocking newer opportunities for themselves.

One of the most important career decisions is the decision to start afresh. A course in Credit Risk Management opens up a great number of possibilities for individuals from a great number of academic backgrounds like graduates in management, finance, marketing, international business, etc. Also, for individuals looking to make a career switch. Imarticus Learning’s Credit Risk Modelling certification provides a wider horizon of opportunities and gives the students a head start into a world of possibilities, well-equipped and well-researched.

Additionally, our ‘Credit Risk and Underwriting Prodegree Course’ is globally recognized with an industry-recognized certificate, making for an impressive addition to one’s résumé. The perfect course for individuals looking to upgrade their résumé.

For more information, contact us through chat support on Online Training Courses & Education Programs | Imarticus Learning or drive to our training centers in Mumbai, Thane, Pune, Chennai, Bengaluru, Delhi, Gurgaon, or Ahmedabad.

At Imarticus, we believe in preparedness when one steps out into the world. Hence, we cover all aspects of Credit Risk Management in our course, like the lending landscape, credit underwriting, credit administration, legal and regulatory compliances, and digital innovation strategies. Our faculties have decades worth of experience, which renders students the opportunity to build on their valuable insights.

One of the best features of the ‘Credit Risk and Underwriting Prodegree Course’ is the collaboration of Imarticus Learning with Moody’s Analytics. This prepares the candidates for the responsibilities while taking on a role in credit at financial institutions by preparing them through mock interviews followed by a comprehensive end-of-course assessment and addresses the challenge that companies face in identifying job-ready candidates.

We are proud of our alumni record, affiliating our candidates with companies like Edelweiss, Reliance Capital, HDFC Bank, etc.

Click here to download our brochure and placement report: Credit Risk and Underwriting Course, Credit Risk Analyst Course – Imarticus Learning.

What Else do I Get When I Take a CRU-PRO Degree?

What Else do I Get When I Take a CRU-PRO Degree?