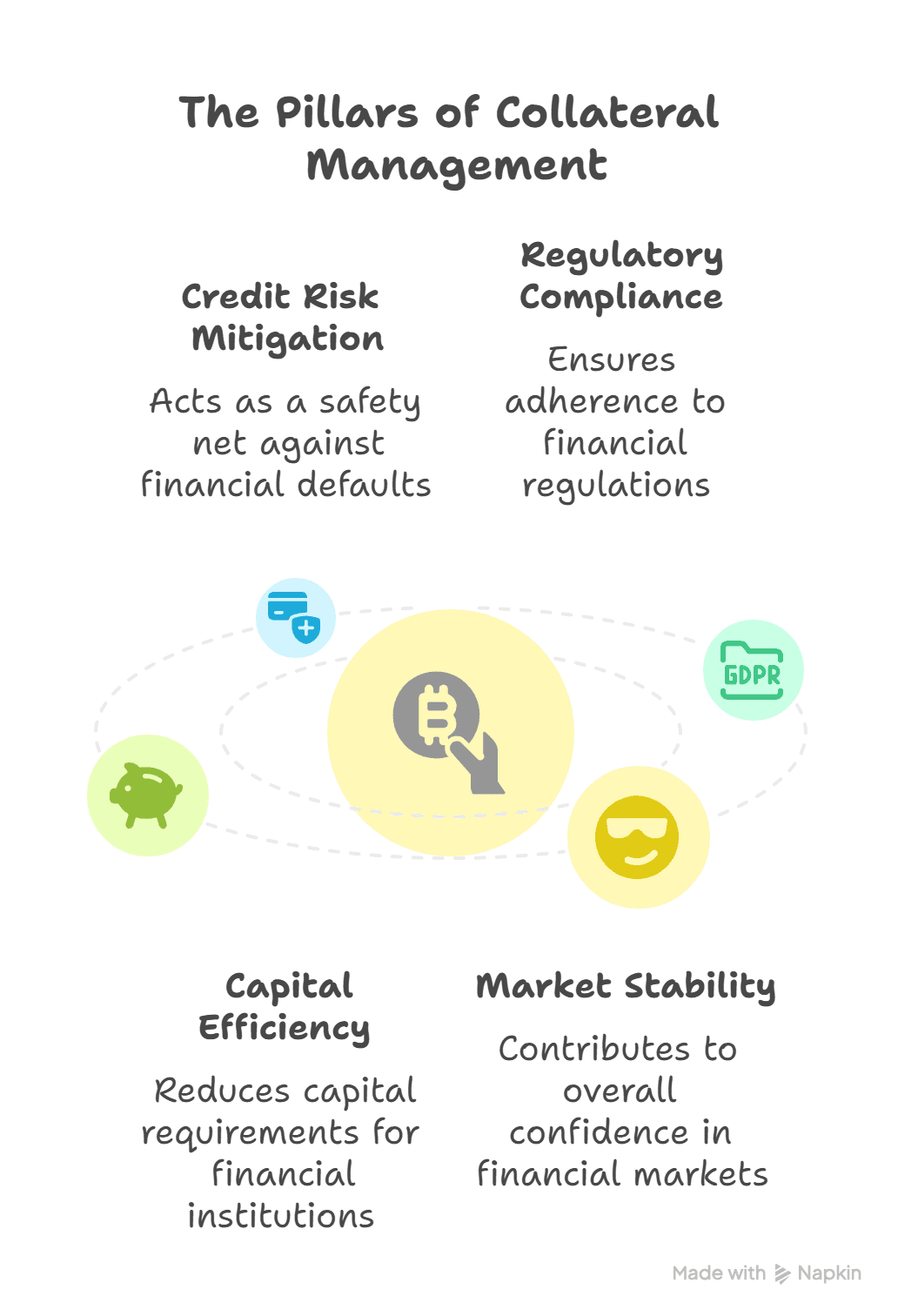

Collateral management is the foundation of the financial markets of today. It safeguards exposures between counterparties, minimises risks, and makes transactions possible with trust and transparency. For investment banking operations professionals, success lies in being superior at collateral management—both as a regulatory requirement but also institutional reputation and profitability safeguarding.

Yet, important as collateral management is, it is filled with traps. From poor valuation methods to ineffective monitoring structures, most institutions are expensive in their mistakes. For finance scholars and future practitioners, it is not only valuable but defining of their future to know these traps.

This article covers the five most prevalent 5 collateral management errors, why they occur, the risks involved, and how systematic learning—like that of Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP) courseware—can help experts build capability in order to prevent them.

Mistake 1: Inaccurate Collateral Valuation

The most common collateral management error is the incorrect valuation of assets. Collateral should act as a security, but in case its value is stale or does not exist, it can lead to under-collateralization or over-collateralization.

Why it Matters?

For instance, market volatility can completely change the value of assets, and businesses using static or periodic refreshing may end up inadvertently assuming more risk. This issue not only endangers institutions with losing money but also undermines confidence between counterparts.

Solution:

Risk of this kind can be minimised by applying real-time valuation models, computerised pricing systems, and compliance with standardised valuation procedures. Additionally, practitioners have to be familiar with practical knowledge of the workings of the market and risk management practices—topics which have been extensively covered in the CIBOP investment banking course by Imarticus Learning.

Mistake 2: Inefficient Collateral Monitoring

Good collateral monitoring is a continuous process, not a point-in-time activity. Institutions will mismonitor at trade execution and miss the exposures that creep in day in and day out. This can lead to failing margin calls or collateral shortfall disputes.

Why it Matters?

Collateral monitoring guarantees the obligations are safeguarded throughout the life of the contract. Without monitoring, companies risk defaulting on contracts, incurring fines, or negotiating with counterparties.

Solution:

Initiating automatic surveillance systems and training teams to adapt to active surveillance is extremely crucial. CIBOP curriculum empowers students with hands-on experience with surveillance practices, case studies, and simulation which generates confidence in tackling actual situations.

Mistake 3: Neglecting Regulatory Compliance

The banking industry is perhaps the most regulated industry in the globe. Basel III, EMIR, and Dodd-Frank regulations impose stringent standards of collateral management conduct. Among the largest missteps businesses make is underestimating the level of complexity involved in compliance.

Why it Matters?

Non-compliance not only triggers fines; it can wreck reputations and close the doors to future business opportunities.

Solution:

Compliance should be ingrained in all collaterals. Audits must be conducted occasionally, there must be adherence to reporting standards, and there must be heightened awareness about the global regulatory challenges. Imarticus Learning offers the CIBOP investment banking course that trains students with domain knowledge in compliance, risk management, and anti-money laundering—keeping professionals adequately prepared enough to deal with such complexities.

Mistake 4: Poor Communication Between Teams

Collateral management is not an isolated process. It requires seamless coordination between the trading, risk, operations, and compliance teams. Communication failure can bring about misunderstandings, delays, and even system crashes.

Why it Happens:

There are silos within each institution between departments, which tend to handle their own objectives rather than looking at the whole picture. This alignment provides bottlenecks and creates space for mistakes.

Solution:

Promoting cross-functional collaboration, application of centralized systems, and sensitizing professionals to different aspects of investment banking operations is critical. The practice-based training framework of the CIBOP program using case studies and real-world scenarios prepares students to comprehend the interconnected nature of activities within an investment bank.

Mistake 5: Over-Reliance on Manual Processes

Despite technology, the majority of companies still employ spreadsheets and manual keying in of data for collateral management. It is time consuming and prone to errors.

Why it Matters:

Record keeping, processing, or reconciling of collateral transactions accurately is lost because of inaccuracies, and discrepancies in financials, disagreements, and loss of goodwill occur. Although the technology is dominating investment banking, it is a grave mistake to cling to the traditional practices.

Solution:

Automation, AI-driven monitoring, and blockchain technology are transforming collateral management. Yet, to utilize these technologies efficiently, one must have a clear understanding of traditional processes along with latest advancements. Imarticus Learning’s investment banking course provides the perfect blend, making students ready to tackle challenges prevailing in current times as well as those that may arise in the future.

Collateral Management Challenges in Today’s Market

In addition to the top 5 mistakes, collateral management also has more general issues like:

- Derivative product complexity evolution.

- Increased transaction volumes to be reconciled in real-time.

- Increased regulatory compliance and reporting cost.

- Being required to manage liquidity in the best possible manner while hedging exposures.

For young professionals, knowledge of these issues and how they can solve them can equal a good investment banking operations career with good returns.

Why Imarticus Learning’s CIBOP Program is the Answer?

The Certified Investment Banking Operations Professional (CIBOP) programme is designed specially for finance graduates and professionals who are ready to lay a strong foundation in investment banking operations. Having trained over 50,000 learners and having 1000+ hiring partners, Imarticus Learning has made standards in finance education.

Key Highlights of the CIBOP Program:

- 100% Job Guarantee with 7 sure-shot interviews.

- 85% placement rate with 9 LPA and above compensation packages.

- Practical securities, wealth management, risk management, and anti-money laundering course curriculum.

- Case study, project, and hands-on training-based experiential learning.

- Awards and Recognition as Best Education Provider in Finance at the 30th Elets World Education Summit 2024.

- Strong proven track record with 1200+ batches and students with a 60% average salary increase.

For work experience of 0–3 years, the program offers ease of flexibility with 2.5-month weekday and 5-month weekend batches—perfectly suited for full-time students as well as working professionals. Know how you can elevate your career in this video: Transform Your Finance Career in Just 90 Days with Investment Banking Course

Conclusion

Collateral management is a critical function to ensure stability and efficacy in financial markets. Typical mistakes such as miscalculation of valuation, inadequate monitoring, compliance loopholes, inadequate communication, and manual processes typically murder its success.

For career seekers who wish to ascend the investment banking career ladder, a clear understanding of these topics is crucial. Imarticus Learning’s CIBOP under mentored training, live exposure, and industry mentorship prepares students to transcend collateral management complexity and thrive in global finance.

It’s your last chance to put your mettle to the test in collateral management and get your investment banking operations career off the ground with serious dedication in mind.

FAQs on Collateral Management

1. What is collateral management in investment banking?

Collateral management is the tracking of collateral given by borrowers to support financial transactions. It secures the satisfaction of counterparty commitments, minimises credit risk, and facilitates smoother financial operations.

2. Why is collateral management important?

It is crucial in counterparty risk mitigation, regulatory compliance support, and liquidity in the financial markets. Without a good collateral management, financial institutions are at risk of default.

3. What are the common challenges in collateral management?

The typical problems in collateral management are poor valuation, poor monitoring, regulatory compliance issues, poor team communication, and too much manual processing.

4. What is collateral monitoring, and why does it matter?

Collateral monitoring consists of ongoing monitoring of collateral over the life of a transaction. It consists of maintaining exposures at any point in time always being collateralised to prevent shortfalls or margin call differences.

5. How does technology improve collateral management?

The most recent technology such as automation, artificial intelligence, and blockchain makes efficiency, accuracy, and transparency in managing collateral much better and greatly reduces errors from manual intervention.

6. How can I build a career in collateral management?

The finance graduates can specialise in investment bank operations, i.e., collateral management, by pursuing systematic courses like Imarticus Learning’s Certified Investment Banking Operations Professional (CIBOP) course that provides hands-on training and job assurance.

7. What makes the CIBOP course at Imarticus unique?

The course provides 100% job assurance, 7 interview assurances, hands-on training, and all the information on investment banking activities—securities, risk management, and compliance—and is most suitable for whoever wants to be a success in collateral management.