If you’re serious about a long-term finance career, you’ve probably heard this line: “CFA is the gold standard.” And for good reason. The CFA Certification (Chartered Financial Analyst) is one of the most globally respected designations in finance, recognised across 160+ countries.

But here’s the thing most people miss: CFA isn’t just about adding three letters after your name. It’s about transforming how you think about money, markets, and management.

Whether you dream of becoming an equity analyst in Mumbai, a portfolio manager in London, or a CFO steering a fintech in Bangalore, CFA opens those doors.

So, let’s cut the noise and get into what actually matters:

What jobs can you get after CFA?

What salaries to expect?

What industries hire CFA professionals?

And yes, what to do after CFA to keep growing?

What Is the CFA Certification?

Imagine finance as an enormous city, full of skyscrapers representing investment banks, asset management firms, and fintech startups. Everyone wants to reach the top floor, where strategy, decision-making, and big money reside. The CFA Certification, short for Chartered Financial Analyst, is the elevator that takes you there. But unlike ordinary elevators, this one tests your patience, your ethics, and your depth of understanding at every floor.

To put what is CFA simply, at its core, it is a professional credential awarded by the CFA Institute that signals you’ve mastered the global language of money. Think of it as a passport to international finance, recognised in 160+ countries and trusted by employers like Goldman Sachs, Morgan Stanley, BlackRock, and many more of their stature.

Where most finance degrees give you an overview, the CFA drills deep. Across its three levels, you study everything from ethics and financial reporting to derivatives, portfolio management, and wealth planning. But more importantly, what makes the CFA so respected is not just its syllabus — it’s the mindset it builds. Passing each level feels like training for a marathon where endurance matters more than speed. Employers know this, which is why the letters CFA after your name instantly signal discipline, integrity, and analytical mastery.

To put it simply:

“An MBA can teach you to manage a business. A CFA teaches you to understand how money moves the world.”

If you’ve ever found yourself reading company reports like detective novels or wondering why markets move the way they do, the CFA Certification is your professional calling. It turns curiosity about finance into a structured, globally recognised expertise.

This video divulges why CFA has been considered a gold standard certification among finance certifications.

Why the CFA Certification Is Worth the Effort

The CFA curriculum doesn’t just teach finance; it builds decision-makers.

You learn ethics, investment management, financial analysis, and portfolio theory, all through real-world application.

But here’s what makes the CFA Certification different:

| CFA Advantage | Why It Matters in the Real World |

| Global Recognition | Over 190,000 charterholders and 160+ societies worldwide mean your credentials are valid anywhere. |

| Depth of Knowledge | CFA dives into valuation models, portfolio optimisation, and risk analytics – skills employers crave. |

| Ethical Foundation | Every CFA charterholder pledges to a code of ethics—something clients and employers deeply value. |

| Career Mobility | It lets you pivot between asset management, investment banking, or corporate finance seamlessly. |

With CFA, you learn how to think like an investor.

The Real Career Growth Path After CFA

Now, this is where most blogs stop at just job titles. But let’s go deeper into how careers actually evolve after each CFA level.

🔹 Level I: Getting Your Foot in the Door

At this stage, your value is in your analytical discipline. You’re employable in roles like:

- Junior Equity Analyst

- Research Assistant

- Data/Valuation Analyst

CFA Starting Salary in India: ₹6–10 LPA (source: Glassdoor India).

💬 Think of Level I as proving your commitment. Recruiters see it as your signal that you’re serious about finance, not dabbling.

🔹 Level II: Building Core Financial Expertise

Once you clear Level II, you can handle complex valuation and modelling assignments. Roles open up in:

- Equity Research

- Investment Banking (Analyst roles)

- Portfolio Support Teams

Salary Range: ₹10–20 LPA in India (AmbitionBox Data).

🔹 Level III: Becoming the Decision-Maker

After earning your CFA Charter, you become the professional who’s trusted to manage portfolios, advise on strategy, and even lead teams.

Popular roles:

- Portfolio Manager

- Investment Strategist

- Corporate Finance Manager

- Chief Financial Officer (CFO)

Average Salary: ₹25–50+ LPA in India, and $120,000+ globally (CFA Society India 2024 Report).

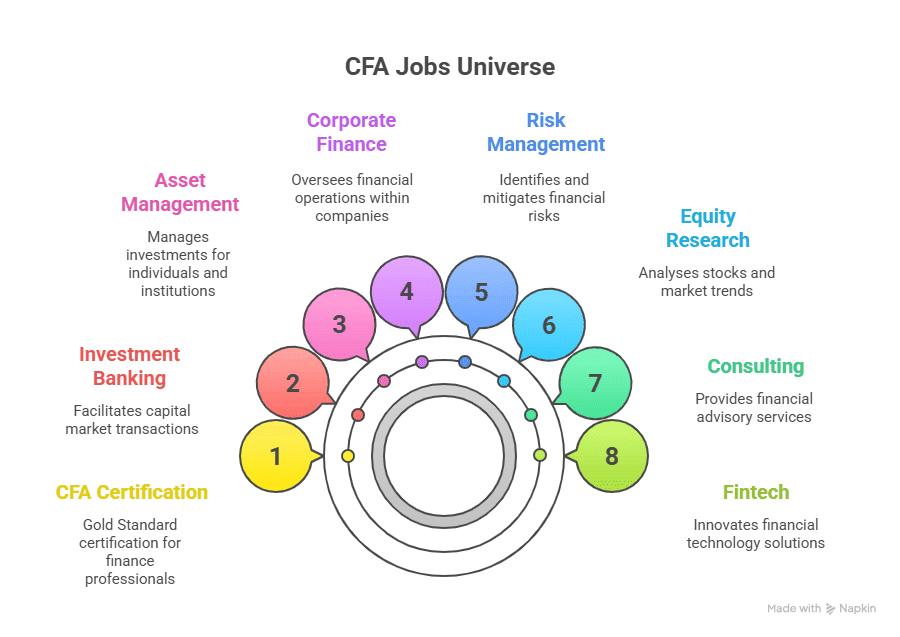

Top Career Options After CFA Certification

Once you’ve earned the CFA certification, the world of finance starts to look very different. You stop seeing job titles and start seeing impact. That is how capital flows, how portfolios grow, how data becomes decisions. That’s the real power of being a CFA: you become fluent in the mechanics of money.

Whether your dream is to decode markets like an equity analyst, manage billion-dollar portfolios, or structure mergers that make headlines, the CFA charter opens doors across investment banking, asset management, corporate finance, fintech, consulting, and risk management. What’s fascinating is how versatile this credential is. A CFA charterholder can fit seamlessly into both Wall Street’s trading floors and a startup’s financial strategy desk.

Let’s explore real roles, their responsibilities, and average pay:

| Role | Core Responsibility | India Avg Salary | Global Avg |

| Portfolio Manager | Designing and managing investment portfolios | ₹15-40 LPA | $100K-150K |

| Equity Research Analyst | Evaluating company performance, writing investor reports | ₹10-30 LPA | $80K-120K |

| Investment Banker | Structuring IPOs, M&As, and fundraising | ₹20-50 LPA | $150K-250K |

| Risk Analyst | Assessing financial and operational risks | ₹8-20 LPA | $70K-120K |

| Quantitative Analyst | Building mathematical models for trading | ₹20-60 LPA | $120K-200K |

| Corporate Finance Manager | Financial planning, budgeting, and capital structuring | ₹12-25 LPA | $90K-160K |

| CFO | Steering overall financial strategy | ₹50+ LPA | $200K+ |

(Salary sources: AmbitionBox, CFA Institute, PwC Salary Guide 2024)

CFA Salary Growth in India

The beauty of the CFA path is that it rewards both patience and precision. Salaries don’t spike overnight – they compound, just like the investments you’ll eventually manage. Think of your career graph as a portfolio: early years are about building capital (skills and credibility), and the later years are where compounding takes effect.

Let’s break down how your earning potential grows with experience, based on LinkedIn Salary Insights and aggregated market data from major financial hubs.

Here’s how salary evolves with experience:

| Experience | Typical Role | Avg Salary |

| 0-2 years | Research Analyst | ₹6-10 LPA |

| 3-5 years | Senior Analyst / Associate | ₹12-20 LPA |

| 6-9 years | Portfolio Manager | ₹25-40 LPA |

| 10+ years | CFO / Director | ₹50+ LPA |

💬 Mentor’s insight: “Your CFA doesn’t automatically multiply your salary—it multiplies your credibility. Salary follows credibility.”

Understanding the Curve: What Really Drives the Jump

Salary growth in CFA careers isn’t just about seniority; it’s a mix of three multipliers:

- CFA Level Progression

- Each level signals a leap in your analytical and ethical competence. Recruiters often tag salary ranges to CFA milestones, for example, Level I candidates earn ~₹6–8 LPA, while Level III pass-outs average ₹18–30 LPA in investment roles.

- Completing the charter can open pay brackets 30–70% higher in mid-career stages.

- Each level signals a leap in your analytical and ethical competence. Recruiters often tag salary ranges to CFA milestones, for example, Level I candidates earn ~₹6–8 LPA, while Level III pass-outs average ₹18–30 LPA in investment roles.

- Domain Specialisation

- Those who align their CFA expertise with niche domains like ESG investing, alternative assets, and fintech analytics often command faster salary jumps.

- Example: A portfolio analyst who pivots to ESG or AI-driven investing can move from ₹18 LPA to ₹30 LPA within two years because demand is skyrocketing.

- Those who align their CFA expertise with niche domains like ESG investing, alternative assets, and fintech analytics often command faster salary jumps.

- City & Industry Factor

- A CFA in Mumbai or Singapore earns significantly more than one in a smaller market, often 1.5x–2x higher.

- Industries like asset management, private equity, and consulting offer the steepest salary slopes, while corporate finance is steadier but slower. (Times of India Salary Report)

- A CFA in Mumbai or Singapore earns significantly more than one in a smaller market, often 1.5x–2x higher.

Best Locations for CFA Jobs

Where you base your career matters. With the CFA Certification in hand (or in progress), choosing the right city can mean 20–40% higher pay, faster growth, and better exposure. Let’s break down the top spots in India, followed by the global hotspots, and look at what the numbers and market trends actually say.

Top Indian Cities for CFA Jobs:

- Mumbai – Financial capital; investment banks and AMCs cluster here.

- Bengaluru – Fintech, startups, and corporate finance hubs.

- Delhi NCR – Consulting and corporate HQs.

- Pune & Hyderabad – Risk and analytics back offices.

Global Hotspots:

If you’re considering international roles (or global exposure from India), these cities dominate CFA hiring:

- New York – Global investment banking, hedge funds, and asset management powerhouse.

- London – Europe’s finance hub, strong for asset management and sustainable finance roles.

- Singapore – Regional headquarters for many APAC asset managers, wealth-management firms.

- Dubai – Middle East hub for private wealth, family offices, and regional investment funds.

- Hong Kong – Gateway to China & Asia asset flows, strong demand for CFA-qualified talent.

While precise city-specific salary data is less public, CFA Institute’s presence in these locations (offices in London, Hong Kong, etc.) shows the strategic importance.

Mentor tip: If you’re targeting a global role, try to pick up one of these locations in your career roadmap (even if it’s through a transfer or remote role) — the global mobility of the CFA Certification matters.

Career Domains That Love CFA Professionals

If you ask ten CFA charterholders where they ended up, you’ll probably get ten different answers, and that’s the beauty of this qualification. The CFA doesn’t lock you into one lane; it opens several. The trick is knowing which path fits your temperament and ambition.

For instance, if you love chasing patterns in chaos, like in stock markets, fund movements, or macro trends, then asset management and equity research will feel like home. But if you get a kick out of solving business puzzles and seeing numbers meet boardroom strategy, corporate finance, or consulting might be your calling.

Below is a table that highlights the career avenues the CFA Certification can provide. If you want to explore a notch further, this CFA Career Guide will help you with the real-world insights.

| Domain | How CFA Helps | Companies Hiring |

| Investment Banking | Deep valuation and deal modelling expertise | JP Morgan, Goldman Sachs |

| Asset Management | Portfolio theory, risk-return balancing | BlackRock, ICICI Prudential AMC |

| Corporate Finance | Capital budgeting, M&A, cash flow management | Amazon, Deloitte, PwC |

| Risk Management | Quantitative and compliance frameworks | Citi, Axis Bank, HSBC |

| Fintech & Startups | Product pricing, data-driven strategy | Zerodha, Groww, CRED |

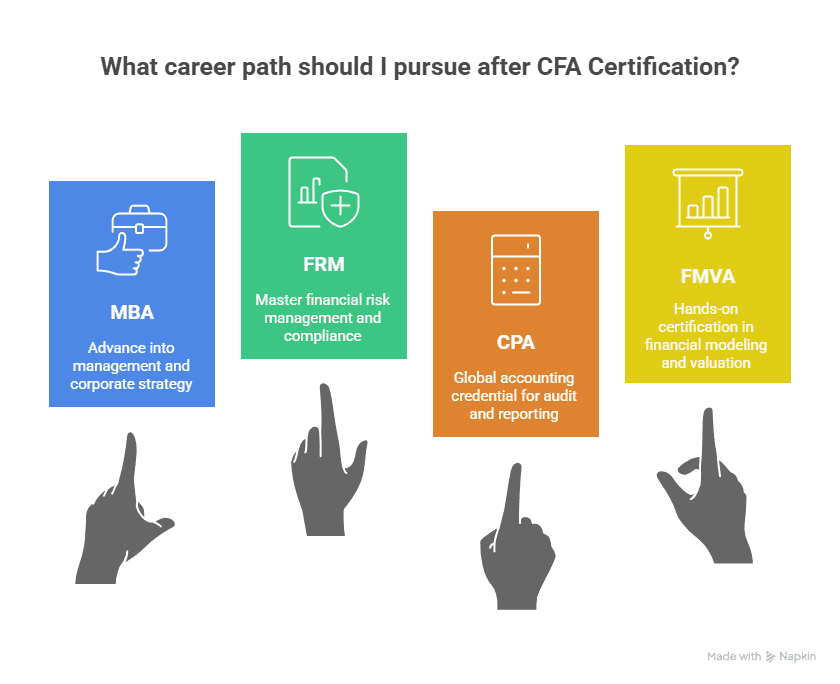

After CFA — Which Course Is Best?

Here’s the thing most people won’t tell you – the CFA isn’t the finish line; it’s the foundation. Once you’ve earned it, you’ve built a deep analytical muscle, but your next move depends on what kind of finance professional you want to become.

Think of your CFA as learning the “grammar” of finance – it teaches you to read balance sheets and markets fluently. But if you want to write your own story in the industry, you’ll often need a specialisation that gives context to your analytical depth. That’s where the “next course” question becomes strategic.

| Goal | Recommended Add-on Course | Why It Helps |

| Move into Corporate Strategy | MBA (Finance) | Builds leadership & business acumen |

| Master Risk Analytics | FRM Certification | Complements CFA with quant and risk depth |

| Enter Accounting Roles | CPA Certification | Adds audit and reporting expertise |

| Excel in Valuation & Modelling | FMVA or Investment Banking Program | Makes your CFA skills job-ready |

| Lead Fintech or Analytics | Data Analytics / Power BI / Python | Helps you translate finance to tech |

💬 Mentor note: “A CFA charter tells the world you can analyse markets. The next course you take should prove you can lead in them.”

So to give you a snapshot-

- If you aim for leadership and strategic roles, an MBA amplifies your CFA by turning analytical skill into management strength.

- Prefer the thrill of markets and risk? FRM sharpens your quantitative insight. Want to blend finance with accounting and corporate governance?

- CPA is your route to global CFO tracks.

- And for those drawn to hands-on valuation and deal-making, FMVA bridges theory with real-world finance execution.

Industry Demand for CFA Professionals

The demand for CFA-certified talent is rising fast – especially in India.

According to CFA Institute India data (2024), CFA enrolments have surged by 25% YoY, driven by:

- Fintech expansion

- Mutual fund penetration in Tier-II cities

- Global investment outsourcing

Here’s what the 2025 outlook looks like in India:

| Industry | 2024 Share | 2025 Expected Growth |

| Investment Banking | 30% | +18% |

| Asset Management | 25% | +22% |

| Fintech | 15% | +35% |

| Corporate Finance | 20% | +16% |

| Consulting | 10% | +12% |

CFA vs Other Finance Certifications

Choosing between the CFA and other finance certifications isn’t about picking “the best”; rather, it’s about knowing which language of finance you want to speak fluently.

Think of it like this: the CFA teaches you the grammar of investments and markets, how to interpret risk, value, and opportunity. A CPA speaks the language of accountability and compliance, while an FRM deals in the dialect of uncertainty and probabilities.

Interestingly, today’s top finance leaders don’t choose one; they stack them. The head of a global asset management firm might hold both CFA and FRM; a CFO in a multinational could blend CPA and CFA. In an age where finance, data, and risk converge, it’s no longer about rivalry – it’s about synergy.

So rather than asking, “Which is better?” ask, “Which one solves the problems I want to solve?” That’s where your edge truly begins.

| Certification | Ideal For | Core Focus | Duration |

| CFA | Investment & Portfolio Mgmt | Valuation, Markets, Strategy | 2.5-3 Years |

| CPA | Accounting & Audit | Financial Reporting | 1-1.5 Years |

| FRM | Risk Management | Quant, Regulation | 1.5-2 Years |

| MBA (Finance) | Business Leadership | Management & Strategy | 2 Years |

| CFP | Wealth Management | Personal Finance | 1-1.5 Years |

Watch this CFA mock interview to understand how candidates connect investment concepts, ethics, and strategy during real finance interviews; a perfect bridge between learning the CFA Certification and living it in the professional world.

FAQs on CFA Certification

If you’re exploring how far the CFA Certification can take your career, you’re not alone. From finance students to working professionals, everyone wants clarity on what happens after CFA—what jobs you can get, how much you can earn, and how the industry is evolving in 2025.

Below, I’ve answered some frequently asked questions about CFA Certification career options, salaries, and the future of finance for CFA professionals.

What are the career options after CFA?

After completing the CFA Certification, you can pursue a range of high-value roles across global finance sectors. Common CFA career options include:

- Portfolio Manager

- Equity Research Analyst

- Investment Banker

- Risk Analyst

- Financial Strategist

- Corporate Finance Manager

- Quantitative Analyst

What jobs can I get with my CFA?

With your CFA Certification, you can land roles in investment firms, banks, consulting companies, and even startups. Some of the most in-demand jobs after CFA include:

- Equity Research Associate (analysing company performance for investors)

- Fund Manager (managing diversified portfolios)

- M&A Analyst (assisting in mergers and acquisitions)

- Risk Consultant (identifying and mitigating market risks)

At Imarticus Learning, you also gain access to industry-aligned mentorship, placement support, and expert-led mentorship

Can CFA earn 1 crore?

Yes, absolutely, but not immediately. Reaching the ₹1 crore annual mark with a CFA Certification typically happens once you reach senior leadership positions such as Vice President (VP), Portfolio Manager, or CFO.

Most CFA charterholders in India start around ₹8–12 LPA, but with 8–10 years of experience and consistent performance, salaries can easily cross ₹1 crore, especially in asset management or investment banking.

Can CFA get a job in India?

Yes. The CFA Certification has seen a major rise in demand across India due to the booming investment ecosystem, fintech innovation, and mutual fund growth. CFA-qualified professionals are also valued by Big 4 consulting firms for valuation and risk advisory projects.

Top cities hiring CFA professionals include Mumbai, Bengaluru, Delhi NCR, Pune, and Hyderabad.

What is CFA Level 1 salary?

After clearing CFA Level 1, candidates typically earn between ₹6–10 LPA in India, depending on their background and skill set.

Common entry-level roles include:

- Junior Equity Analyst

- Research Assistant

- Financial Data Associate

- Valuation Analyst

These roles act as stepping stones: by Level 2, professionals often double their salary potential.

Will CFA be replaced by AI?

Unlikely. While AI is automating many data-heavy financial tasks, the CFA Certification emphasises human judgment, ethical reasoning, and strategic decision-making—skills machines can’t replicate.

AI tools may assist CFAs in analysis, but they can’t replace the strategic thinking, risk evaluation, and client trust that CFA professionals bring.

Is CFA worth it in 2025?

Yes, perhaps more than ever.

In 2025, with markets globalising and data-driven investing becoming the norm, CFA holders are increasingly hired in Fintech, ESG Investing, Private Equity, and Corporate Strategy, alongside traditional banking roles.

It’s not just worth it—it’s future-proofing your finance career.

Can you make $500,000 a year as an accountant?

Typically, accountants don’t reach that range, but CFA-qualified finance professionals can, especially in portfolio management, hedge funds, or investment leadership.

The CFA Certification isn’t designed for accounting roles like CPA—it’s meant for investment and financial strategy careers, where compensation can scale far beyond $500K at senior levels.

What jobs will be gone by 2030?

By 2030, repetitive financial roles such as basic data entry, bookkeeping, and low-level audit work will likely be automated.

However, roles requiring judgment, ethics, client engagement, and investment strategy—the essence of the CFA Certification—will continue to grow.

Summing it Up

With the CFA certification, you start by studying markets, but by the end, you understand people: investors, clients, and economies alike. That’s what makes the CFA so powerful: it trains you to see patterns where others see numbers, to act with reason when others act with emotion.

Finance isn’t just about capital; it’s about trust, and the CFA helps you build that trust with skill, ethics, and global credibility. When you’ve gone through those long study nights, those mock exams, those “aha!” moments of connecting theory to real markets, you don’t just become a finance professional. You become someone who can interpret the rhythm of money itself.

If you’re wondering where to start or how to sustain the momentum through three demanding levels, that’s where structured mentorship makes the difference.

The CFA Certification Course in collaboration with KPMG in India, offered by Imarticus Learning, isn’t just designed to help you pass; it’s built to help you lead. You learn directly from expert mentors who bring a boardroom perspective into the classroom. Each concept is reinforced through case-driven training, practical case studies, and real-world valuation projects, so theory never stays theory for long.

You also gain the advantage of placement-driven support, joint certification, and internship opportunities with KPMG in India, giving you both academic depth and practical edge.