Banking was never earlier one of the most desired professions for future graduates. The profession is secure, gigantic, and allows the prospect to work across the globe. But among all banking careers, investment banking is the dream career. With the promise of luscious salaries, envy, and brain teasers, investment banking is the career aspiration of the world’s smartest individuals.

In this blog, we’ll explore why an investment banking career path stands out, what skills are needed for banking jobs, the roadmap of how to become an investment banker, and how the right banking and finance courses can fast-track your journey. We will also discuss why it is so critical to be an investment banker, why being an investment banker is beneficial, and how certifications such as the Certified Investment Banking Operations Professional (CIBOP) can be utilized to advance your career.

Why Choose a Career in Banking?

Banking dominated the global economy for decades. billion-pound corporate mergers and high-street savings accounts are merely two of the firm’s faces that interact with nearly every aspect of what is contemporary. To be a banker is to belong to a constantly changing profession operating across:

- International Opportunities – It’s an international organisation.

- Multifaceted Roles – High street banking through corporate finance.

- First-Rate Stability – Banks prop systems of money.

- Career Growth – Bureaucratic promotion allows room for growth.

- Spectacular Rewards – Particularly along the career ladder of investment banking.

However, consumer banking and commercial banking are safe, investment banking requires record size and pay, and therefore the career zenith of banking.

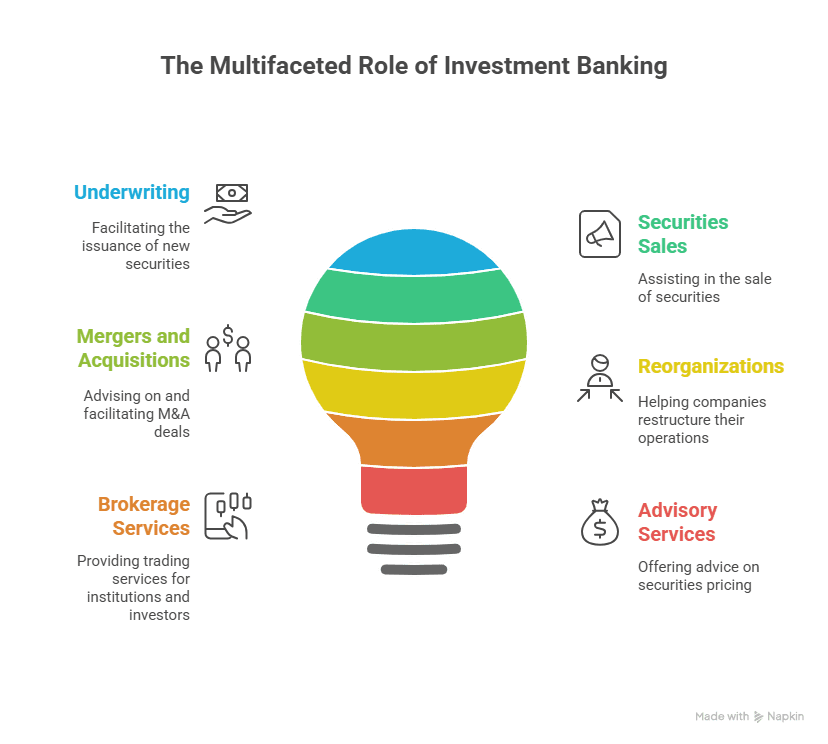

What Makes Investment Banking the Ultimate Path?

The investment banking career is demanding, ruthless, but rewarding. Why it’s the ideal career:

Better Remuneration: Remuneration is relatively greater for initial years of a career compared to other banking professional careers.

- International Exposure: Investment bankers are required to work with international transactions, clients, and markets.

- Status and Power: They are fortunate enough to work with Fortune 500 companies, government, and organizations.

- Enhanced Skills: It enhances analytical skills, negotiating skills, and finance modeling skills.

- Career Choice: Respected in hedge funds, private equity, or management positions.

Short answer: Investment bank career jobs are demanding but extremely rewarding.

Investment Banking Career Path: Step by Step

Investment banking careers start at the analyst level, but investment banking’s career progression is uniquely pecking order:

1. Analyst (0–3 Years of experience)

Job: Financial model, presentation, and pitchbooks.

Salary: Competitive and high-bonus compensation.

2. Associate (3–6 Years of experience)

Job: Deal execution, analyst management, client management.

3. Vice President (6–10 Years Experience)

Job: Management and closure of new business and customer relationships.

4. Director/Executive Director (10–15 Years)

Job: Leadership, networking, and strategic transaction negotiation.

5. Managing Director (15+ Years)

Job: Revenues generation, people management, and global management.

This is a job that needs to be justified for why investment banking is the best of any career in banking.

Skills Needed for Banking Jobs

If you wish to enter a career in banking or other investment banking industry professional careers, the following skills are required:

1. Historical Knowledge

- Historical finance and accounting experience

- Financial analysis and reporting

- Entity accounting

2. Technical Skills

- Financial modeling

- Valuation techniques (DCF, comparables, precedent transactions)

- Capital markets experience

3. Analytical Skills

- Data analysis

- Market forecasting

4. Soft Skills

- Communication and negotiation

- Time management

- Leadership qualities

4. Business Know-how

- Regulation, compliance, and international financial systems

- Finance and banking degrees (i.e., CIBOP) will likely instruct you on all of this and how to hustle.

How to Become an Investment Banker?

All prospective gurus ask, “How to become an investment banker?” It is education, professional certifications, and experience.

Step 1: Obtain a Related Degree

Finance, Economics, Accounting, or related field.

Step 2: Advanced Coursework

Pursue finance and banking specific certifications like the Certified Investment Banking Operations Professional (CIBOP) to differentiate.

Step 3: Core Competency Development

Development of bank specific skills, i.e., Excel, financial model, and valuation.

Step 4: Intern/Entry-Level Professional Experience

Position yourself as an analyst or intern in investment houses, finance institutions, or banks.

Step 5: Certification and Networking

Get linked with industry professionals.

Include certifications like FRM, CIBOP, or CFA.

This approach addresses directly the most critical question: how to be an investment banker.

Jobs in Investment Banking Sector

The investment bank career path includes a broad range of careers appropriate for a broad range of talent levels:

- Mergers & Acquisitions Analyst

Helps companies with strategic transactions.

- Equity Research Analyst

Analyzes equities and makes recommendations to clients.

- Sales & Trading Professional

Trades institution clients’ equities.

- Corporate Finance Specialist

Helps companies raise funds through structuring debt/equity.

- Risk Management Officer

Maintains regulation compliance and financial risk management.

All the above form an investment banking career path.

Importance of Banking and Finance Courses

Taking the right courses in banking and finance is the best to become career-ready for a banking career. This is due to:

- Fills Skills Gaps: Real skills are imparted by professionals such as CIBOP.

- Industry Recognition: Certification improves the professional resume.

- Placement Support: Certain courses, including CIBOP, offer interview support.

- Practical Training: Live project training, case study training, and simulation training.

Certified Investment Banking Operations Professional (CIBOP) is another professional course certification for the same reason.

Certified Investment Banking Operations Professional (CIBOP)

CIBOP is suitable for the fresher and the young professionals who are ready to get placed in the investment banking industry.

- 100% Job Guarantee with 7 guaranteed interviews.

- Placement Rate: 85% with offer up to 9 LPA.

- Duration: 2.5 months (working days) or 5 months (weekends).

- Awards and Honors: Best Education Provider in Finance 30th Elets World’s Education Summit 2024.

- Students: Trained over 50,000 graduates, 1200+ batches passed.

Benefits of CIBOP

- Investment banking professional development with hands-on exposure.

- Syllabus on securities, wealth management, risk, and compliance, as hands-on learning.

- Guidance in career in the form of resume preparation and mock interviews.

- Development of practical skills for skills required in banking careers like KYC, AML, and financial modeling.

CIBOP shapes the candidates into professionals who can offer the best investment banking careers.

Watch this story for an inspirational story of a learner Sunil M Neshvi’s Investment Banking Success |CIBOP Journey with Imarticus Learning|Imarticus Reviews

FAQs

Q1. Is the 2025 banking profession lucrative?

Yes, due to increased global finances and the evolving world of work, a bank profession is still lucrative and safe.

Q2. What is the best investment banking profession?

To become an analyst and subsequently a managing director is the most conventional and rewarding career.

Q3. What are the professional skills required in the area of banking professionals?

Analytical mind, finance modeling, verbal communication skills, and knowledge of regulations.

Q4. How to be an investment banker without an MBA?

Completing certain finance and banking training like CIBOP and having industry experience.

Q5. Industry’s most prized jobs in investment banking

M&A analyst, equity research analyst, sales & trading, corporate finance, and risk management.

Q6. Banking and finance course is compulsory?

Yes, they connect banking education and training requirements.

Q7. How long does it take to be in banking as a career?

2–3 years is fine with proper courses and internship to start on right path.

Q8. What is the investment banking salary increase?

You can start with competitive grade pay and move to multi-crore career roles depending on experience.

Q9. Is CIBOP a guaranteed shot investment banking area placement?

Yes, 100% job assurance with 7 sure shot interviews.

Q10. Is there a possibility for finance graduates from non-IB schools to pursue a career in banking?

Yes, but specialisation course in banking and finance must be completed to be taken.

Conclusion

Bank career is stable, global in outlook, and fulfilling, but investment banker career is street-smart players’ holy grail. It requires the perfect combination of skills bank careers have, hard work, and smart career planning.

The equation to be a future investment banker is easy—obtain good education, obtain technical and soft skills, and study like topics as CIBOP Course to stand out from the crowd.

There are more than a hundred successful career choices and successful investment banking career opportunities to pursue, so there is never a more opportune moment than now to turn your dream into a reality. Start today, invest in yourself, and have investment banking shape unbeatable success.