Table of Contents

- Introduction

- Understanding ACCA Certification

- ACCA Job Opportunities Abroad

- High Salary Jobs After ACCA

- Global Careers with ACCA: Pathways and Possibilities

- ACCA Certified Professional Salary Breakdown

- International Finance Jobs for ACCA Graduates

- ACCA Qualification Benefits: Why It Matters

- ACCA Scope Worldwide: Market Trends and Future Outlook

- FAQs

- Key Takeaways

- Conclusion

Introduction

If you’ve dreamed of getting one of the top finance roles in London, Singapore, Dubai or New York, you are not alone! ACCA Certification is gaining practice with thousands of Indian finance students and finance professionals who are using it as a passport to global careers in accounting and audit, investment, and consultancy. Why? because the world is hiring ACCA professionals like never before. From Big 4 firms to global banks, companies seek ACCA talent for their deep financial expertise and international recognition. But what makes ACCA Certification so valuable? And how exactly does it open doors to high-paying international roles? Let’s break down everything you need to know.

Understanding ACCA Certification

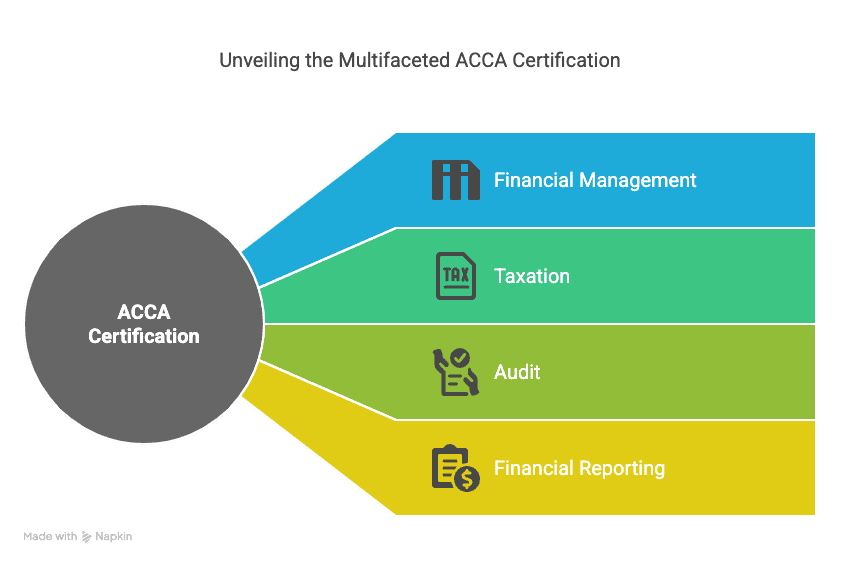

The ACCA (Association of Chartered Certified Accountants) represents the highest form of global certification in accounting and finance available today. It’s a comprehensive certification program with a full syllabus covering: financial reporting, taxation, audit, ethics, and strategic management—the top skills in demand around the world. ACCA Certification not only gives you global competitiveness, but will increase your employment opportunities in over 180 countries. It also has a flexible study model so Indian students can undertake this qualification while in college, or even while working, which makes it a great option for young professionals!

ACCA Job Opportunities Abroad

The world is your playground with an ACCA qualification. International employers actively seek candidates who understand global accounting standards, making Indian ACCA professionals a top choice.

With the growing demand for IFRS (International Financial Reporting Standards), many countries prefer hiring ACCA-certified professionals over local qualifications. That means better job mobility, visa approvals, and higher pay brackets.

Top Countries Hiring ACCA Professionals

| Country | Common Roles | Estimated Salary (INR Equivalent) |

| UK | Financial Analyst, Audit Manager | 45-70 LPA |

| UAE | Compliance Officer, Finance Manager | 40-60 LPA |

| Singapore | Risk Analyst, Corporate Accountant | 35-55 LPA |

| Canada | Internal Auditor, FP&A Specialist | 38-65 LPA |

| Australia | Investment Analyst, Tax Consultant | 40-60 LPA |

ACCA job opportunities abroad are not just limited to traditional finance roles—they now include fintech, ESG reporting, and risk advisory too.

High Salary Jobs After ACCA

The earning potential with ACCA Certification is significant, especially when combined with global exposure. Employers value ACCA members for their analytical abilities, ethics training, and cross-border accounting knowledge.

Even in India, ACCA-qualified professionals are offered CTCs between INR 6–12 LPA at entry level, and this figure multiplies with global placement or after a few years of experience.

List of High-Paying Roles After ACCA:

- Management Accountant

- Internal Auditor

- Tax Analyst (International Tax)

- Financial Controller

- Risk and Compliance Manager

- Group Finance Manager

- Treasury Analyst

- Strategy Consultant

- ESG Reporting Analyst

- CFO (with experience)

High salary jobs after ACCA are possible because ACCA is not just a certificate—it’s a career multiplier.

Global Careers with ACCA: Pathways and Possibilities

One of the key advantages of the ACCA Certification is how it aligns with global frameworks. Whether it’s IFRS, global tax structures, or multinational regulations, ACCA prepares professionals to hit the ground running in any finance team worldwide.

Many multinational companies—including PwC, EY, KPMG, Deloitte, BDO, HSBC, Barclays, and Unilever—actively prefer or even mandate ACCA for global roles. It’s also accepted by over 7500 employers who are part of ACCA’s approved employer program.

Global careers with ACCA span the following industries:

- Banking and Financial Services

- Consulting and Advisory

- FMCG and Retail Conglomerates

- Oil & Gas

- Public Sector and NGOs

- Technology and FinTech

ACCA Certified Professional Salary Breakdown

Let’s explore how ACCA Certification can transform your earning potential. Whether you stay in India or go abroad, the salary jump is clear and compelling.

Salary Breakdown by Experience and Geography

| Experience Level | India Salary Range | Global Salary Range (USD) |

| Entry-Level (0–2 yrs) | INR 6–10 LPA | $40,000 – $60,000 |

| Mid-Level (3–7 yrs) | INR 12–25 LPA | $65,000 – $90,000 |

| Senior-Level (8+ yrs) | INR 30–50 LPA | $100,000+ |

ACCA certified professional salary also includes bonuses, ESOPs, international allowances, and career growth perks that often exceed expectations.

International Finance Jobs for ACCA Graduates

The demand for internationally competent finance professionals has never been greater. ACCA Certification equips graduates with the necessary tools to take on leadership and strategic roles across sectors.

From global reporting to cross-border M&As and digital finance transformation, ACCAs are leading key projects in multinational environments.

International finance jobs for ACCA graduates often include:

- M&A Advisory Roles

- Global Treasury Management

- IFRS Implementation Consultant

- International Tax Planning

- Financial Risk Strategist

Pro Tip: Check job boards like Michael Page, Indeed Global, and LinkedIn for global ACCA listings.

ACCA Qualification Benefits: Why It Matters

Why are more Indian students choosing ACCA over traditional CA? Because the benefits are broader, faster, and globally recognised.

Unlike local finance certifications, ACCA Certification gives you access to both domestic and international markets. Its recognition by accounting bodies in UK, Australia, UAE, and Singapore boosts your professional credibility.

ACCA qualification benefits include:

- Global recognition in over 180+ countries

- Flexibility to pursue with graduation

- Fewer papers (13 vs 21 in Indian CA)

- Practical Experience Requirements (PER) enhances real-world readiness

- Alignment with IFRS, GAAP, Ethics, Audit, and Tax

ACCA Scope Worldwide: Market Trends and Future Outlook

The future of global finance is digital, cross-border, and regulation-heavy. And ACCA Certification positions you at the center of all three.

With the rise of ESG finance, AI-enabled accounting, and international compliance frameworks, ACCA professionals are in growing demand.

Current Market Trends Supporting ACCA Scope Worldwide:

- IFRS adoption is now standard in 140+ countries

- ESG reporting is mandatory in EU and expanding globally

- Fintech firms seek ACCAs for financial controls and ethics

- Remote hiring for finance roles is on the rise, enabling global access

ACCA scope worldwide is expected to grow at over 6% CAGR in job demand across international finance roles in the next five years.

FAQs

1. Is ACCA a superior qualification to CA in India for international careers?

Yes, if you want to work internationally and have better recognition and a better mobility path, you will be more recognized with ACCA compared to CA qualification, especially if you want to go to the UK, UAE, Singapore etc.

2. Can I pursue my B.Com alongside studying for ACCA?

Yes, many students begin their ACCA journey while they are in their graduation. So, by the time they complete their college and graduation, they have made a head start in terms of their careers.

3. How long will it take me to finish ACCA?

Most students finish in about 2.5 to 3 years, especially those who passed multiple exams on each cycle and obtained their PER in parallel.

4. What is the total cost of doing ACCA from India?

Around INR 2.5 – 3.5 lakhs total (including tuition fees, registration & exam fees), it varies greatly depending on your choice of coaching and location of study.

5. Do Big 4 firms in India employ ACCA professionals?

Yes, all Big 4 firms hire ACCA members & affiliates for audit, advisory and international tax related profiles.

6. Will I be able to work in the UK or UAE with ACCA?

Yes, both countries recognize ACCA certification. They both actively recruit professionals with their requisite experience.

7. What is PER in ACCA?

PER stands for Practical Experience Requirement—36 months of relevant work experience under a mentor or approved employer.

8. What kind of job roles can I expect after completing ACCA?

Roles include Audit Associate, Finance Manager, Business Analyst, Internal Auditor, and more.

9. Is ACCA Certification valid in Canada or the US?

It is accepted in Canada and allows entry into advanced finance roles. In the US, it is not a CPA substitute but still recognised by MNCs.

10. Can ACCA professionals earn more than MBAs?

In finance-specific roles, especially with international exposure, experienced ACCA professionals often command higher salaries than generalist MBAs.

Key Takeaways

- ACCA Certification is a globally accepted finance credential recognised in 180+ countries.

- Students can land high-paying international jobs post-ACCA.

- Roles span from audit and tax to fintech, M&A, and ESG reporting.

- Big 4 firms and MNCs actively hire ACCA-qualified professionals.

- Salaries abroad range from INR 35–70+ LPA depending on location and experience.

Conclusion

For Indian finance aspirants looking to go global, ACCA Certification is no longer an alternative—it’s a competitive edge. With global job prospects, great salary potential, and flexible learning, the ACCA qualifications are paving the way for a new era of finance professionals.

Whether your dream job is in the skyscrapers of Dubai or the boardrooms of London, it starts with your first ACCA paper.

So, what are you waiting for? An international finance career is just one decision away.