Certified Public Accountants (CPAs) play a crucial role in navigating complex tax laws. Whether you’re an individual or a business, recognising the role of a CPA in tax planning and preparation can significantly affect your financial well-being.

This concise blog article outlines how CPAs add value, details their services, and examines their impact on tax efficiency and compliance.

What Is the Role of a CPA?

A CPA for tax planning does more than prepare returns. They:

- Analyse financial data to devise tax-saving strategies

- Conduct audits to ensure accuracy and regulatory compliance.

- Offer guidance on business decisions, such as entity structuring.

- Implement internal controls to safeguard assets.

CPAs combine technical expertise with up-to-date knowledge of tax laws, helping clients minimise liabilities while adhering to legal requirements.

CPA for Tax Planning: A Strategic Approach

Effective tax planning involves proactive measures to reduce liabilities. A CPA for tax planning may:

- Defer or Accelerate Income: Adjust the timing of income recognition to match tax bracket expectations.

- Maximise Deductions: Identify deductible expenses—charitable gifts, business costs—and ensure proper documentation.

- Advise Entity Structure: Recommend whether to operate as a sole trader, LLP, or private limited for optimal tax treatment.

- Suggest Tax-Advantaged Investments: Highlight schemes like the National Pension Scheme (NPS) or specified equity-linked savings schemes (ELSS).

Rather than relying on generic software, a CPA tailors strategies to your unique situation, considering factors such as marital status, dependents, or retirement goals.

Tax Preparation by CPA: Ensuring Compliance

When engaging in Tax preparation by CPA, CPAs ensure:

- Accurate Reporting: Properly report income sources—salary, capital gains, rent

- Deduction Optimisation: Identify business expenses, home office costs, or education-related deductions

- Timely Filing: Meet deadlines for returns (ITR, GST) to avoid penalties

- Audit Support: Represent clients during tax authority reviews

Utilising professional software and thorough reviews, CPAs reduce error risk. Their expertise extends to both Indian tax laws (Income Tax Act, GST) and cross-border considerations for clients with overseas interests.

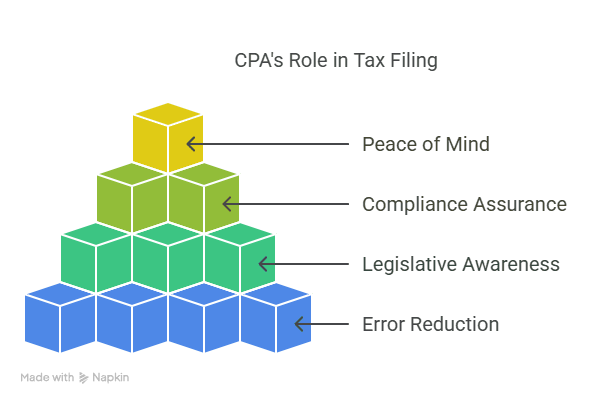

Importance of CPA in the Tax Filing Process

Filing taxes involves numerous forms and changing regulations. The Importance of CPA in tax filing lies in:

- Error Reduction: Multi-step review protocols catch mistakes pre-submission

- Legislative Awareness: CPAs stay current with updates to Income Tax rules and GST notifications

- Compliance Assurance: Professional credentials reduce the chance of audits

- Peace of Mind: Clients can focus on business or personal matters, confident in CPA oversight

CPAs streamline documentation, reconcile ledgers, and prepare transparent statements for tax authorities.

CPA Tax Advisory Services: Going Beyond Numbers

Beyond standard accounting, CPA tax advisory services include:

- Cross-Border Taxation: Advise NRIs and companies on double taxation avoidance agreements (DTAA) and transfer pricing

- Succession Planning: Structure estates and trusts to transfer wealth tax-efficiently

- Corporate Restructuring: Guide mergers, demergers, and other transactions for minimal tax impact

- R&D Incentives: Identify eligible research expenditures for credits or grants

By acting as strategic partners, CPAs help clients leverage incentives, mitigate currency risks, and optimise cash flows under varied market conditions.

Benefits of Hiring a CPA for Tax Matters

Engaging a CPA offers multiple advantages:

- Up-to-Date Expertise: Rigorous exams and continuing education ensure familiarity with law changes

- Time Savings: Outsourcing complex tasks allows focus on core activities

- Holistic Perspective: CPAs often provide wider financial advice—investment, retirement, and estate planning

- Risk Mitigation: Professional oversight reduces audit and penalty risks

- Bespoke Solutions: Tailored advice, whether you’re planning an IPO or filing as a freelancer

In a dynamic tax landscape, a CPA’s reassurance is invaluable.

How a CPA Fits Into Financial Planning

Tax planning and financial planning go hand in hand. The Role of CPA in financial planning includes:

- Retirement Strategy: Advise contributions to NPS, PPF, and EPF to balance tax benefits with growth

- Insurance Review: Evaluate life and health cover to maximise exemptions under Section 80C/80D of the Income Tax Act

- Portfolio Management: Optimise asset allocation—equities, debt, real estate—considering after-tax returns

- Estate Planning: Collaborate on wills, trusts, and wealth transfer to minimise inheritance tax

By integrating these areas, CPAs help clients anticipate liabilities, optimise savings, and create long-term wealth strategies.

CPA Qualifications and What They Mean for You

Key steps in becoming a CPA:

- Educational Requirements: A bachelor’s in accounting, finance, or commerce is typical

- Examination: Candidates often prepare through programmes like Imarticus Learning’s Certified Public Accountant course, aligned with AICPA standards

- Licensure: Passing four exam sections—AUD, BEC, FAR, and REG—and fulfilling experience hours set by state boards or AICPA

- Continuing Education: CPAs complete CPE hours annually to maintain licensure

Dual expertise in Indian and US GAAP offers a competitive advantage for clients with global operations.

Career Levels and CPA Salary in India

Demand for CPAs in India is high, reflected by attractive salaries:

| Level | Role | Salary Range (₹) |

| Entry | Assistant Accountant | ₹3 lakh – ₹5 lakh p.a. |

| Mid | Senior Associate (Big 4) | ₹5.6 lakh – ₹12 lakh p.a. |

| Senior | Senior Consultant (Big 4) | ₹10 lakh – ₹28 lakh p.a. |

| Associate Director | Associate Director (Big 4) | ₹28 lakh – ₹50 lakh p.a. (Median ₹37 lakh) |

| Executive | CFO / Financial Controller | ₹40 lakh+ p.a. |

Higher roles—such as CFO—extend into strategic decision-making, underlining why the Role of CPA is a respected, lucrative career.

Unique Perspective: AI and Tax Planning

Integrating Artificial Intelligence (AI) into the Role of CPA in financial planning enhances service:

- Automated Analysis: AI tools process transaction data quickly, flagging potential savings

- Predictive Tax Modeling: Machine learning forecasts tax liabilities for proactive adjustments

- Chatbots & Virtual Assistants: Provide instant client support for routine queries, freeing CPAs for complex advice

- Blockchain Audits: Immutable ledgers simplify audit trails, boosting transparency and reducing compliance costs

By adopting these tools, CPAs deliver tailored tax planning well in advance of filing deadlines.

Frequently Asked Questions (FAQs)

- What does a CPA do in tax planning?

A CPA analyses finances, identifies deductions, and recommends strategies—such as timing income or choosing tax-saving investments—to minimise liabilities. - Are CPAs for tax planning worth the cost?

Yes. Professional fees are often offset by savings gained through deductions, audit risk reduction, and long-term efficiency. - How does tax preparation by CPA differ from DIY software?

Software follows preset rules. CPAs tailor advice based on individual circumstances and anticipate legislative changes. - Can a CPA represent me in an audit?

Yes, CPAs have legal authority to represent clients before tax authorities, handling documentation and defence. - How does hiring a CPA improve financial planning?

CPAs integrate tax strategies with investment, retirement, and estate planning—maximising after-tax returns. - What qualifications should I seek in a CPA for tax advisory services?

Verify licensure, CPE compliance, industry experience (e.g., manufacturing, real estate), and credentials like CA or CFP. - Is the role of CPA in tax filing limited to returns?

No. CPAs advise on compliance, audits, cross-border issues, and strategic planning—ensuring holistic management. - How often should I meet my CPA for tax planning?

Quarterly or biannual reviews are recommended, with extra meetings after major life events (marriage, property purchase). - What benefits come from hiring a CPA versus a tax attorney?

CPAs offer cost-effective, broad services—financial analysis, bookkeeping, and advisory—whereas tax attorneys focus on legal disputes. - Where can I find professional tax preparation help?

Look for firms accredited by ICAI (Institute of Chartered Accountants of India) or AICPA (American Institute of CPAs), or explore Imarticus Learning’s Certified Public Accountant programme.

Conclusion and Key Takeaways

In summary, understanding the Role of a CPA in tax planning and preparation provides clarity on how these professionals deliver significant value.

Key Takeaways:

- Professional Expertise: CPAs combine credentialled knowledge with ongoing education to optimise tax savings.

- Holistic Financial View: CPAs integrate tax planning with broader financial goals—investments, retirement, and estate planning.

- Lucrative Outlook: With salaries from ₹3 lakh to ₹50 lakh+ per annum, CPAs are in high demand in India’s financial sector.

Ready to master tax planning or pursue a rewarding career as a CPA? Discover Imarticus Learning’s Certified Public Accountant preparation program today and take the next step toward expert tax advisory services or professional qualification.