Last Updated on 8 months ago by Imarticus Learning

Are you still missing, or are you actually measuring?

Do tables full of data or dashboards packed with numbers confuse or stress you out? You’re not alone. Many PGDM students majoring in fintech struggle to make sense of data. Even though you learn how to use certain tools, you may not always know how to use them effectively.

Employers do not want people who are familiar with regression; they want applicants who can explain, “This is what the data says, and this is what we are going to do next.”

When you find yourself wondering how to really be different in the world of fintech, then you need to know: The days when you can get by without the skill of quantitative data analysis are gone; it is now part and parcel of your success.

Why Fintech Needs Quantitative Data Analysis, Not Just Theories

The fintech industry runs on data, user behaviour, risk profiles, fraud detection, trading patterns, and market trends. That’s why PGDM in Fintech students must know how to apply quantitative data analysis methods and draw conclusions that impact business.

Quantitative research applies mathematics and statistics to fields like economics and marketing. Unlike qualitative data, which focuses on ‘why’ and ‘how,’ quantitative data analysis tells you ‘what’ and ‘how much.’ The difference? It’s the difference between opinion and action.

Your career in fintech depends on how well you bridge this gap.

The Real-World Use of Quantitative Data in Fintech

Experts expect the data analytics market in India to reach a projected revenue of US$21,286.4 million by 2030. Between 2025 and 2030, the market is likely to grow at a compound annual rate of 35.8%.

Whether you’re joining a startup or a global bank, you’ll encounter massive amounts of financial data. You may be looking at credit scores, transaction histories, or investment behaviour. Without proper data analysis, all of that remains just noise.

Here’s how firms actually use quantitative data analysis:

- Build loan approval models using regression.

- Forecast currency fluctuations with time-series data.

- Identify fraud using outlier detection methods.

- Test product changes using A/B testing.

And this is where qualitative and quantitative data analysis often complement each other. You might use surveys to get feedback (qualitative), but validate impact using numbers (quantitative).

Why PGDM in Fintech: Students Must Prioritise Data Skills

You’re studying fintech because you want to lead in this space, right?

Then it’s not enough to understand tech platforms and finance models. You need to bring in quantitative data analysis methods that show measurable results. They need people who know how to take a dataset and say, “This trend needs our attention.” And that kind of skill doesn’t come from last-minute learning.

So yes, mastering quantitative data analysis isn’t just about passing exams. It’s about building confidence, credibility, and job readiness.

Methods That Matter: What You Should Really Focus On

Let’s be honest: Not every data method is relevant to fintech. Some are more helpful than others.

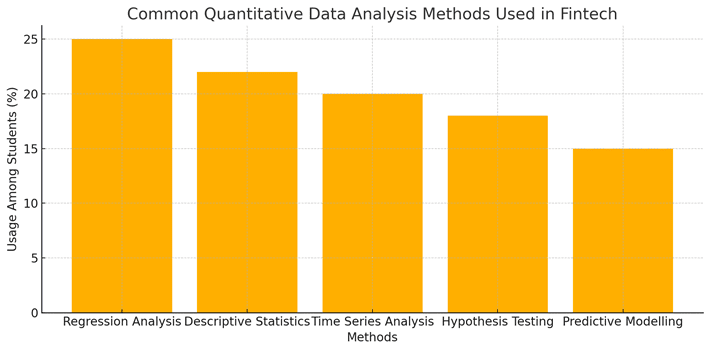

Below is a visual breakdown:

As you can see, regression analysis and descriptive statistics are widely used, especially in roles like credit risk, analytics, and investment modelling. Hypothesis testing and time-series techniques are equally crucial for back-testing strategies and forecasting.

Traditional vs Fintech-Oriented Data Analysis

Here’s a quick comparison to show how your learning should evolve:

| Skill Area | Traditional Business Courses | PGDM in Fintech Approach |

| Data Focus | Historical reports and basic insights | Real-time analytics and predictive models |

| Tools Used | Excel, PowerPoint | Python, R, Tableau, SQL, APIs |

| Learning Style | Theory-based lectures | Case studies, real-time simulations |

| Decision-Making | Gut-feel, senior leadership-driven | Data-first, model-driven |

| Application | General strategy | Financial products, customer journeys, and fraud systems |

If you want to succeed in a PGDM in Fintech, start thinking in models, not just in marks.

Common Mistakes Students Make with Quantitative Analysis

Let’s call them out:

- Only learning tools like Excel or Python without understanding when to use what.

- Thinking that qualitative and quantitative data analysis are completely separate (they’re not).

- Memorising formulas instead of practising real use cases.

- Ignoring industry-specific datasets like market feeds, customer data, or financial statements.

- Relying too much on software outputs without interpreting the logic behind them.

Fintech companies hire thinkers, not just tool users.

How PGDM in Fintech at Imarticus Learning Helps

If you’re looking for a course that not only teaches fintech but also focuses on mastering data, the PGDM in Fintech from Imarticus Learning in partnership with ISBR is worth your time.

This two-year, full-time programme offers far more than just lectures.

It includes:

- A Fintech Workshop by PwC Academy, with practical sessions led by domain experts.

- A curriculum designed around emerging fintech trends, including blockchain, cybersecurity, and data science.

- Case-based learning, where you solve actual financial problems using real datasets.

- Internship opportunities with top companies, this is not theory. It’s in-office, real-world work.

- Expert-led learning where faculty members bring current industry practices into the classroom.

The PGDM in Fintech by Imarticus Learning make you job-ready in both skills and confidence.

Apply for the PGDM in Fintech by Imarticus Learning and build your career with hands-on data experience.

FAQ

1. What is quantitative data analysis in fintech?

It’s the practice of using mathematical and statistical methods to examine financial data and make informed decisions.

2. How are qualitative and quantitative data analysis different in PGDM in Fintech?

Qualitative research helps understand opinions, while quantitative research measures trends and results. Fintech uses both, often in combination.

3. Which quantitative data analysis methods are most used in fintech?

Common ones include regression, time series, hypothesis testing, and predictive modelling.

4. Is data analysis part of the PGDM in Fintech syllabus?

Yes. At Imarticus Learning, it’s a major part of the curriculum with hands-on casework and tools.

5. Can I learn quantitative data analysis without a tech background?

Yes, with the right training and focus, students from all backgrounds can pick it up.

6. Do employers expect PGDM in Fintech grads to know data modelling?

Yes. In fact, strong modelling skills often increase placement chances and packages.

7. How does Imarticus Learning help in applying data analysis practically?

With case-based learning, PwC-led workshops, and real internships, students don’t just learn, they apply.

The Final Words

At the end of the day, tools change. But the way you solve problems stays. That’s why quantitative data analysis is something every PGDM in Fintech student must learn and practise till it becomes second nature. It’s not just about job interviews. It’s about making better decisions every single day in your career.

If you can’t measure, you can’t improve. So start now, practise, apply, reflect, and you’ll build skills that no one can take away.